US & Canada: Rising buying pressure

By Colin Twiggs

October 28th, 2013 3:00 am EDT (5:00 pm AEDT)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

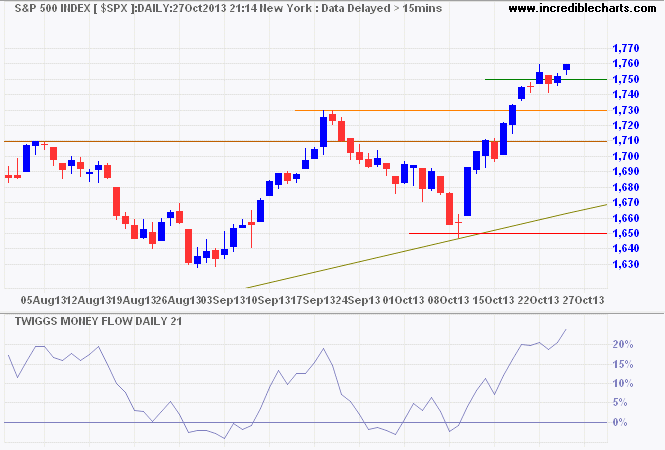

The S&P 500 short retracement at 1750 is a bullish sign, confirming the advance to 1800*. Rising 21-Day Twiggs Money Flow indicates buying pressure. Reversal below 1730 is most unlikely at present, but would warn of a test of primary support at 1650.

* Target calculation: 1730 + ( 1730 - 1650 ) = 1810

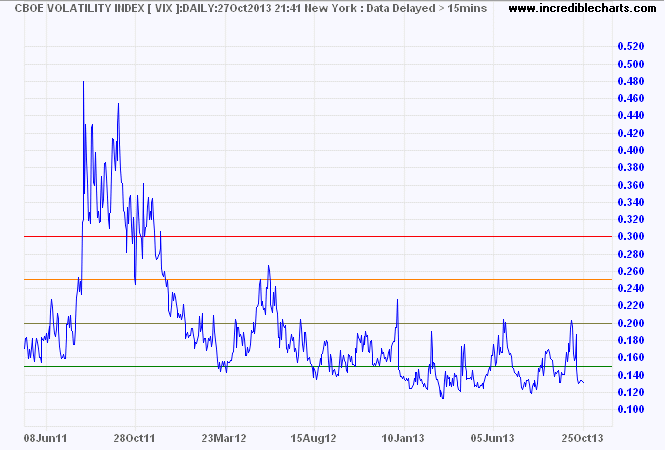

VIX below 15 flags low market risk.

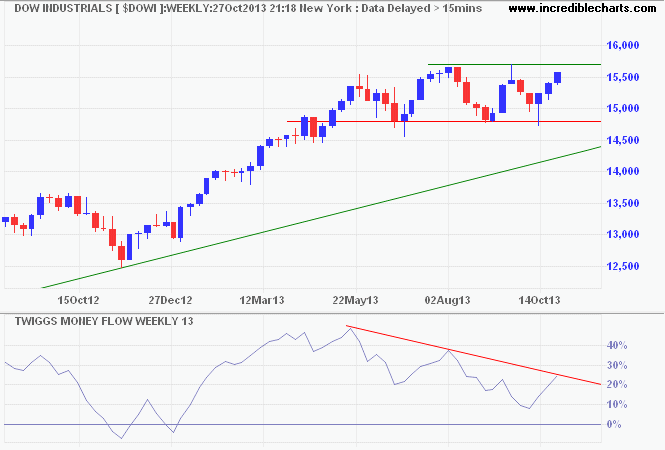

Dow Jones Industrial Average is headed for a test of resistance at 15700; breakout would offer a target of 16600*. Recovery above the descending trendline on 13-week Twiggs Money Flow would negate the earlier bearish divergence. Breach of 14800 is unlikely, but would warn of a reversal.

* Target calculation: 15700 + ( 15700 - 14800 ) = 16600

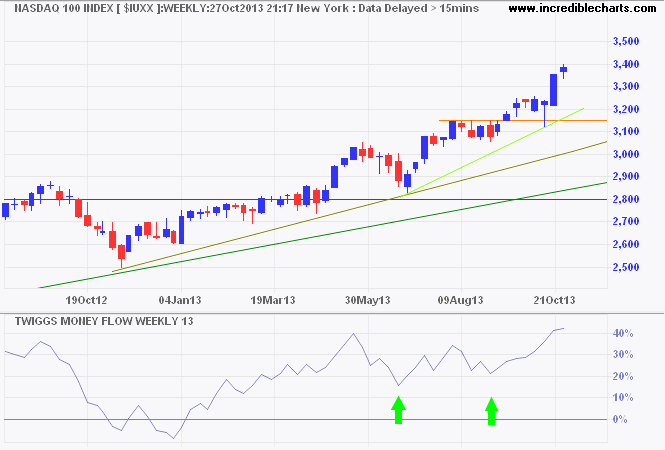

The Nasdaq 100, with 13-week Twiggs Money Flow troughs well above zero, indicates strong buying pressure.

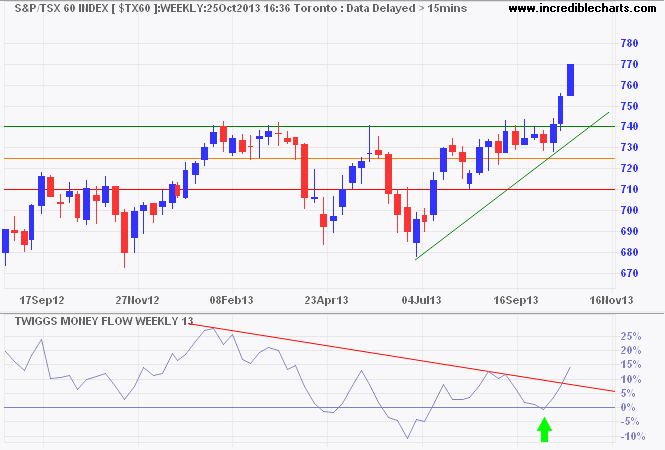

Canada's TSX 60 is advancing toward its target of 800*, the trough above zero on 13-week Twiggs Money Flow indicating strong buying pressure. Reversal below 740 is now most unlikely.

* Target calculation: 740 + ( 740 - 680 ) = 800

It is hard to let old beliefs go. They are familiar. We are comfortable with them and have spent years building systems and developing habits that depend on them. Like a man who has worn eyeglasses so long that he forgets he has them on, we forget that the world looks to us the way it does because we have become used to seeing it that way through a particular set of lenses. Today, however, we need new lenses. And we need to throw the old ones away.

~ Kenich Ohmae