Gold breakout as dollar weakens

By Colin Twiggs

July 14th, 2011 3:00 a.m. ET (5:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

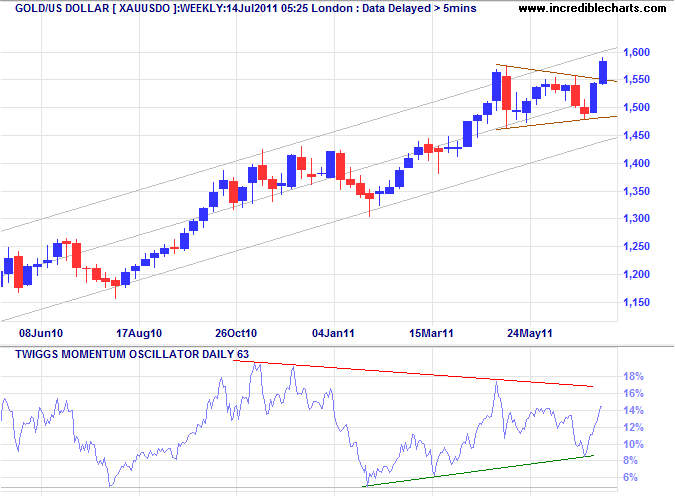

Gold

Spot gold broke out above the triangle formation on the weekly chart, signaling a new advance with a target of 1650*.

* Target calculation: 1550 + ( 1575 - 1475 ) = 1650

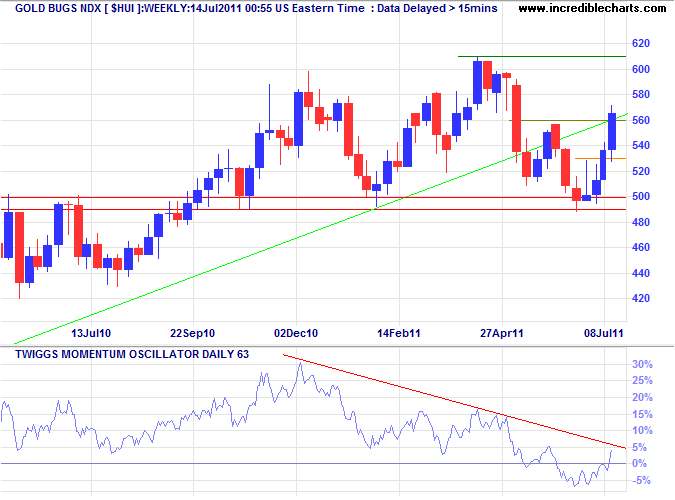

AMEX Gold Bugs Index, representing unhedged gold stocks, broke through resistance at 560, signaling another test of 610. The 63-day Momentum recovered above zero but has yet to break the descending trendline, which would strengthen the signal.

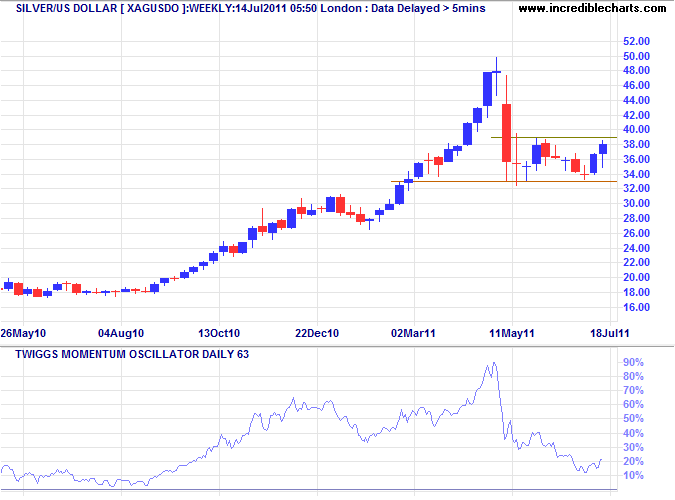

Silver

Silver rallied to test resistance at $39. Breakout would signal a rally to $50 — a bullish sign for gold — while respect would test primary support at $33.

