Dow Faces Key Test At 8200

By Colin Twiggs

July 6, 2:15 a.m. ET (4:15 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

USA

Fund managers are likely to withdraw support for stocks on their balance sheet now that the June 30 quarter-end has passed. This increases the risk of a significant correction across major markets — which would test the lows from March 2009.

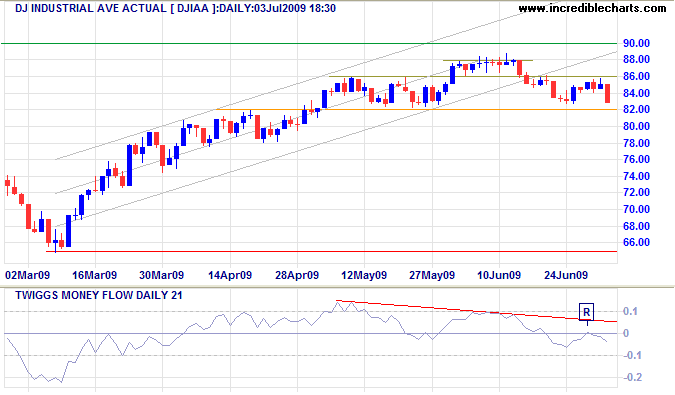

Dow Jones Industrial Average

The Dow threatens to complete a head and shoulders reversal if it breaks through support at 8200. The recent trend channel breakout already warns of a down-swing to test primary support at 6500 — reinforced by Twiggs Money Flow (21-Day) bearish divergence and a peak [R] that respects the zero line from below.

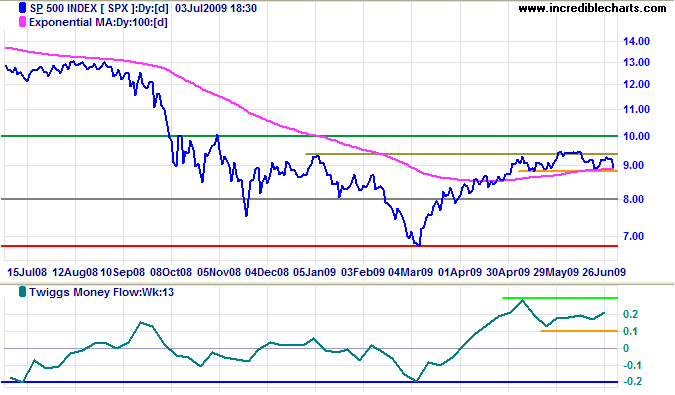

S&P 500

The S&P 500 is similarly headed for a test of support at 880. Breakout would test primary support at 670. Reversal above 950 is now unlikely, but would signal a primary up-trend with a target of 1100. Bearish divergence on Twiggs Money Flow (21-Day) warns of selling pressure, but the longer-term (13-Week) indicator is more evenly balanced: a fall below 0.1 would confirm the down-swing, while a rise above 0.3 would indicate a primary advance.

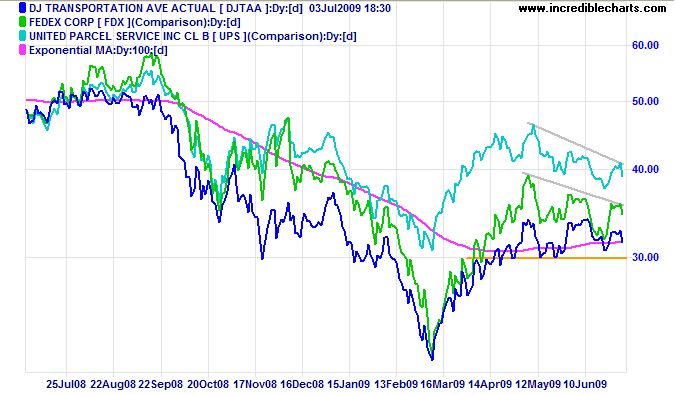

Transport

The Dow Transport Index is consolidating above 3000. A down-turn would add weight to the Industrial and S&P 500 signals. Bellwether stocks Fedex and UPS both commenced another down-swing, but the gentle slope of the downward trendline indicates the presence of buyers. Respect of primary support at their March 2009 lows would be a bullish sign.

