Commodities rise leads Aussie dollar higher

By Colin Twiggs

February 2nd, 2011 11:30 p.m. ET (3:30 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

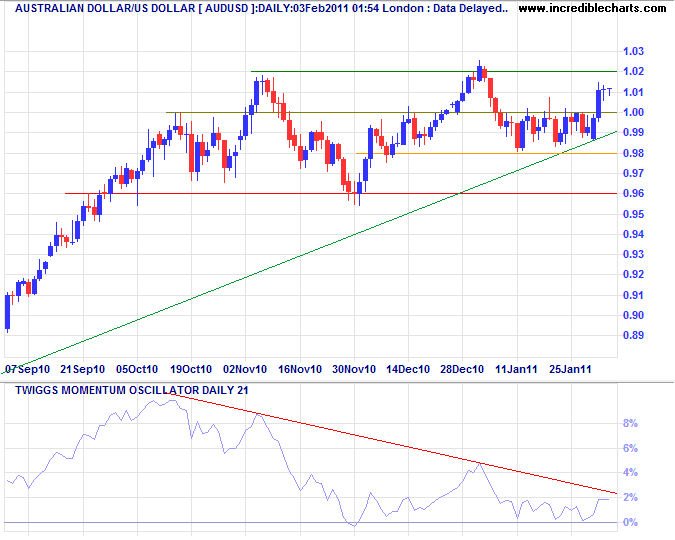

Australian Dollar

The Aussie dollar displays a higher trough against the greenback, forming a large bullish ascending triangle. Breakout above $1.02 would offer a target of $1.08*. Twiggs Momentum has respected the zero line; recovery above the descending trendline would indicate a fresh advance.

* Target calculation: 1.02 + ( 1.02 - 0.96 ) = 1.08

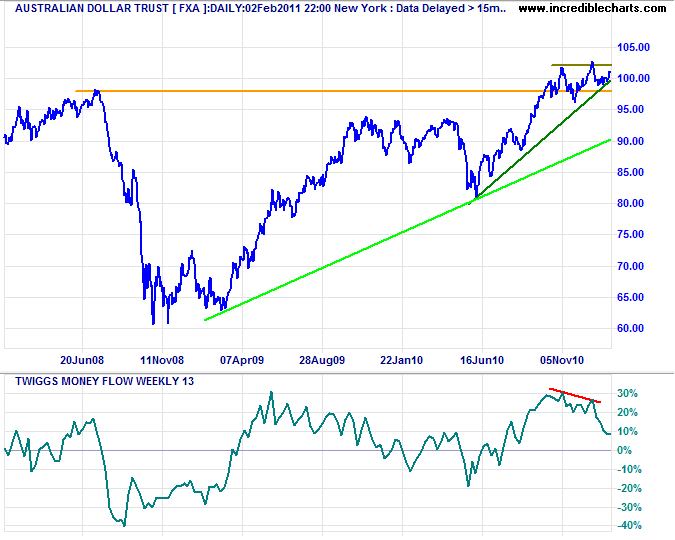

The long-term picture however, reveals weakness, with a bearish divergence on Twiggs Money Flow. Reversal below $0.98 would strengthen the warning.

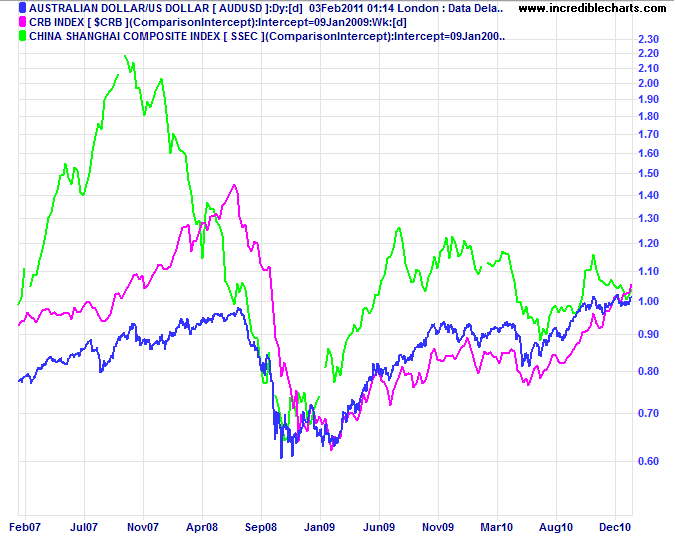

The little battler has been closely shadowing the CRB Commodities index since late 1998, but $CRB is now surging ahead. Expect the Aussie to follow. We can also see the influence of China on the two, with the Shanghai Composite leading by several months. Where Shanghai goes, expect the $CRB and AUD to follow.

