Financial Markets Easing

By Colin Twiggs

November 13, 2008 6:00 a.m. ET (10:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

What's New

Stock Screen Update

Users of the stock screener may note some minor improvements. At the request of a number of members, saved stock screens now include the following additional fields:

- Exchange;

- Index;

- Sector;

- Watchlist;

- Sort By and Sort Order; and

- Results Per Page.

We have also fixed bugs reported with display of watchlists, sorting, percentage price decimals, field validation, and remembering your most recent settings.

Chart Of The Day

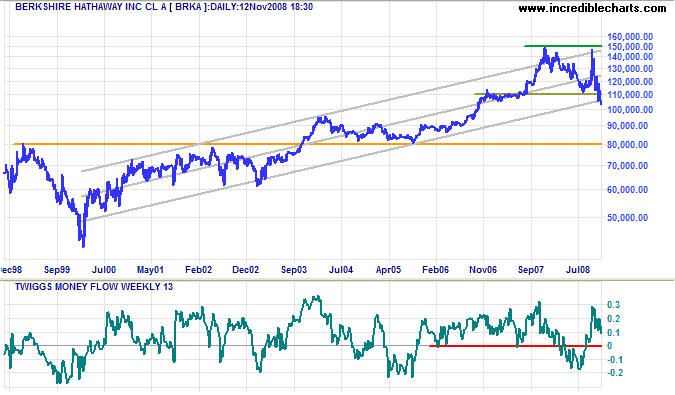

Berkshire Hathaway (BRKA) broke out of its 8 year trend channel after completing a double top reversal. Twiggs Money Flow (13-week) still shows signs of buying support, but retracement that respects resistance at $110,000 would confirm the down-trend.

Rating Agencies

Rating agencies are coming under close scrutiny by Congress and EU financial regulators after failing to alert investors to the pitfalls of mortgage-backed securities and collateralized debt obligations. "Let's hope we are all wealthy and retired by the time this house of cards falters" wrote one rating agency employee, warning of the impending disaster (MarketWatch). Plagued by conflicts of interest, agencies were paid by issuers to rate new issues, but were also paid by issuers for advice on how to improve their ratings. The new issues, unsurprisingly, received good ratings. "Profits were running the show" Frank Raiter, head of mortgage ratings at Standard & Poor's until 2005, testified before Congress (NYTimes). Firms appear to have focused more on winning market share from rivals than on maintaining standards.

What is needed is to treat rating agencies in much the same way as auditors. Audit firms were forced, several years ago, to divest themselves of their consulting arms to reduce potential conflicts of interest. Other parallels would be an obligation of due care to investors, personal liability of senior management, minimum capital requirements, and high standards for employed staff. Agencies would continue to be paid by issuers, but should be appointed in a similar fashion to auditors: by a committee of non-executive directors acting independently of senior management.

Interbank Lending

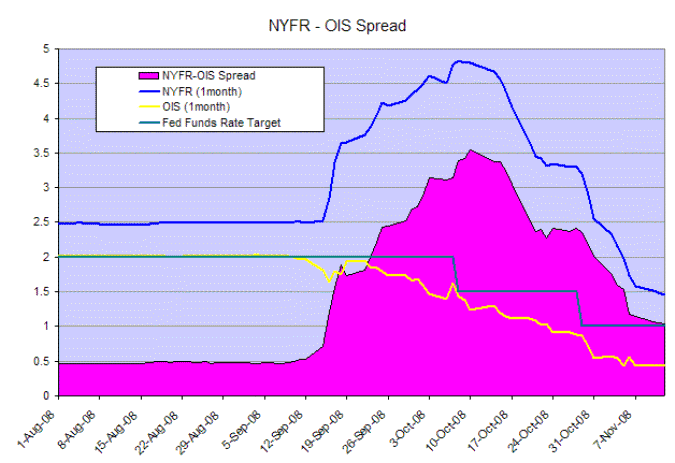

The spread between the 1-month New York Funding Rate and the Overnight Index Swap Rate declined to 100 basis points (1.0%) and appears headed for a more normal 50 basis points. Massive injections of capital by Treasury and liquidity from the Fed appear to be finally having an effect.

The ICAP New York Funding Rate indicates the rate at which banks are prepared to lend to each other in the open market. The Overnight Index swap rate reflects traders' best estimates of the effective fed funds rate. The current 0.43 percent is well below the 1 percent target rate — signaling another 0.50 percent rate cut by the Fed.

Treasury Yields

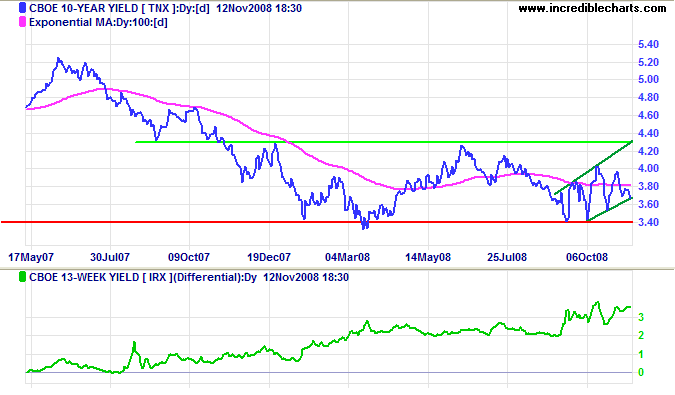

Ten-year treasury yields are testing the lower border of a bearish ascending broadening wedge formation. The recent failed up-swing also warns of a downward breakout which would offer a target of 3.00 percent. Rising yield differentials are boosting bank margins, but it will take some time to restore lost capital.

