Sideways market

By Colin Twiggs

July 25th, 2011 8:00 a.m. ET (10:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Not much to get excited about. The Nasdaq 100 and Nikkei 225 broke resistance to signal fresh advances, and India may be forming a bottom, but China threatens to join Brazil and Australia in a primary down-trend.

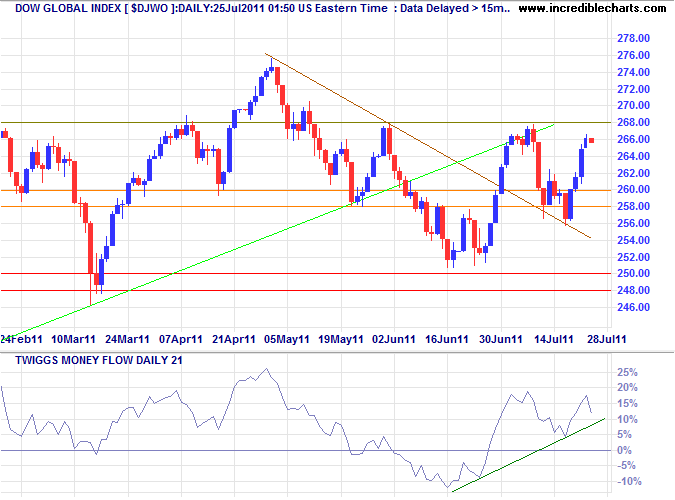

Global Index

The Dow Jones Global Index is headed for another test of resistance at 268. Breakout would signal an advance to 280*. Rising 21-day Twiggs Money Flow indicates medium-term buying pressure. Reversal below the band of support at 250 is unlikely at present, but would signal a primary down-trend.

* Target calculation: 268 + ( 268 - 256 ) = 280

USA

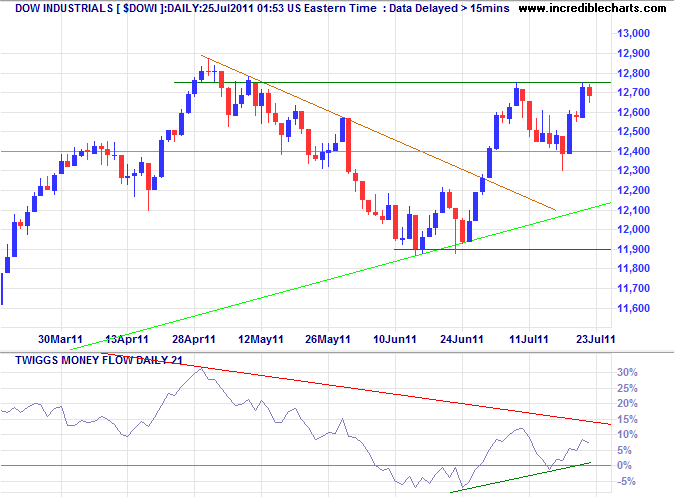

Dow Jones Industrial Average

The Dow Industrial Average is likewise testing resistance at 12750. Breakout would offer a short-term target of 13100*. Twiggs Money Flow formed a trough above the zero line, indicating medium-term buying pressure; reversal below zero, however, would reinforce the long-term bearish divergence.

* Target calculation: 12750 + ( 12750 - 12400 ) = 13100

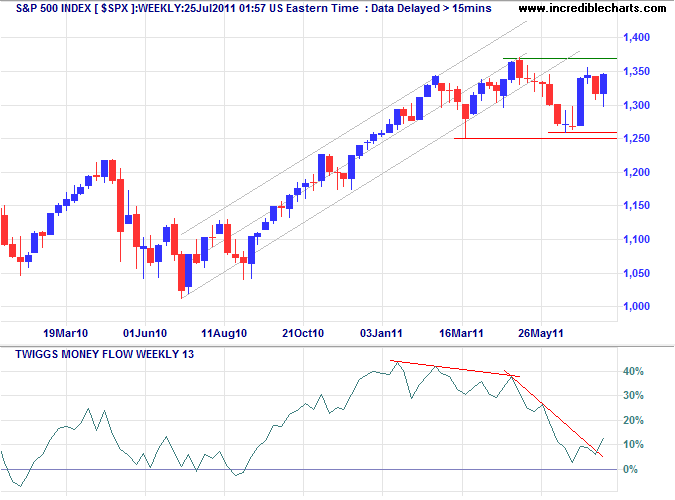

S&P 500

The weekly chart of the S&P 500 is testing resistance at 1350. Recovery of 13-week Twiggs Money Flow above its descending trendline indicates medium-term buying support. Breakout above 1350 would offer a medium-term target of 1450*. Primary support remains at 1250.

