US: Low CPI and soft Treasury Yields/

Australia: ASX 200 Selling Pressure

By Colin Twiggs

August 11, 2017 9:30 p.m. EDT (11:30 a.m. AEST)

Disclaimer

Please read the Disclaimer. I am not a licensed investment adviser.

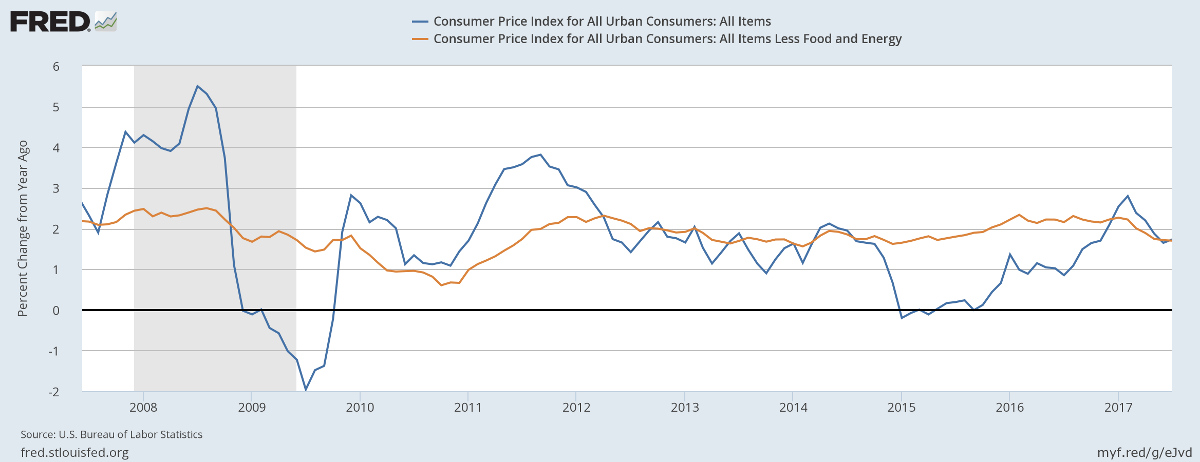

The Consumer Price Index (CPI) and Core CPI (excluding food and energy) both came in at a low 1.7% p.a. for the 12 months ended July 2017.

Source: St Louis Fed, BLS

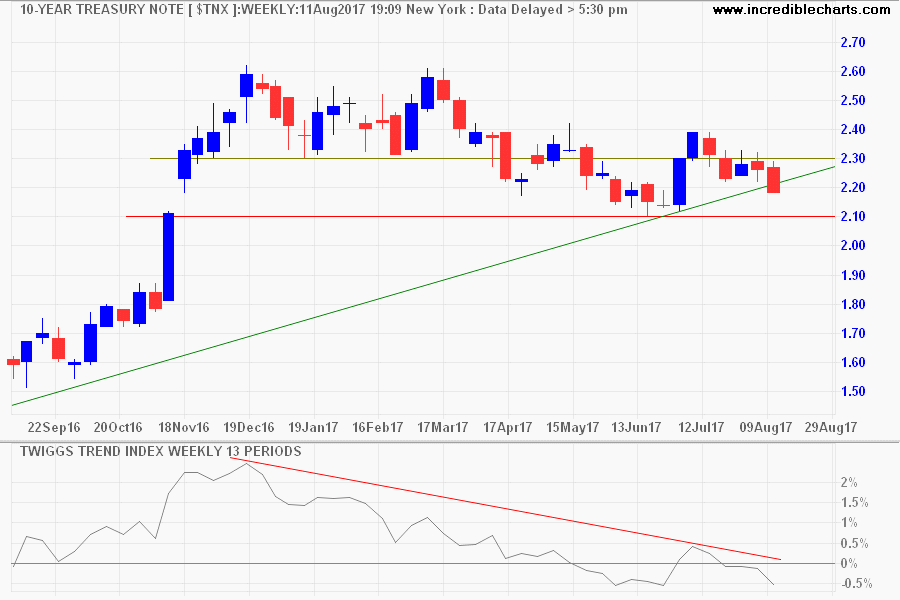

Long-term interest rates are trending lower as CPI moderates. Breach of support at 2.10% by 10-Year Treasury Yields would signal another primary decline with a target of 1.80%*.

