US strengthens while China & India fall

By Colin Twiggs

November 22, 2010 3:00 a.m. ET (7:00 p.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

North American and European indices rallied in the last few days, while China and India fell, dragging Australia and Singapore with them. Japan and South Korea managed to evade the bears, however, and continue to strengthen.

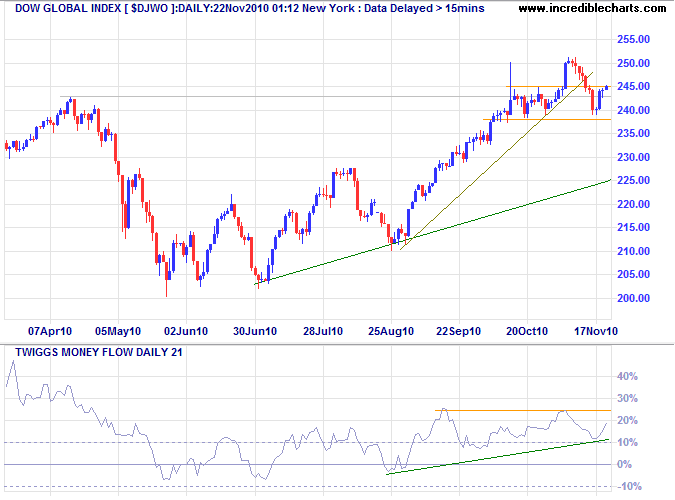

The Dow Global index ($DJWO) found support at 240 before rallying to test resistance at 245. Breakout would indicate a primary advance to 280; follow-through above 250 would confirm. Twiggs Money Flow (21-day) recovery above 25% would negate the previous (orange) bearish divergence. Reversal below 240 remains as likely, and would signal a correction to the trendline at 225.

* Target calculations: 242 + ( 242 - 204 ) = 280

USA

Dow Jones Industrial Average

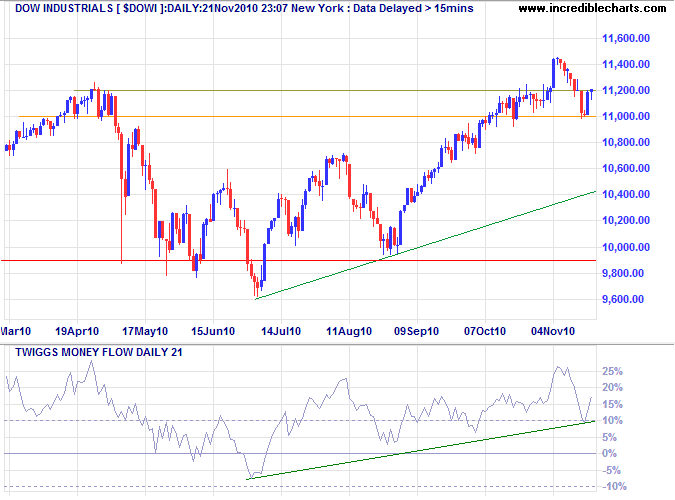

The Dow is similarly testing resistance at 11200. Breakout would indicate an advance to 12000*, while reversal below 11000 would signal a correction to the rising trendline near 10500. Twiggs Money Flow (21-day) holding above zero reflects buying pressure, suggesting the primary up-trend will continue.

