Three Resolutions and Outlook for 2018

By Colin Twiggs

January 12, 2017 10:00 p.m. EDT (2:00 p.m. AEST)

Please read the Disclaimer.

Three Resolutions

I wish you a healthy and prosperous New Year.

These are my resolutions for 2018. In order of priority:

- Health. Without good health any other achievements are worth little. I enjoy physical exercise but this needs to be combined with a healthy diet and a healthy mind. Diet is fairly straight-forward if you stick to whole, unprocessed foods. A moderate amount of stress is good for you. Set yourself challenges but don't over-commit and avoid situations where you are unable to influence the outcome. Hope is not a strategy. The two resolutions below help to reinforce a healthy mind. Which in turn will help you to achieve these objectives.

- Focus. Prioritize more. Concentrate your efforts in the few areas where you have the greatest ability and opportunity.

- Stay objective. The market is dominated in the short- and medium-term by a seething mass of emotions. Stay detached and follow a methodical, systematic approach. Recognize that caution is good but an excess of caution will erode performance in much the same way as its opposite. Follow the middle road.

Apologies if this sounds a bit like the Desiderata but it pays to set simple, achievable goals. Focus on the execution and not the outcome. Concentrate on the task at hand rather than the end goal which be unrealistic, invoke stress and hinder performance. Recognize that circumstances are often beyond our control. But how we prepare for and respond to those circumstances can make the difference between success and failure.

Outlook for 2018

At this time of year we are usually inundated with projections for the year ahead, from predictions of imminent collapse to expectations of a record year.

We live in a world of uncertainty, where both extremes are possible, but neither is likely.

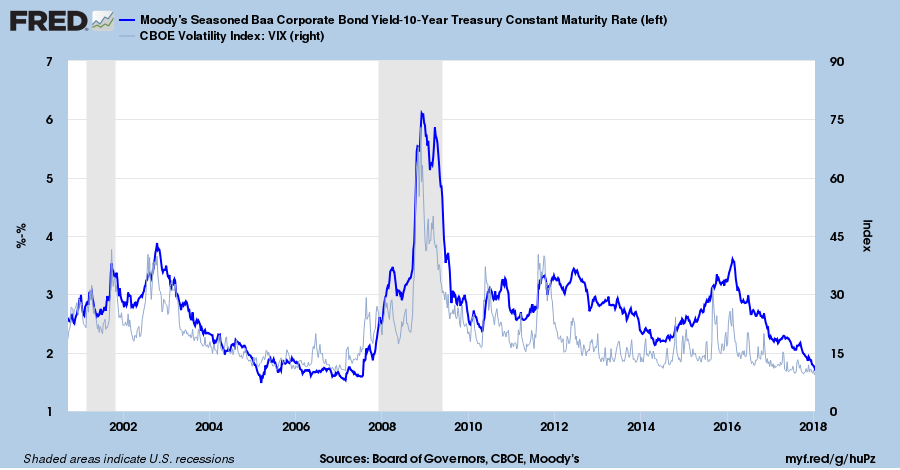

We are clearly in stage 3 (the final stage) of a bull market. Risk premiums are close to record lows. The yield spread between lowest investment-grade (Baa) bonds and equivalent risk-free Treasuries has crossed to below 2.0 percent, levels last seen prior to the 2008 global financial crisis. The VIX is also close to its record low, suggesting high levels of investor confidence.