Target: 2.10% - (2.40% - 2.10%) = 1.80%

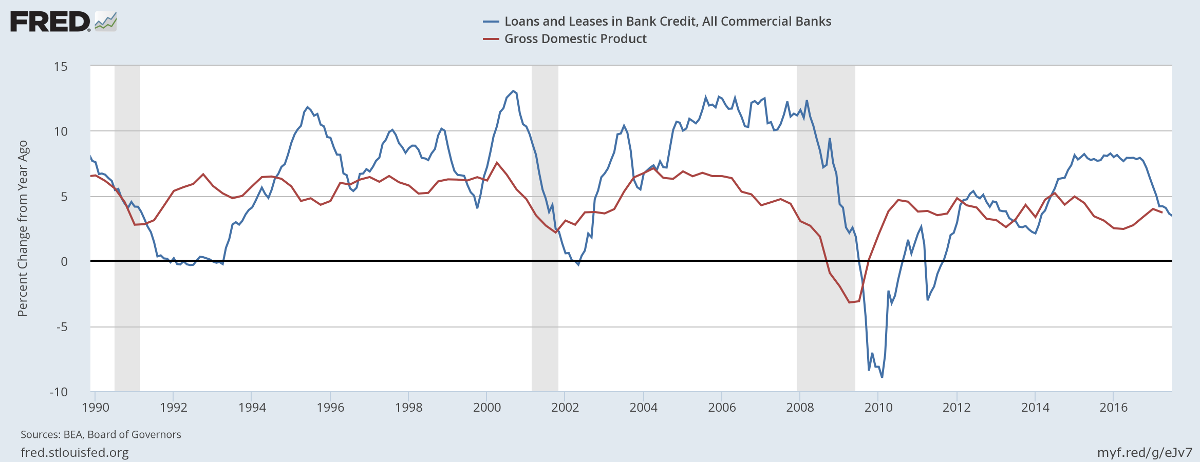

Bank credit growth is slowing, to the level where it is tracking nominal GDP growth, avoiding some of the excesses of previous cycles. But if bank credit falls below GDP growth that would warn of tighter monetary conditions and the economy is likely to slow.

Source: St Louis Fed, FRB, BEA

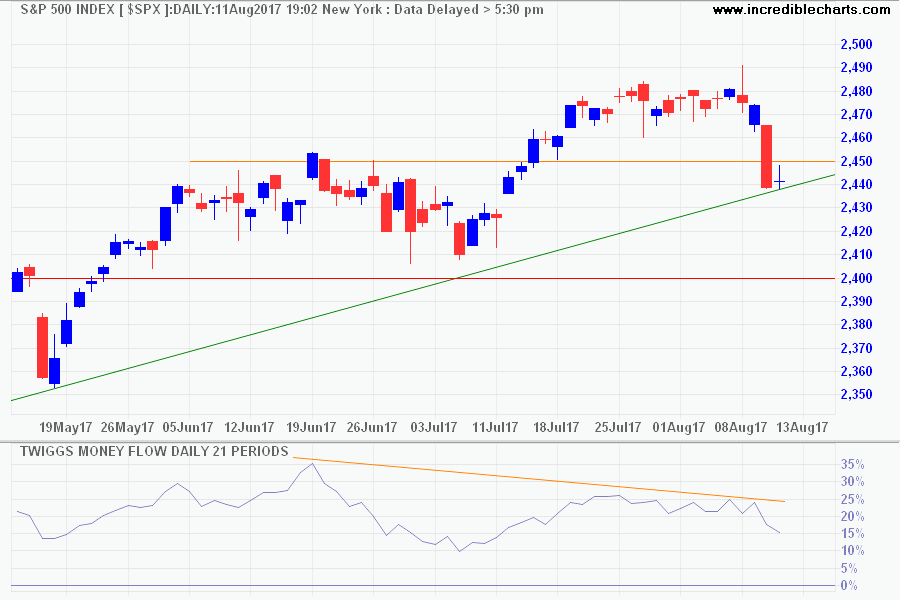

The S&P 500 is testing its long-term rising trendline, while bearish divergence on Twiggs Money Flow warns of selling pressure. But the market appears to have shrugged off Donald Trump's promises of North Korean "fire and fury" and both of these movements seem secondary in nature. A correction is likely but the primary trend remains on track for further gains.

