Gold Tests Support

By Colin Twiggs

May 14, 2008 3:30 a.m. ET (5:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Gold

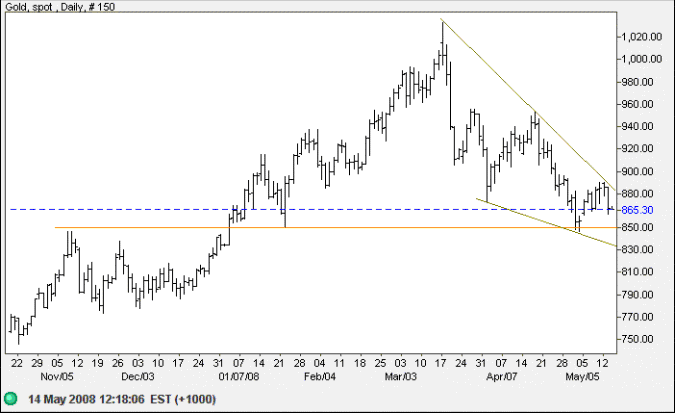

Spot gold is headed for a second test of the important $850 support level. Respect of $850 would signal a healthy primary up-trend, while failure would signal a test of primary support at $770. The falling wedge is a continuation pattern and increases the chances of support holding. Subsequent reversal above $900 would signal the end of the correction and start of another primary advance.

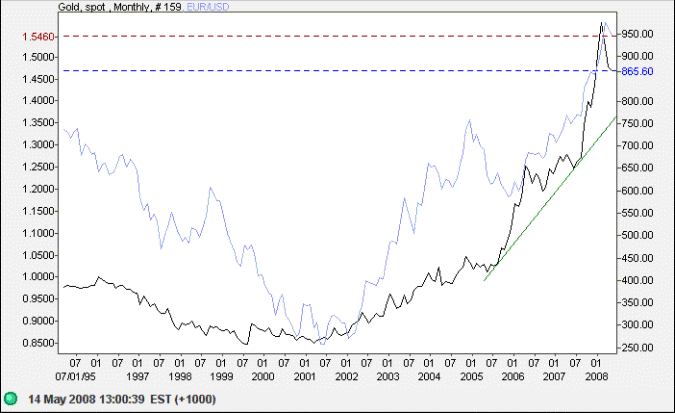

The monthly chart shows how gold has retraced more than the euro but, if we compare performance since 2001, gold has quadrupled while the euro barely doubled against the dollar. In other words, gold has doubled against the euro since 2001.

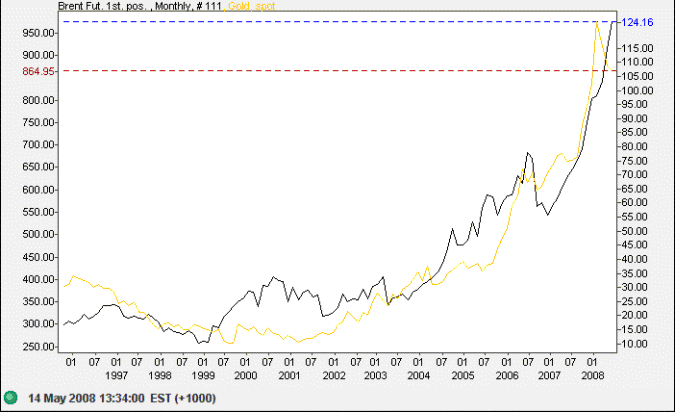

What has caused gold to appreciate against both currencies? Compare gold to the oil price over the same period: in 1999 an ounce of gold would buy 25 barrels of oil, today the gold-oil ratio is as low as 7. When the crude price is high, oil-rich nations tend to invest surplus profits in real assets such as gold, rather than in depreciating currencies. This may also account for the surprising resilience of the stock market in the face of an expected recession.

Source: Netdania

Crude Oil

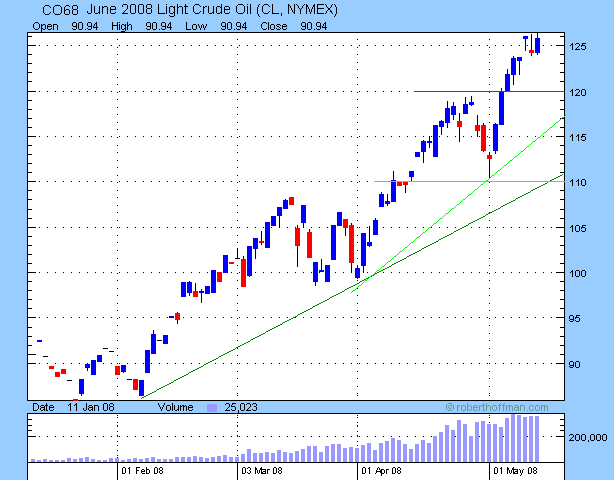

June 2008 Light Crude is consolidating at $125 per barrel after a steep climb from $120. Narrow consolidations are continuation patterns, making an upward breakout likely — and a test of $130. Reversal below $124, however, would signal a short-term retracement. The rising trendlines show an accelerating up-trend, or self-reinforcing cycle. If the acceleration continues we are likely to witness a sharp upward spike followed by a steep drop as the market corrects from its excesses.

Currencies

There has been much discussion in recent weeks about government intervention in financial markets. The Working Group on Financial Markets, also known as the Plunge Protection Team, was set up by Ronald Reagan after the October 1987 crash. Their role is to prevent the market going into free-fall as it did on Black Monday, when the Dow fell more than 20%. Some writers suggest that the group intervened in the stock market to arrest the recent fall. While the indexes have been unusually resilient, this is unlikely to have been caused by direct government intervention. What is clear since the last G7 summit on April 11, however, is the concerted effort being made by central banks to arrest the depreciation of the dollar against the euro and other major currencies.

