Europe: DAX selling pressure

By Colin Twiggs

August 6th, 2014 4:00 a.m. EDT (6:00 p.m. AEST)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

Research & Investment: Performance update

ASX200 Prime Momentum strategy returned +20.35%* for the 12 months ended 31st July 2014, outperforming the benchmark ASX200 Accumulation Index by +3.81%.

Returns for July 2014 were 4.67%, so why the decline in rolling 12-month performance? Because performance for July 2013 (11.00%) is now excluded from the last 12 months. Another exceptional month was January 2014 (9.04%). Momentum performance tends to concentrate in a few good months each year which is why we are so averse to timing secondary corrections — if you miss one good month, it will hurt your annual performance.

The S&P 500 Prime Momentum strategy has been running nine months, since November 2013, and returned 8.92%* for the period, compared to 11.63% for the S&P 500 Total Return Index. A sell-off of momentum stocks affected performance since April, but macroeconomic and volatility filters indicate low risk typical of a bull market and we maintain full exposure to equities.

* Results are unaudited and subject to revision.

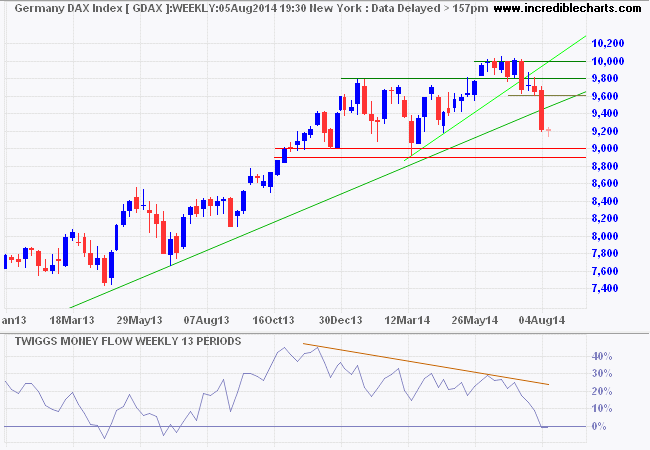

DAX selling pressure

Germany's DAX is broke support at 9600, warning of a correction to 9000 — and a weakening primary up-trend. Decline of 13-week Twiggs Money Flow below zero reflects (long-term) selling pressure. Breach of primary support at 8900/9000 would signal a primary down-trend. Recovery above 9800/10000 is unlikely at present, but would indicate another advance.

* Target calculation: 9750 + ( 9750 - 9000 ) = 10500

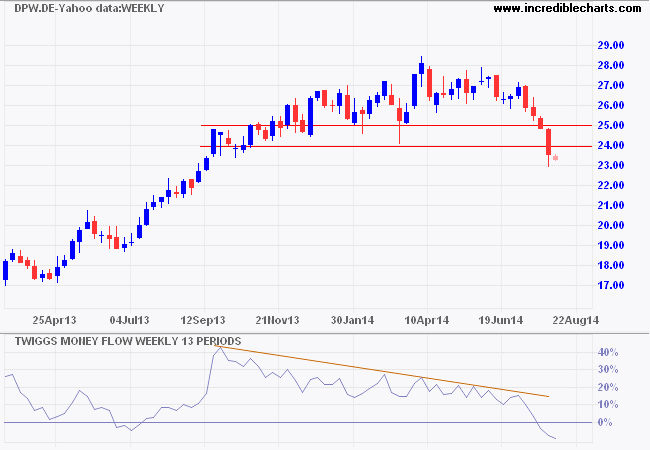

Deutsche Post AG (y_DPW.DE) serves as a bellwether for European markets. Deutsche Post DHL couriers holds a similar position to that of Fedex in US markets. The stock broke support at 24.00/25.00, completing a rounding top. Decline of 13-week Twiggs Money Flow below zero reflects (long-term) selling pressure. Target for the breakout is 20.00*. A down-trend warns of slowing economic activity.

* Target calculation: 24 - ( 28 - 24 ) = 20

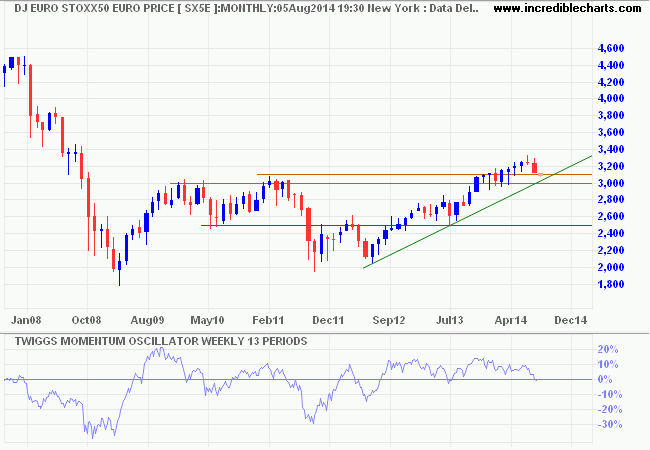

Dow Jones Euro Stoxx 50 is retracing to test support at 3000/3100. Breach of support would suggest a decline to 2500 as indicated on the monthly chart. Respect of support, however, would indicate another advance.

* Target calculation: 3150 + ( 3150 - 3000 ) = 3300

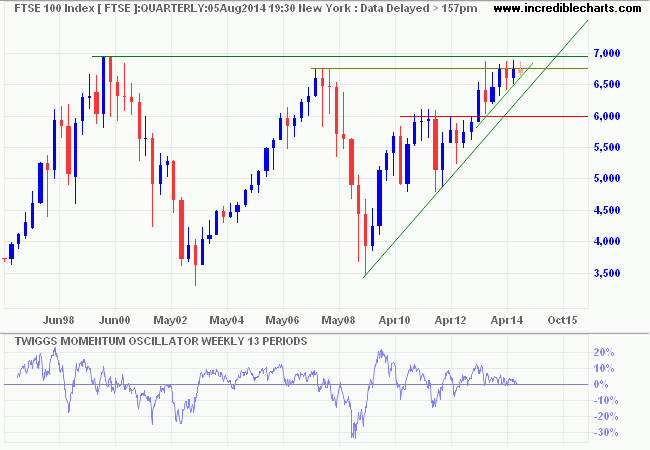

A quarterly chart shows the Footsie consolidating in a long-term triangle below its previous high of 6950. Ascending triangles favor an upward breakout, but I would be cautious with the current outlook for Europe. Reversal below 6650 would warn of a correction to 6400/6500.

* Target calculation: 6900 + ( 6900 - 6500 ) = 7300

Though men now possess the power to dominate and exploit every corner of the natural world, nothing in that fact implies that they have the right or the need to do so.

~ Edward Abbey