* Target calculation: 11000 + ( 11000 - 10000 ) = 12000

S&P 500

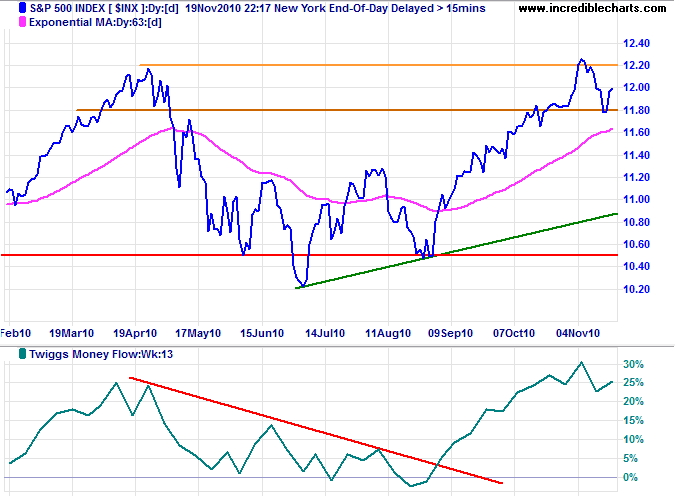

The S&P 500 likewise found support at 1180. Recovery above 1200 would suggest another primary advance, while failure of support would warn of a correction. Twiggs Money Flow (13-week) high above zero continues to indicate a strong up-trend. Recovery above 1220 would confirm the long-term target of 1420*.

* Target calculation: 1220 + ( 1220 - 1020 ) = 1420

Transport

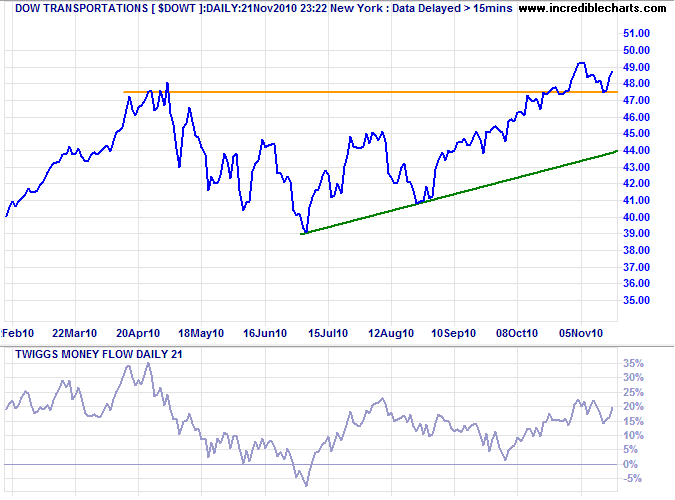

The Dow Transport index respected support at its April high, indicating a primary advance. Twiggs Money Flow (21-day) holding above the zero line indicates buying pressure.

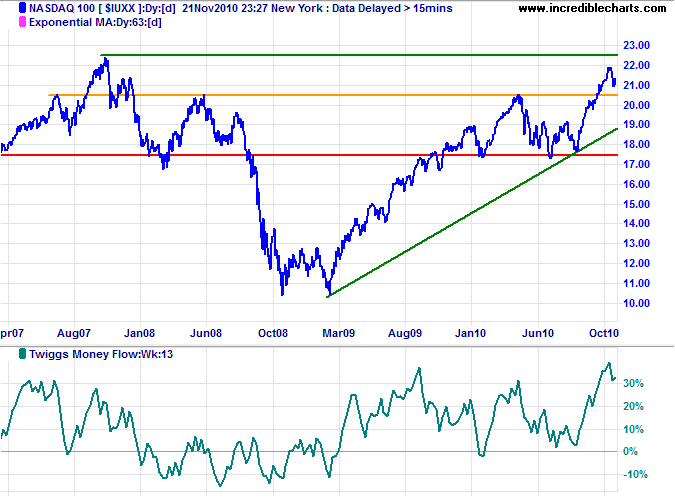

Technology

The Nasdaq 100 is retracing to test support at 2050; respect would signal an advance to the 2007 high of 2250. Twiggs Money Flow (13-week) high above zero indicates strong buying pressure.