* Target calculation: 1350 + ( 1350 - 1250 ) = 1450

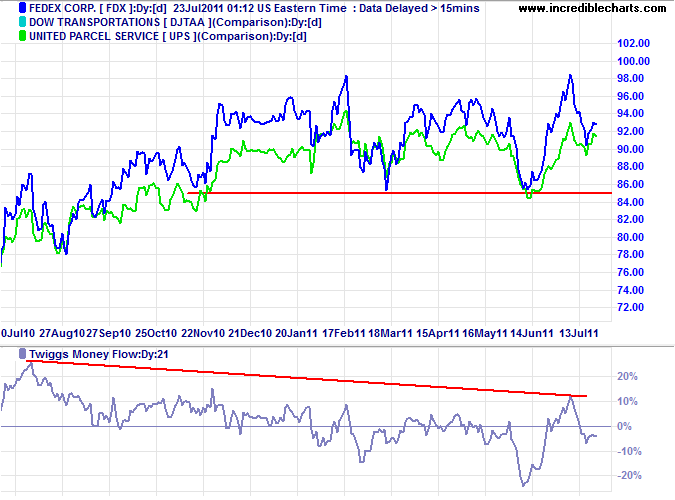

Transport

Bellwether transport stocks Fedex and UPS continue their long-term consolidation, reflecting stagnant economic activity levels. Twiggs Money Flow oscillating around zero shows no clear trend.

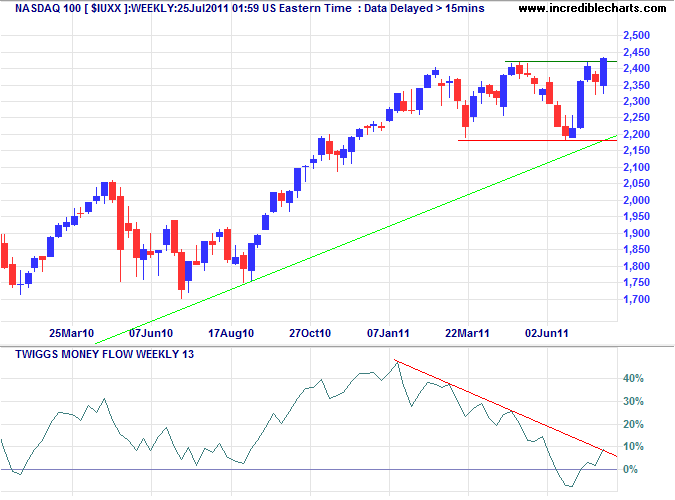

Technology

The Nasdaq 100 broke resistance at 2425 on the weekly chart, offering a short-term target of 2500 and medium-term at 2600*. Recovery of 13-week Twiggs Money Flow above the descending trendline would strengthen the breakout signal.

* Target calculation: 2400 + ( 2400 - 2200 ) = 2600

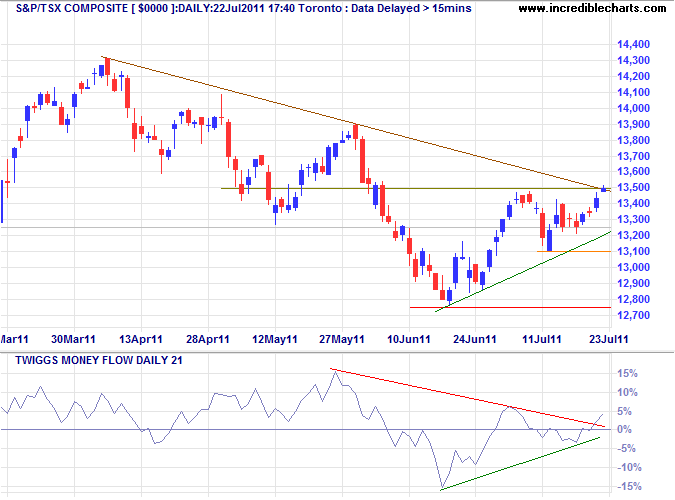

Canada: TSX

The TSX Composite Index is testing resistance at 13500 and the descending trendline. Breakout would indicate that the down-trend is losing momentum, offering a short-term target of 13900. Rising 21-day Twiggs Money Flow indicates medium-term selling pressure. Reversal below 13100 is unlikely, but would test primary support at 12750.

