Thanksgiving

By Colin Twiggs

November 25, 2010 2:00 a.m. ET (6:00 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Happy Thanksgiving to all US readers.

We so often criticize and find fault with the actions of our governments and central bankers that we fail to appreciate how much worse things could be. I criticized the TARP rescue program for letting Wall Street off the hook without a real haircut, but at least we have a functioning banking system. A total banking collapse would have caused another Great Depression — worldwide. I may blame government stimulus programs for wasteful expenditures and rising national debt, but am sure that a number of small businesses have been rescued, that would otherwise have failed. And some infrastructure built will benefit us for years to come. The political system is widely viewed as misguided, self-serving or even corrupt — and dominated by large interest groups. But many politicians work tirelessly, with little thanks, to improve the lot of their fellow man. Compare the benefits of living in a democracy, with all its faults, to the plight of citizens in autocracies such as China, North Korea or Myanmar. With no right of free speech, things would be a lot worse. Is our system perfect? No. Can it be improved? Certainly. Should we be grateful for what we have? Most definitely.

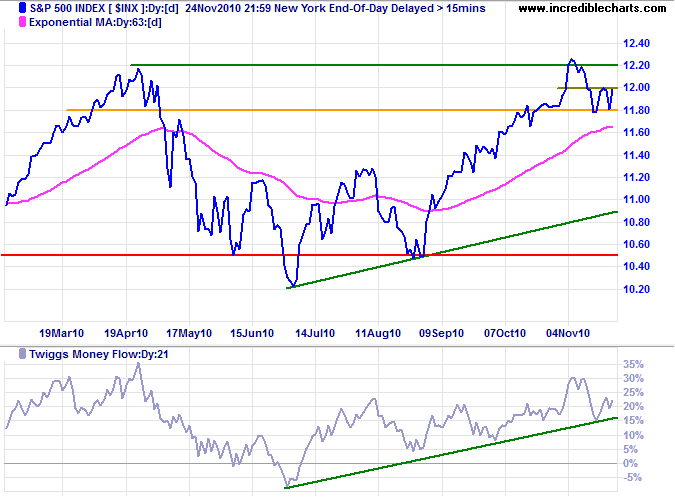

Markets slowed ahead of the Thanksgiving holiday, leaving us without clear direction. The S&P 500 twice respected support at 1180 and breakout above 1200 would signal another test of the April high at 1220. Rising Twiggs Money Flow (21-day) continues to flag buying pressure and recovery above 1220 would signal a fresh primary advance. Reversal below 1180 is less likely, but would warn of a secondary correction.

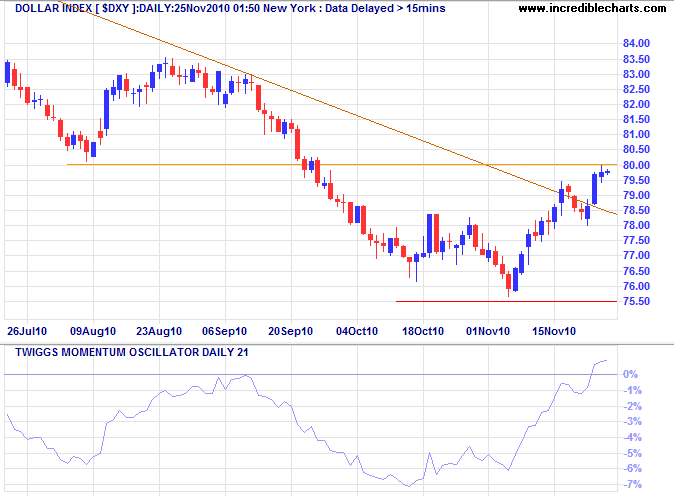

US Dollar Index

The US Dollar Index is testing secondary resistance at 80 (from the August low). Penetration of the rising trendline indicates that the down-trend is losing momentum. Twiggs Momentum (21-day) holding above the zero line would confirm. The primary trend remains down, however, and only a decline that respects support at 75.50 would signal a trend change.

* Target calculation: 76 - ( 80 - 76 ) = 72

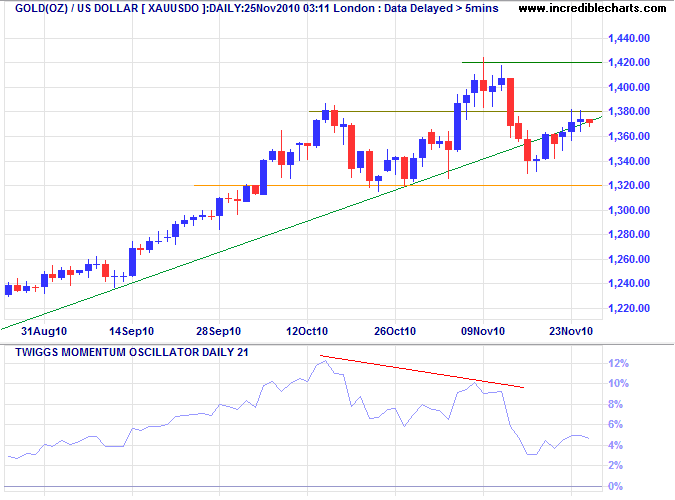

Gold

Bearish divergence on Twiggs Momentum (21-day) and penetration of the rising trendline both warn of a correction. Failure of support at $1320 would confirm — while recovery above $1380 would suggest an advance to 1500*.