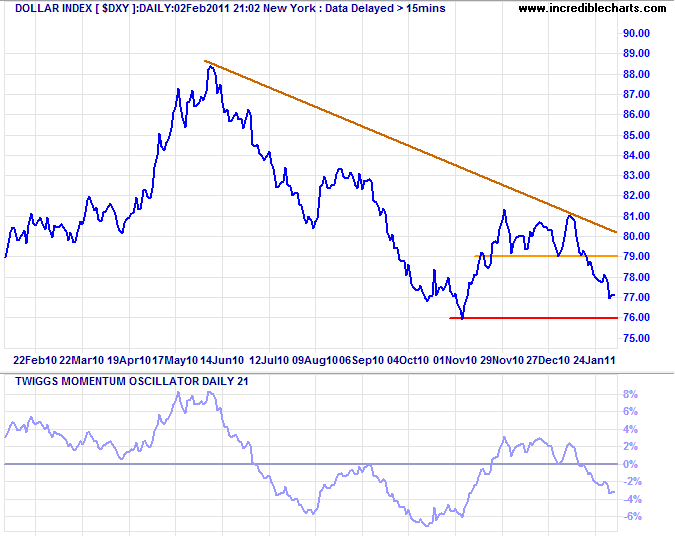

US Dollar Index

The Dollar Index is headed for a test of primary support at 76. Respect would suggest that a bottom is forming; failure would offer a target of 71*. Twiggs Momentum (21-day) below zero indicates a down-trend, but a higher trough would also suggest a bottom.

* Target calculation: 76 - ( 81 - 76 ) = 71

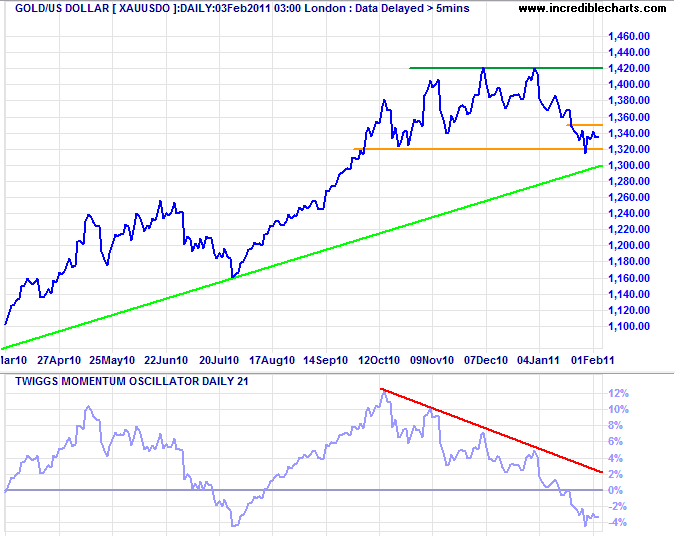

Gold

The weakening dollar is likely to strengthen precious metals and commodity prices. Gold is testing support at $1320; recovery above $1350 would signal another attempt at $1420, while failure of support would offer a target of $1220*. Twiggs Momentum (21-day) below zero indicates weakness, but recovery above the declining trendline would indicate another rally.

* Target calculation: 1320 - ( 1420 - 1320 ) = 1220; 1420 + ( 1420 - 1320 ) = 1520