* Target calculation: 12750 - ( 13500 - 12750 ) = 12000

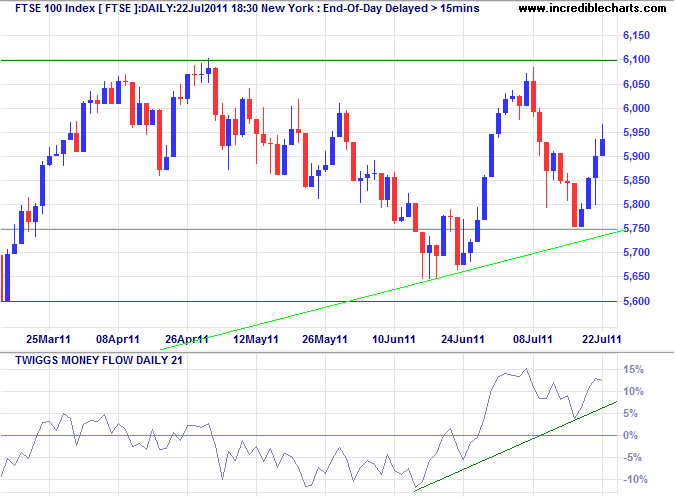

United Kingdom

The FTSE 100 opened slightly lower Monday after weak performance from Asia, but rising 21-day Twiggs Money Flow indicates buying support and another test of 6000/6100 is likely. Breach of support at 5600/5650 is unlikely at present, but would warn of a primary down-trend.

* Target calculation: 6100 + ( 6100 - 5700 ) = 6500 or 5600 - ( 6100 - 5600 ) = 5100

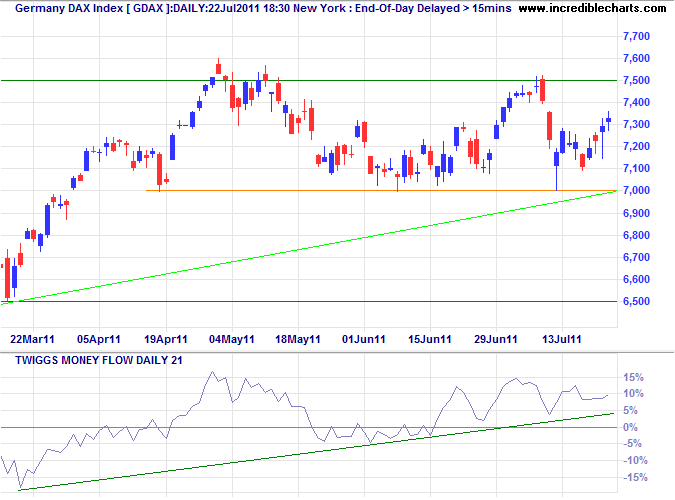

Germany

The DAX is headed for another test of resistance at 7500, supported by rising 21-day Twiggs Money Flow. Breakout would offer a target of 8000*. Reversal below 7000 is unlikely at present, but would warn of a primary down-trend.

* Target calculation: 7500 + ( 7500 - 7000 ) = 8000

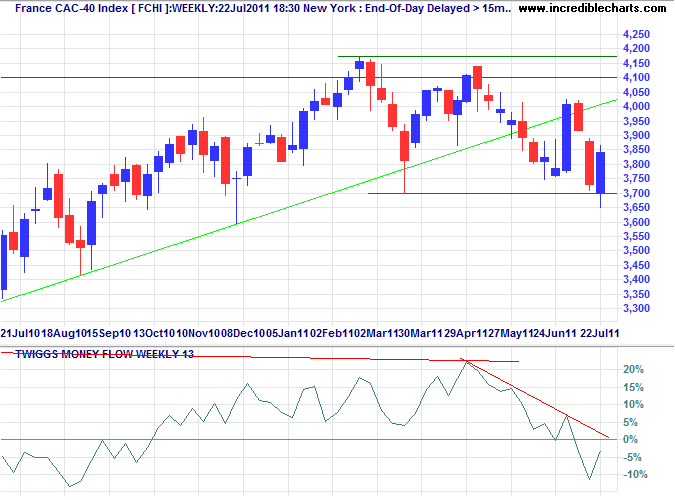

France

The CAC-40 found support at 3700, but 13-week Twiggs Money Flow below zero continues to warn of a reversal. Breach of support at 3700 would confirm.

