Australia; Housing bubbles and declining business investment

By Colin Twiggs

September 10, 2017 9:00 p.m. EDT (11:00 a.m. AEST)

Please note changes to the Disclaimer

Colin Twiggs is a director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Australian Housing

The Australian housing bubble is alive and kicking, with house prices growing at close to 10% per year.

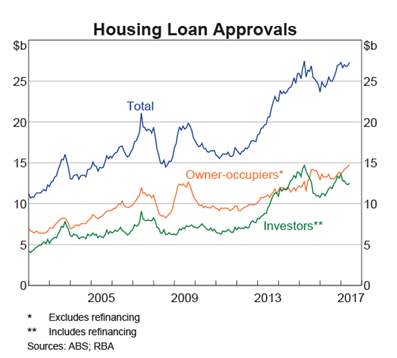

Loan approvals are climbing, especially for owner-occupiers. Fueled by record low interest rates.

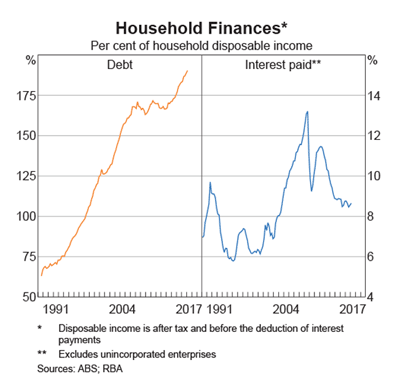

Causing household debt to soar relative to disposable income.

Business Investment

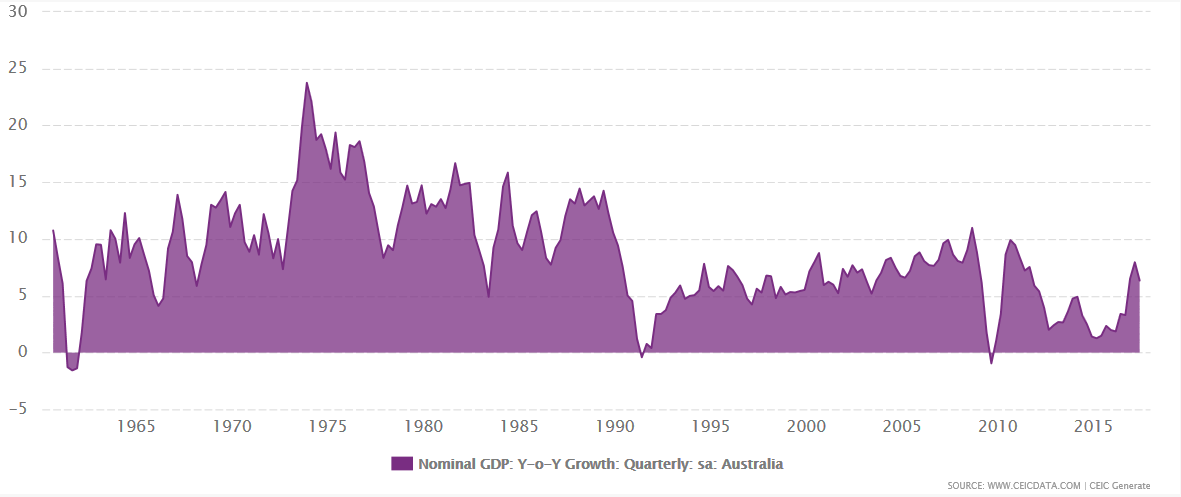

Nominal GDP growth of 6.34% for the 2017 FY is a rough measure of the average return on capital investment.

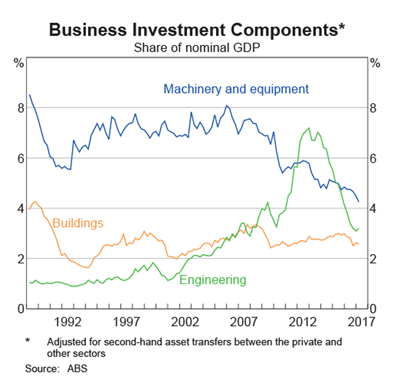

With a mean of close to 5% over the last two decades, it is little wonder that business investment is falling. Not only in mining-related engineering but in machinery and equipment.

Capital Misallocation

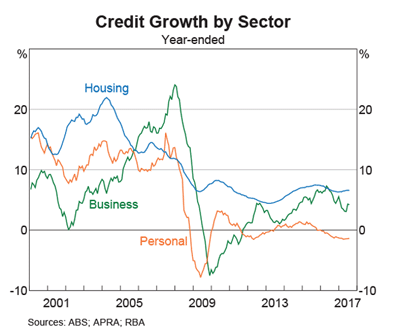

More capital is being allocated to housing than to business investment.

Returns on housing are largely speculative, premised on further house price growth, and do little to boost GDP growth and productivity.

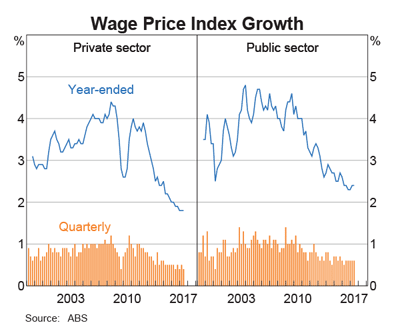

The result of soaring house prices and household debt is therefore lower business investment and lower GDP and wages growth.

You don't have to be the sharpest tool in the shed to recognize that soaring household debt and shrinking wage growth is likely to end badly.

In the short run, the market is a voting machine

but in the long run it is a weighing machine.~ Benjamin Graham: Security Analysis (1934)