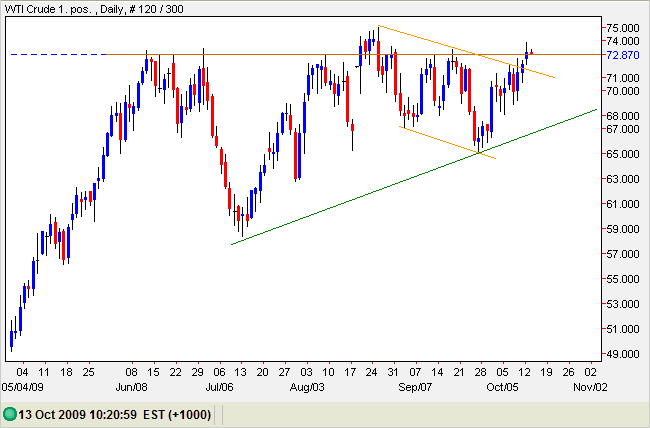

Crude Oil Rising

By Colin Twiggs

October 12, 2009 10:00 p.m. ET (1:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Crude oil broke out of its weak downward trend channel, rallying to penetrate medium-term resistance at $73 on the back of a weakening dollar. Expect a test of $75 in the short term. A marginal new high followed by reversal below $73, however, would form a rising wedge reversal pattern. In the long term, breakout above $75 would confirm a primary advance with a target of $86*, while failure of support at $65 would signal reversal to a primary down-trend.

Source: Netdania

* Target calculation: 73 + ( 73 - 60 ) = 86

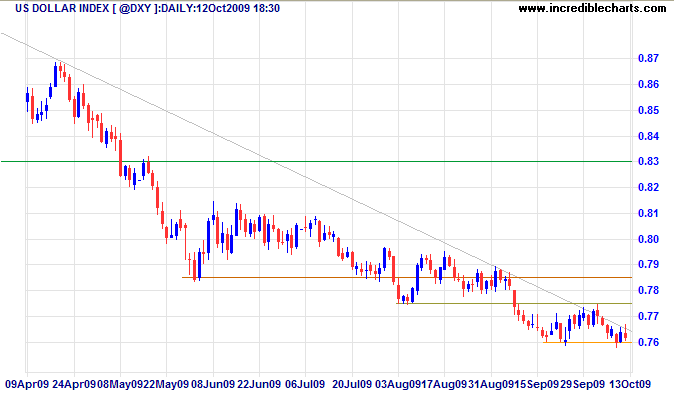

US Dollar Index

The US Dollar Index is again testing support at 76; breakout would offer a short-term target of 74.50*. Reversal above 77.50 is unlikely, but would indicate that the down-trend has ended. A weakening dollar exerts upward pressure on gold, crude oil and general commodity prices.

* Target calculation: 76.00 - ( 77.50 - 76.00 ) = 74.50

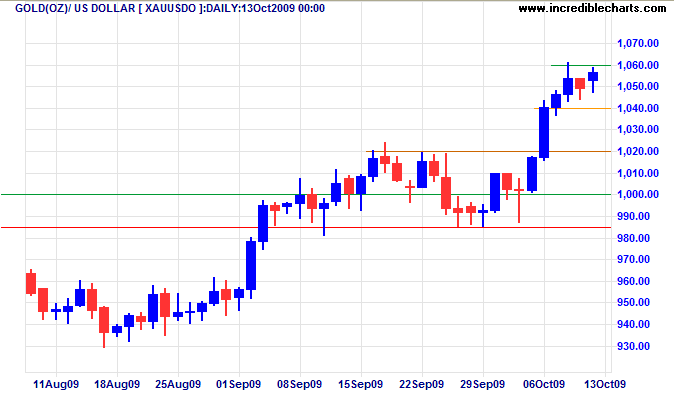

Gold

Spot gold is consolidating between $1060 and $1040. Upward breakout is more likely and would indicate an advance to $1100*. Reversal below $1040 would retrace to test $1000; respect of support at $1020 would be a bullish sign. In the long term, breakout above $1000 offers a target of $1300*; failure of support at $985 is unlikely, but would warn of a primary trend reversal.