* Target calculation: 3700 - ( 4100 - 3700 ) = 3300

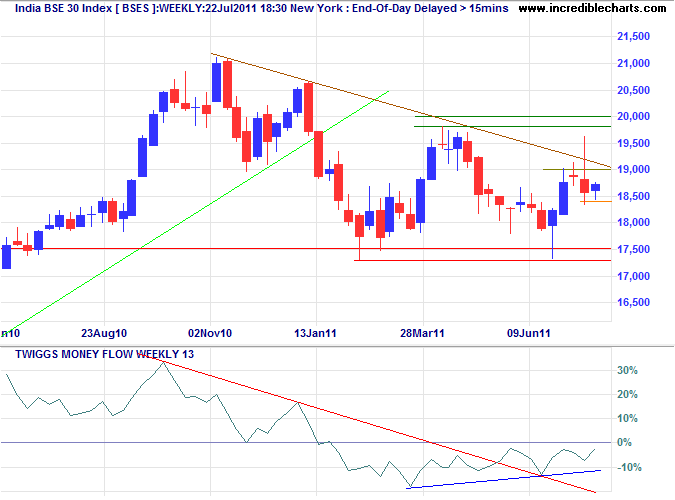

India

The Sensex re-tested resistance at 19000 Monday on the weekly chart. 13-Week Twiggs Money Flow remains below zero, however, and failure of short-term support at 18400 would warn of another test of primary support at 17500. Breakout above 19000 accompanied by a Twiggs Money Flow rise above zero, on the other hand, would offer a target of 20000.

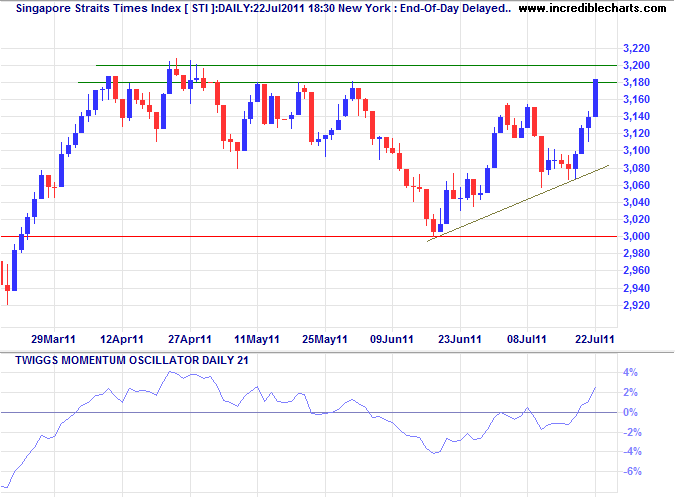

Singapore

The Straits Times Index consolidated between 3150 and 3170 Monday, below the band of resistance at 3180 to 3200. Breakout above 3200 would signal a primary advance to 3400*. Respect of resistance at 3180 would re-test the rising trendline at 3100.

* Target: 3200 + ( 3200 - 3000 ) = 3400

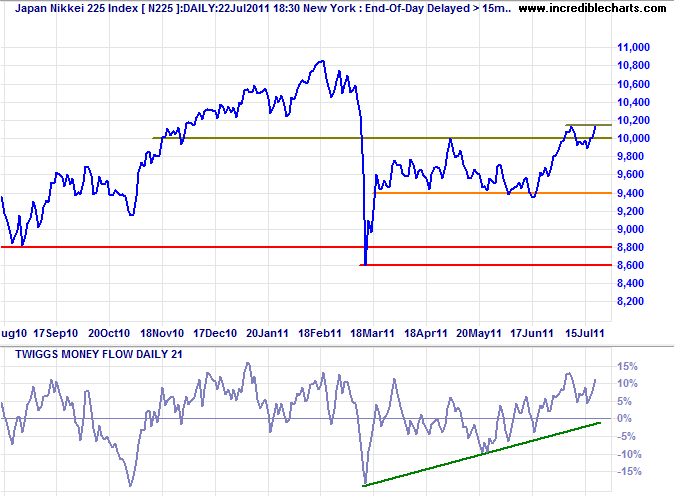

Japan

The Nikkei 225 retraced Monday for a re-test of the new support level at 10000. Rising 21-day Twiggs Money Flow indicates buying pressure. Respect of support would confirm an advance to the February high of 10800.

