Is This A Real Recovery?

By Colin Twiggs

March 9, 2010 6:00 a.m. ET (10:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Having survived the global financial crisis, are we on the road to recovery or are we like the proverbial twin-engined airplane: when one engine cuts, the second will carry you to the scene of the crash. The GFC itself is far from over. It has merely transformed from a banking crisis to a sovereign debt crisis. Transferring massive losses from the banking sector to the public balance sheet re-capitalized the banks, but created a more serious problem with excessive public sector borrowing. Many national leaders continue to ignore the basic rule: you can't borrow your way out of a financial crisis.

You can't borrow your way out of a financial crisis

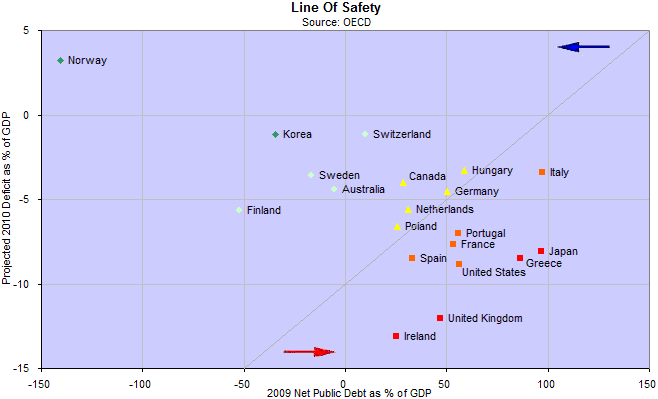

PIMCO published a ("Ring Of Fire") chart comparing national deficits to gross national debt. Gross debt, however, is not always an accurate reflection of financial stress. Some states hold substantial financial assets that can be used to pay down debt. Countries like Norway, Sweden, Finland, South Korea and Australia hold financial assets in excess of their public debt — often merely retaining some debt to maintain a functioning market. Net public debt presents a more accurate picture.

The chart below compares projected 2010 deficits to net public debt, both expressed as a percentage of GDP. Nations below the diagonal line risk falling into financial distress. The diagonal represents two risk factors as a single measure: (1) the larger your public debt, the more precarious your position, and (2) the greater your current deficit (below zero) the faster your financial position will deteriorate. The US, for example, with net debt below 60 percent is in the same risk category as Italy, because it is running larger deficits. Greece and Japan are obviously in the worst position, but the UK and Ireland*, with deficits greater than 10 percent, risk joining them within the next five years.

If you invest in bonds, as PIMCO does, countries above the diagonal line would offer the least risk of default or inflation. The further a country is below the diagonal, the closer it is to "junk bond" status.

Also bear in mind that public debt does not reflect contingent liabilities of the state. In the US, for instance, it does not recognize potential losses from guarantees made during the liquidity crisis as well as the implicit guarantee of $5 trillion of Fannie Mae and Freddie Mac on- and off-balance sheet liabilities. Nor does it reflect the $41 trillion of unfunded Social Security, Medicare and Medicaid obligations. That would increase net public debt to over 350 percent of GDP — exceeding even Zimbabwe (304%).

*Ireland and Greece announced measures to reduce their national deficit which are not taken into account in the OECD projections. Whether Greek austerity measures are sufficient to rescue them from the red zone is questionable, and may merely serve to slow their rate of descent if further steps are not taken.

For the technically minded, I have used the projected change in net public debt levels rather than the budget deficit. There are subtle differences, with budget deficits often understating the increase in national debt levels.

The Two Ds

Governments in financial distress, generally where public debt exceeds GDP, have two "quick fixes" available to them:

- default; or

- debase the currency.

Default, informing creditors that you are unable to repay them, is the simplest option, but leads to financial distress, not only for creditor banks, but also for the nation itself. Defaulting nations lose access to normal trade credit, severely restricting international trade.

Debasing the currency through inflation is only effective where debts are denominated in the national currency — not an option for members of the European Monetary Union, such as Greece. While it may seem the easy way out, the cost is financial instability, higher interest rates and higher unemployment.

The High Road

The long hard road back from financial distress through austerity is a third option. Surpluses, generated by cuts in expenditure or increased taxes, can be used to pay down debt over time. Australia set this as a goal during the Howard era, paying off its entire public debt within a decade.

The key is to provide a stable financial base to encourage real growth in GDP — that is private sector growth, not jobs funded out of present or future taxes. GDP growth has a double payoff: not only raising tax revenues to generate a larger surplus, but also lowering the debt to GDP ratio — making the debt more affordable.

