Gold: Two elephants in a lifeboat

By Colin Twiggs

May 30th, 2013 6:00 a.m. EDT (8:00 p:m AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

There are currently two players destabilizing global financial markets — like elephants in a lifeboat. One is the Bank of Japan, with markets uncertain as to how massive expansion of the monetary base will play out. The second is the Fed, where hints of a taper were enough to send the market into a panic, forcing the Fed to tone down its rhetoric. Emphasis now is on marginal rather than sizable decreases in QE.

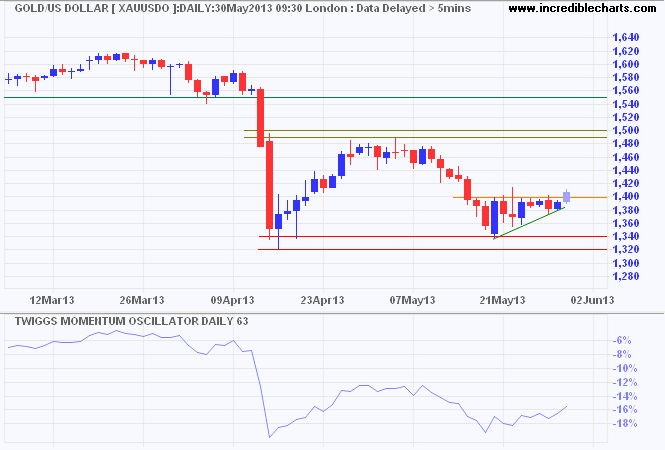

Gold broke resistance at $1400, respecting primary support at $1320 and headed for another test of $1500. Uncertainty is high with the metal as likely to break resistance at $1500, signaling a primary up-trend, as to break primary support, which would offer a target of $1200*.

* Target calculation: 1350 - ( 1500 - 1350 ) = 1200

Treasury Yields

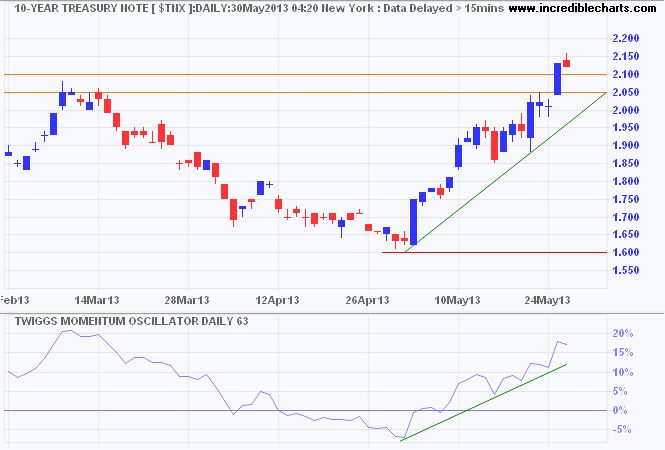

Ten-year treasury yields broke resistance at 2.10%, signaling a primary up-trend. First, expect retracement to test the new support level at 2.00/2.05 percent. Breach of that level would warn of another test of primary support at 1.60%. I do not believe that rising yields indicate a resurgence of inflation expectations, but rather anticipation of the Fed taper of quantitative easing. No one wants to be left holding bonds when yields start rising.

Crude Oil

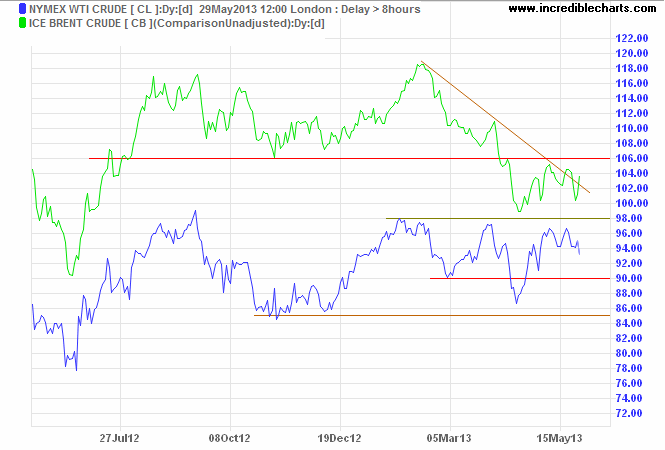

Brent Crude is headed for another test of resistance at $106/barrel. Respect would indicate a down-swing to $92*, while failure would signal reversal to an up-trend. Nymex WTI respected resistance at $98 and is expected to re-test resistance at $85/barrel. A classic pair trade, the spread between the two is likely to narrow as the European economy under-performs.

Commodities

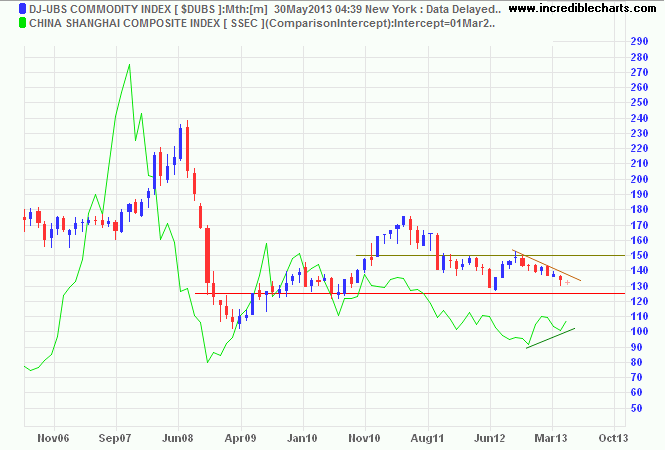

Commodity prices continue to fall, with the Dow Jones/UBS Commodity Index headed for primary support at 125/126. But signs of a base forming on the Shanghai Composite Index are likely to lift commodity prices. A Shanghai breakout above 2500 or penetration of the declining trendline would indicate a test of 150 for $DUBS.

What we should grasp, however, from the lessons of European history is that, first, there is nothing necessarily benevolent about programmes of European integration; second, the desire to achieve grand utopian plans often poses a grave threat to freedom; and third, European unity has been tried before, and the outcome was far from happy.

~ Margaret Thatcher, Statecraft: Strategies for a Changing World (2002)