Time for cautious optimism

By Colin Twiggs

February 4th, 2013 12:30 a.m. ET (4:30 pm AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

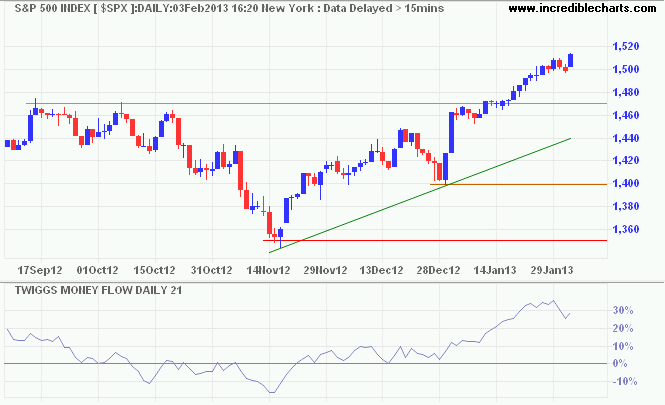

The S&P 500 displays evidence of buying pressure on the daily chart, with brief retracement to test support at 1500 followed by a surge to a new 5-year high. Expect a test of the 2000/2007 highs at 1550/1565.

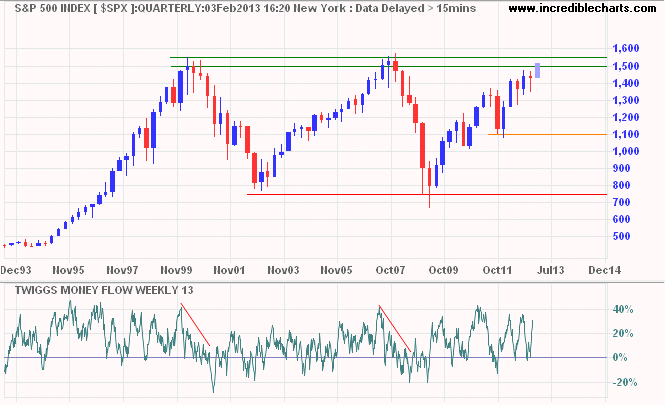

Troughs above the zero line on 13-week Twiggs Money Flow indicate longer-term buying pressure. Breakout is likely and would signal an advance to 1750*. Reversal below 1500, however, would warn of a widely predicted correction.

* Target calculation: 1550 + ( 1550 - 1350 ) = 1750

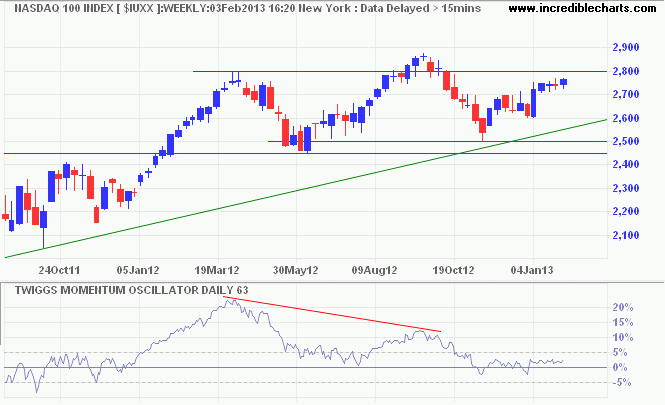

Declining 63-day Twiggs Momentum on the Nasdaq 100, however, warns of a reversal. Respect of resistance at 2800 would strengthen the warning, while retreat below 2500 would complete a head and shoulders reversal. Follow-through above 2900 is less likely, but would confirm a bull market signal from the Dow/S&P 500.

These are times for cautious optimism. Central banks are flooding markets with freshly printed money, driving up stock prices, but this could create a bull trap if corporate earnings, capital investment and employment fail to respond.

A propensity to hope and joy is real riches:

One to fear and sorrow, real poverty.

~ David Hume, Scottish philosopher (1711 - 1776)