* Target calculation: 2050 + ( 2050 - 1750 ) = 2350

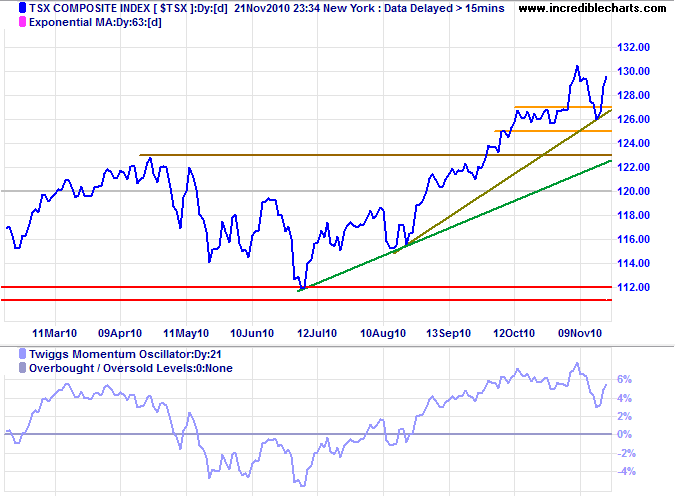

Canada: TSX

The TSX Composite respected support at 12500/12600, indicating an advance to 13400*. Twiggs Momentum holding above zero indicates the primary up-trend will continue.

* Target calculation: 12300 + ( 12300 - 11200 ) = 13400

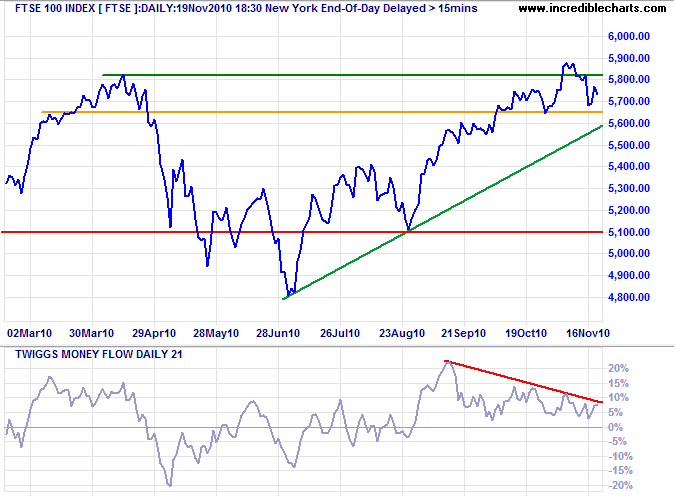

United Kingdom

The FTSE 100 found support at 5650, but divergence on Twiggs Money Flow (21-day) warns of a correction. Reversal below zero would confirm. Recovery above 5900 is less likely, and would signal an advance to the 2007 high at 6750*.

* Target calculation: 5800 + ( 5800 - 4800 ) = 6800

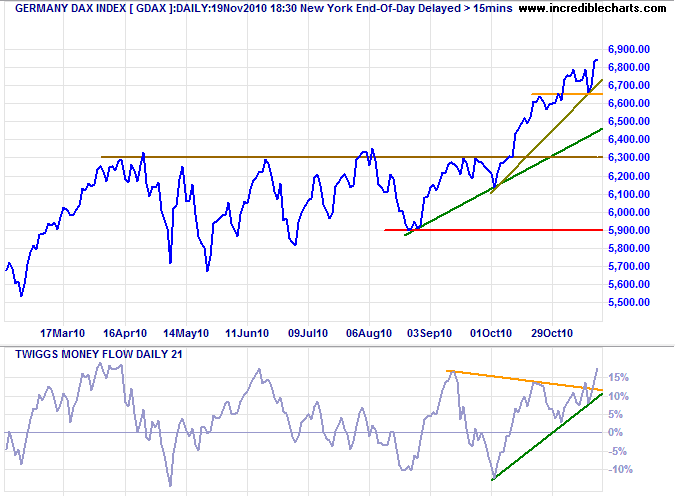

Germany

Rising 21-day Twiggs Money Flow on the DAX indicates buying pressure. Expect an advance to 7000*.