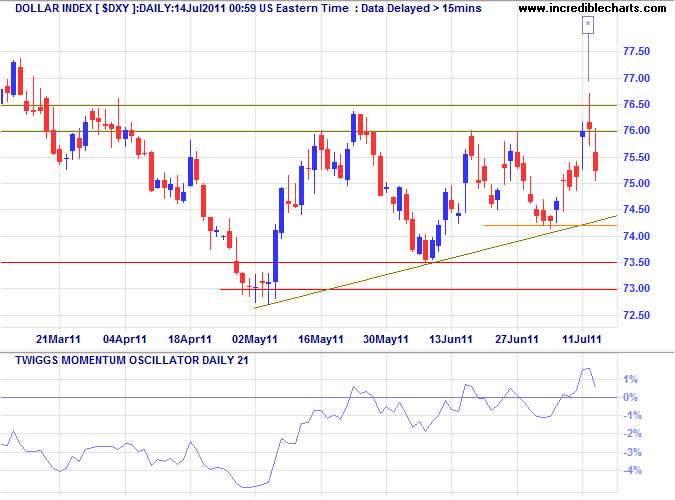

US Dollar Index

The Dollar Index made a false break through 76.50 at [*], threatening a bull trap. Breach of the rising trendline would warn of another down-swing with a target of 70* — a bullish sign for gold — but narrow oscillation of 21-day Momentum around the zero line indicates no strong trend as yet.

* Target calculation: 74 - ( 76.5 - 72.5 ) = 70

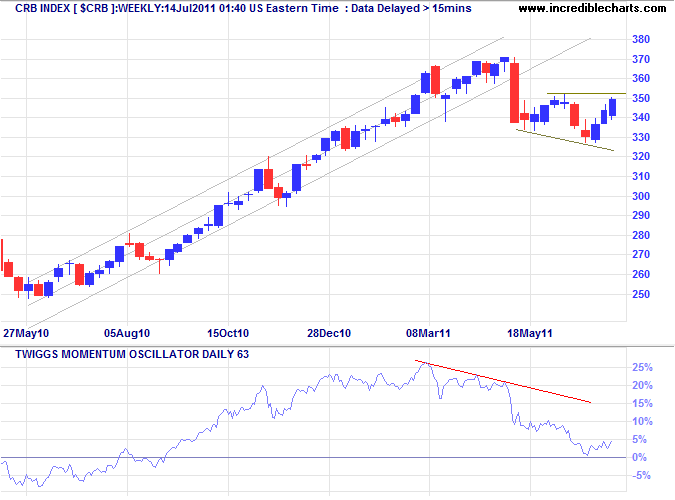

Commodities

The CRB Commodities Index is testing resistance at 352 on the weekly chart, but breakout could merely be a broadening wedge formation. The next retracement should provide further evidence. Bearish divergence on 63-day Momentum continues to warn of a primary down-trend. Reversal below 330 would confirm. A weakening dollar would boost demand for commodities.

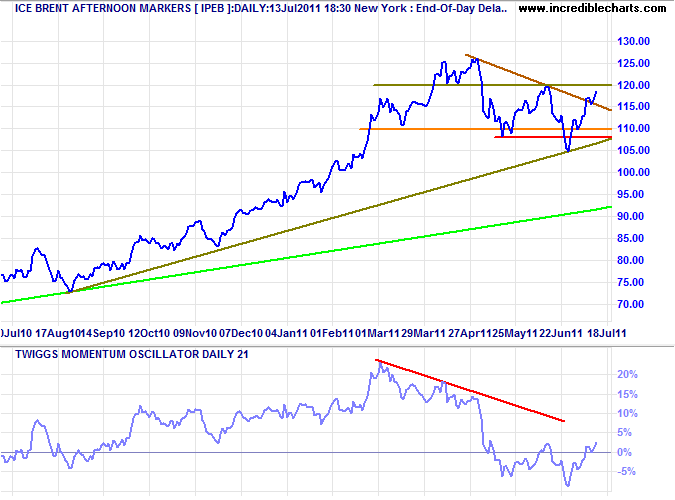

Crude Oil

Brent crude is headed for a test of resistance at $120. Breakout, similar to the CRB index, could merely indicate a broadening wedge formation and we will have to wait for the next retracement to provide further evidence. Renewal of crude's primary up-trend would boost gold, but add another nail in the coffin of the faltering stock rally.

