S&P500 tide changing

By Colin Twiggs

July 7th, 2013 5:30 pm EDT (7:30 am AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

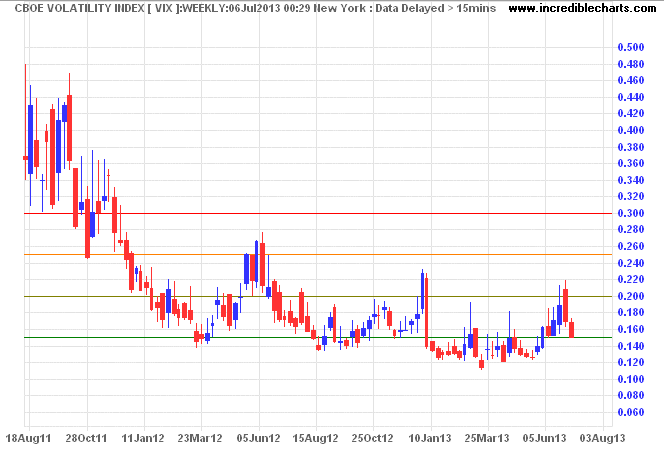

The VIX retreated below 15, signaling that market risk is falling.

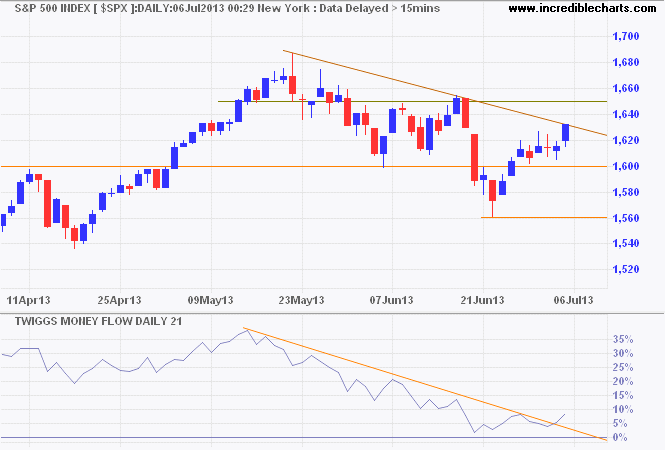

The S&P 500 is testing its declining trendline after a brief consolidation above 1600. Penetration would suggest that the correction is over; confirmed if resistance at 1650 is broken. 21-Day Twiggs Money Flow is leveling out and a trough above the line would signal a healthy primary up-trend. Target for an advance would be 1800*.

* Target calculation: 1680 + ( 1680 - 1560 ) = 1800

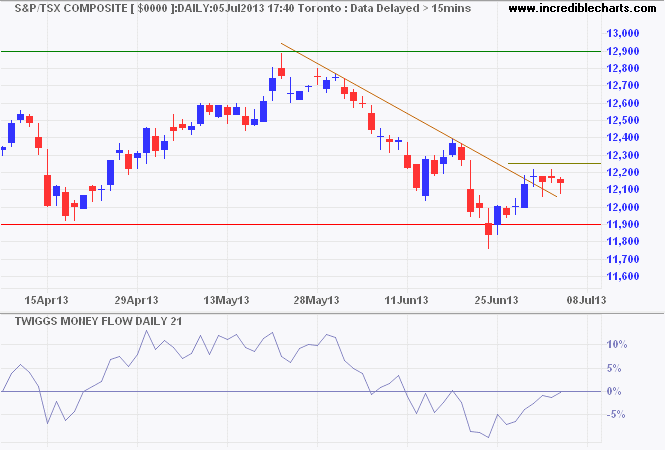

The TSX Composite index penetrated its declining trendline, suggesting that the correction is over. Follow-through above 12250 would strengthen the signal, while a rise above 12400 would confirm. Recovery of 21-day Twiggs Money Flow above zero would indicate buying pressure. Target for an advance would be 12900/13000. Reversal below 11900 is now unlikely, but would signal a primary down-trend.

...The left's agenda is a disservice to [the poor], as well as to society. ...The agenda of the left — promoting envy and a sense of grievance, while making loud demands for "rights" to what other people have produced — is a pattern that has been widespread in countries around the world. This agenda has seldom lifted the poor out of poverty. But it has lifted the left to positions of power and self-aggrandizement, while they promote policies with socially counterproductive results.

~ Thomas Sowell