* Target calculations: 1000 + ( 1000 - 900 ) = 1100 and 1000 + ( 1000 - 700 ) = 1300

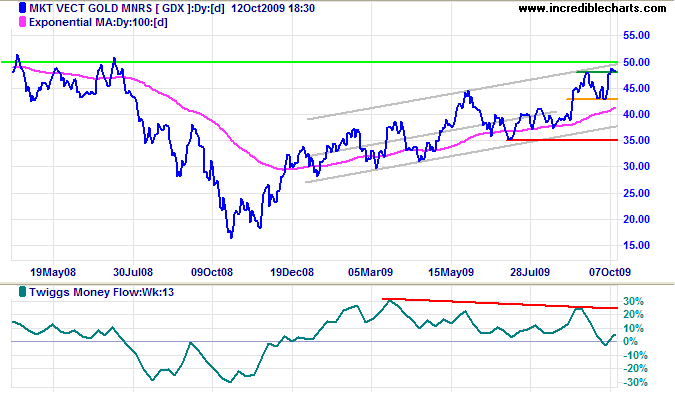

The Market Vectors Gold Miners Index [GDX] breakout above $50 would confirm the rise in spot gold. Bearish divergence on Twiggs Money Flow (13-week), however, warns of selling pressure. Reversal below $43 would signal a secondary correction — a bearish sign for gold. Divergences between gold miners and physical gold often forewarn of changes in the spot price.

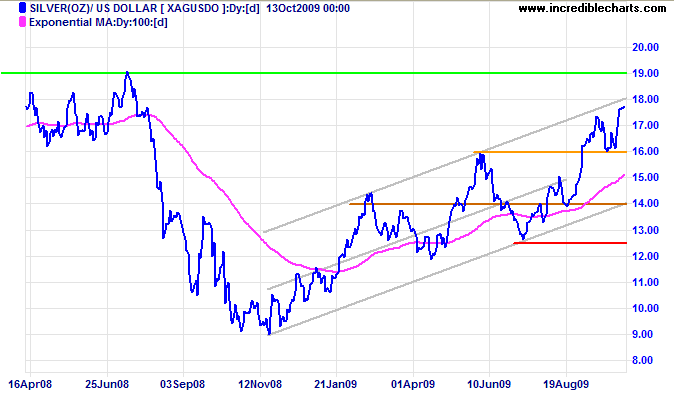

Silver

Spot silver is similarly testing its upper trend channel. The medium-term target is $19*, but reversal below $16 would warn of a secondary correction.

* Target calculation: 16 + ( 16 - 13 ) = 19

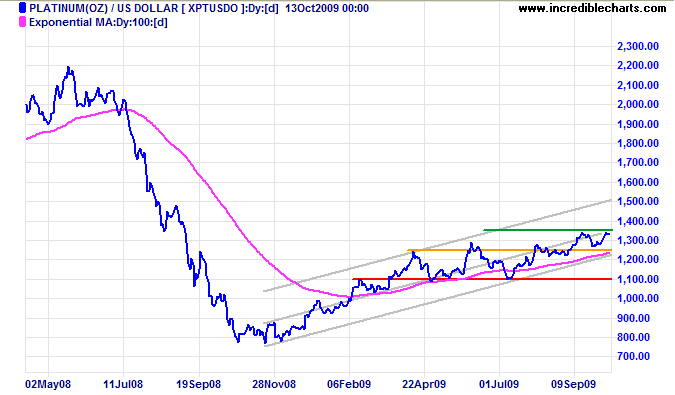

Platinum

Platinum found support at $1250 before rallying to test resistance at $1350. Upward breakout is likely and would offer a medium-term target of 1450*, but reversal below $1250 would warn of a secondary correction. In the long term, expect a primary advance to $1500*, while breakout below the trend channel would warn that the up-trend is weakening.

* Target calculations: 1350 + ( 1350 - 1250 ) = 1450 and 1300 + ( 1300 - 1100 ) = 1500

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Like a baseball game, wars are not over till they are over.

Wars don't run on a clock like football.

No previous generation was so hopelessly unrealistic that this had to be explained to them.

~ Thomas Sowell