Gold faces conflicting forces

By Colin Twiggs

May 3rd, 2013 5:00 a.m. EDT (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

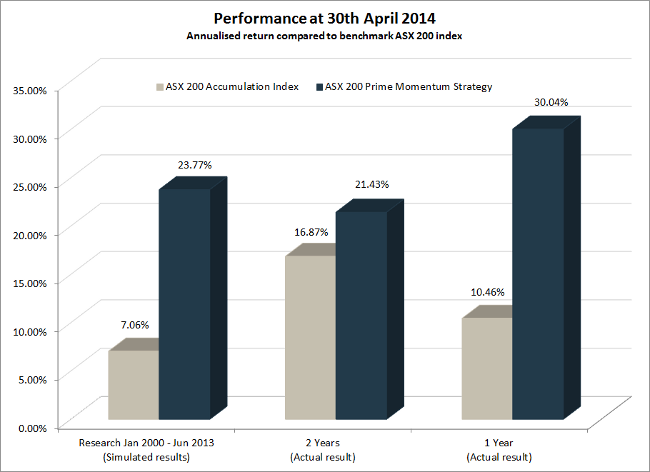

Research & Investment: Performance update

Our ASX200 Prime Momentum strategy returned +30.04%* for the 12 months ended 30th April 2014, outperforming the benchmark ASX200 Accumulation Index by +19.58%.

The S&P 500 Prime Momentum strategy has been running six months, since November 2013, and returned 7.79%* for the period, compared to 8.36% for the S&P 500 Total Return Index.

A sell-off of momentum stocks affected performance in April, but macroeconomic and volatility filters indicate low risk typical of a bull market and we see current weakness as a buying opportunity.

* Results are before fees, unaudited and subject to revision.

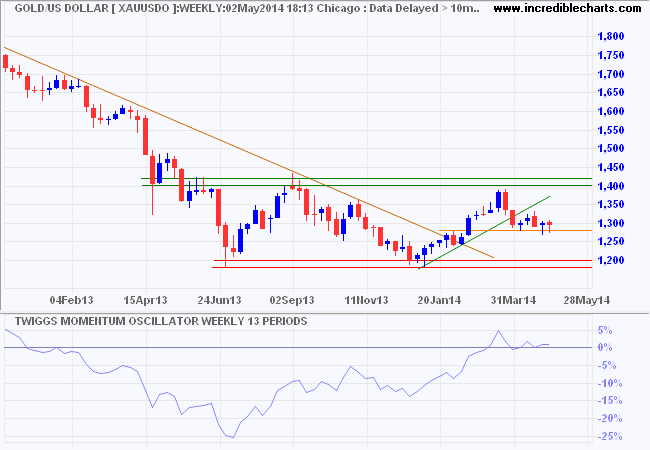

Gold and the Dollar

Overview:

