It's the economy, stupid

By Colin Twiggs

July 28th, 2011 5:00 a.m. ET (7:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The global monetary system rests on a knife-edge, with the US Treasury about to default unless a last-minute agreement can be brokered between major political players. If not, the world's only reserve currency will plunge in value, with dramatic consequences for the global monetary system. Here are a few observations:

A debt limit is a LIMIT. It is not supposed to be raised. How we got to the present situation was by repeatedly raising the limit, fostering the impression that it is only a target. The onus remains on the incumbent party to cut spending (or increase revenues) so that the limit is never reached. When Democrats lost their majority in the House the job became tougher, but they still bear responsibility for brokering a deal that has majority support — even if they have to eat some peas. They could not assume that the debt limit would be raised. Waiting until the 11th hour in order to blackmail opponents with another case of too-big-to-fail might be sharp political practice but displays a clear lack of fiscal responsibility.

The agenda is being driven by politics rather than by a desire to solve the country's problems. The elephant in the room is Medicare, Medicaid and Social Security; you can't start negotiations by declaring these off-limits. Each side is guilty of political grandstanding, with positions carefully crafted for next year's election; and negotiations conducted through the media are doomed to failure. If both sides were genuine in their attempt to resolve the deadlock, there would be a media blackout until an agreement had been hammered out between them.

Capital markets are unforgiving and the time is coming when they will deliver a clear message: whoever wins the next election is irrelevant — it's the economy, stupid.

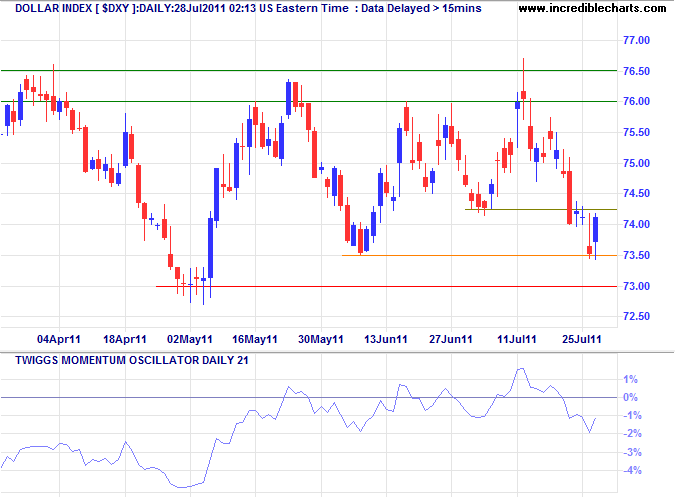

US Dollar Index

Despite the turmoil in Washington, the Dollar Index rallied to test short-term resistance at 74.25. But the medium-term trend is down and reversal below 73.50 would test primary support at 73. Narrow oscillation of 21-day Momentum around the zero line indicates no strong trend as yet. The long-term picture remains bearish and a break below 73 would signal a primary decline to 70*.

* Target calculation: 73 - ( 76 - 73 ) = 70

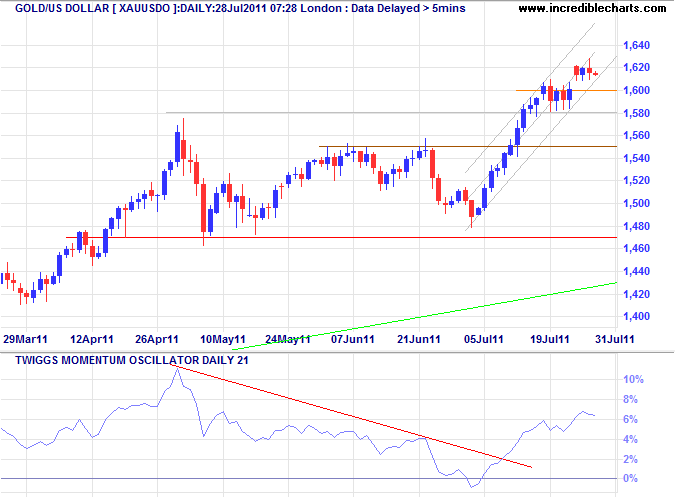

Gold

Spot gold is consolidating in a narrow band below 1620 on the daily chart. Upward breakout would test the upper trend channel around 1650*/1660. Reversal below 1600 is less likely, but would warn of another retracement to find support.