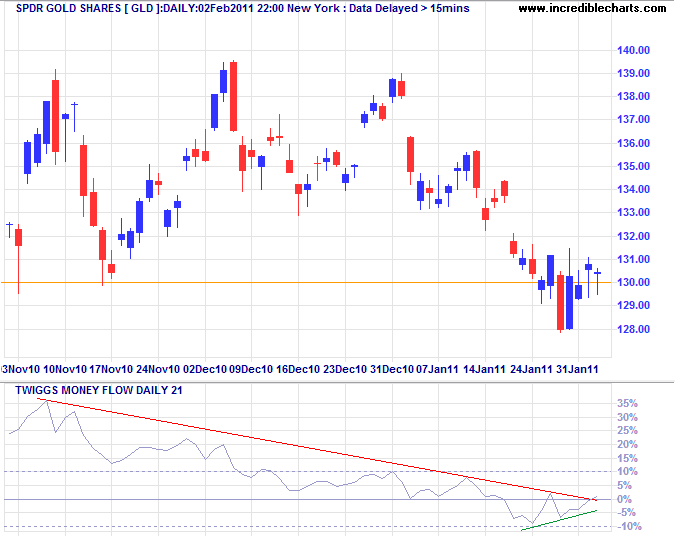

Bullish divergence on Twiggs Money Flow (21-day) indicates buying support on GLD .

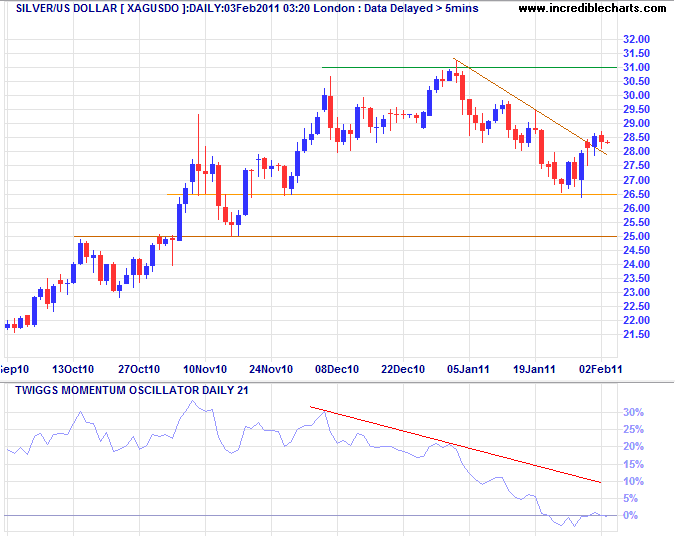

Silver

Silver found support at $26.50/ounce. Breach of the descending trendline suggests that a bottom is forming. A rally above the descending trendline on Twiggs Momentum (21-day) would confirm.

* Target calculation: 28 - ( 31 - 28 ) = 25

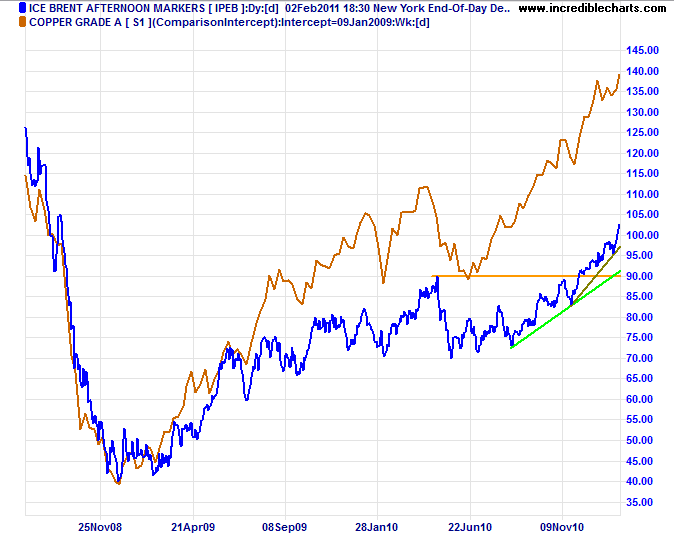

Crude Oil & Commodities

Brent Crude broke psychological resistance at $100/barrel as the up-trend accelerates.

* Target calculation: 88 + ( 88 - 68 ) = 108

Steep price rises are evident across a broad range of commodities — as with copper on the above chart. This is already causing an upsurge of inflation in emerging economies, and will flow through to developed economies as they start to recover. The bad news is: the longer the lag, the more persistent inflation will be when it does take hold.