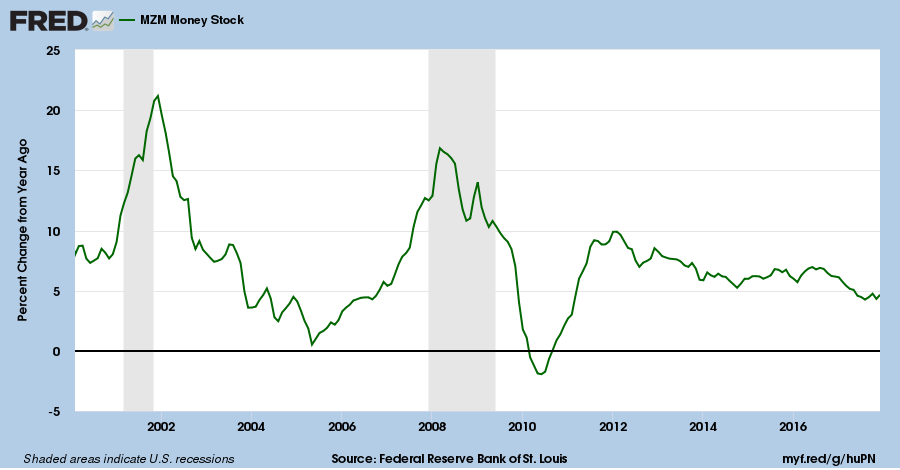

Money supply continues to grow at close to 5.0 percent, reflecting an accommodative stance from the Fed. MZM, or Zero Maturity Money, is basically M1 plus travelers checks and money market funds.

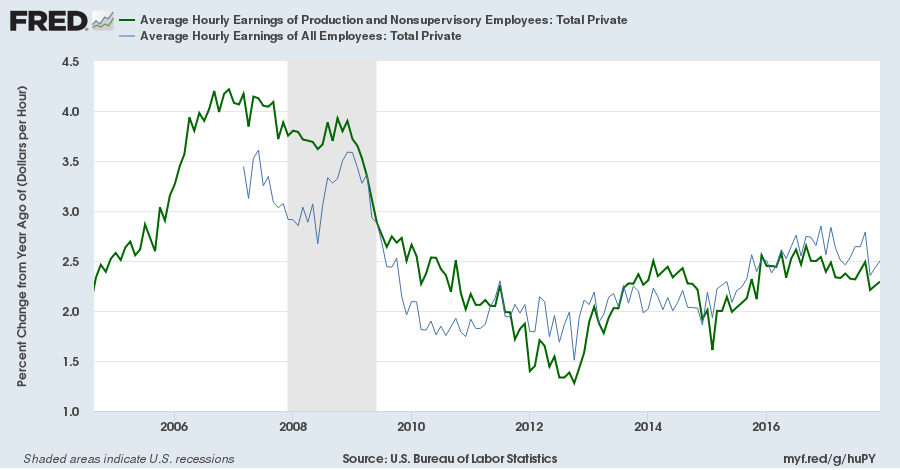

Inflationary forces remain subdued, with average hourly wage rates growing at below 2.5 percent per year. A rise above 3.0 percent, which would pressure the Fed to adopt a more restrictive monetary policy, does not appear imminent.

Tax relief and higher commodity prices are likely to exert upward pressure on inflation in the year ahead. But the Fed's stated intention of shrinking its balance sheet, with a reduction of $100 billion in the first 12 months, is likely to have an opposite, contractionary effect.

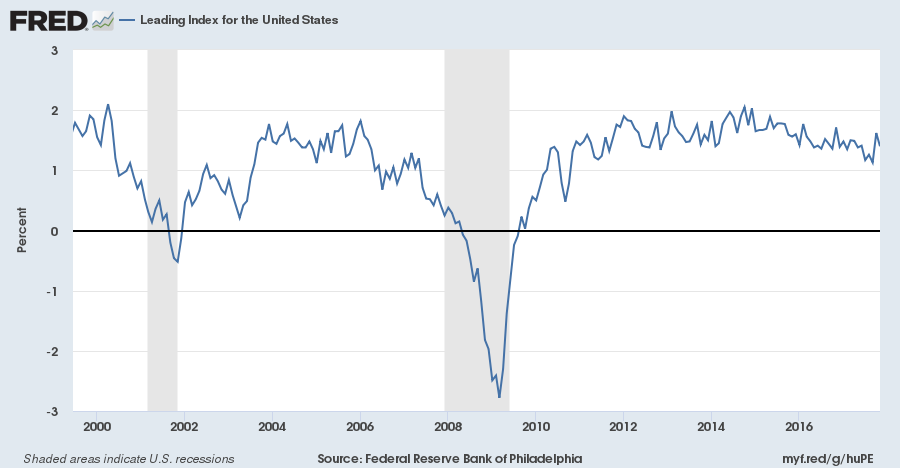

The Leading Index from the Philadelphia Fed gave a bit of a scare, dipping below 1.0 percent towards the end of last year. But data has since been revised and the index now reflects a far healthier outlook.