* Target calculation: 10000 + ( 10000 - 9300 ) = 10700

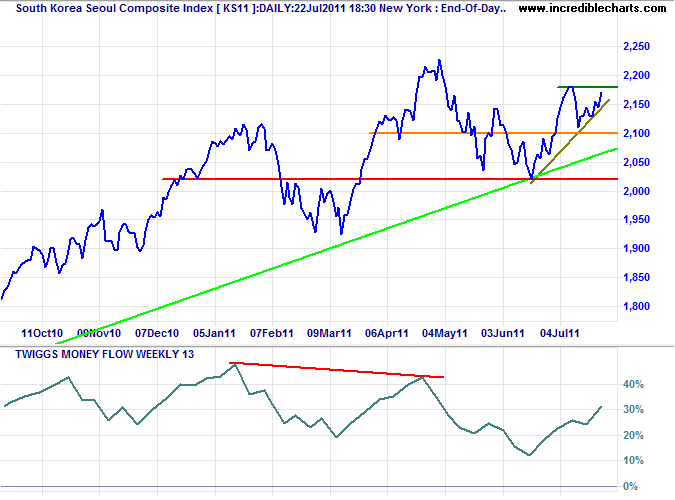

South Korea

The Seoul Composite Index consolidated Monday below resistance at 2180. Breakout would indicate an advance to 2400*. Reversal below 2100 is unlikely, but would re-test primary support at 2000. Buying pressure is weakening but remains positive according to 13-week Twiggs Money Flow.

* Target calculation: 2200 + ( 2200 - 2000 ) = 2400

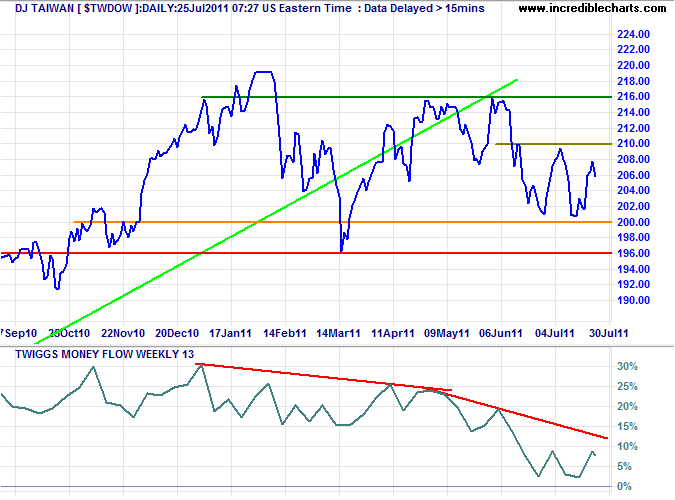

Taiwan

The Dow Jones Taiwan Index continues to warn of reversal to a primary down-trend, with breach of the declining trendline and bearish divergence on 13-week Twiggs Money Flow. Failure of support at 200 would test primary support at 196.

* Target calculation: 196 - ( 216 - 196 ) = 176

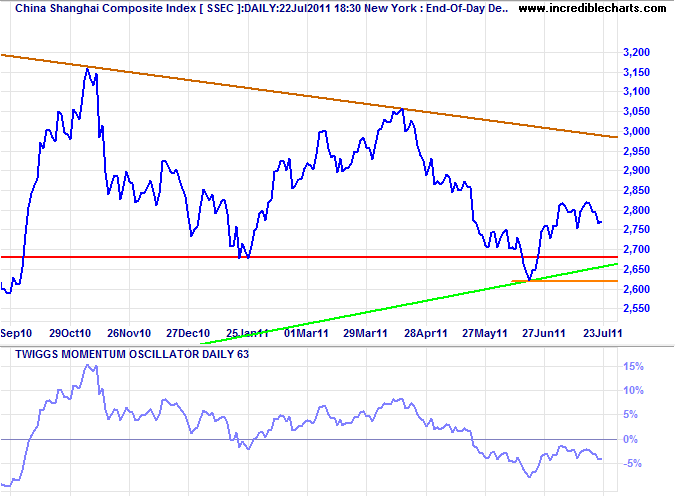

China

The Shanghai Composite Index tested the primary support level of 2680 Monday. Failure of support would warn of a primary down-trend — confirmed if support at 2620 is breached. 63-Day Twiggs Momentum holding below zero strengthens the bear signal.

