Falling Dollar & Inventories Lift Crude

By Colin Twiggs

July 14, 2009 2:30 a.m. ET (4:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

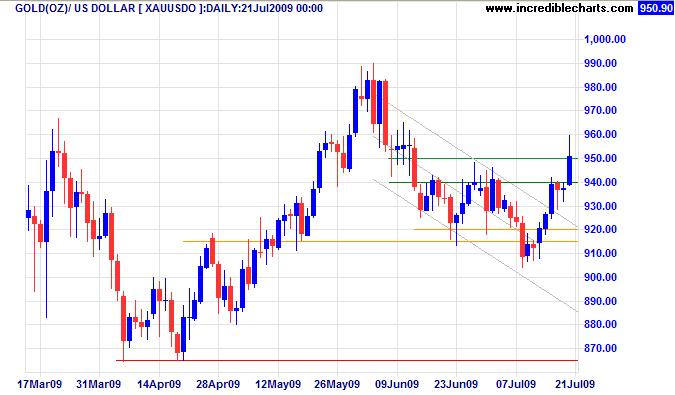

Gold

Spot gold broke through resistance at 950, but the tall shadow and weak close are unconvincing. Follow-through above $960 would confirm that the correction is over, while reversal below $940 would signal continuation — and a likely test of primary support at $865. In the long term, breakout above $1000 would signal a primary advance with a target of 1100, while failure of primary support at $865 would test the November 2008 low of $700.

Inflation fears are the main driver behind the gold price. Dennis Lockhart, president of the Atlanta Fed, yesterday reassured his audience that inflationary and deflationary risks are evenly balanced. He also pointed out that "the absolute size of the Fed's balance sheet is not as scary as it used to be." The Fed now pays interest on excess reserves held on behalf of banks and is able to control the flow of liquidity into the economy by varying this interest rate. The question remains: will they do the right thing — or bow to the inevitable political pressure?

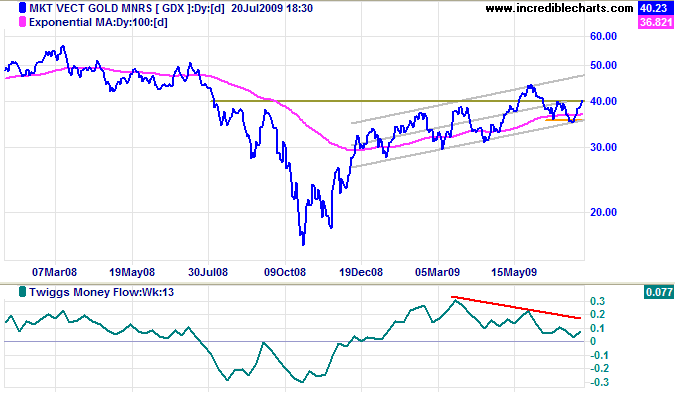

The Gold Miners Index [GDX] is testing resistance at $40. Breakout would signal a test of the upper trend channel — a bullish sign for spot gold. Twiggs Money Flow (13-Week), however, shows a bearish divergence — warning of strong selling pressure and increasing the likelihood of a downward breakout from the trend channel.

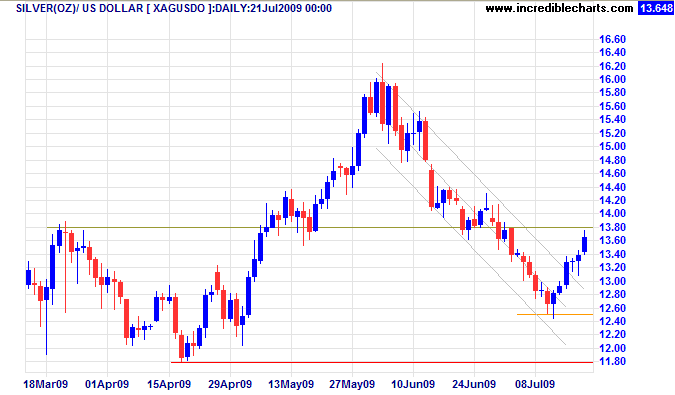

Silver

Spot silver rallied to test medium-term resistance at $13.80; breakout from the trend channel indicating that the secondary correction is weakening. Respect of resistance would test support at $12.50. The correction is not over, however, until we see a higher trough followed by a new high. In the long-term, penetration of support at $11.80 would warn of a primary down-trend, while respect of primary support would indicate another test of $16.

