Gold Strengthens But Oil Weakens

By Colin Twiggs

October 5, 2009 9:30 p.m. ET (12:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

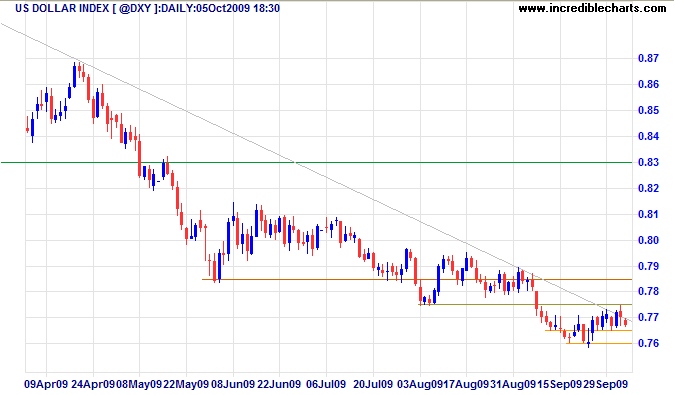

US Dollar Index

The US Dollar Index is testing short-term resistance at 77.50. Breakout above resistance and the declining trendline would warn that the down-trend is weakening. Reversal below 76 is, however, more likely and would signal another down-swing with a target of 74.50*. The weakening dollar exerts upward pressure on gold, crude oil and general commodity prices.

* Target calculation: 76.00 - ( 77.50 - 76.00 ) = 74.50

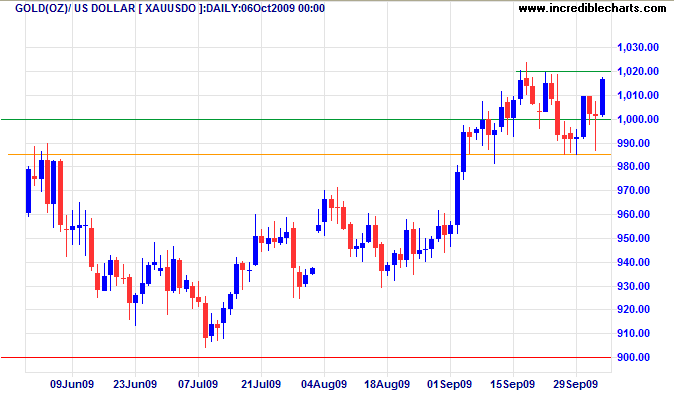

Gold

Spot gold respected support at $985 and is now headed for a test of resistance at $1020. Upward breakout is more likely and would indicate an advance to $1100*. Retracement that respects support at $1000 would be a bullish sign. Reversal below $985 is unlikely, but would warn of a correction to test primary support at $900. In the long term, breakout above $1000 offers a target of $1300*; failure of support at $900 remains unlikely, but would signal a primary down-trend to test the November low at $700.

* Target calculations: 1000 + ( 1000 - 900 ) = 1100 and 1000 + ( 1000 - 700 ) = 1300

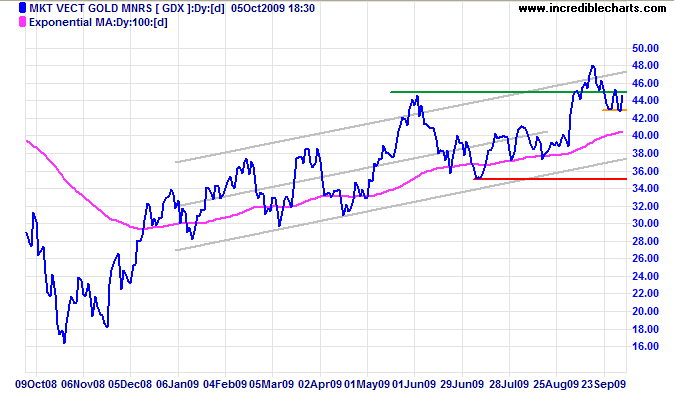

The Market Vectors Gold Miners Index [GDX] has yet to respond to the rising gold price, retreating from its upper trend channel. Respect of short-term resistance at $45 and reversal below $43 would be a bearish sign for gold. Divergences between gold miners and physical gold often forewarn of changes in the spot price.