* Target calculation: 6350 + ( 6350 - 5700 ) = 7000

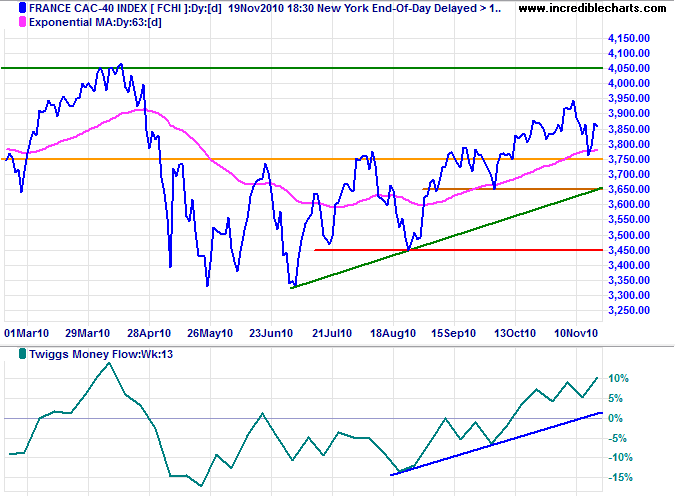

France

The CAC-40 index found support at 3750. Rising Twiggs Money Flow (13-week) indicates buying pressure. Expect a rally to test 4050*; failure of support at 3750, however, would warn of a correction.

* Target calculation: 3750 + ( 3750 - 3450 ) = 4050

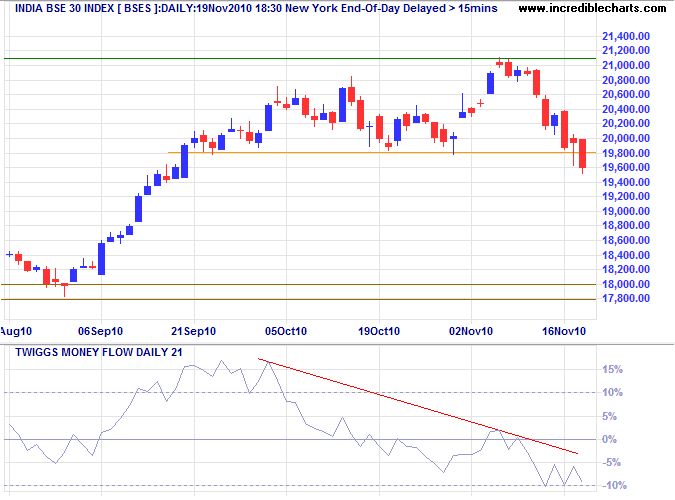

India

The Sensex broke its band of support at 19800/20000, signaling a correction to 18000. Bearish divergence on Twiggs Money Flow (21-day) warns of medium-term selling pressure.

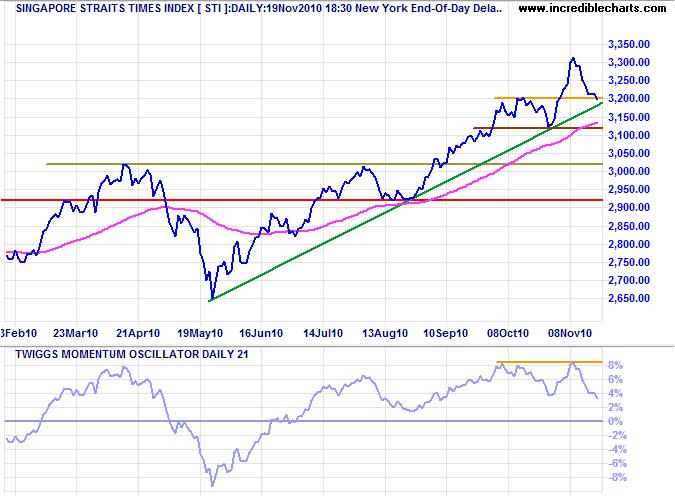

Singapore

Falling Momentum on the Straits Times Index warns of a correction. Reversal below support at 3120 would confirm. The primary trend remains up, but watch if Momentum reverses below zero.