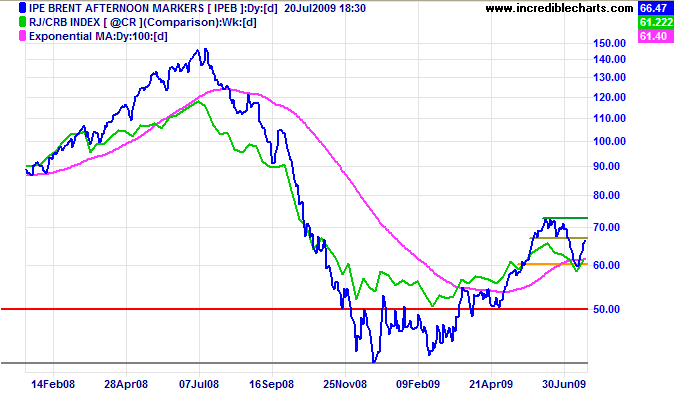

Crude Oil

Crude oil and commodities prices rallied sharply, but remain in a secondary correction. Brent crude breakout above $67/barrel would indicate that the correction is weakening, while respect of resistance would signal another down-swing. The primary trend remains upward — assisting precious metal prices as inflation fears rise.

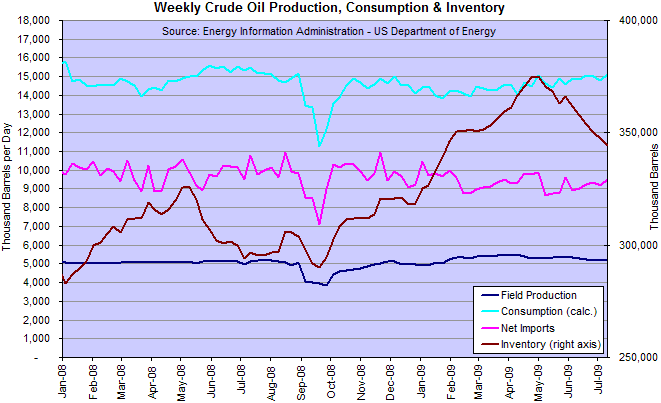

US crude oil inventories are declining as consumption edges upwards while imports ease — increasing upward pressure on crude prices.

US Dollar Index

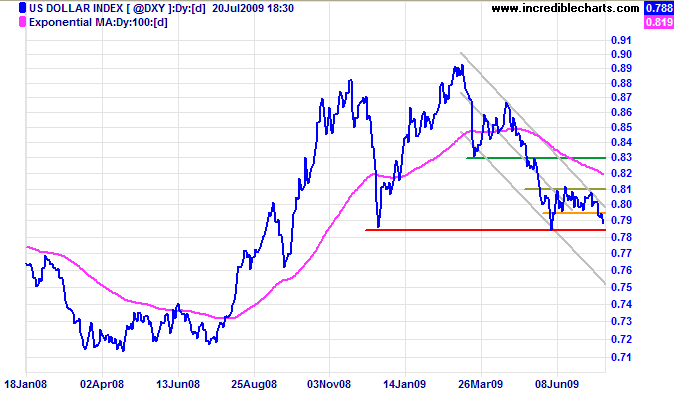

A down-turn in the US Dollar Index would also boost precious metal prices. Breakout from the narrow consolidation between 79.50 and 81 will test primary support at 78.50. Failure of support would warn of another primary decline, targeting the lower channel border. Recovery above 81 is most unlikely, but would signal a test of the March low at 83.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

I predict future happiness for Americans if they can prevent the government

from wasting the labors of the people under the pretense of taking care of them.

~ Thomas Jefferson (1743 - 1826)