Forex: Aussie falls but Euro and Yen unfazed

By Colin Twiggs

June 6th, 2012 4:00 a.m. EDT (6:00 p:m AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

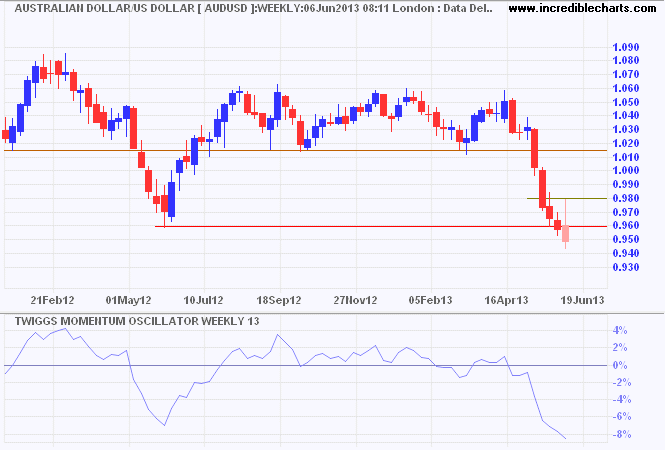

After a weak rally to $0.98, the Aussie Dollar broke primary support at $0.96, signaling a strong down-trend. Long-term target for the decline is $0.80*.

* Target calculation: 0.95 - ( 1.10 - 0.95 ) = 0.80

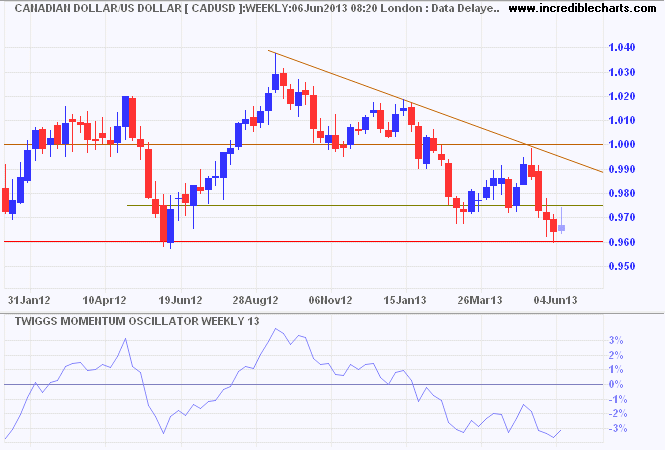

Canada's Loonie is also likely to break support at $0.96, offering a long-term target of $0.82*.

* Target calculation: 0.94 - ( 1.06 - 0.94 ) = 0.82

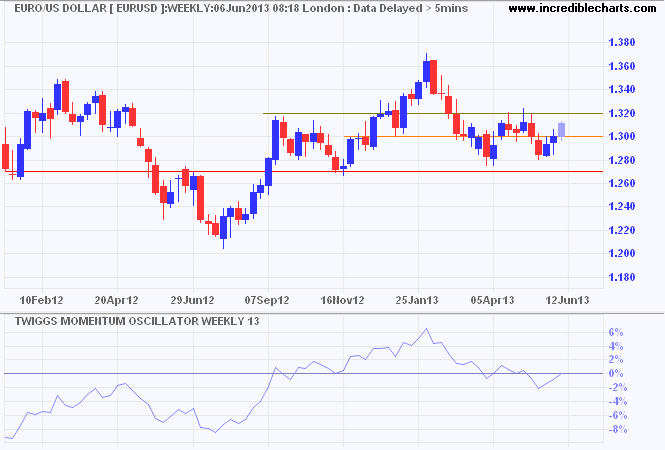

The euro, however, broke resistance at $1.30 and is headed for a test of $1.32. Breach of that level would offer a target of $1.36*. But respect of $1.32 would warn of a head and shoulders reversal — completed if support at $1.27 is broken.

* Target calculation: 1.32 + ( 1.32 - 1.28 ) = 1.36

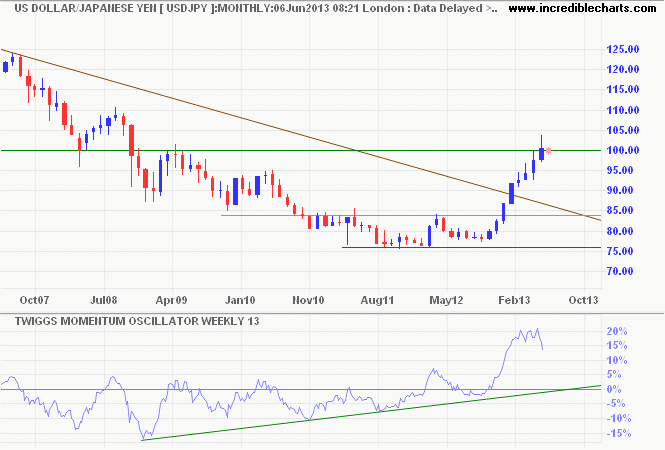

The greenback reversed sharply against the Yen in the last week, falling from ¥104 to ¥99. But the scale of the reversal is placed in its proper perspective on a monthly chart. The primary up-trend is unfazed, and recovery above resistance at ¥100 would signal a fresh advance with a target of ¥110*. The 30-year secular bear trend is over. Long-term target for the advance is the 2007 high at ¥125*.

* Target calculations: (a) 104 + ( 104 - 99 ) = 109; (b) 100 + ( 100 - 75 ) = 125

Accepting losses is the most important single investment device to ensure safety of capital.

~ Gerald Loeb