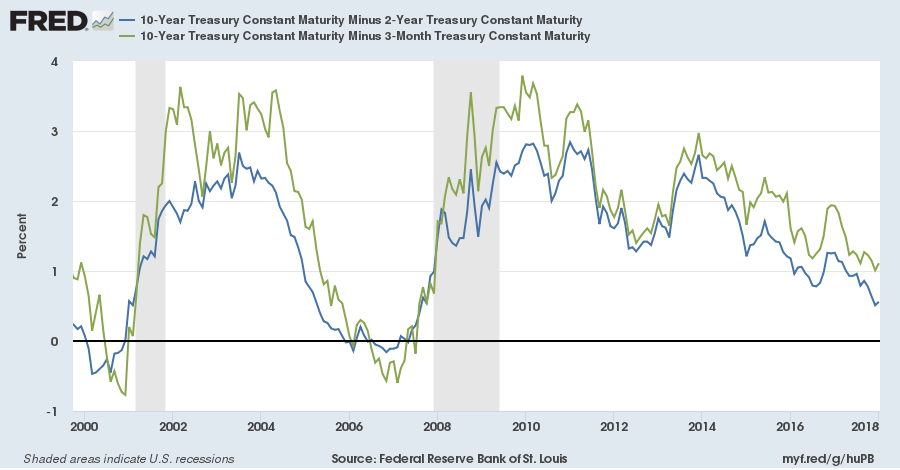

A flattening yield curve has also been mooted as a potential threat, with a negative yield curve preceding every recession over the last 50 years.

A yield differential, between 10-year and either 2-year or 3-month Treasuries, below zero would warn of a recession. When long-term yields fall below short-term yields financial markets stop working efficiently and bank lending tends to contract. Banks, who generally borrow at short-term rates and lend at long-term rates, find their margins are squeezed and become strongly risk-averse. Contracting lending slows the economy and normally leads to recession.

But we are some way from there. If we take the last cycle as an example, the yield curve started flattening in 2005 (when yield differentials fell below 1 percent) but a recession only occurred in 2008. The market could continue to thrive for several years before the impact of a negative yield curve is felt. To exit now would seem premature.

Desiderata

Go placidly amid the noise and the haste, and remember what peace there may be in silence. As far as possible, without surrender, be on good terms with all persons.

Speak your truth quietly and clearly; and listen to others, even to the dull and the ignorant; they too have their story.

Avoid loud and aggressive persons; they are vexatious to the spirit. If you compare yourself with others, you may become vain or bitter, for always there will be greater and lesser persons than yourself.

Enjoy your achievements as well as your plans. Keep interested in your own career, however humble; it is a real possession in the changing fortunes of time.

Exercise caution in your business affairs, for the world is full of trickery. But let this not blind you to what virtue there is; many persons strive for high ideals, and everywhere life is full of heroism.

Be yourself. Especially, do not feign affection. Neither be cynical about love; for in the face of all aridity and disenchantment it is as perennial as the grass.

Take kindly the counsel of the years, gracefully surrendering the things of youth.

Nurture strength of spirit to shield you in sudden misfortune. But do not distress yourself with dark imaginings. Many fears are born of fatigue and loneliness.

Beyond a wholesome discipline, be gentle with yourself. You are a child of the universe no less than the trees and the stars; you have a right to be here.

And whether or not it is clear to you, no doubt the universe is unfolding as it should. Therefore be at peace with God, whatever you conceive Him to be. And whatever your labors and aspirations, in the noisy confusion of life, keep peace in your soul. With all its sham, drudgery and broken dreams, it is still a beautiful world. Be cheerful. Strive to be happy.~ by Max Ehrmann (1927).

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.