Shanghai Correction Unsettles Markets

By Colin Twiggs

August 17, 6:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

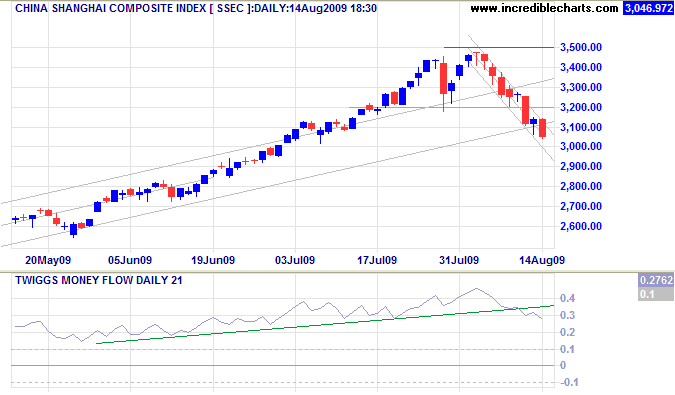

The Shanghai Composite Index broke through support at 3200, signaling the start of a secondary correction. Runaway trends lack clear support levels and the correction may well exceed the calculated target of 2900* from the double top formation. Twiggs Money Flow (21-Day) reversal below the rising trendline confirms selling pressure.

* Target calculations: 3200 - ( 3500 - 3200 ) = 2900

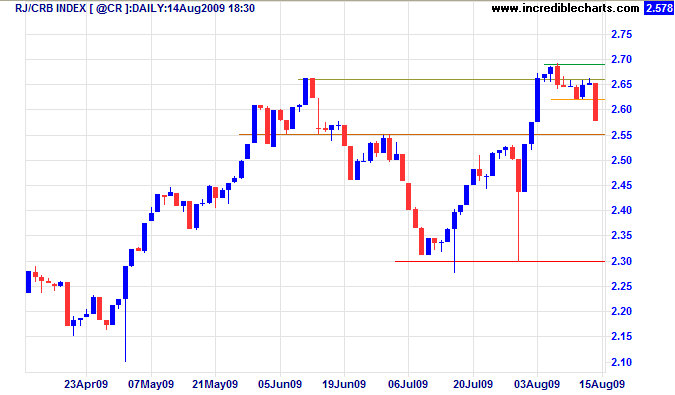

The CRB Commodities Index, shaken by the prospect of falling demand from China, retreated below short-term support — signaling a bull trap. Bad news for resources stocks. Breakout below 255 would confirm a test of primary support at 230.

USA

Dow Jones Industrial Average

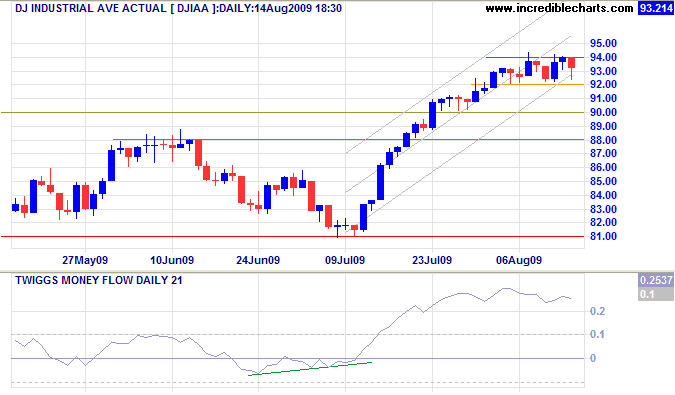

The Dow is consolidating between 9200 and 9400. Upward breakout would continue the primary advance with a target of 10000*, while reversal below 9200 (and the trend channel) would warn of a secondary correction to test support at 8800. In the longer term, failure of support at 8100 is unlikely, but would signal a new primary down-trend. Any signal on the Dow, however, needs to be confirmed by the S&P500 and Dow Transport Index.

