A Crude Awakening

By Colin Twiggs

May 20, 2010 5:00 a.m. ET (7:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Crude oil is plummeting as speculators cover their positions. Turmoil in Europe and the down-turn in China suggests that demand will fall sharply. Niels Jensen reminds us to beware when you are the market. Most activity in crude oil markets is now speculation: "Over the past 15 years, financial futures have grown from 2 times the size of physical markets to almost 12 times the size."

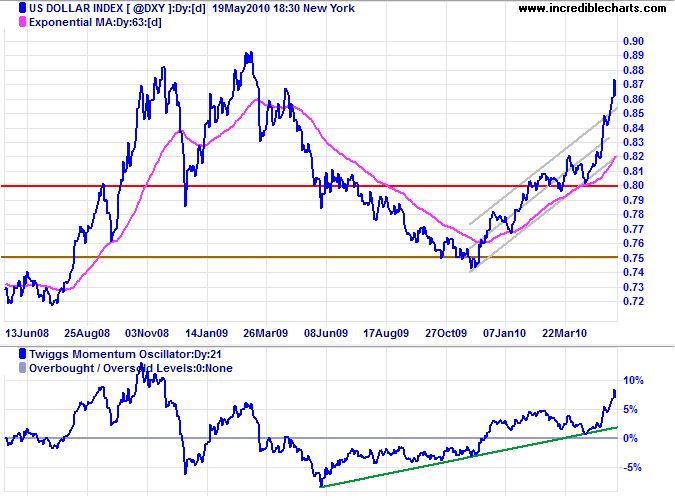

US Dollar Index

The US Dollar Index has benefited from the uncertainty, breaking through the upper border of its trend channel. Twiggs Momentum (21-day) holding above zero confirms the strong primary up-trend. Expect resistance at the 2009 high of 89. Bear in mind that blow-offs such as this are unsustainable and can reverse sharply.

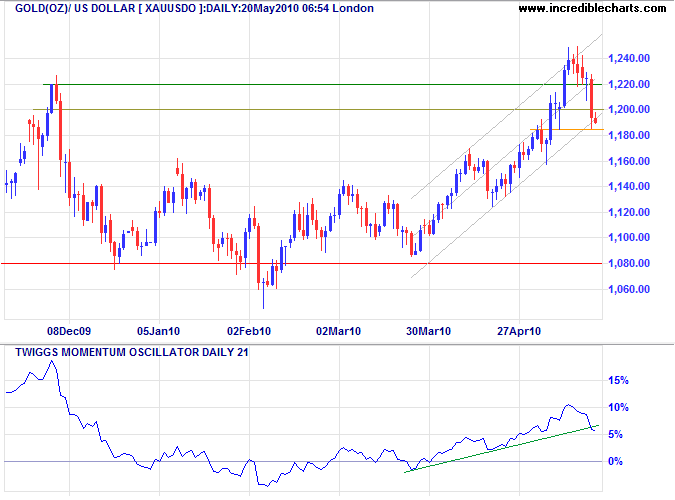

Gold

Gold is weakening, reversing its recent relationship with the dollar, and testing the lower trend channel. Failure of support at $1185 would signal a bull trap and warn of a correction to test primary support. Recovery above $1220 remains as likely, however, and would signal an advance to $1380*.

* Target calculation: 1220 + ( 1220 - 1060 ) = 1380

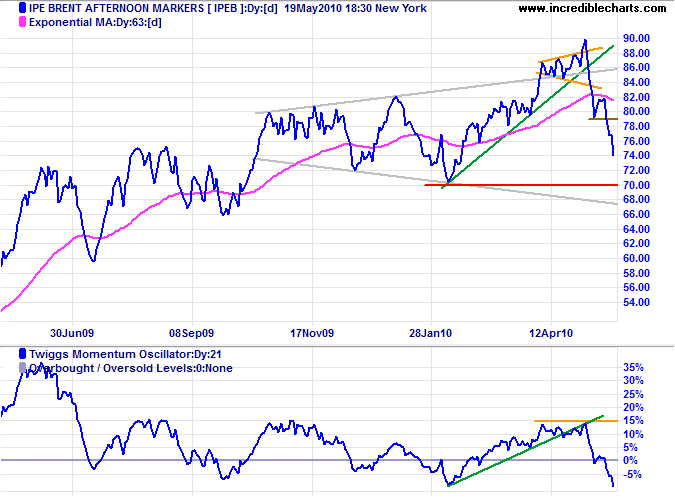

Crude Oil

Crude is headed for a test of the band of support between $68 and $70. Breakout below the lower border of the large broadening wedge formation would signal a primary down-trend. Twiggs Momentum respecting the zero line from below would strengthen the signal.

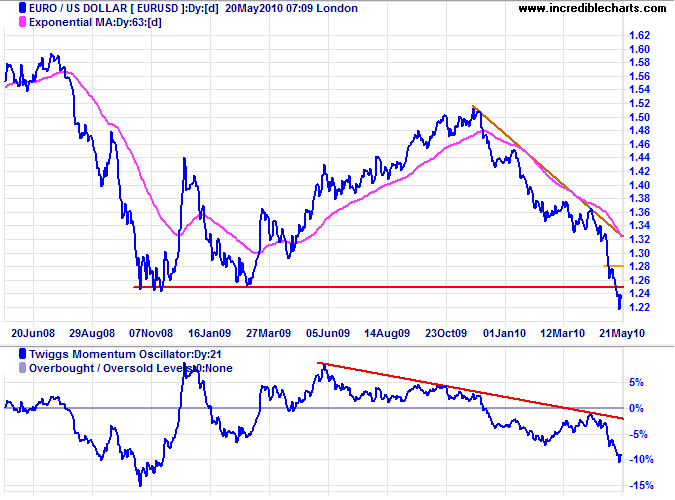

Euro

The euro broke through long-term support at $1.25, warning of a further decline with a target of parity*. Twiggs Momentum respecting zero from below strengthens the signal. Recovery above $1.28 is unlikely, but would warn of a bear trap.