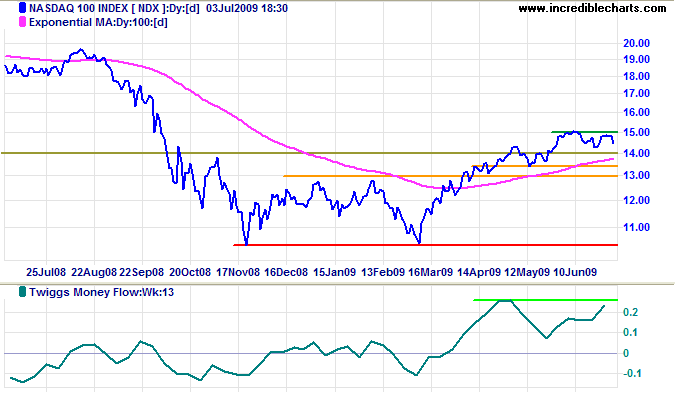

Technology

The Nasdaq 100 encountered resistance at 1500, but remains stronger than the Dow and S&P 500. Breakout above 1500 would signal another primary advance with a target of 1600 — calculated as 1300 + ( 1300 - 1000 ). Reversal below 1340 is unlikely, but would warn of a secondary correction. Twiggs Money Flow (13-Week) rising above 0.25 would confirm a primary advance.

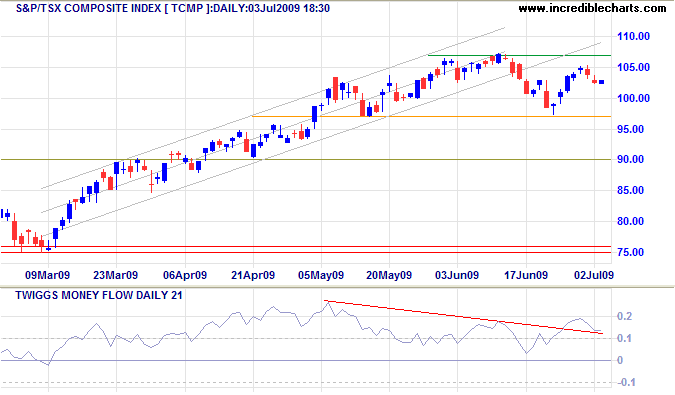

Canada: TSX

TSX Composite breakout below its trend channel warns of a secondary correction, but the bearish divergence on Twiggs Money Flow (21-Day) has weakened. Breakout above 10700 would signal another primary advance, while reversal below 9700 would confirm the secondary correction.

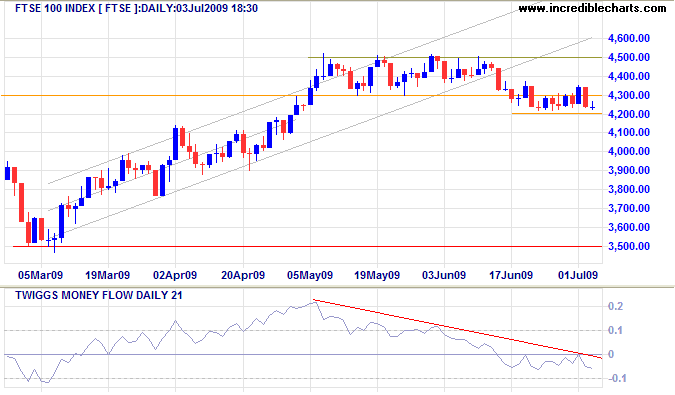

United Kingdom: FTSE

FTSE 100 broke through support at 4300 — only to form a narrow consolidation above 4200. Downward breakout would confirm a down-swing to test primary support at 3500. Bearish divergence on Twiggs Money Flow (both 21-Day and 13-Week) indicates strong selling pressure. Reversal above 4500 is most unlikely, but would test primary resistance at 4650.

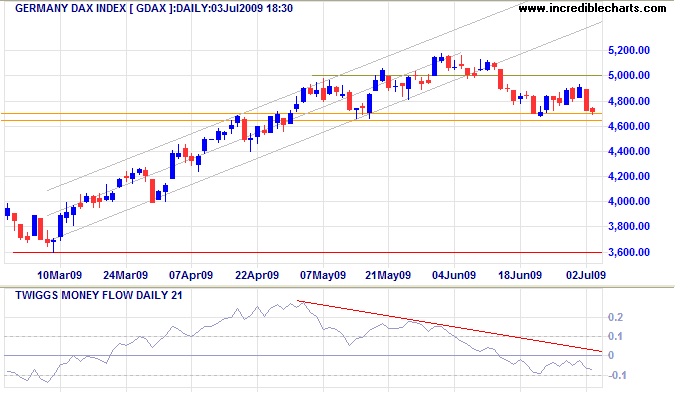

Europe: DAX

The DAX threatens a head and shoulders reversal after breakout below its trend channel. Failure of support at 4650 would confirm a down-swing to test primary support at 3600. Bearish divergence on Twiggs Money Flow (both 21-Day and 13-week) warns of strong selling pressure.