* Target calculation: 9000 + ( 9000 - 8000 ) = 10000

S&P 500

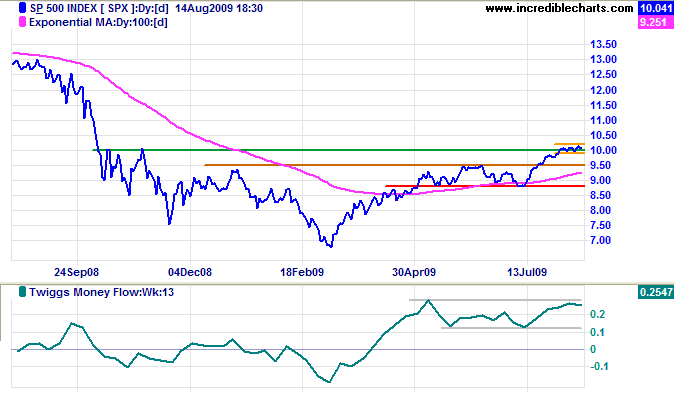

The S&P 500 is similarly consolidating around the 1000 level. Breakout above 1015 would signal a primary advance with a target of the August 2008 high*. Reversal below 990, however, would warn of a secondary correction. In the long term, failure of support at 880 would signal a new down-trend.

* Target calculation: 1000 + ( 1000 - 700 ) = 1300

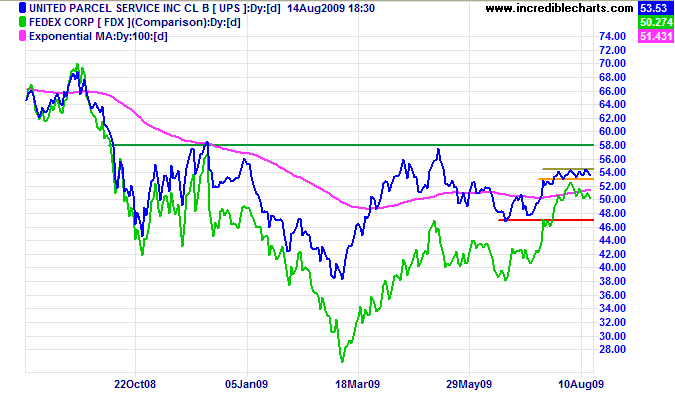

Transport

UPS has so far failed to confirm the Fedex and Dow Transport Average primary up-trend. Breakout from the present narrow consolidation would signal future direction — for the stock and the broader economy.

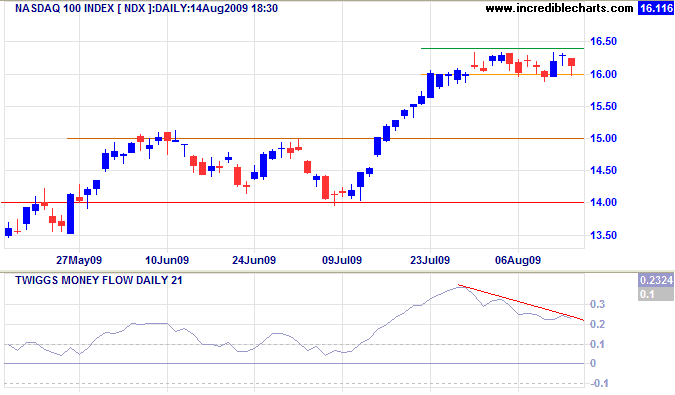

Technology

The Nasdaq 100 is consolidating in a narrow band above 1600. Declining Twiggs Money Flow (21-Day) warns of increased selling pressure. Reversal below 1600 would signal a secondary correction to test support at 1500, while breakout above 1640 would continue the primary advance to 1700*.