* Target calculation: 1.25 - ( 1.50 - 1.25 ) = 1.00

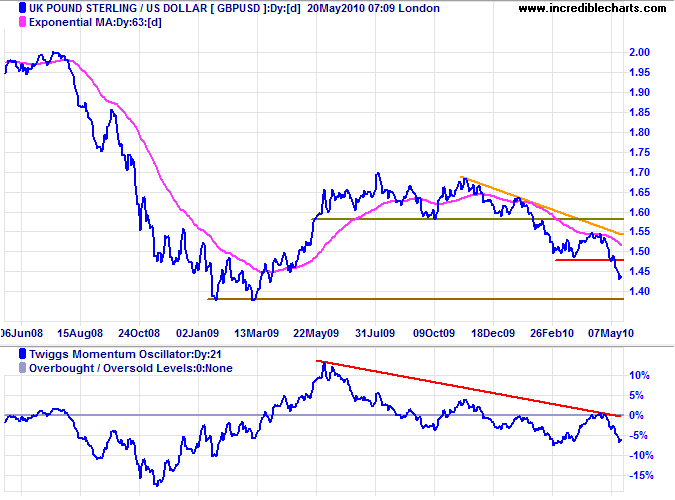

UK Pound Sterling

The pound broke support at $1.48, signaling a test of $1.38. Twiggs Momentum (21-day) respecting zero from below strengthens the signal.

* Target calculation: 1.48 + ( 1.58 - 1.48 ) = 1.38

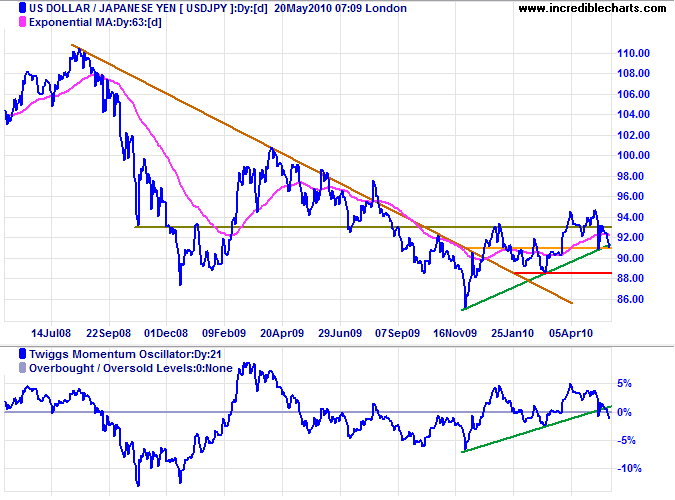

Japanese Yen

The dollar is making poor progress against the yen, reversing below the new support level at ¥93.50. Failure of short-term support at ¥91 would test primary support at ¥88, while recovery above ¥93.50 would indicate an advance to ¥100*. Twiggs Momentum retreating below zero favors a correction.

* Target calculation: 94 + ( 94 - 88 ) = 100

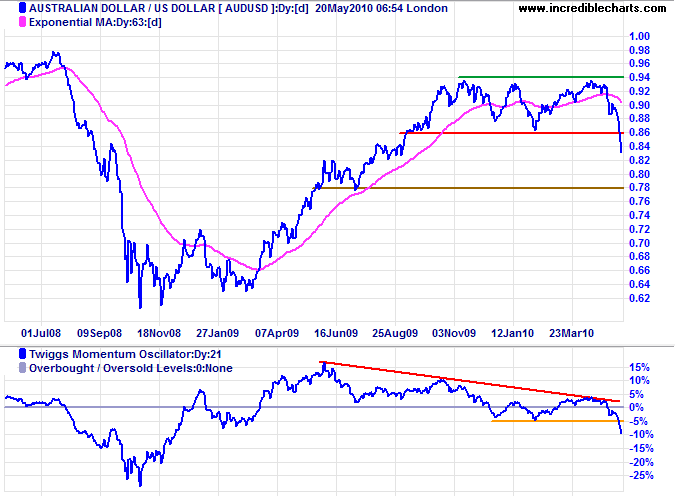

Australian Dollar

The Aussie dollar broke through support at $0.86, signaling a primary down-trend. Australia survived the recession, despite the mediocre performance of its present government, but the big question is: will it survive the recovery? China's massive fiscal stimulus boosted commodity exports, but authorities are now struggling to curb the excesses of an over-heated economy, while European austerity measures are now du jour. Both are likely to impact on the commodity market and force further belt-tightening down under.

Twiggs Momentum falling to a new 2010 low confirms the down-trend. Initial target for the decline is $0.78*. Recovery above $0.86 is unlikely, but would warn of a bear trap.

* Target calculation: 0.86 + ( 0.94 - 0.86 ) = 0.78

The meaning of things lies not in the things themselves,

but in our attitude towards them.

~ Antoine de Saint-Exupery