* Target calculation: 1550 + ( 1575 - 1475 ) = 1650

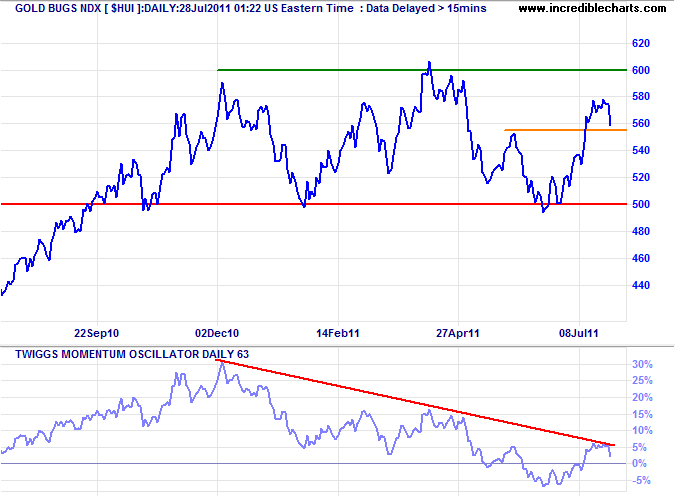

The Gold Bugs Index ($HUI), representing unhedged gold stocks, however, failed to make a new high. Short-term uncertainty may be fueling demand for gold, but the long-term picture, represented by miners, remains in a broad consolidation between 500 and 600. Reversal of 63-day Twiggs Money Flow below zero would strengthen the bearish outlook.

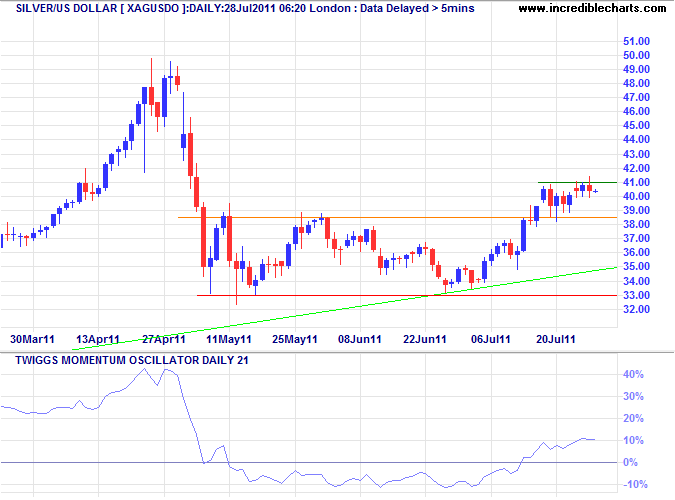

Silver

Silver respected its new support level at $39, confirming the breakout. Follow through above $41 would signal an advance to $50 — a bullish sign for gold.

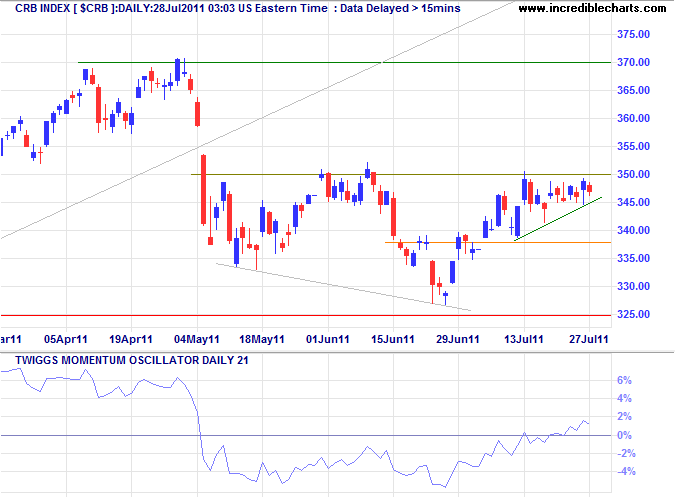

Commodities

The CRB Commodities Index displays an ascending triangle below 350, indicating continuation of the advance. Breakout from the broadening wedge would signal an advance to 370*.