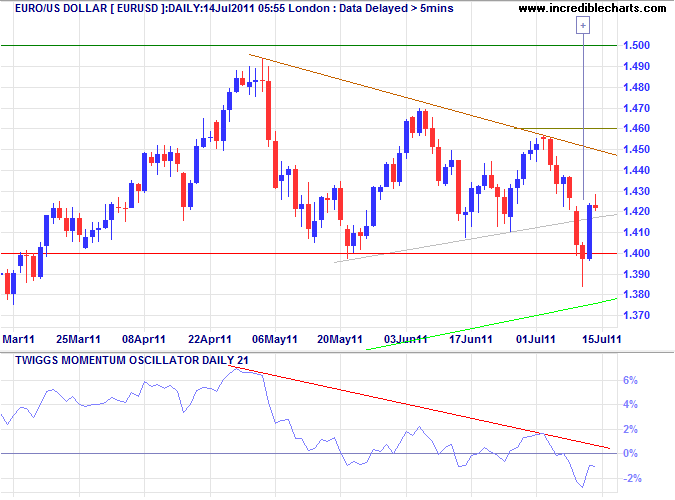

Euro

The euro found buying support at $1.40, signaled by a long tail on the red candle [+]. Expect a test of $1.46, but 63-day Momentum remains below zero, indicating weakness. Breakout above $1.46 would signal another advance, with a target of $1.56*, but reversal below primary support at $1.40 would warn of a primary down-trend.

* Target calculation: 1.46 + ( 1.50 - 1.40 ) = 1.56 or 1.41 - ( 1.50 - 1.40 ) = 1.31

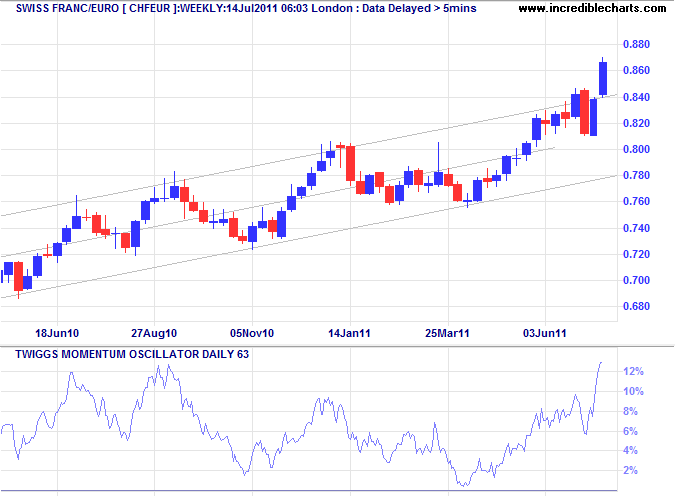

Swiss Franc

The Swiss franc broke out above its trend channel against the euro on the weekly chart, indicating an accelerating up-trend. The sharp rise on 63-day Momentum confirms. Accelerating, or self-reinforcing trends are renown for rapid gains, but also for their spectacular blow-offs. Given the current troubles in the EMU, however, this trend could show some staying power.

* Target calculation: 1.00 + ( 1.00 - 0.80 ) = 1.20

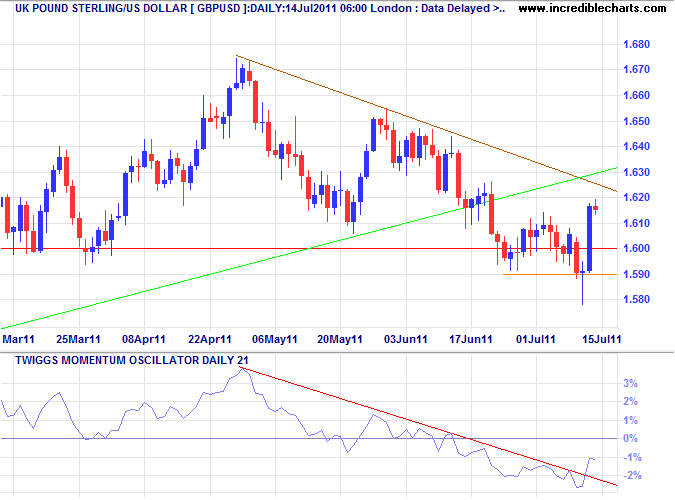

UK Pound Sterling

The pound recovered above primary support at $1.60, suggesting a bear trap. Breakout above the declining trendline would indicate the correction is over — and warn of another test of $1.67. Reversal below $1.59 is unlikely, but would signal a decline to $1.53*.