* Target calculations: 2700 - ( 3000 - 2700 ) = 2400

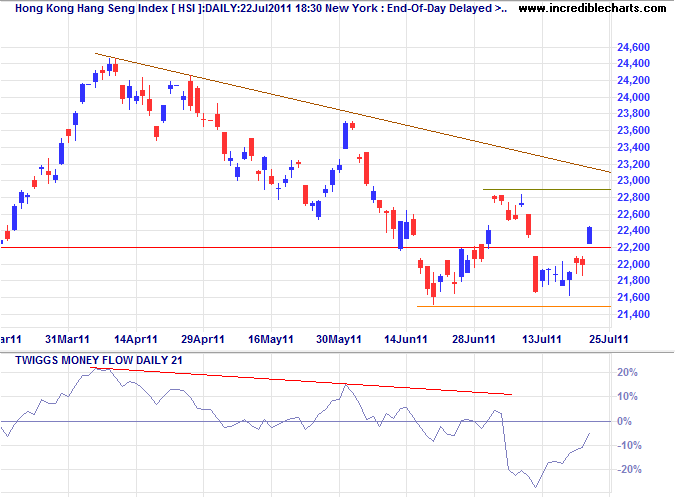

The Hang Seng Index is also testing its primary support level. Reversal below 22200 would warn of a primary down-trend. Breach of 21500 would confirm, offering a target of 20000*. Twiggs Money Flow below zero continues to warn of selling pressure.

* Target calculation: 22200 - ( 24400 - 22200 ) = 20000

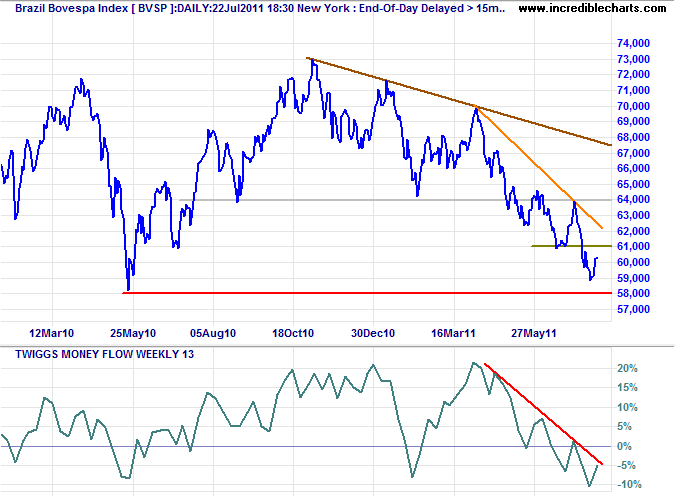

Brazil: Bovespa

The Bovespa Index remains in a strong primary down-trend. Respect of resistance at 61000 would signal a test of the May low at 58000*. 13-Week Twiggs Money Flow below zero indicates strong selling pressure.

* Target calculation: 61000 - ( 64000 - 61000 ) = 58000

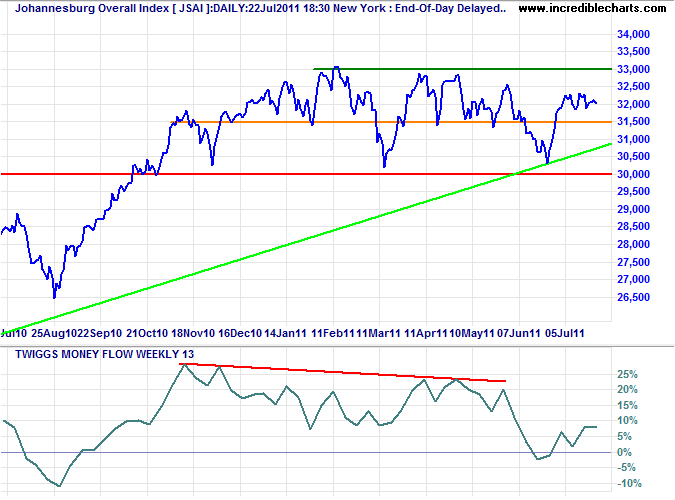

South Africa: JSE

The JSE Overall Index continues in a long-term consolidation. 13-Week Twiggs Money Flow is weakening and a failed swing, that does not reach 33000, would strengthen the bear signal.

