Gold weakens on Dollar strength

By Colin Twiggs

July 31st, 2014 2:00 a.m. EDT (4:00 p.m. AEST)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

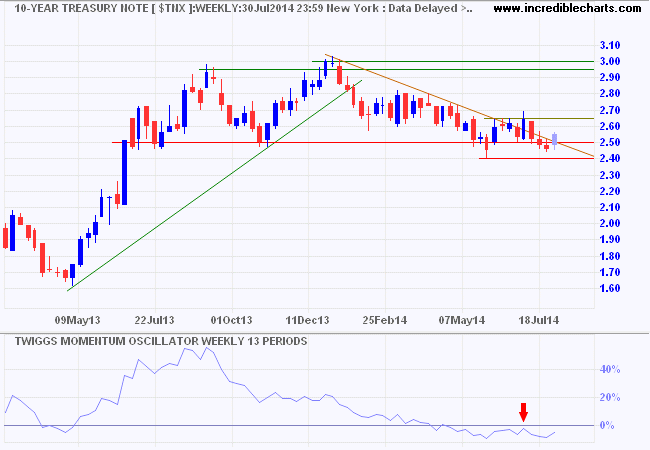

- Treasury yields find support

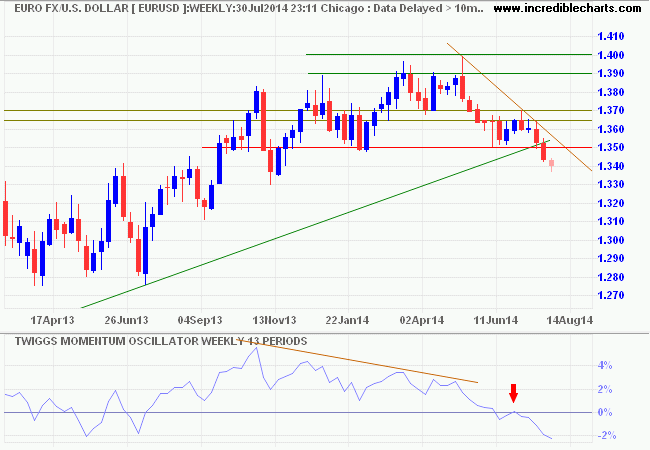

- Euro signals a primary down-trend

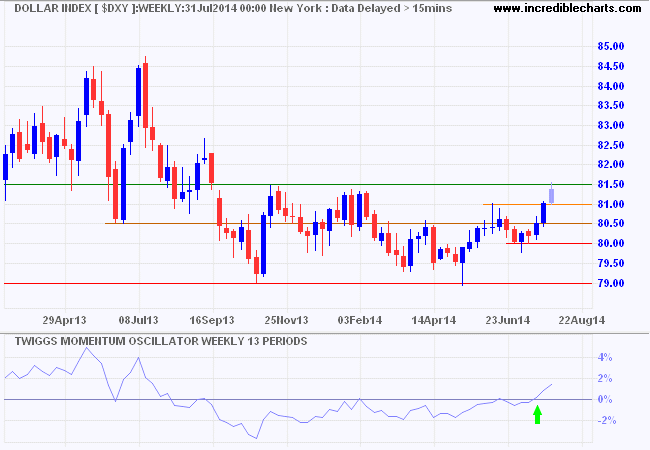

- Dollar continues to strengthen

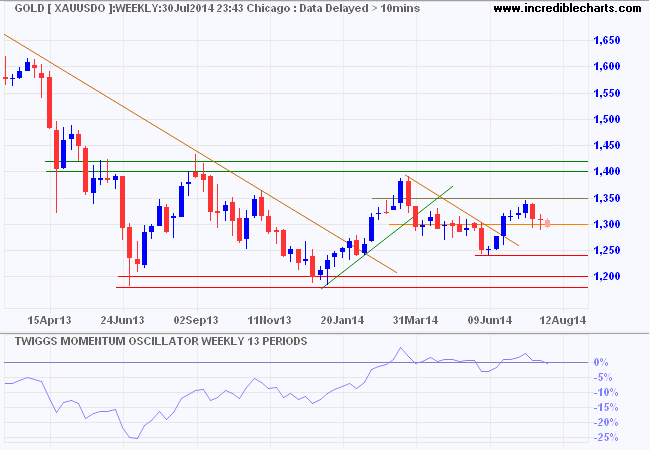

- Gold weakens

Interest Rates and the Dollar

The yield on ten-year Treasury Notes recovered above 2.50 percent, suggesting that a bottom is forming. Follow-through above 2.65 would strengthen the signal. Reversal below 2.40, however, would confirm a decline to 2.0 percent*.

* Target calculation: 2.50 - ( 3.00 - 2.50 ) = 2.00

The euro broke primary support at $1.35, signaling a primary decline with a target of $1.30*. Reversal of 13-week Twiggs Momentum below zero confirms the down-trend. Recovery above $1.35 is unlikely, but would warn of a bear trap.

* Target calculation: 1.35 - ( 1.40 - 1.35 ) = 1.30

The Dollar Index rallied on strong GDP figures, testing resistance at 81.50. Breakout is likely and would signal a primary advance with a target of 84*. Recovery of 13-week Twiggs Momentum above zero indicates a primary up-trend. Reversal below 80.50 is unlikely, but would warn of another test of primary support at 79.00.

* Target calculation: 81.50 - ( 81.50 - 79.00 ) = 84.00

Gold

Gold is testing support at $1295/$1300. Failure of support would warn of a primary down-trend. Breach of $1240/$1250 would confirm. Recovery above $1350 is unlikely at present, but would indicate another test of $1400/$1420. Reversal of 13-week Twiggs Momentum below zero would strengthen the bear signal, but oscillation close to the zero line presently signals hesitancy.

* Target calculation: 1200 - ( 1400 - 1200 ) = 1000

If gold has been prized because it is the most inert element, changeless and incorruptible, water is prized for the opposite reason — its fluidity, mobility, changeability that make it a necessity and a metaphor for life itself. To value gold over water is to value economy over ecology, that which can be locked up over that which connects all things.

~ Rebecca Solnit, Storming the Gates of Paradise