Gold Tests $1220

By Colin Twiggs

May 27, 2010 10:00 p.m. ET (12:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

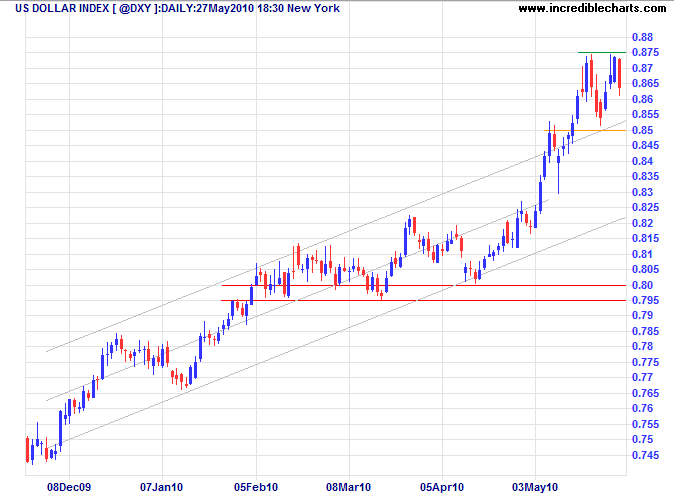

US Dollar Index

The US Dollar Index is retracing to test short-term support at 85 after breaking out of its trend channel. Failure would signal the end of the rally and a test of the lower trend channel. Upward breakout remains as likely, however, and would offer a short-term target of 90*.

* Target calculation: 87.5 + ( 87.5 - 85 ) = 90

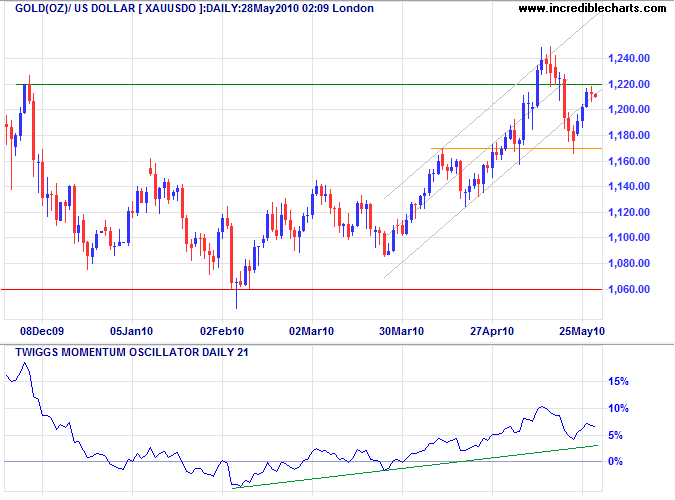

Gold

Gold is testing resistance at the December 2009 high of $1220. Respect would warn of a down-swing to primary support at $1060 — confirmed if support at $1170 is broken — while breakout would signal an advance to $1380*.

* Target calculation: 1220 + ( 1220 - 1060 ) = 1380

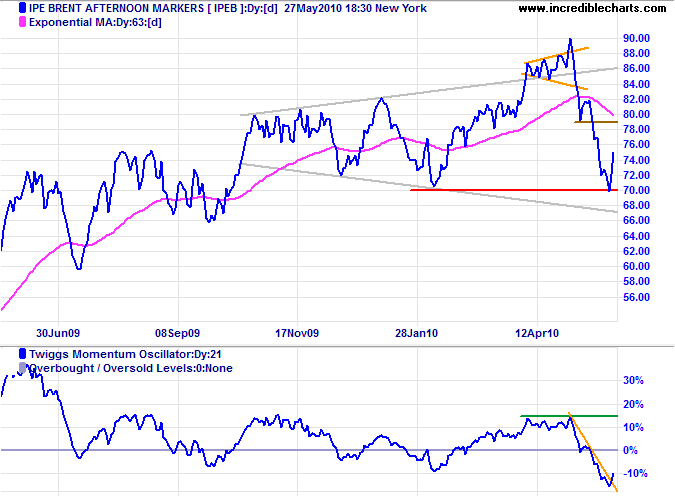

Crude Oil

Crude rebounded off primary support at $70 and is headed for a test of short-term resistance at $79. The correction is not yet over and breakout below the lower border of the large broadening wedge formation would signal a primary down-trend. Twiggs Momentum respecting the zero line from below would strengthen the signal.

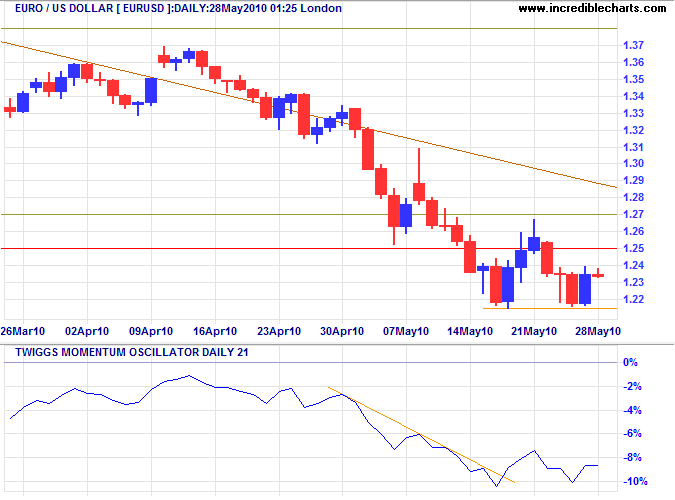

Euro

The euro is testing short-term support at $1.22 after recently breaking long-term support at $1.25; downward breakout would confirm the long-term target of parity*. Recovery above $1.27 is unlikely, but would warn of a bear trap.

