US markets pause in anticipation of March sell-off

By Colin Twiggs

March 12th, 2012 5:00 a.m. ET (9:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

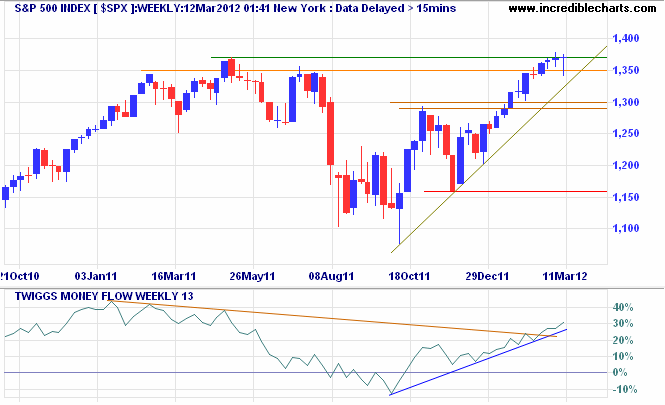

US markets are anticipating a quarter-end sell-off in the second half of March, driven by the tax season and Spring-cleaning of fund balance sheets. The S&P 500 Index continues to test resistance at 1370. Breakout would signal the start of another primary advance, with a target of 1450*. Reversal below 1350, however, would warn of a correction, testing support at 1300 and possibly 1250.

* Target calculations: 1300 + ( 1300 - 1150 ) = 1450

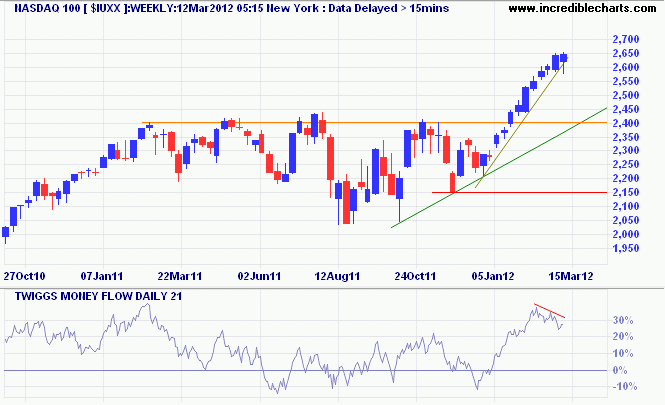

The Nasdaq 100 reached its initial target of 2650 and is due for a correction. Bearish divergence on 21-day Twiggs Money Flow indicates medium-term selling pressure. Expect retracement to test support at 2400.

* Target calculations: 2400 + ( 2400 - 2150 ) = 2650

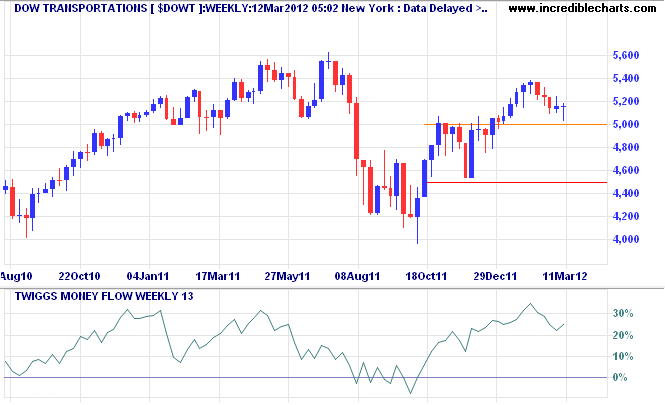

Dow Jones Transport Index has retraced over several weeks to test support at 5000. Respect would signal another attempt at 5600, while failure would indicate that momentum is slowing.

The political machine triumphs because it is a united minority acting against a divided majority.

~ Will Durant