Can Global Trade Recover Without A Stable Financial Base?

Without a stable financial base, global trade is likely to remain fragile.

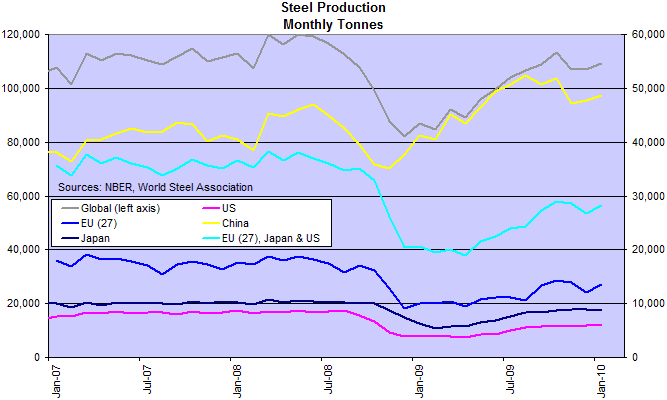

Global steel production has been restored to 2008 levels, thanks to a huge surge in Chinese infrastructure spending as part of their stimulus program.

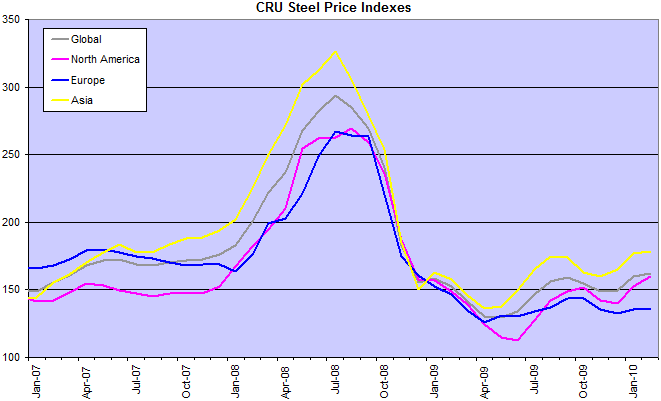

Steel prices, represented by the CRU Steel Price Index, apart from Europe, are also on the rise.

Is steel production a temporary surge caused by various stimulus programs or does it reflect rising demand from the manufacturing sector?

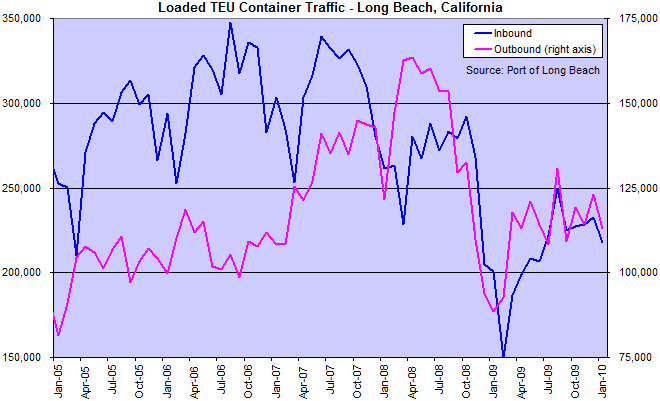

Container freight through Long Beach California is significantly higher than January 2009. January is generally a quiet month, promising further gains in the month ahead. Los Angeles likewise reports a significant increase in outbound traffic over the same period last year, reflecting an increase in exports to Asia.

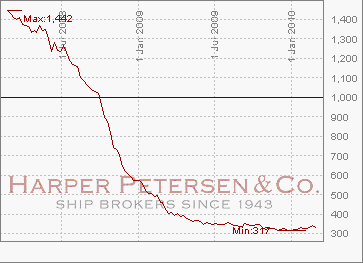

Increases in global manufactured exports remain patchy, however. The HARPEX container freight index is close to its 25-year low of 317. The 1000 level represents the breakeven point for ship operators, where time charter rates just cover ship operating and financing costs — illustrating how depressed conditions actually are.

I will leave you with this extract from Harper Petersen's latest report: Despite the optimism, some perspective is required: charter rates for all sizes remain at painfully low levels for owners and most operators continue to lose money......

Compromise is but the sacrifice of one right or good in the hope of retaining another — too often ending in the loss of both.

~

Tryon Edwards