The Shadow Banking System

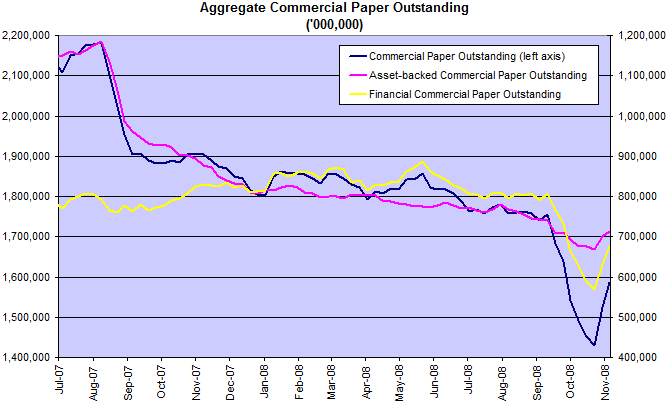

Commercial paper rates are falling after recent Fed purchases to support short term funding for large corporates. Investors are now risk averse and liquidating investments in money market funds, hedge funds and other high-yield investments forcing a credit contraction.

Housing

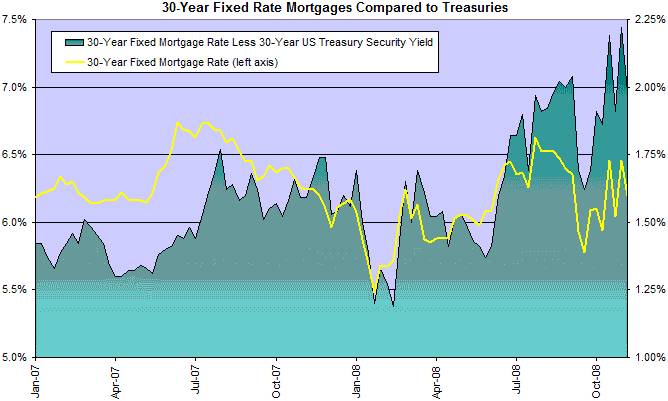

Fixed mortgage rates are likely to benefit from falling long-term treasury yields, but presently are being offset by higher spreads due to concern over default levels. Falling mortgage rates would encourage home buyers and support prices.

Banks

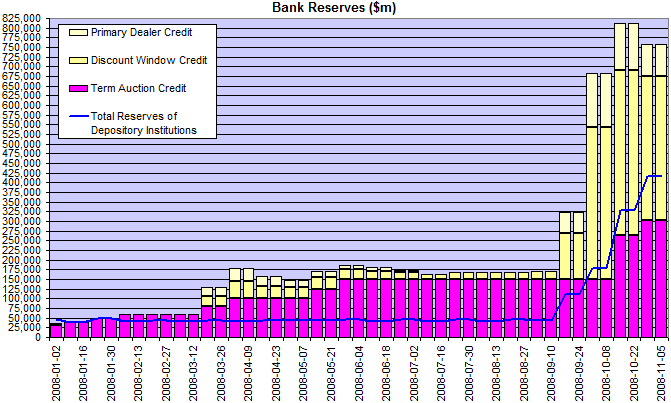

Fed support of financial markets eased to $750 billion. This excludes the $29 billion net holdings in the Bear Stearns bailout and Treasury support for GSEs, AIG and money market funds. The system remains on life support.

Bank reserves on deposit with the Fed are rising as excess deposits now earn interest at the fed funds rate, encouraging banks to deposit with the Fed rather than lend in the interbank market.

Consumers

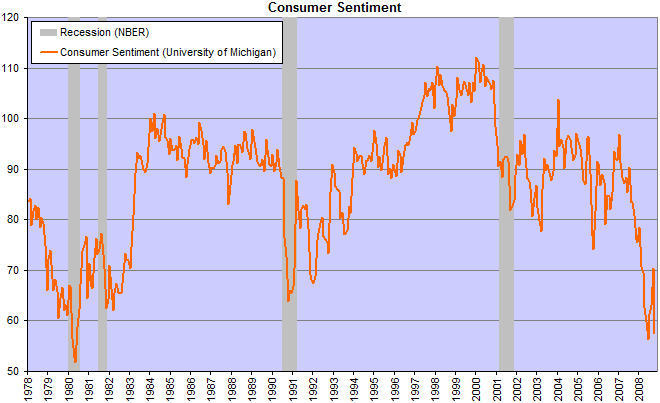

Consumer sentiment appears headed for 1980 lows at 50. More bad news for retailers.

Labor

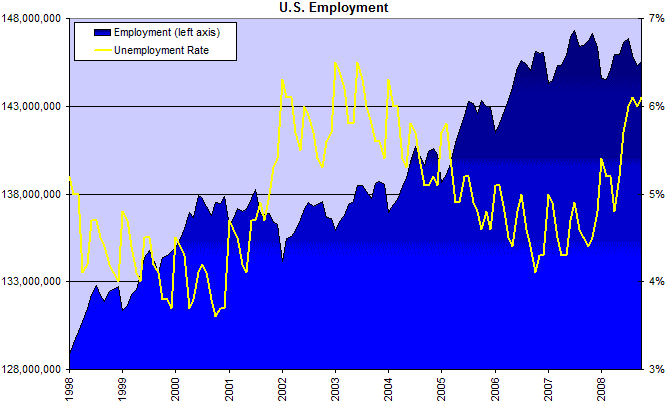

Unemployment is at 6.0 percent and rising. Further bad news for retail sales and the housing market.

When there is a lack of honor in government,

the morals of the whole people are poisoned.

~ Herbert Hoover, 31st President of the United States (1929-1933)