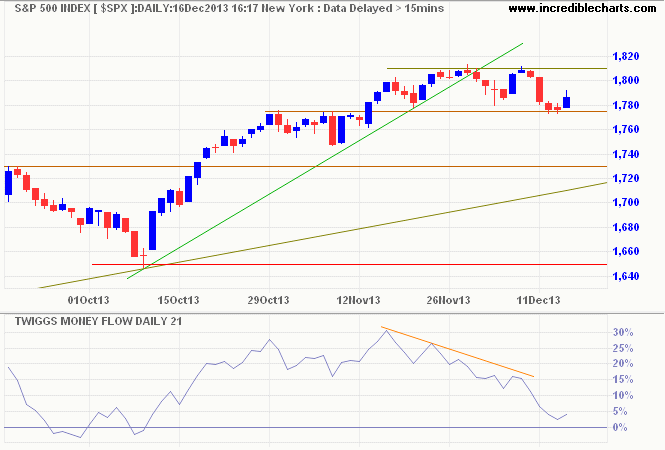

S&P 500 correction over?

By Colin Twiggs

December 17th, 2013 1:30 am ET (5:30 pm AEDT)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

The S&P 500 found support at 1775, but declining 21-day Twiggs Money Flow warns the correction is not yet over. Breach of 1775 would indicate a test of the ascending trendline and medium-term support at 1730. Recovery above 1810 is less likely, but would suggest an accelerating up-trend — with sharper gains and shorter retracements.

* Target calculation: 1725 + ( 1725 - 1650 ) = 1800

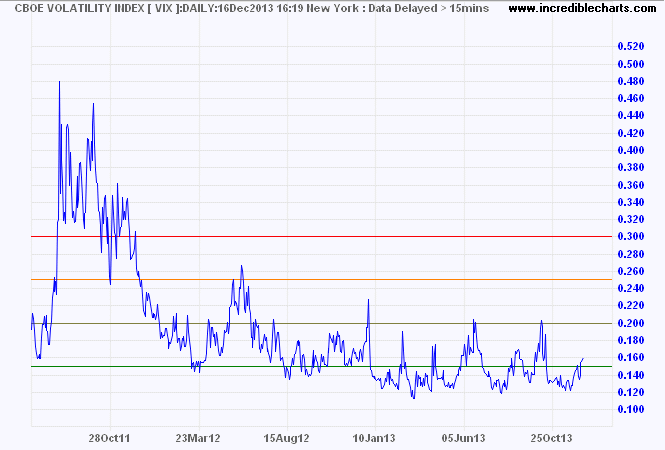

CBOE Volatility Index (VIX) readings below 20 are indicative of a bull market.

Such as are your habitual thoughts, such also will be the character of your mind; for the soul is dyed by the thoughts.

~ Marcus Aurelius