* Target calculation: 1.25 - ( 1.50 - 1.25 ) = 1.00

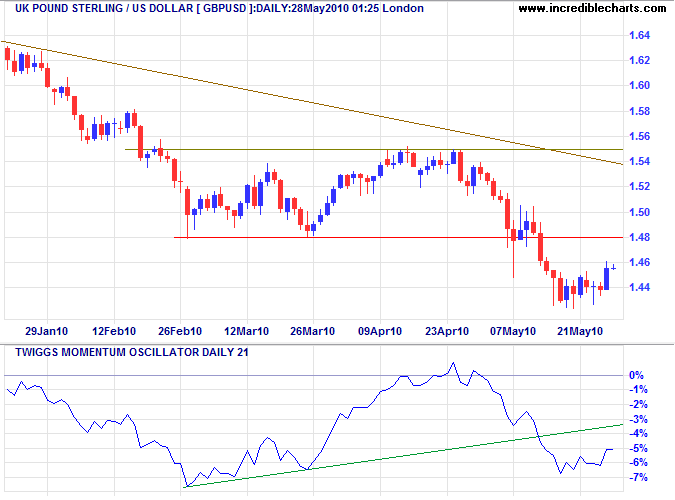

UK Pound Sterling

The pound is retracing to test the new resistance level at $1.48. Respect would confirm the medium-term target of $1.38. Twiggs Momentum (21-day) oscillating below zero strengthens the signal.

* Target calculation: 1.48 + ( 1.58 - 1.48 ) = 1.38

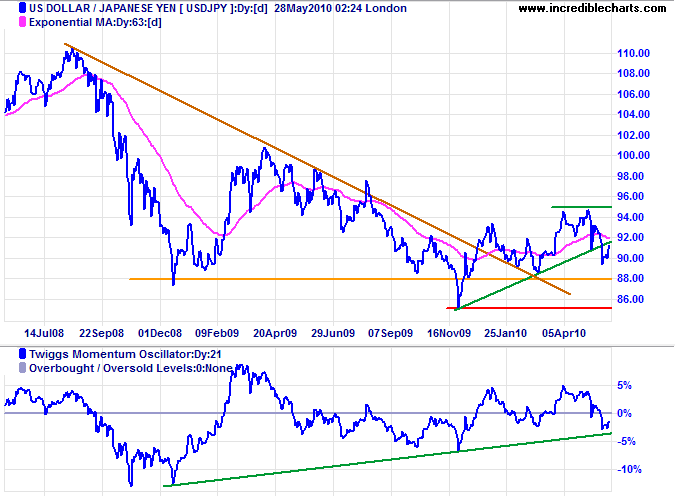

Japanese Yen

The dollar is forming a long-term base against the yen, but has yet to show much of an up-trend. Rising Twiggs Momentum confirms the long-term signal. Breakout above ¥95 would signal an advance to ¥100*, while failure of support at ¥88 would warn of further weakness.

* Target calculation: 94 + ( 94 - 88 ) = 100

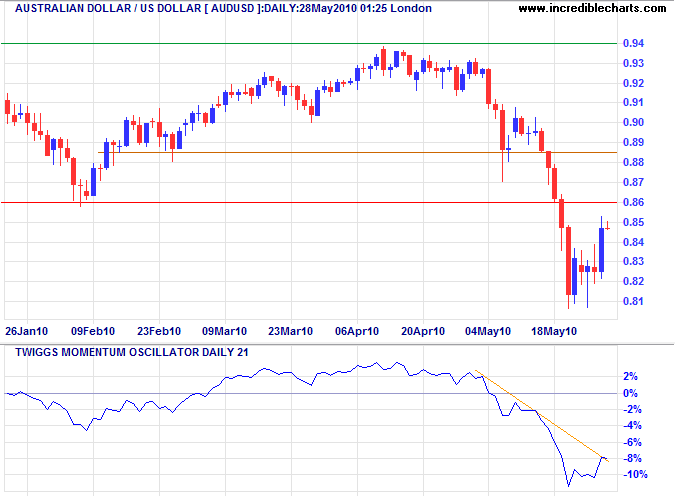

Australian Dollar

The Aussie dollar is retracing to test the new resistance level at $0.86. Respect would confirm the primary down-trend, while recovery above $0.89 would signal a bear trap. A Twiggs Momentum rally that respects the zero line (from below) would also confirm the down-trend.

* Target calculation: 0.86 + ( 0.94 - 0.86 ) = 0.78

The machine does not isolate man from the great problems of nature but plunges him more deeply into them.

~ Antoine de Saint-Exupery