* Target calculation: 3000 + ( 3000 - 2650 ) = 3350

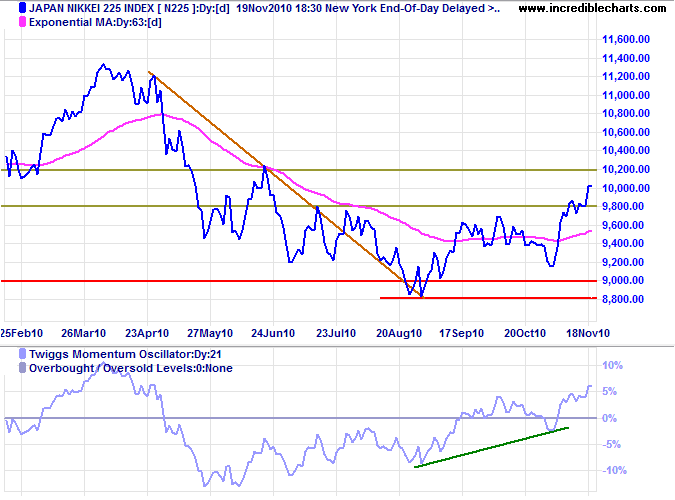

Japan

The Nikkei 225 held above 9800, indicating a rally to 10200. A Momentum (21-day) trough above the zero line would confirm the up-trend.

* Target calculation: 8800 - ( 9800 - 8800 ) = 7800

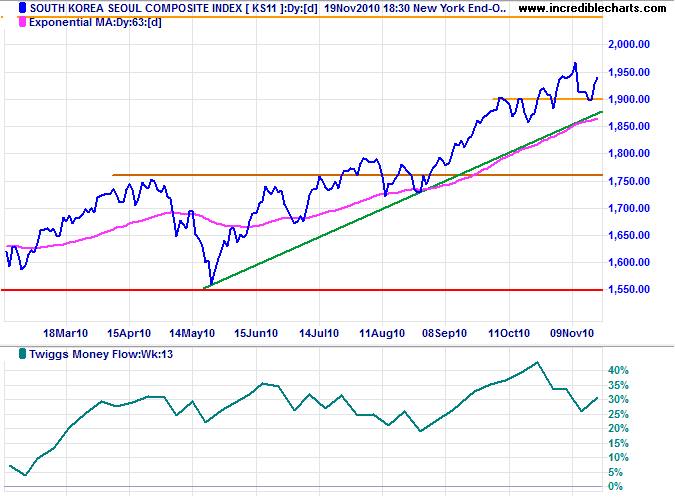

South Korea

The Seoul Composite index remains in a strong up-trend. Respect of support at 1900 indicates an advance to the 2007 high at 2050; confirmed if short-term resistance at 1950 is broken. Reversal below 1850 and the rising trendline are unlikely, but would warn of a correction. Twiggs Money Flow (13-week) holding high above zero indicates long-term buying pressure.