* Target calculation: 1600 + ( 1600 - 1500 ) = 1700

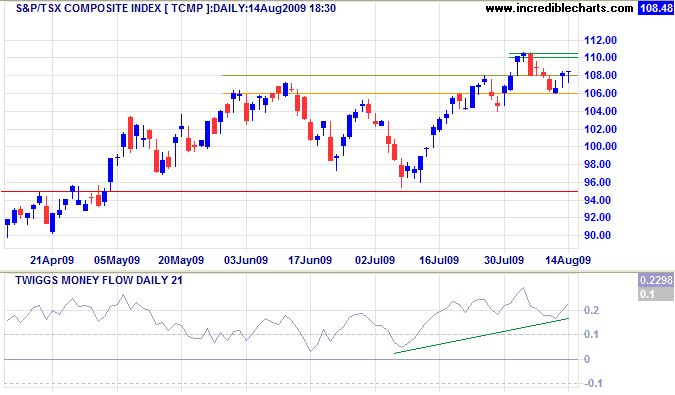

Canada: TSX

The TSX Composite is testing support at 10600. Reversal above 11050 would continue the primary advance with a target of 11700*. Rising Twiggs Money Flow (21-Day) indicates long-term buying pressure. Failure of 10600 is unlikely, but would warn of a secondary correction.

* Target calculation: 10700 + ( 10700 - 9700 ) = 11700

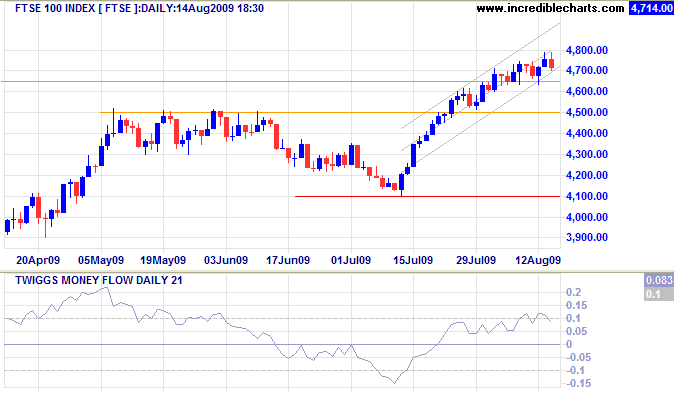

United Kingdom: FTSE

The FTSE 100 continues its primary advance with a target of 5000*. Rising Twiggs Money Flow (21-Day) indicates buying pressure. Reversal below 4650, however, would warn of a secondary correction; and failure of support at 4500 would confirm.

* Target calculation: 4500 + ( 4500 - 4000 ) = 5000

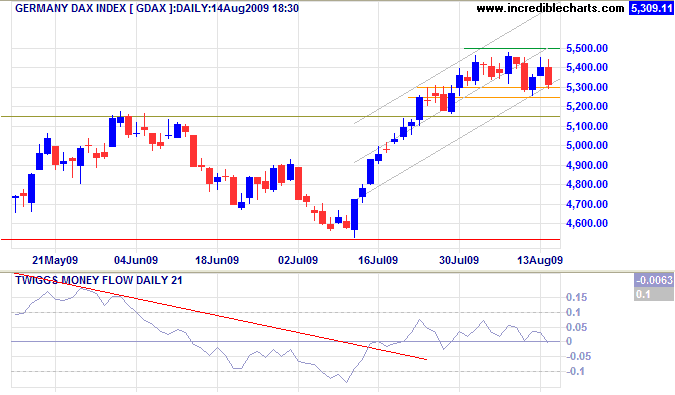

Europe: DAX

The DAX continues to consolidate between 5300 and 5500. Upward breakout would signal a swing to the upper trend channel, around 5700*. Declining Twiggs Money Flow (21-Day), however, warns of selling pressure. Reversal below 5250 would indicate a secondary correction.