Target 2400 + ( 2400 - 2300 ) = 2500

Australia: ASX 200 Selling Pressure

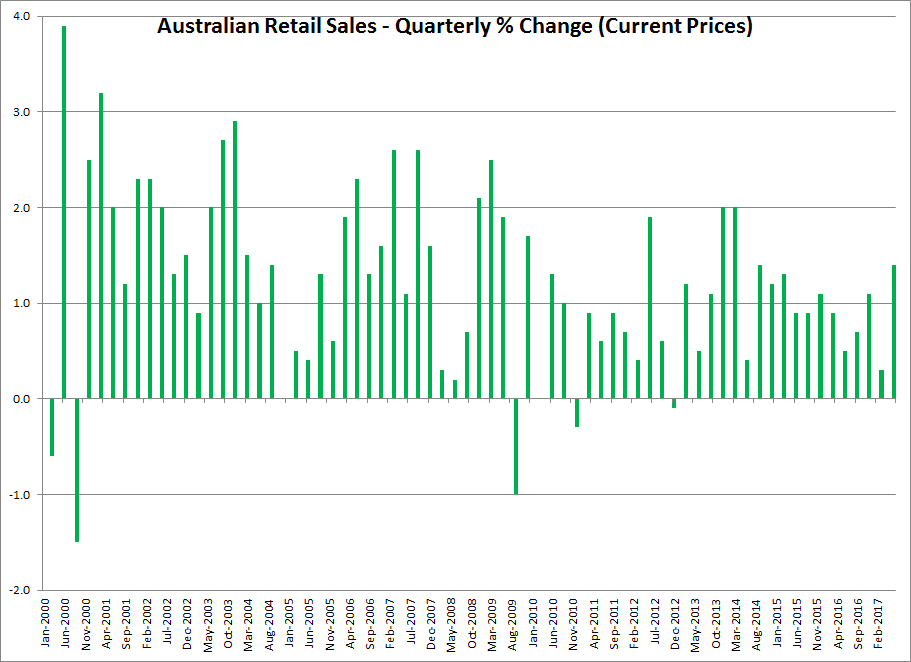

June Quarter retail sales are up 1.4% over the preceding quarter, the best June Quarter since 2012.

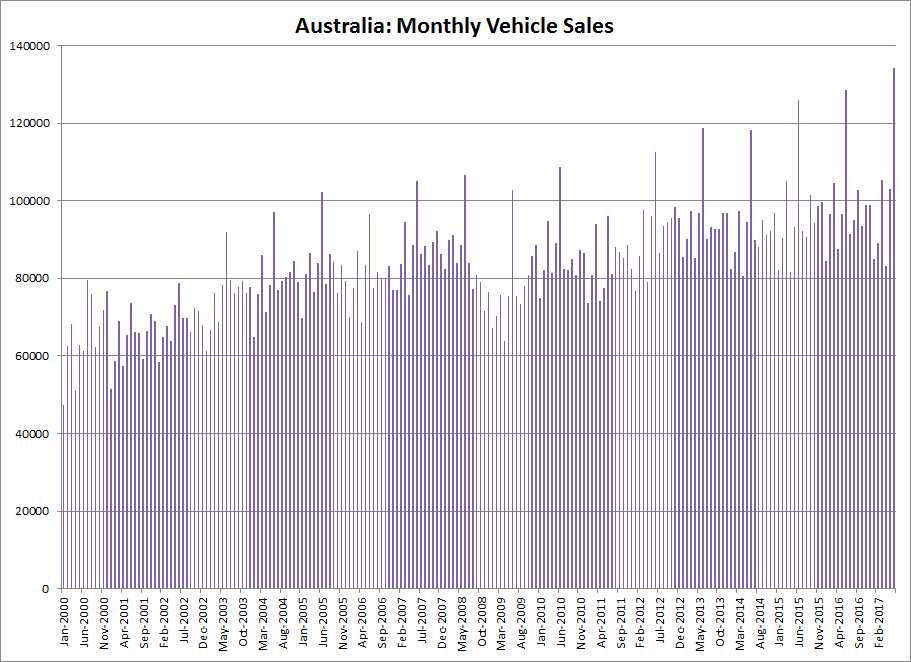

Vehicle sales for June 2017 also reflect healthy growth over previous financial year ends.

Despite the good figures, one should not ignore Bill Evans' more sombre assessment of the latest RBA forecasts:

From our perspective, a fall in housing construction; subdued consumer spending and a drag on services exports from the high Australian Dollar will constrain employment growth through 2018. The [Reserve] Bank sees things differently, expecting recently strong employment growth to persist into 2018, with the unemployment rate expected to fall to 5.4% by the end of 2019 compared to our current forecast that the unemployment rate will in fact be rising through 2018, reaching 6% by year's end.

Two other domestic factors are important, firstly the Bank is of the view that "wage growth is expected to pick up gradually over the next few years". That is despite convincing evidence offshore, that countries with full employment, and in the case of the US, an unemployment rate considerably below the full employment rate, are not experiencing wage pressures. This different assessment of household income growth is one of the key explanations behind our more downbeat view of the economic outlook. Secondly, we expect that the wealth effect from sharply rising house prices in NSW and Victoria is about to reverse. There is no argument that household debt levels are elevated. The prospect of very limited further increases of house prices in those markets may start to dampen consumer spending in particular by discouraging households to further subsidise consumption growth by lowering their saving rates.....