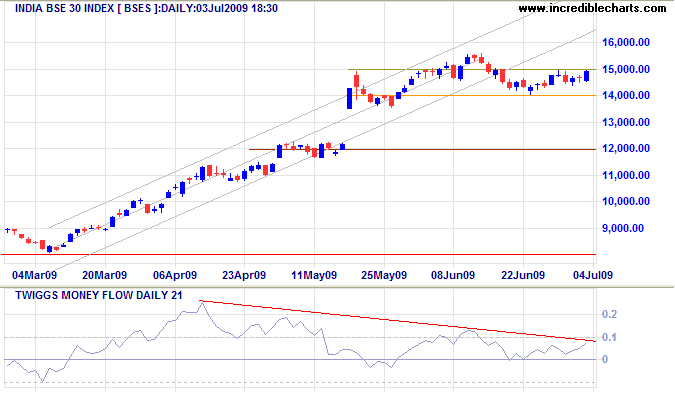

India: Sensex

The Sensex displays a similar "head and shoulders" pattern following breakout below its trend channel. Failure of support at 14000 would warn of a secondary correction to test support (from the large gap) at 12000. Bearish divergence on Twiggs Money Flow (21-Day), however, failed to cross below zero. Breakout above 15000 is now as likely — and would indicate another primary advance.

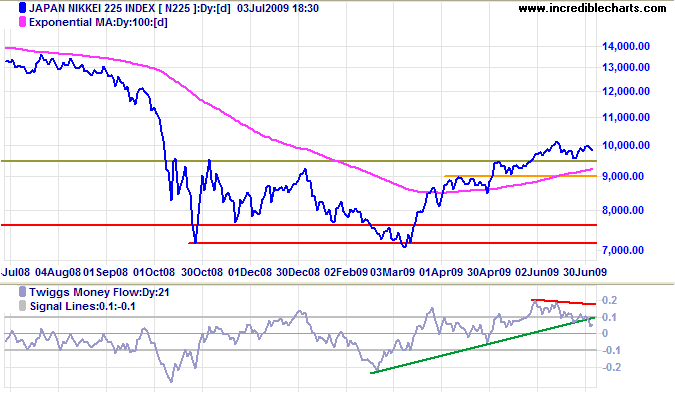

Japan: Nikkei

The Nikkei 225 respected resistance at 10000

and Twiggs Money Flow (21-Day) shows a bearish divergence.

Failure of support at 9500 would warn of a secondary correction.

Reversal above 10000, while less likely, would signal a primary advance with a target of 12000

— calculated as

9500 + ( 9500 - 7000 ).

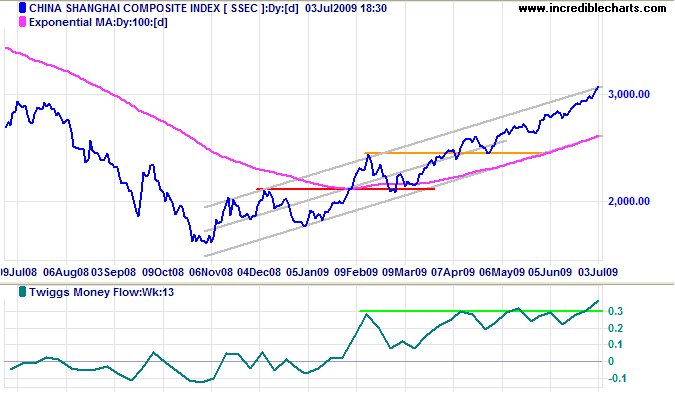

China

The Shanghai Composite Index continues in a primary up-trend. Breakout above the trend channel warns that the trend is accelerating — and could lead to a blow-off. Twiggs Money Flow (13-Week) confirms strong buying pressure.

China has come in for criticism recently for the rapid expansion of its money supply — M2 grew by 26 percent in the last 12 months. But this structural instability will take time to translate into higher inflation and a slow-down in bank lending before it impacts on the stock market.

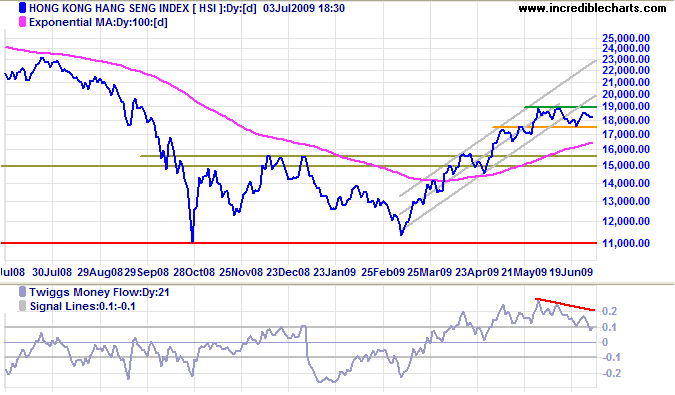

Hang Seng breakout below its trend channel warns of a secondary correction. Twiggs Money Flow (21-day) bearish divergence indicates selling pressure; a fall below zero would strengthen the signal. Reversal below 17500 would confirm a secondary correction, while recovery above 19000 would signal another primary advance.