* Target calculation: 33000 + ( 33000 - 30000 ) = 36000

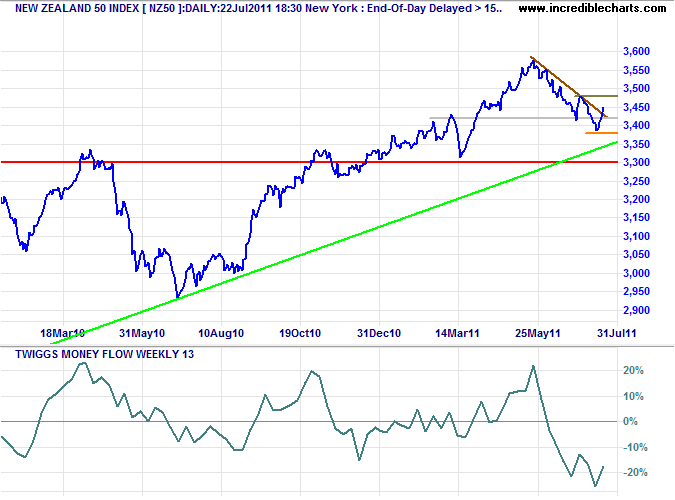

New Zealand: NZX

The NZ50 penetrated its declining trendline, but then retreated Monday to 3430. Failure of support at 3380 would test primary support at 3300. The sharp fall on 13-week Twiggs Money Flow continues to warn of a primary reversal.

* Target calculation: 3425 + ( 3425 - 3300 ) = 3550

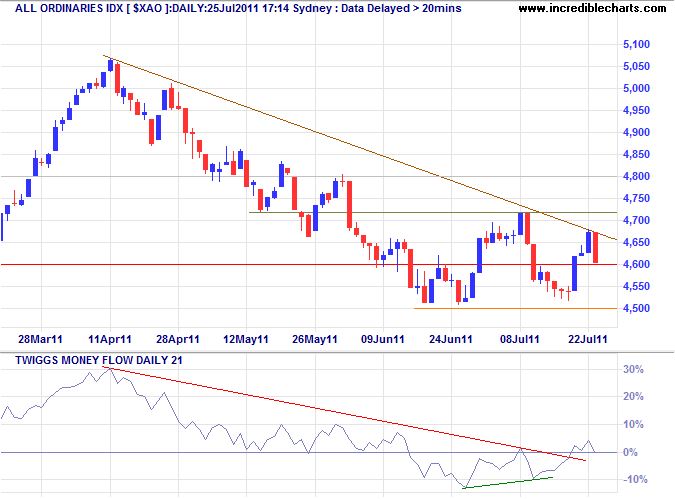

Australia: ASX

The All Ordinaries is again testing primary support at 4600. Breach would again warn of a primary down-trend. Follow-through below 4500 would confirm. The slight rise on 21-day Twiggs Money Flow indicates short-term buying support, but the big picture is bearish.

* Target calculation: 4600 - ( 5000 - 4600 ) = 4200

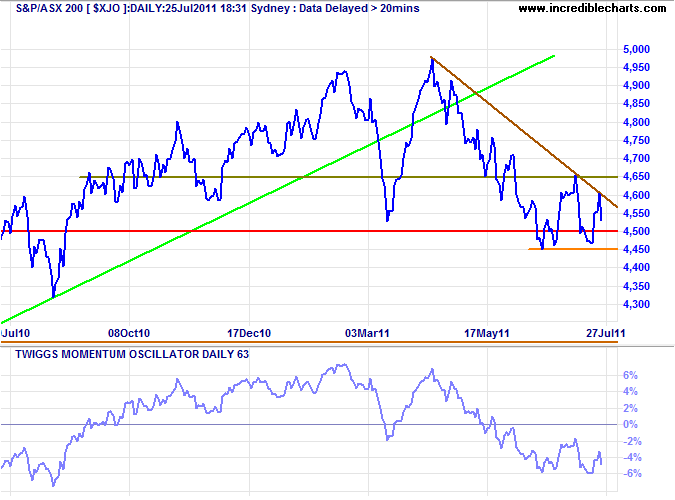

The ASX 200 is similarly testing support at 4500. Follow-through below 4450 would confirm the primary down-trend. 63-Day Twiggs Momentum holding below zero strengthens the bear signal.

* Target calculation: 4500 - ( 5000 - 4500 ) = 4000

Without education, we are in a horrible and deadly danger of taking educated people seriously.

~ G. K. Chesterton