- Falling housing construction;

- Slow consumption growth;

- Slow services export growth;

- Slow employment growth;

- Slow wages growth; and

- Slowing house price growth.

I think Bill is right on the money, but there are always other variables like iron ore and Chinese financial markets that can disrupt even the best forecasts.

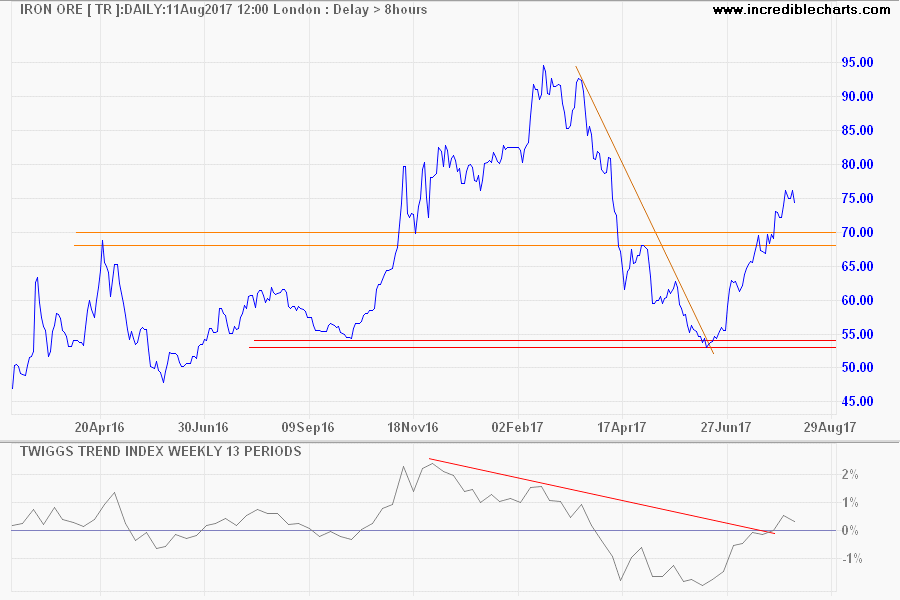

Iron ore looks set to retrace to test support between 68 and 70. Respect would signal a primary advance but I suspect that support at 60 is likely to be tested.

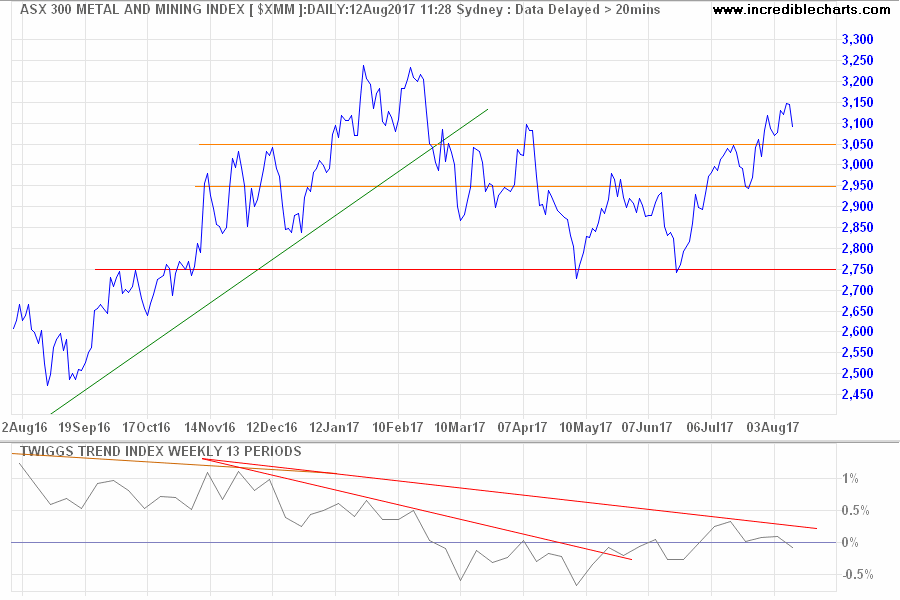

ASX 300 Metals & Mining is also likely to retrace, but bearish divergence on Twiggs Trend Index warns of selling pressure. Respect of 2950 would signal a primary advance but a test of primary support at 2750 is as likely.