* Target calculation: 5100 + ( 5100 - 4500 ) = 5700

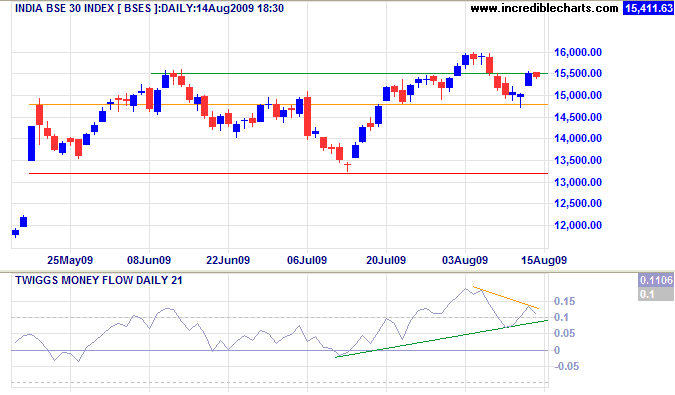

India: Sensex

The Sensex respected short-term support at 14800, but has encountered resistance at 15500. Upward breakout would signal a primary advance with a target of 17500*. Declining Twiggs Money Flow (21-Day), however, indicates selling pressure. Failure of support at 15500 would indicate a secondary correction to test 13200.

* Target calculation: 15500 + ( 15500 - 13500 ) = 17500

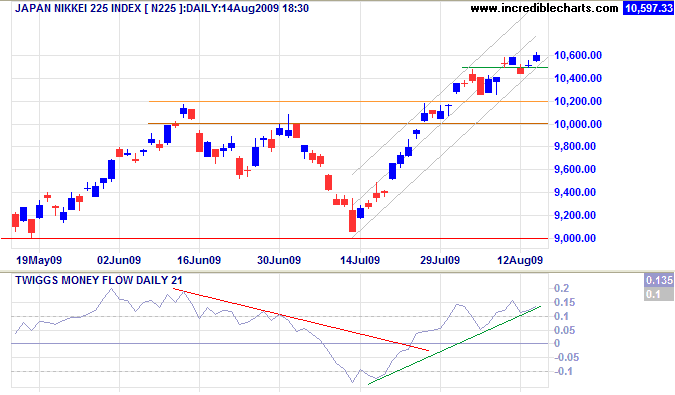

Japan: Nikkei

The Nikkei 225 respected support at 10500/10400, signaling continuation of the primary advance — with a target of 11000*. Rising Twiggs Money Flow (21-Day) indicates buying pressure. Reversal below 10200 is unlikely, but would signal a secondary correction.

* Target calculation: 10000 + ( 10000 - 9000 ) = 11000

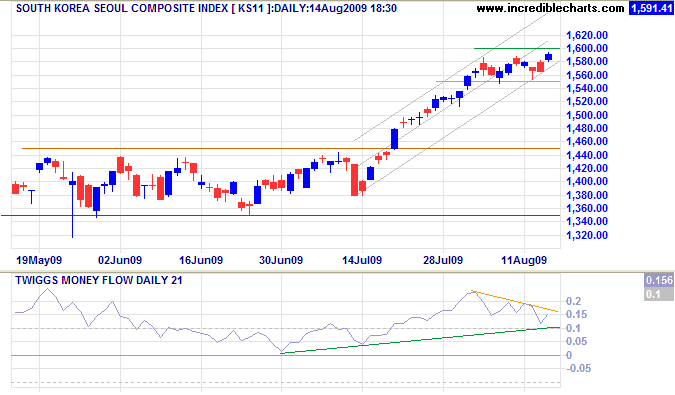

South Korea

The Seoul Composite Index is consolidating below 1600. Upward breakout would continue the primary advance with a target of 1700*. Declining Twiggs Money Flow (21-day), however, indicates selling pressure. Reversal below 1550 would warn of a secondary correction.