* Target calculation: 1.60 - ( 1.67 - 1.60 ) = 1.53

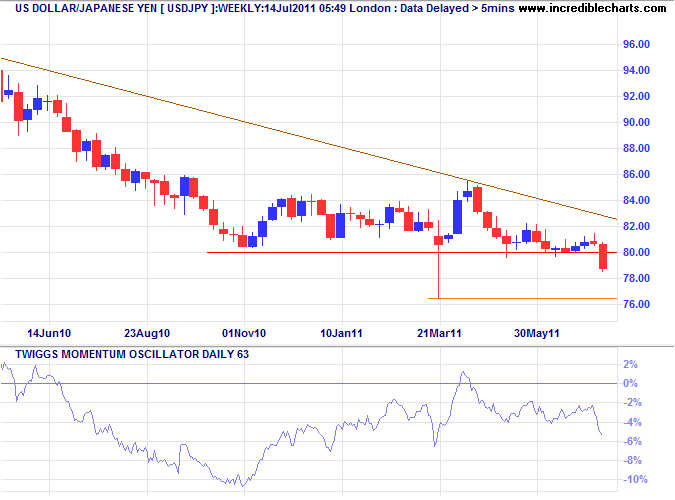

Japanese Yen

The dollar broke through support at ¥80, warning of a decline to ¥75*. Expect the BOJ to make further efforts to halt appreciation of the yen, but it appears they are being over-whelmed by market forces. Weak 63-day Momentum, holding below zero, confirms the down-trend.

* Target calculation: 80 - ( 85 - 80 ) = 75

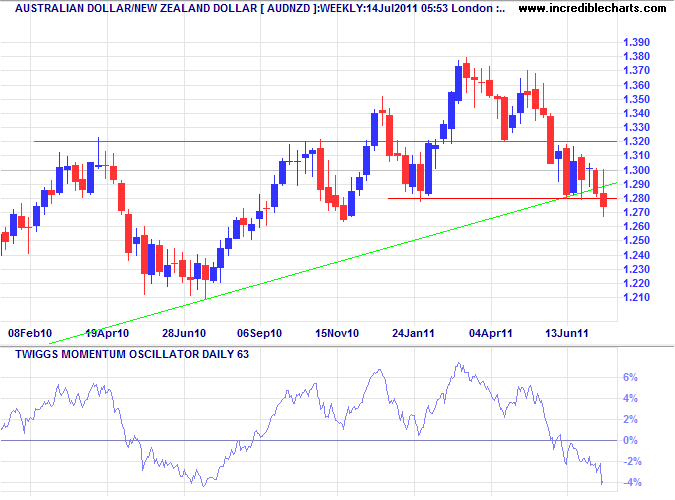

New Zealand Dollar

The Aussie dollar broke primary support at $1.28 against its Kiwi, signaling a primary down-trend, with a target of the June 2010 low at $1.22*. A peak on 63-day Momentum that respects the zero line would confirm.

* Target calculation: 1.30 - ( 1.38 - 1.30 ) = 1.22

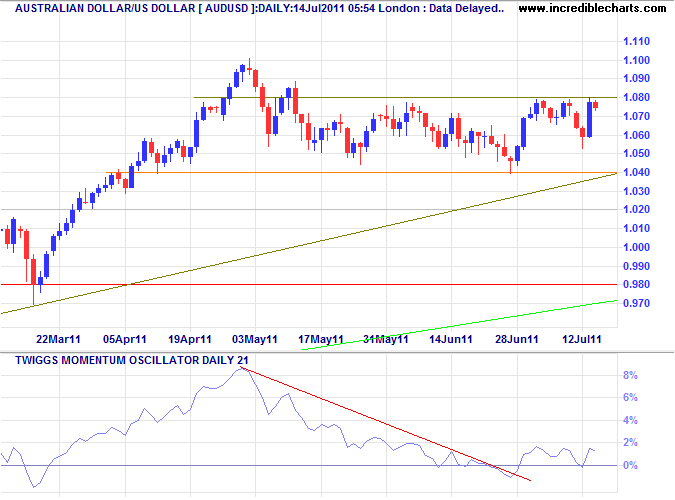

Australian Dollar

The Aussie dollar is again testing resistance at $1.080 against the greenback. Breakout would signal an advance to $1.12*, but another test of $1.04 is equally likely. Narrow oscillation of 21-day Momentum around zero indicates no clear trend as yet, but keep an eye on the CRB index as this is a significant influence.

* Target calculation: 1.08 + ( 1.08 - 1.04 ) = 1.12

Expecting the world to treat you fairly because you are good, is like expecting the bull not to charge because you are a vegetarian.

~

Dennis Wholey (1937)