Gold Rally

By Colin Twiggs

March 5, 2009 9:00 p.m. ET (1:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

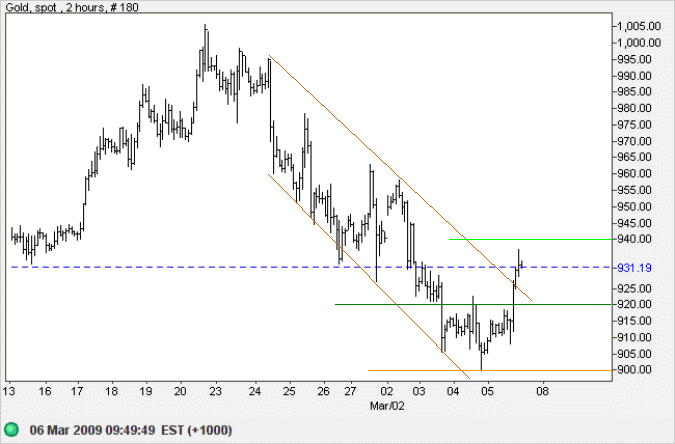

Gold

Spot gold respected support at $900, rallying above short-term resistance at $920 and breaking out of its trend channel to signal reversal of the recent down-trend. The short-term target is $940; calculated as 920 + ( 920 - 900 ). Retracement that respects the new support level at $920 would confirm the up-trend, offering a medium-term target of $1000. Failure of support at $900 is now unlikely, but would warn of a test of $700. In the long term, breakout above $1000 would offer a target of $1200; calculated as 900 + ( 1000 - 700 ) from the large descending broadening wedge over the last 12 months.

Source: Netdania

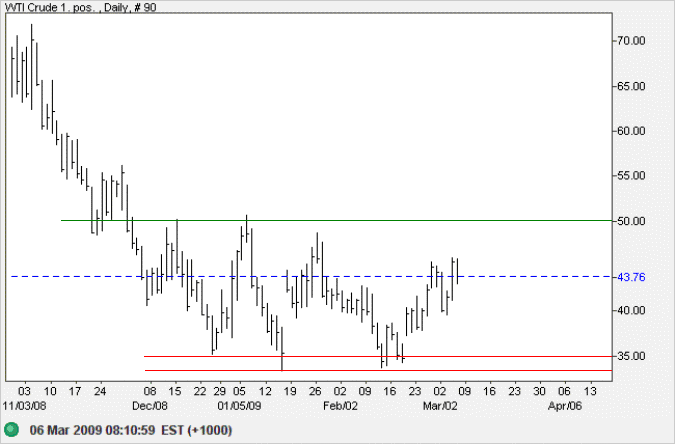

Crude Oil

West Texas Crude is headed for a test of resistance at $50 per barrel. The primary trend is down and likely to remain so, given the contraction in the global economy. Expect resistance to hold and, in the long term, reversal below $33 would warn of a down-swing to test the 2003 low of $20. The target is calculated as 35 - (50 - 35).

Source: Netdania

Wisdom consists not so much in knowing what to do in the ultimate as knowing what to do next.

~ Herbert Hoover