* Target calculation: 1450 + ( 1450 - 1200 ) = 1700

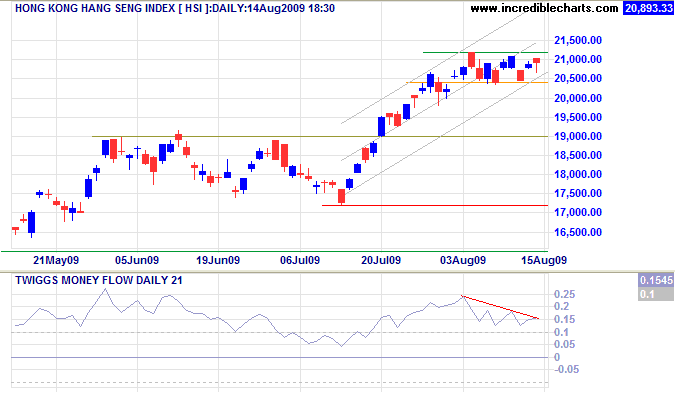

China

The Hang Seng is consolidating around its previous target of 21000*. Declining Twiggs Money Flow (21-Day) warns of selling pressure. Reversal below 20400 would warn of a secondary correction, while recovery above 21200 would signal a further advance — to the upper trend channel.

* Target calculation: 19000 + ( 19000 - 17000 [red] ) = 21000

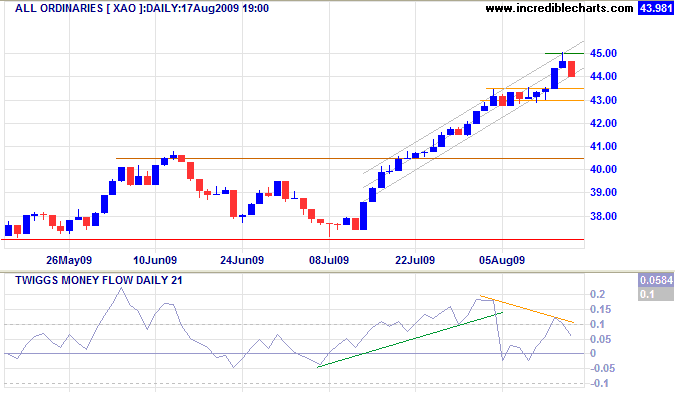

Australia: ASX

Australian resources stocks are affected by the down-turn in China and the decline in commodity prices. The All Ordinaries, having reached its target of 4400*, is testing the lower trend channel. Breakout would warn of a secondary correction; confirmed if short-term support at 4300 is broken. Reversal above 4500 is less likely, but would signal a further advance. The signal on Twiggs Money Flow (21-Day) cannot be trusted because of unusual volume attributable to a single stock (GPT).

* Target calculation: 4050 + ( 4050 - 3700 ) = 4400

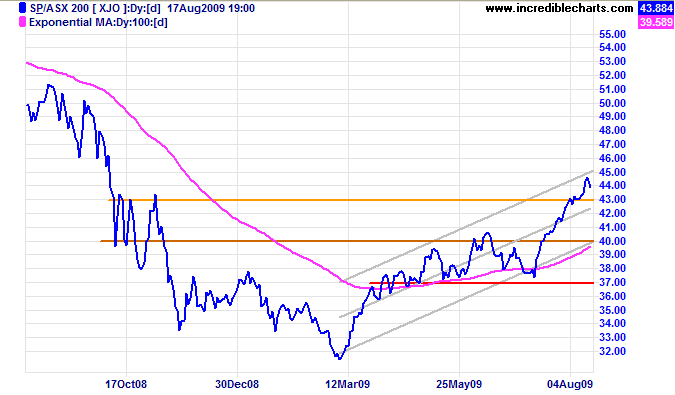

The ASX 200 is retreating from the (long-term) upper trend channel. Reversal below 4300 would indicate a secondary correction to test the lower channel border.

A reminder for the next few weeks: This is no blue sky rally. Enjoy it while it lasts. But bear in mind that it could end badly. And keep your stops tight.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

We may consider each generation as a distinct nation, with a right, by the will of its majority,

to bind themselves, but none to bind the succeeding generation, more than the inhabitants of another country.

~ Thomas Jefferson (1743 - 1826)