* Target calculation: 1420 + ( 1420 - 1340 ) = 1520

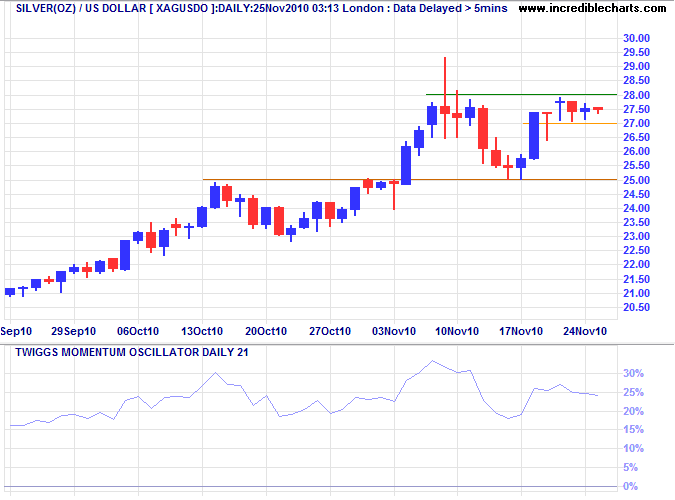

Silver

Silver's narrow consolidation below resistance at 28 favors an upward breakout and advance to 31*. Further gains would spur demand for gold. Reversal below $25 is less likely, but would complete a double top, warning of a correction.

* Target calculation: 28 + ( 28 - 25 ) = 31

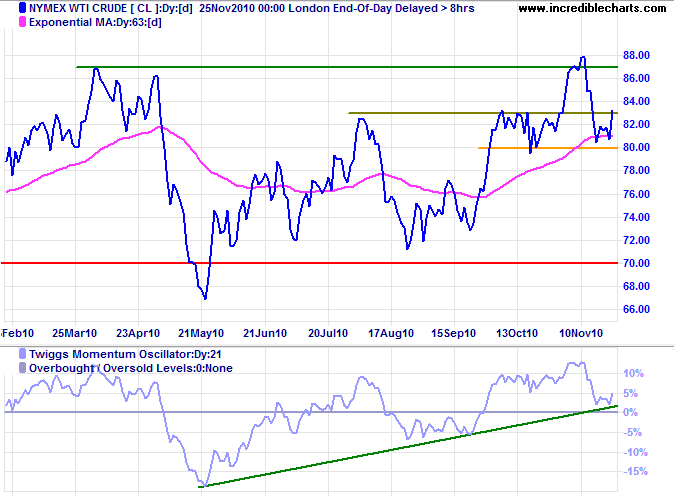

Crude Oil

Nymex WTI Crude respected support at $80 per barrel and is headed for another test of $88. Completion of a Twiggs Momentum (21-day) trough above the zero line would confirm the up-trend.

* Target calculation: 87 + ( 87 - 67 ) = 107

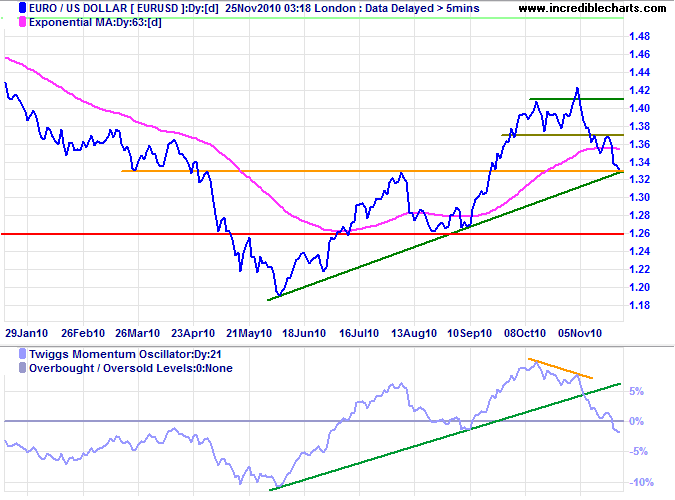

Euro

The euro is testing secondary support at $1.33; failure would indicate that (primary up-trend) momentum is slowing. Twiggs Momentum (21-day) recovery above the zero line would be a bullish sign. Recovery above $1.37 is unlikely at present, but would suggest that the correction has ended.