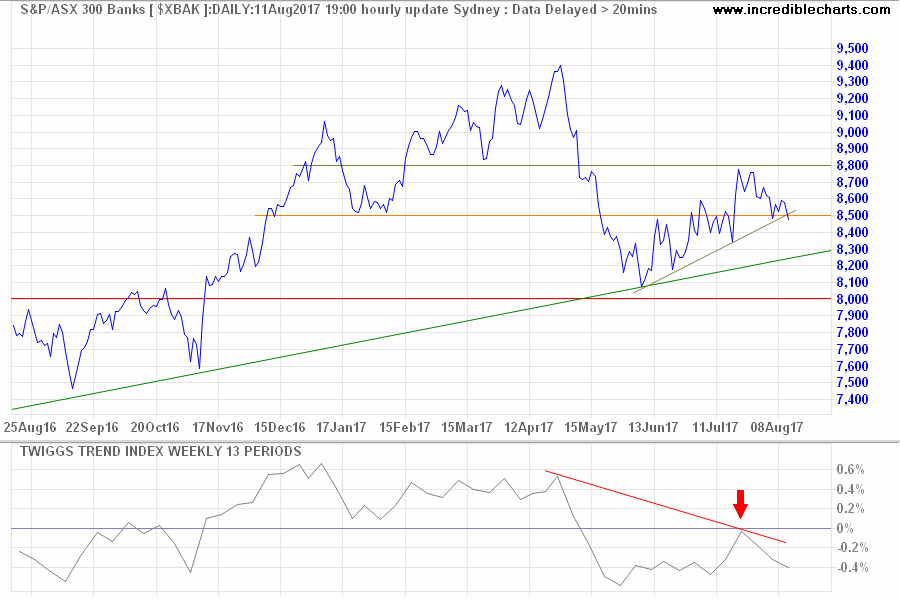

The ASX 300 Banks index retreated below support at 8500. Follow-through would test primary support at 8000. Declining Twiggs Money Flow, with a large peak below zero, warns of strong selling pressure.

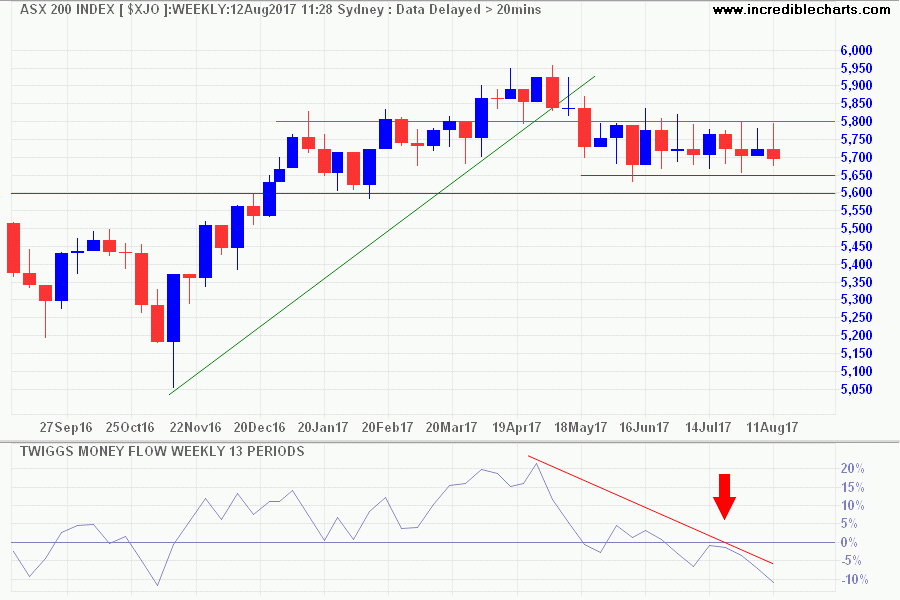

Declining Twiggs Money Flow also flags strong selling pressure on the ASX 200. Breach of support at 5650 is likely and would signal a primary down-trend. Follow-through below 5600 would confirm.

Here's to the crazy ones. The misfits. The rebels. The trouble-makers. The round pegs in square holes. The ones who see things differently. They're not fond of rules, and they have no respect for the status-quo. You can quote them, disagree with them, glorify, or vilify them. But the only thing you can't do is ignore them. Because they change things. They push the human race forward. And while some may see them as the crazy ones, we see genius. Because the people who are crazy enough to think they can change the world, are the ones who do.

~ Apple co-founder Steve Jobs

(I think he had Elon Musk in mind more than Donald Trump)