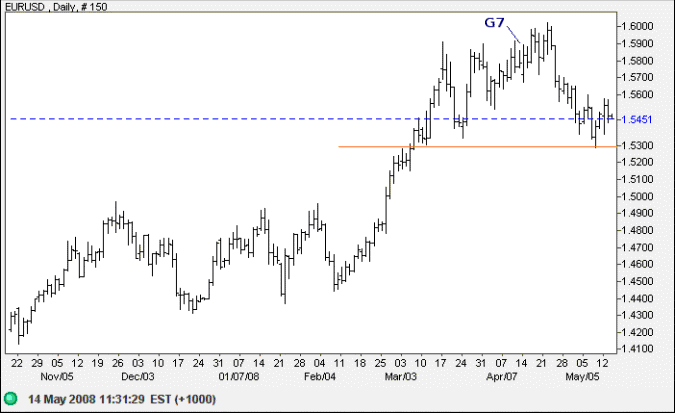

The euro appreciated for several days after the G7 meeting before reversing sharply to test support at $1.53. If the intention is merely to prevent further appreciation, we are likely to see selling pressure ease and the euro again appreciate — where it will be given another "haircut" if it threatens to break out of the targeted range. Respect of support at $1.53 would indicate another test of $1.60, while failure would warn of a secondary correction, testing initial support at $1.50, followed by primary support at $1.43.

Source: Netdania

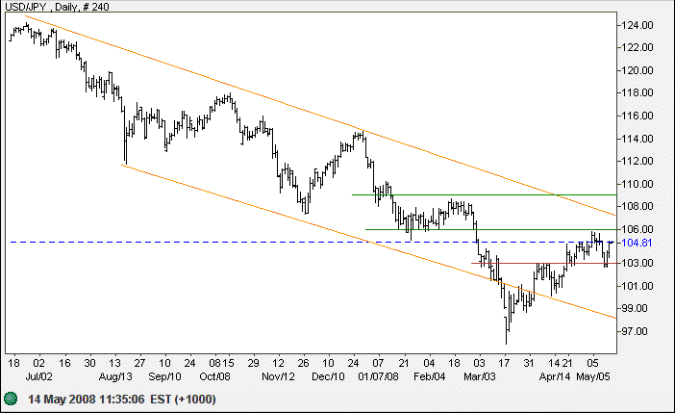

The greenback found resistance at 106 yenbefore retracing to support at 103. Upward breakout from the upper trend channel would be a positive sign but we are more likely to see further consolidation followed by a test of 100. Signs of another breakout below 100 yen are also likely to result in a "haircut".

Source: Netdania

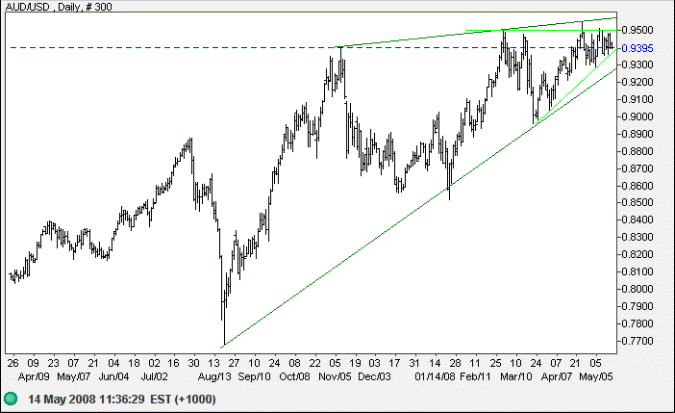

Identifying chart patterns can sometimes be like staring at ink blots, with the shape of the pattern in the eye of the beholder. The Australian dollar displays a bullish ascending triangle against the greenback, with short-term support at $0.93 and resistance at $0.95. However, a longer term view displays a bearish rising wedge — where reversal below $0.93 would signal a test of the August low at $0.77. Conclusion: Expect further consolidation between $0.95 and $0.93. Upward breakout (confirmed if a retracement respects support at $0.95) would offer a target of 0.95+(0.95-0.90)=1.00 (parity). All bets are off, however, if we see reversal below $0.93.

Source: Netdania

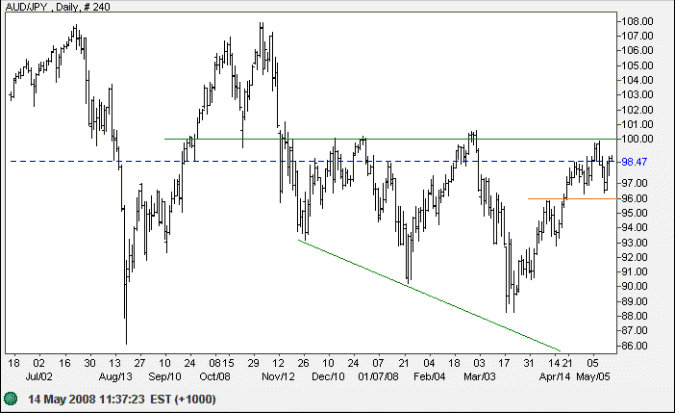

The Aussie is headed for another test of the upper border of a descending right-angled broadening pattern against the yen. Expect strong resistance at 100 yen. Upward breakout offer a target of 108, while reversal below 96 would signal a test of long-term support at 86.

Source: Netdania

A pessimist? That's a person who has been intimately acquainted with an optimist.

~ Elbert Hubbard

To understand my approach, please read About The Trading Diary.