Which way gold?

By Colin Twiggs

April 12th, 2012 4:00 a.m. ET (6:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

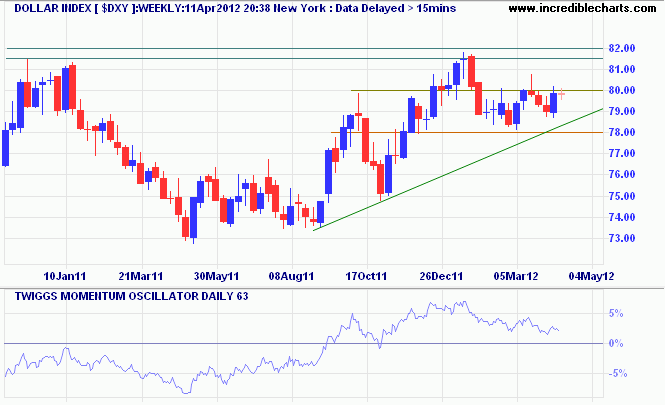

The Dollar Index is consolidating on the weekly chart, indicating uncertainty. Respect of resistance at 80.00 would warn of another test of support at 78.00, while breakout would indicate continuation of the primary up-trend. In the longer term, breakout above 82.00 would offer a target of 86.00*, while failure of support at 78.00 would signal a primary down-trend. Reversal of 63-day Twiggs Momentum below zero would also warn of a primary down-trend.

* Target calculation: 82 + ( 82 - 78 ) = 86

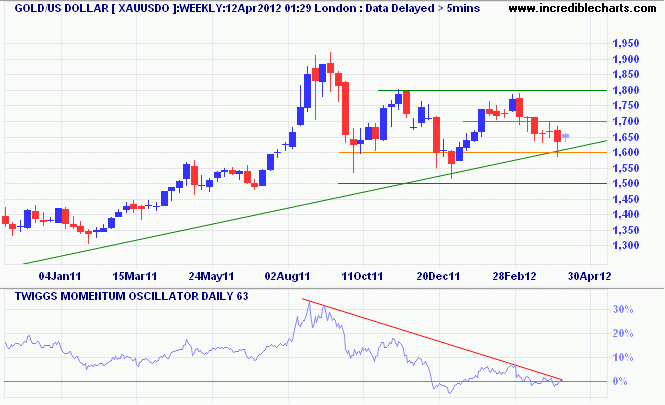

Gold remains undecided despite a sharp fall on the Gold Bugs Index. The long tail on last week's candle for spot gold indicates buying pressure at the $1600 support level. Recovery above $1700 would respect the long-term trendline and indicate another test of $1800, suggesting the start of a new up-trend. Breakout above $1800 would confirm, offering a target of $2000/ounce*. A 63-day Twiggs Momentum trough predominantly above the zero line would strengthen the bull signal. Reversal below support at $1600, however, would warn of a primary down-trend — confirmed if support at $1500 is broken.

* Target calculation: 1800 + ( 1800 - 1600 ) = 2000

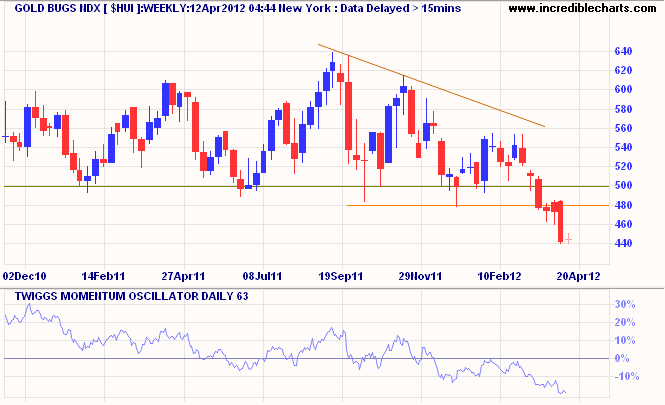

Gold Bugs Index, representing un-hedged gold stocks, is in a clear primary down-trend since breaking support at 500. Peaks below zero on 63-day Twiggs Momentum also signal a strong down-trend.

Politics is not an end, but a means. It is not a product, but a process. It is the art of government. Like other values it has its counterfeits. So much emphasis has been placed upon the false that the significance of the true has been obscured and politics has come to convey the meaning of crafty and cunning selfishness, instead of candid and sincere service.

~ Calvin Coolidge