Interest Rates & Yield Curves

By Colin Twiggs

November 1, 2007 4:00 a.m. ET (7:00 p.m. AET)

In an attempt to make the newsletters more readable, we will

trial splitting the weekly coverage in two: gold, oil and forex

on Tuesdays; the economy and interest rates on Thursdays.

Please give us your feedback when we conduct a survey, in a few

weeks.

These extracts from my trading diary are for educational

purposes and should not be interpreted as investment advice.

Full terms and conditions can be found at

Terms of Use.

The Fed & Interest Rates

As expected, the Fed lowered the discount rate to 5.0% and the

target for the federal funds rate to 4.50%, a quarter per cent

cut in both rates.

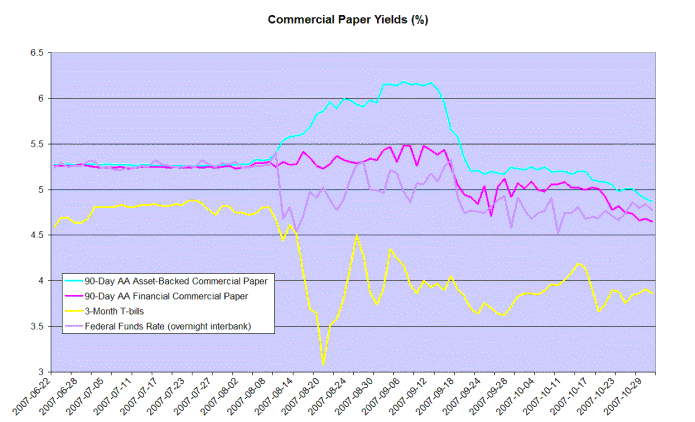

Discount rates on commercial paper declined in anticipation,

but the spread between (pink) financial CP and (blue)

asset-backed CP indicates the market's continued wariness of

the almost $900 billion of asset-backed commercial paper in

circulation. The level is expected to decline over the next few

months, forcing banks to substitute on-balance sheet

funding.

The spread between the (yellow) 3-month treasury bill yield and

the (pink) discount rate on financial commercial paper reflects

the level of unease with financial markets in general. Only

when the margin has narrowed to half a percent (50 points), as

reflected prior to August, will this signal that the subprime

crisis is over.

GDP Growth

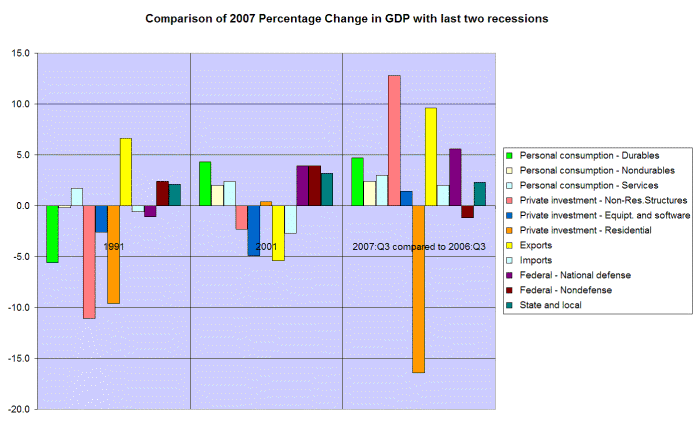

GDP growth came in at a healthy (annualized) 3.9 percent for

the quarter. When we look at the percentage change on an annual

basis (2007 Q3 compared to 2006 Q3) we can see why the Fed

chose to proceed with the rate cut. Private residential

investment has fallen sharply, even when compared to the

previous two recessions.

The difference between 2007 and 1991 is the resillience of

durables and non-residential investment (though defense

spending has also played a part). We need to keep a weather eye

on these two sectors for signs of slow-down, which would warn

that the economy is sliding into a recession.

Source: Bureau of Economic Analysis

The 2001 recession can be ignored for purpose of comparison. It is not atypical and can largely be ascribed to the aftermath of Y2K, with a decline in equipment & software investment and a similar fall in exports.