* Target calculation: 350 + ( 350 - 325 ) = 375

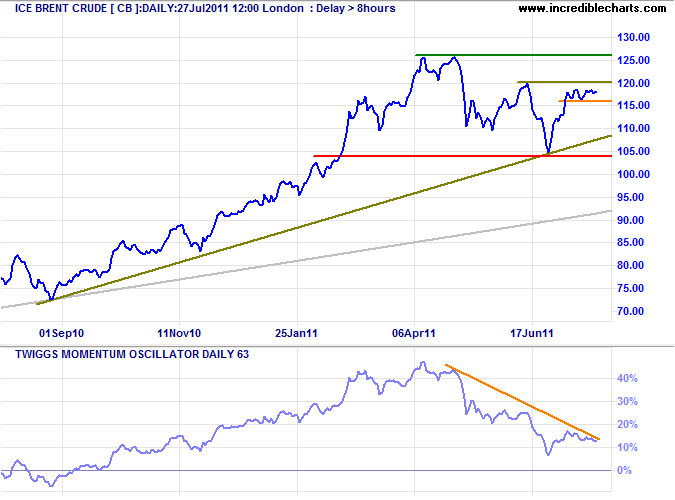

Crude Oil

Brent crude is testing resistance at $120. Narrow consolidation also suggests an upward breakout — which would test $126. Renewal of the primary up-trend (above $126) would boost gold but add another nail in the coffin of the recovery. Nymex Crude continues to diverge from Brent prices, but this difference should last no longer than the election next year.

* Target calculation: 125 + ( 125 - 105 ) = 140 or 110 - ( 125 - 110 ) = 95

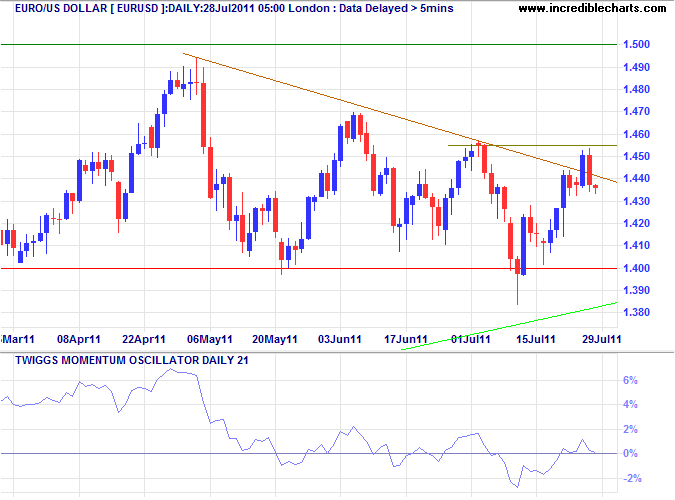

Euro

The euro retreated below the descending trendline and follow-through below $1.43 would again test primary support at $1.40. 21-Day Momentum oscillating in a narrow range around zero shows no clear trend. Recovery above $1.455, however, would test $1.50.

* Target calculation: 1.45 + ( 1.45 - 1.40 ) = 1.50

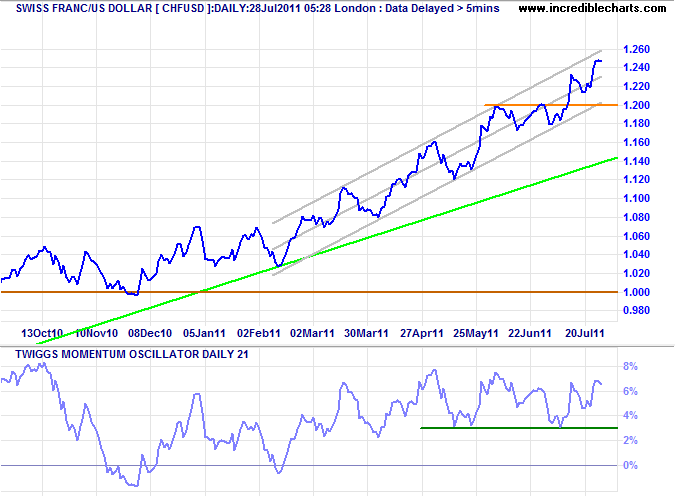

Swiss Franc

The Swiss franc rallied to test the upper trend channel at $1.25 against the dollar. 21-Day Momentum holding well above zero confirms the strong up-trend. Expect retracement in the short-term to test the lower trend channel above $1.20.