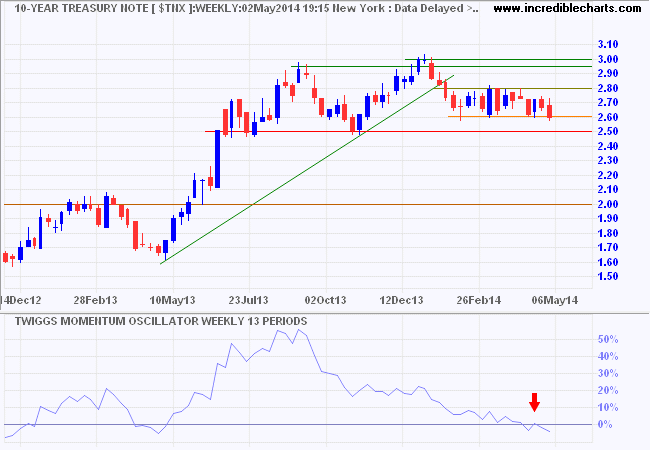

- Treasury yields are falling

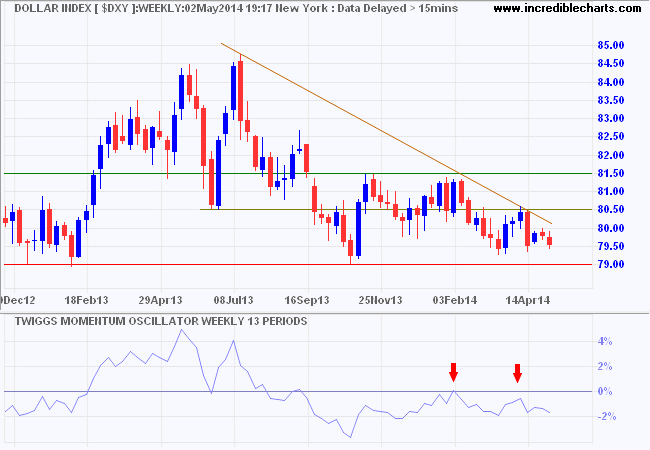

- The Dollar is weakening

- Inflation expectations are falling

- Gold and silver are testing support

Interest Rates and the Dollar

The yield on ten-year Treasury Notes closed below support at 2.60 percent, warning of another decline. Follow-through below 2.50 percent would signal a primary down-trend, with an immediate target of 2.00 percent*. Reversal of 13-week Twiggs Momentum below zero also suggests weakness. Recovery above 2.80 is unlikely at present, but would indicate another advance.

* Target calculation: 2.50 - ( 3.00 - 2.50 ) = 2.00

The Dollar Index is heading for a test of primary support at 79.00. Peaks below the zero line on 13-week Twiggs Momentum signal a primary down-trend. Breach of primary support at 79.00 would confirm, offering a target of 76.50*. Recovery above 80.50 is unlikely, but would signal that the index has bottomed.

* Target calculation: 79.0 - ( 81.5 - 79.0 ) = 76.5

Gold and Silver

Gold faces conflicting forces: low inflation reduces demand for precious metals, but low interest rates and a weaker Dollar increase demand.

Spot gold continues to test support at $1300/$1280 per ounce. Failure of support would indicate a test of primary support at $1200, but long tails and 13-week Twiggs Momentum recovery above zero indicate that another test of $1400 remains as likely.

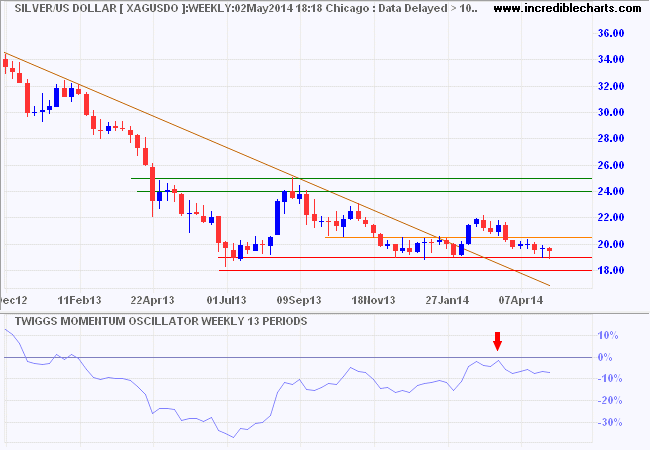

Silver is more bearish and failure of primary support at $19/ounce would offer a target of $16*. Respect of the zero line (from below) by 13-week Twiggs Momentum suggests continuation of the primary down-trend. A down-swing on silver would be likely to be followed by gold. Recovery above $22/ounce is less likely, but would signal a primary up-trend.

* Target calculation: 19 - ( 22 - 19 ) = 16

This country has nothing to fear from the crooked man who fails. We put him in jail. It is the crooked man who succeeds who is a threat to this country.

~ Theodore Roosevelt (1905)