The Yield Curve

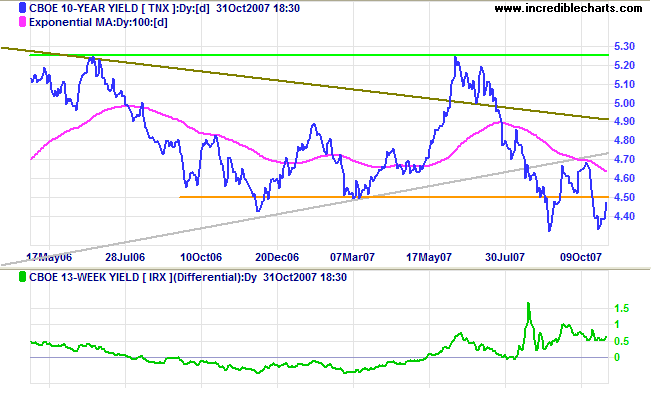

Ten year treasury yields are recovering as a result of the rate

cut and consequent weakening of the dollar.

The yield differential remains positive as a result of the

sharp decline in short-term yields, reducing the pressure on

bank interest margins.

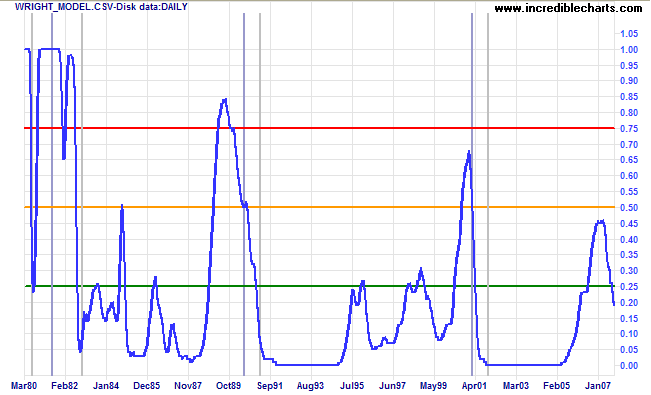

Jonathan Wright's recession prediction model indicates the probability of a recession in the next four quaters has fallen to a low 19 percent. The model is based on the nominal level of the fed funds rate and the yield differential between 10-year and 3-month treasuries. As such it fairly accurately predicts a decline in the availability of credit caused by a narrowing of bank interest margins. However, it will not reflect a decline in availability of credit caused by other factors, such as a collapse of the commercial paper market. Not all recessions are atypical, as I pointed out earlier. While the model remains a useful tool, I believe that it underestimates the risk of recession in the present environment.

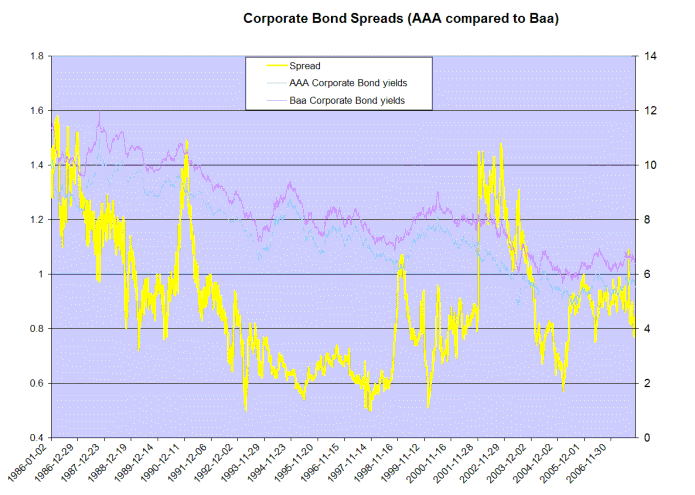

Corporate Bond Yields

The spread between high-risk and low-risk corporate bond yields is another useful warning sign. Note how the spread between AAA and Baa bonds spiked sharply upwards in 1990, 1998 and 2001 — reflecting concern about the impact of a down-turn on lower-ranked corporates.

The current low 85 point spread is positive sign, reflecting no immediate concerns about debt servicability.

Let me issue and control a nation's money and I care not who

writes the laws.

~ Mayer Amschel Rothschild

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.