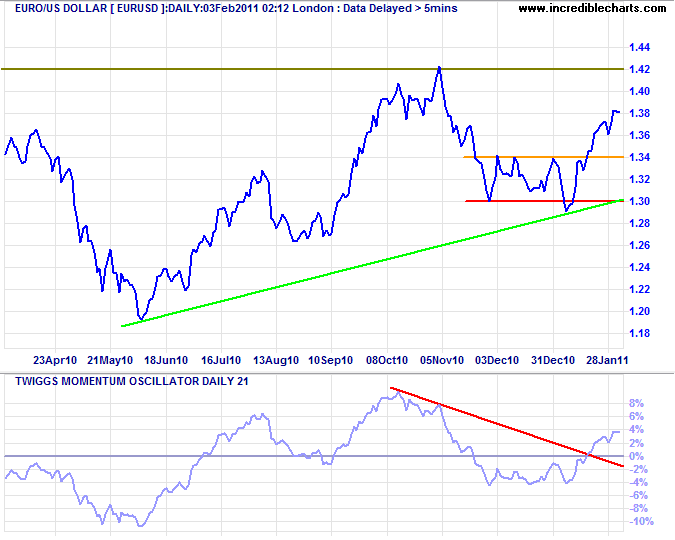

Euro

The euro is advancing to test resistance at $1.42*. Breakout would offer a target of $1.50. A Twiggs Momentum trough above zero would strengthen the bull signal.

* Target calculation: 1.40 + ( 1.40 - 1.30 ) = 1.50

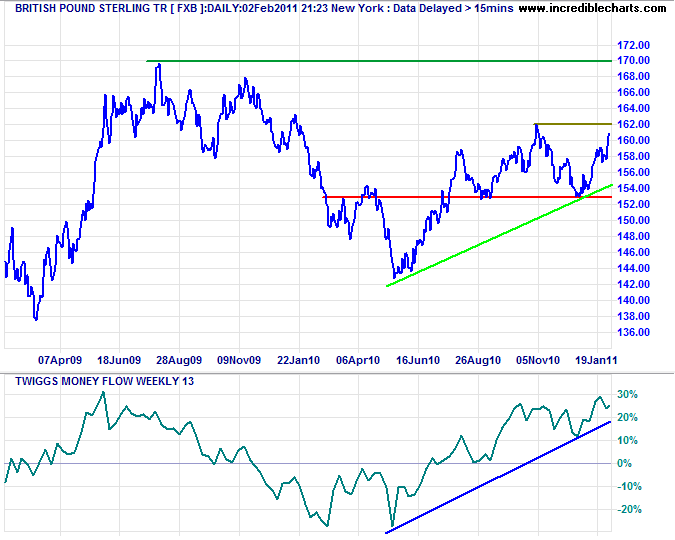

UK Pound Sterling

The pound is testing medium-term resistance at $1.62. Rising Twiggs Money Flow signals buying pressure. Breakout above $1.62 would test the 2009 high of $1.70*. Failure of primary support at $1.53 is now unlikely.

* Target calculation: 1.62 + ( 1.62 - 1.53 ) = 1.71

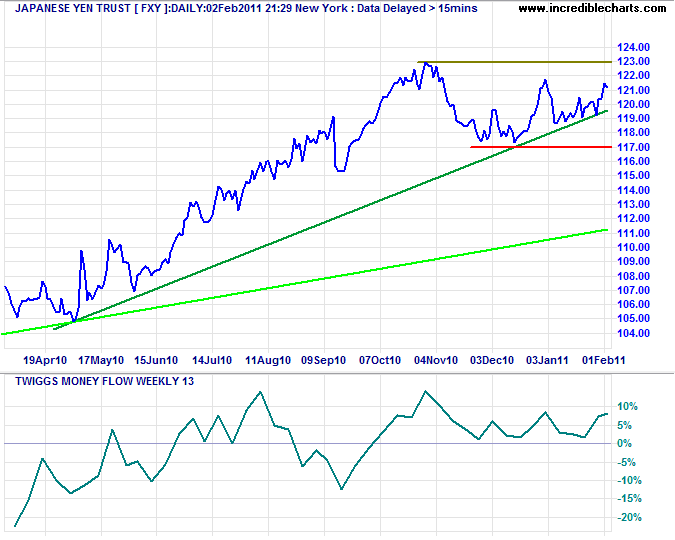

Japanese Yen

The yen is headed for another test of its 1995 high of $0.0123 against the dollar (or ¥81 per dollar). The higher trough and Twiggs Money Flow holding above zero indicate buying pressure. Breakout would offer a target of $0.0129*.

* Target calculation: 123 + ( 123 - 117 ) = 129

What the superior man seeks, is in himself.

What the mean man seeks, is in others.

~ The Analects of Confucius