* Target calculation: 1750 + ( 1750 - 1550 ) = 1950

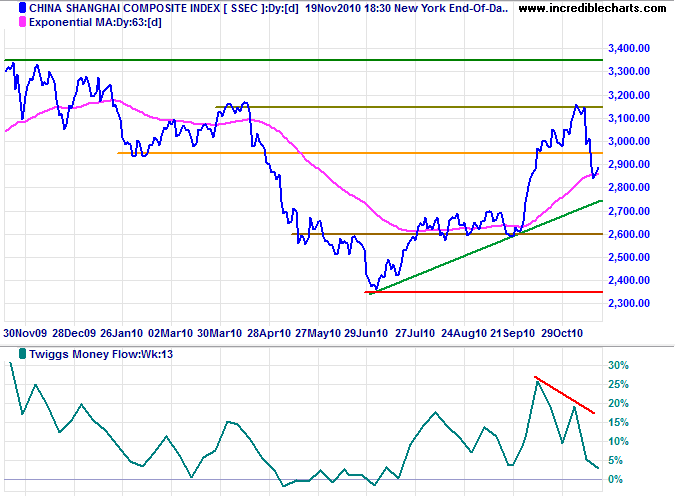

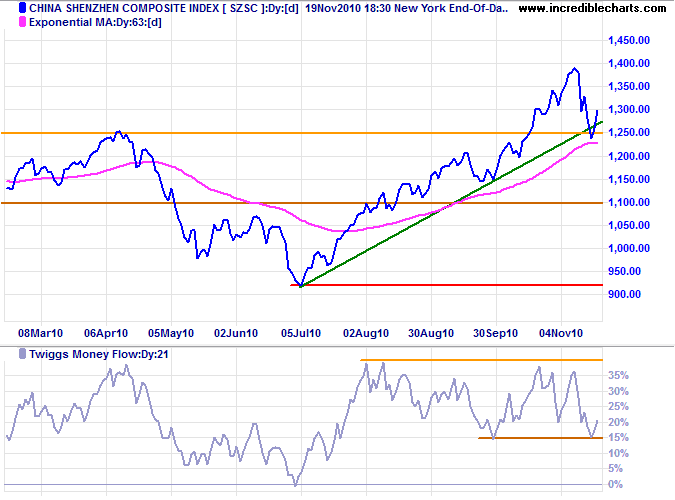

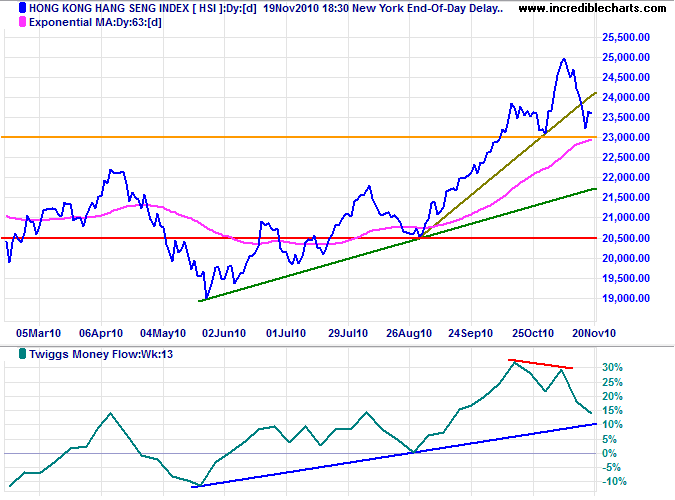

China

The Shanghai Composite index fell sharply below support at 2950, warning of a correction. Bearish divergence on Twiggs Money Flow (13-week) indicates selling pressure. Expect retracement to test the new resistance level; respect would confirm the correction, while recovery above 3000 would warn of a bear trap.

The Shenzhen Composite index respected the new support level at 1250. Follow-through above 1300 would confirm the strong primary up-trend. Twiggs Money Flow (21-day) reversal below 15%, however, would warn of selling pressure.

The Hang Seng index is testing support at 23000; failure would confirm a correction to the rising (green) trendline. Bearish divergence on Twiggs Money Flow (13-week) warns of selling pressure. The primary trend, however, remains upward.