* Target calculation: 1.00 + ( 1.00 - 0.80 ) = 1.20

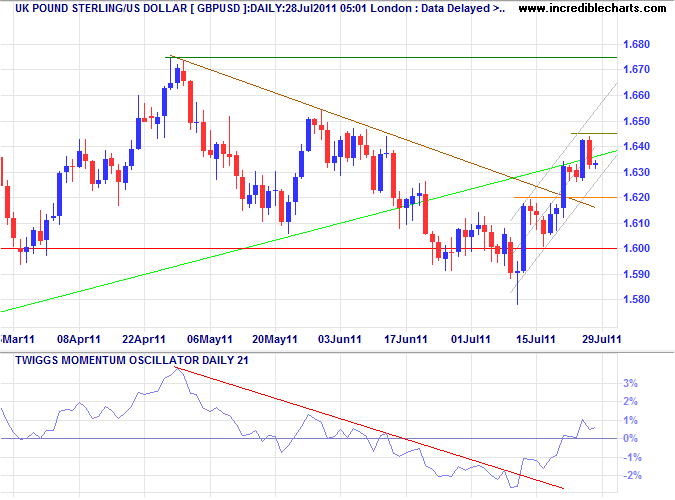

UK Pound Sterling

The pound continues its steep ascent, but failure of the (lower) trend channel would warn of another test of primary support at $1.60.

* Target calculation: 1.60 - ( 1.67 - 1.60 ) = 1.53

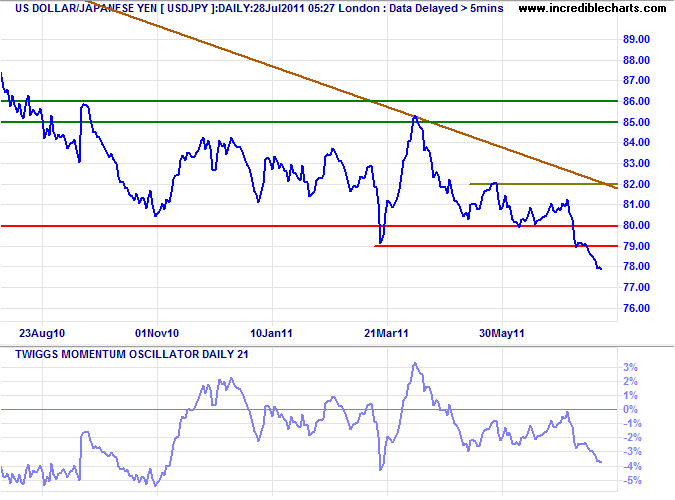

Japanese Yen

The dollar continues to weaken against the yen. Failure of support at ¥79/78.50 signals a decline to ¥75*. Weak 21-day Momentum, holding below zero, confirms the down-trend.

* Target calculation: 80 - ( 85 - 80 ) = 75

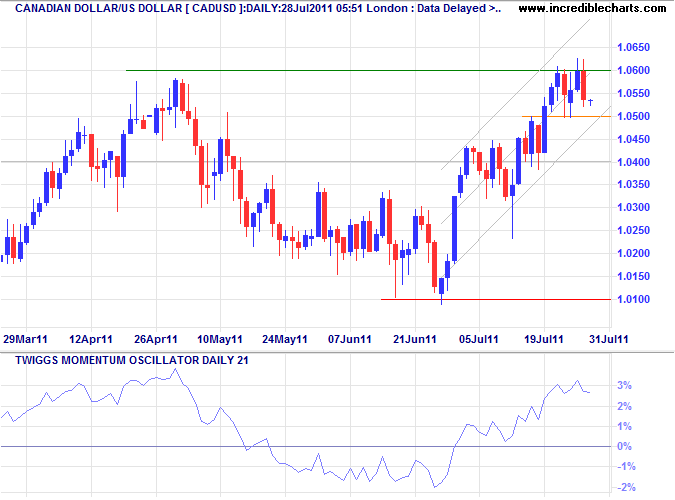

Canadian Dollar

The Loonie is testing resistance at $1.06 against the greenback. Narrow consolidation suggests an upward breakout, which would test the upper trend channel at $1.09 on the weekly chart.

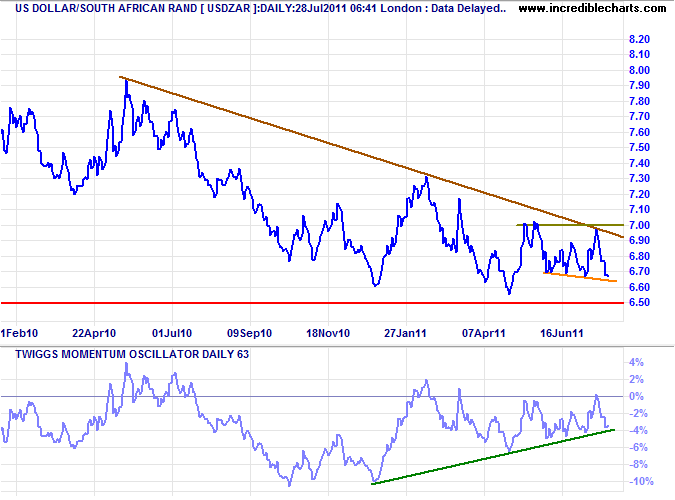

South African Rand

The dollar continues to edge lower against the Rand but will encounter long-term support at R6.50. The rise in 63-day Momentum warns of reversal to an up-trend; strengthened if there is a recovery above zero. Breakout above R7.00 would indicate a primary up-trend.