Australia: ASX

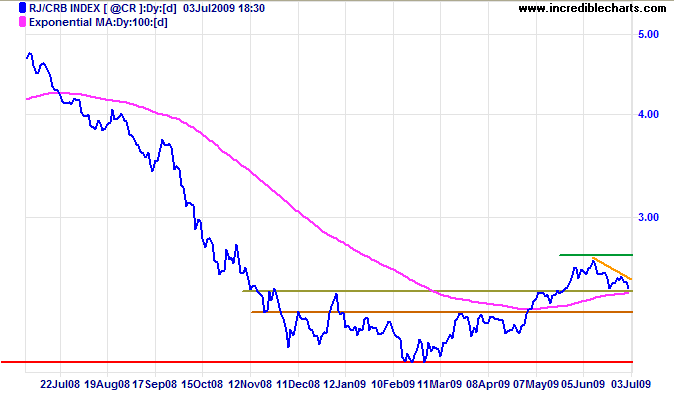

The CRB Commodities Index is testing the new support level at 245 [khaki]; respect would signal a strong primary up-trend. Failure of support at 230 [brown], on the other hand, would warn of a bull trap — a bearish signal for resources stocks.

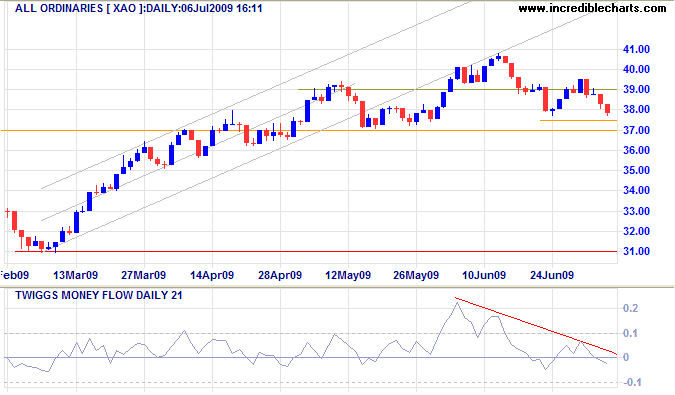

The All Ordinaries testing support at 3750 threatens a similar head and shoulders reversal to the Dow. Breakout below its trend channel and bearish divergence on Twiggs Money Flow (21-Day) increase the likelihood of a correction. Penetration of support at 3700 would provide further confirmation. The target for a correction would be the March low of 3100. Reversal above 4000 is most unlikely — but would indicate a primary advance.

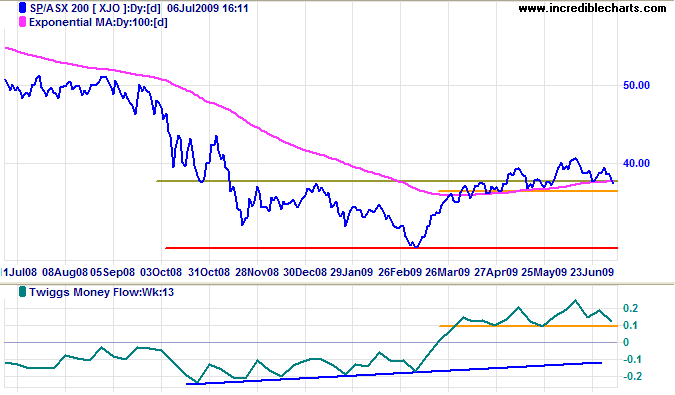

ASX 200 reversal below 3700 [orange] would signal a secondary correction to test primary support at 3150. Bearish divergence on Twiggs Money Flow (21-Day) warns of selling pressure; reversal of the longer-term 13-Week indicator below 0.1 would confirm the bear signal.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

This disposition to admire, and almost to worship, the rich and powerful, and to despise, or

at least neglect, persons of poor and mean conditions, though necessary both to establish and to maintain the distinction of ranks and the order of society,

is, at the same time, the great and most universal cause of the corruption of our moral sentiments.

~ Adam Smith (1723 - 1790)