* Target calculation: 23000 + ( 23000 - 19000 ) = 27000

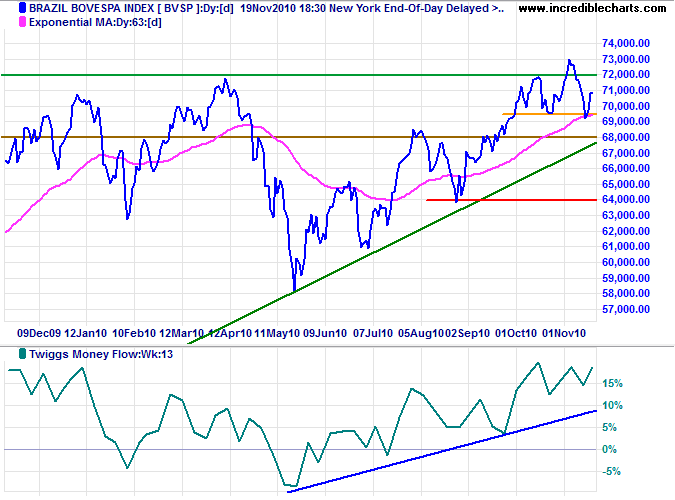

Brazil

The Bovespa index found support at 69000. Rising Twiggs Money Flow (13-week) indicates buying pressure. The primary trend is up and recovery above 72000 would signal another advance. Failure of support is unlikely, but would signal a correction.

* Target calculation: 70000 + ( 70000 - 60000 ) = 80000

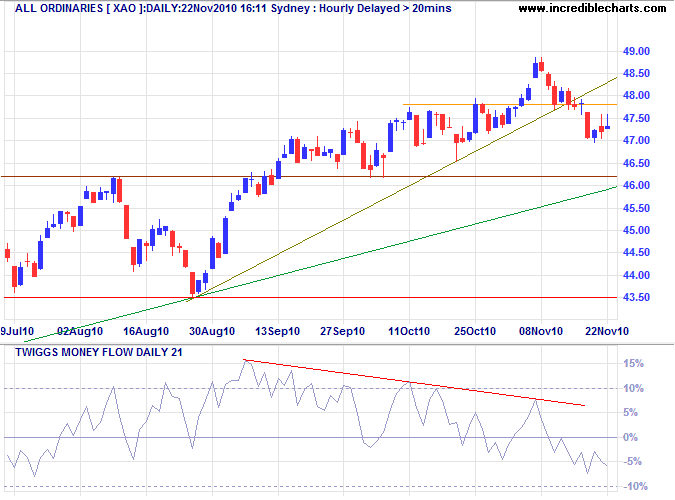

Australia: ASX

The All Ordinaries signals selling pressure, with tall shadows on the last two candles and Twiggs Money Flow (21-day) declining below zero. Expect a test of the rising green trendline at 4600. Failure of short-term support at 4700 would confirm.

* Target calculation: 4650 + ( 4650 - 4250 ) = 5050

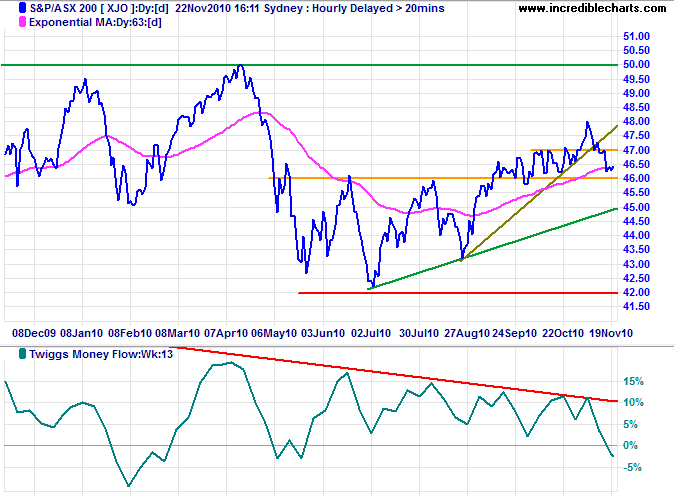

Twiggs Money Flow (13-week) has also dipped below zero on the ASX 200, signaling a correction. Reversal below 4600 would confirm.

We tend to forget that happiness doesn't come as a result of getting something we don't have, but rather of recognizing and appreciating what we do have.

~ Frederick Koenig