* Target calculation: 7.00 + ( 7.00 - 6.50 ) = 7.50 or 6.50 - ( 7.00 - 6.50 ) = 6.00

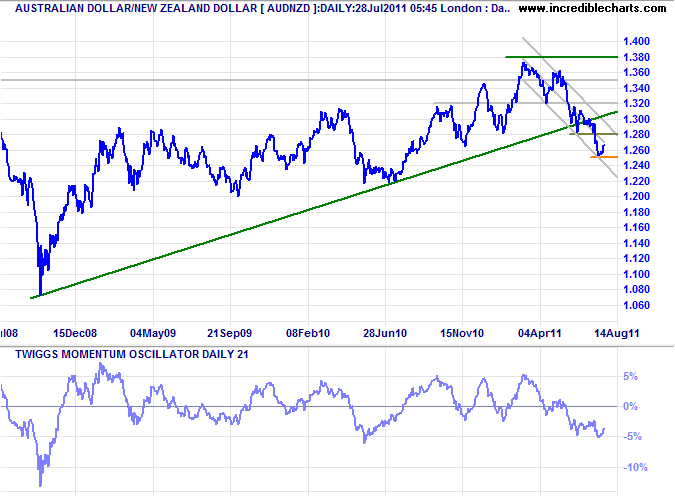

New Zealand Dollar

The Aussie dollar is in a primary down-trend against its Kiwi counterpart. The latest retracement should test the upper trend channel at $1.28. Declining 21-day Momentum indicates continuation of the down-trend.

* Target calculation: 1.30 - ( 1.38 - 1.30 ) = 1.22

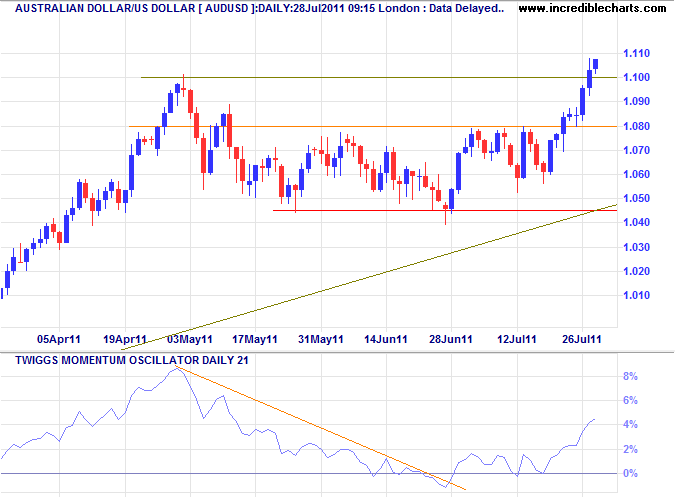

Australian Dollar

The Aussie dollar broke through resistance at $1.10 against the greenback, accompanied by a surge in 21-day Momentum. Target for the advance is $1.15*, but first expect retracement to test the new support level.

* Target calculation: 1.10 + ( 1.10 - 1.05 ) = 1.15

Whenever destroyers appear among men, they start by destroying money, for money is men's protection and the base of a moral existence. Destroyers seize gold and leave to its owners a counterfeit pile of paper. This kills all objective standards and delivers men into the arbitrary power of an arbitrary setter of values. Gold was an objective value, an equivalent of wealth produced. Paper is a mortgage on wealth that does not exist, backed by a gun aimed at those who are expected to produce it. Paper is a check drawn by legal looters upon an account which is not theirs: upon the virtue of the victims. Watch for the day when it bounces, marked: 'Account overdrawn'.

~ Ayn Rand:

Atlas Shrugged (1957)

Hat tip to Jon for this quote from Ayn Rand, whose words now seem prophetic. I do not, however, endorse her philosophy, siding more with Konrad Lorenz.