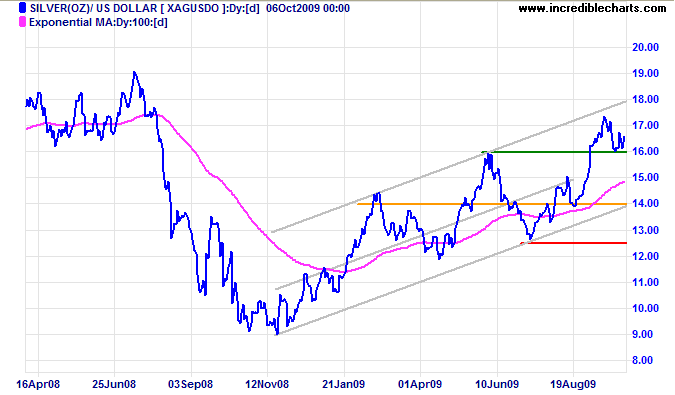

Silver

Spot silver is testing the new support level at $16; respect would signal a primary advance, with a target of $19*. Failure of support is less likely, but would indicate a test of the lower trend channel and support at $14.

* Target calculation: 16 + ( 16 - 13 ) = 19

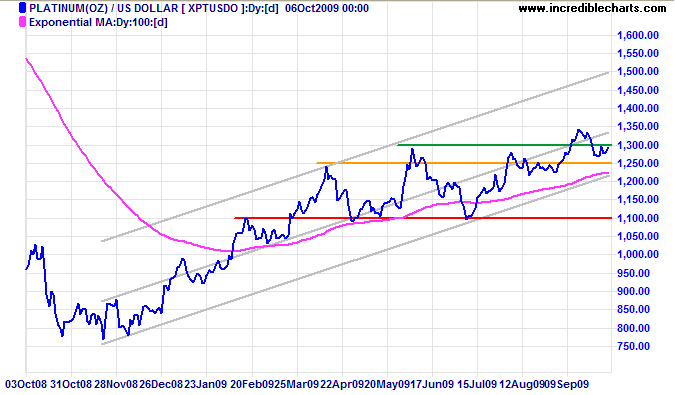

Platinum

Platinum is testing short-term resistance at $1300. Penetration would signal a primary advance with a long-term target of $1500*, while breakout below the trend channel would warn that the up-trend is weakening.

* Target calculation: 1300 + ( 1300 - 1100 ) = 1500

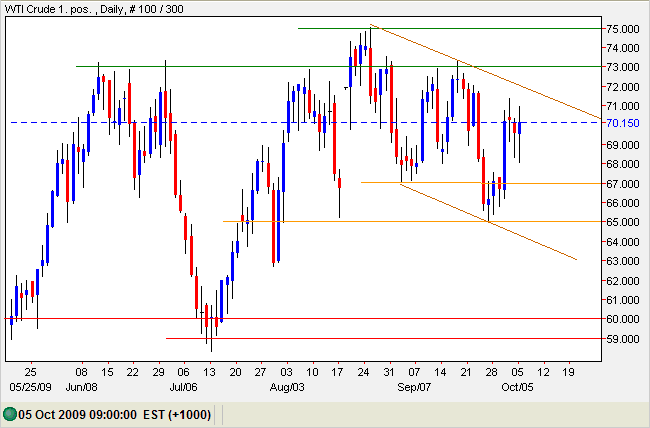

Crude Oil

Crude oil is edging lower, forming a weak down-trend — with a lower high at $73 followed by a new low below $67. The weakening dollar works against this, and recovery above $73 would signal a primary advance with a target of $86*. Failure of support at $65, however, would confirm a secondary correction to test primary support at $59/$60.

Source: Netdania

* Target calculation: 73 + ( 73 - 60 ) = 86

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

People who pride themselves on their "complexity" and deride others for being "simplistic"

should realize that the truth is often not very complicated. What gets complex is evading the truth.

~ Thomas Sowell