* Target calculation: 1.41 + ( 1.41 - 1.33 ) = 1.49

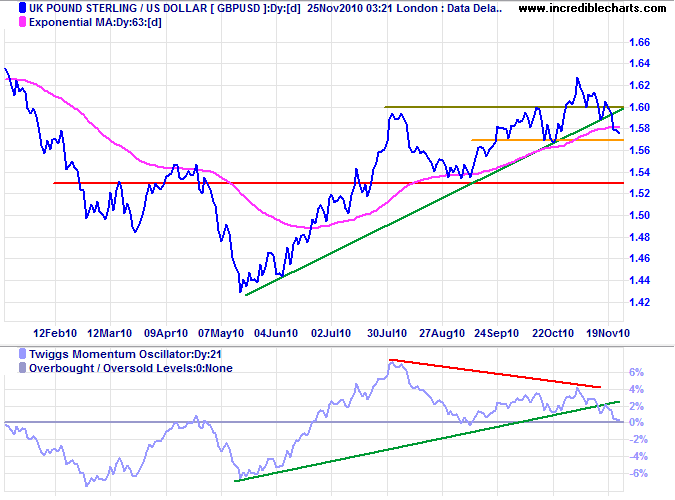

UK Pound Sterling

The pound is testing support at $1.57. Bearish divergence on Twiggs Momentum (21-day) warns of a correction. Failure of $1.57 would confirm another test of primary support at $1.53. Recovery above $1.60 is most unlikely, but would warn of a bear trap and advance to $1.66*.

* Target calculation: 1.60 + ( 1.60 - 1.54 ) = 1.66

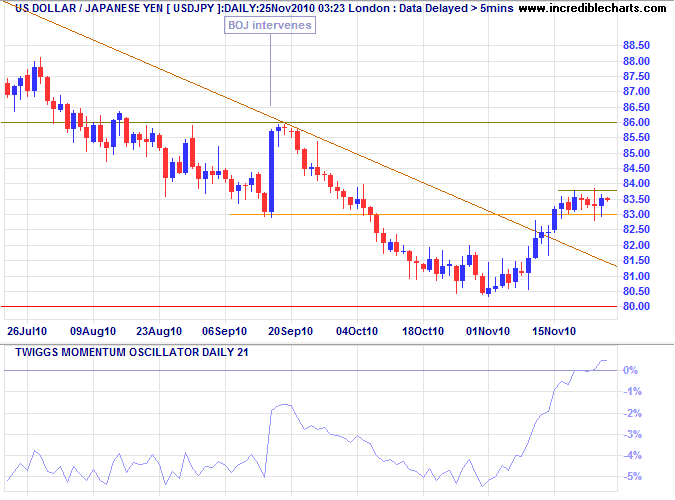

Japanese Yen

The dollar is consolidating in a narrow band above support (formerly secondary resistance) at ¥83. Follow-through would signal a test of ¥86, but failure of the new support level would signal another test of ¥80. Momentum is slowing, but the primary trend remains downward.

* Target calculations: 80 - ( 83 - 80 ) = 77

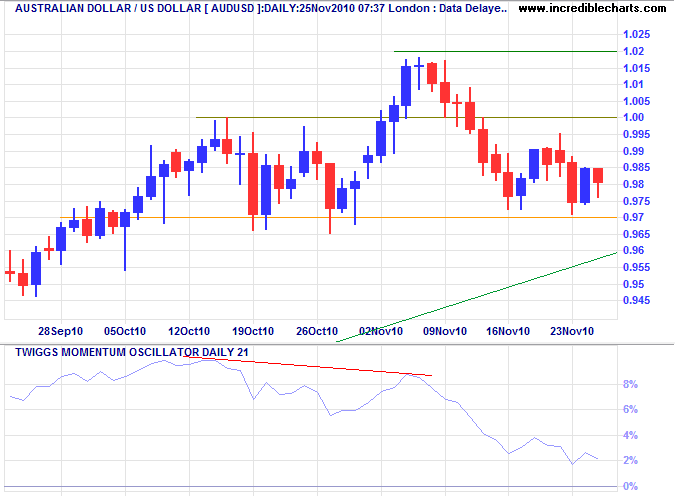

Australian Dollar

The Aussie dollar is again finding support at $0.97. Recovery above $0.99 would suggest another rally; confirmed by a breakout above parity. Bearish divergence on Twiggs Momentum (21-day) continues to warn of a correction. Failure to follow through above parity would strengthen the signal; and penetration of support at $0.97 would confirm. The primary trend, however, remains upward.

* Target calculation: 1.02 + ( 1.02 - 1.00 ) = 1.04

As we express our gratitude, we must never forget that the highest appreciation is not to utter words, but to live by them.

~ John Fitzgerald Kennedy