The Big Picture

By Colin Twiggs

March 20, 2007 9:00 p.m. ET (12:00 a.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

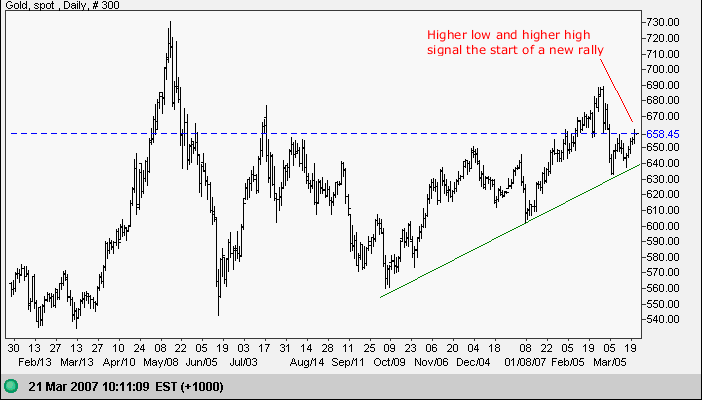

Gold

Spot gold respected the long-term (green) trendline, indicating

that the up-trend is healthy. The higher low and higher high

signal the start of a new rally with a target of $750 ( 690 + [

690 - 630 ] ), but expect significant resistance at $690.

Falling crude oil prices may weaken demand for gold.

Source: Netdania

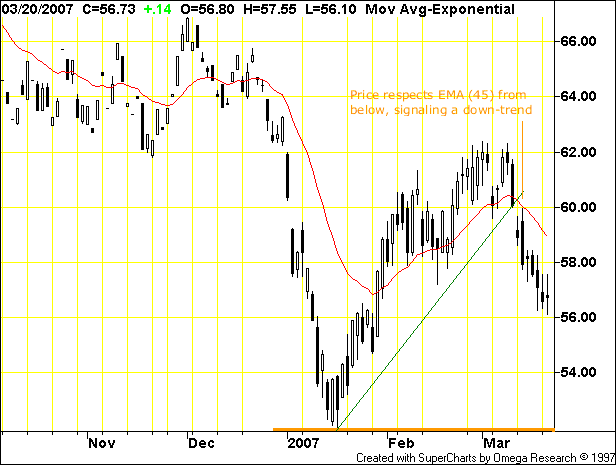

Crude Oil

April Light Crude is headed for a test of primary support at $52/barrel, after breaking below $57.

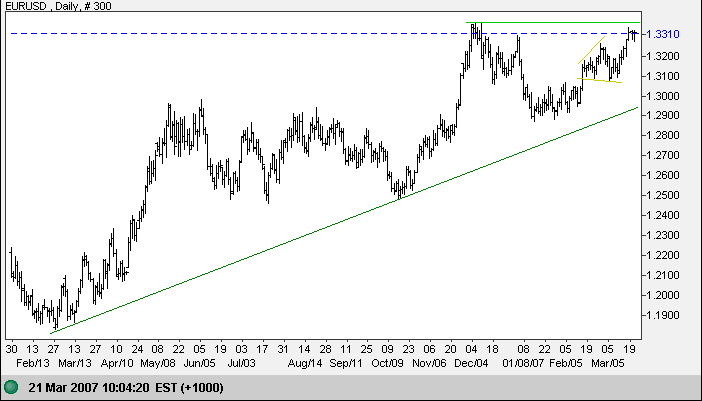

Currencies

The euro is testing resistance at the December 2006 high of $1.34 after a bullish broadening formation. Expect further substantial resistance at the 2005 high of $1.37 if $1.34 is penetrated.

Source: Netdania

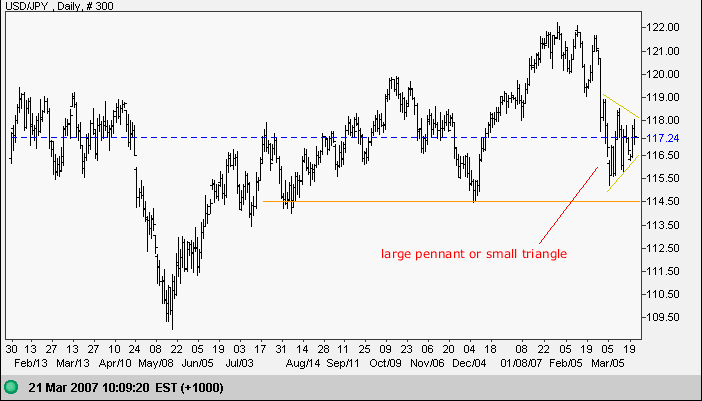

The dollar is consolidating above support at 114.50 against the yen. The large pennant is a continuation pattern and we can expect another test of $114.50. Failure of support would signal reversal to a down-trend and a test of 109, possibly even long-term support at 100. Respect of support, on the other hand, would signal another test of 121.50.

Source: Netdania

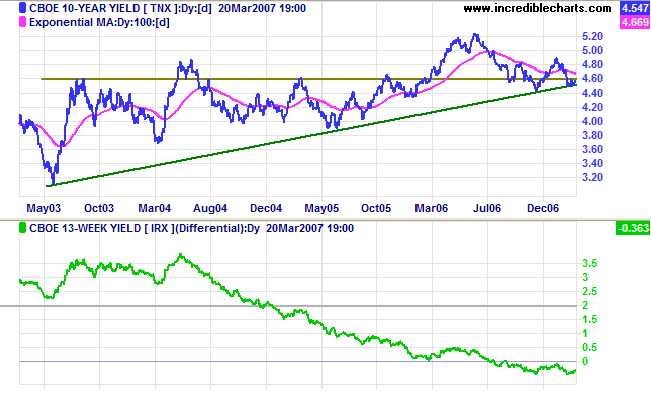

Treasury Yields

Ten-year treasury yields are testing the long-term trendline and support at 4.5%. Respect of the trendline would signal another rally to test resistance at 5.25%, while failure would warn of reversal to a down-trend. Low (long-term) treasury yields encourage higher valuations in the stock market, offsetting to some extent the negative impact of an inverted yield curve.

The negative yield differential (10-year minus 13-week treasury yields) continues to warn of pressure on banking margins and a possible contraction of bank credit, restricting new investment.

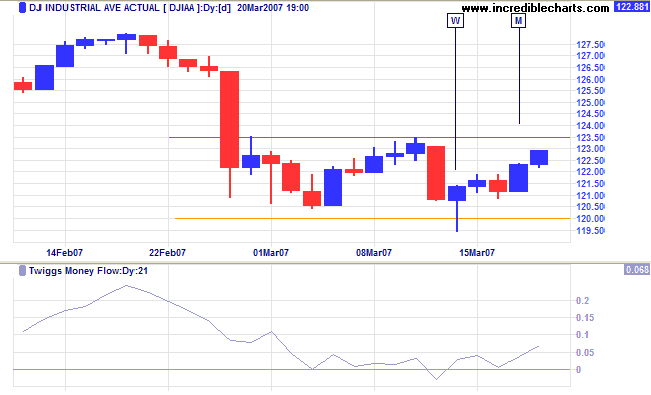

Dow Jones Industrial Average

The Dow Jones Industrial Average is headed for a test of resistance at 12350. A close above this level would signal a rally to test the February high and the likely end of the recent correction. Consolidation between 12000 and 12350, however, would be a bearish sign, warning of continuation of the recent down-trend and a test of support at the May 2006 high of 11600. Twiggs Money Flow is holding above zero, signaling short-term accumulation.

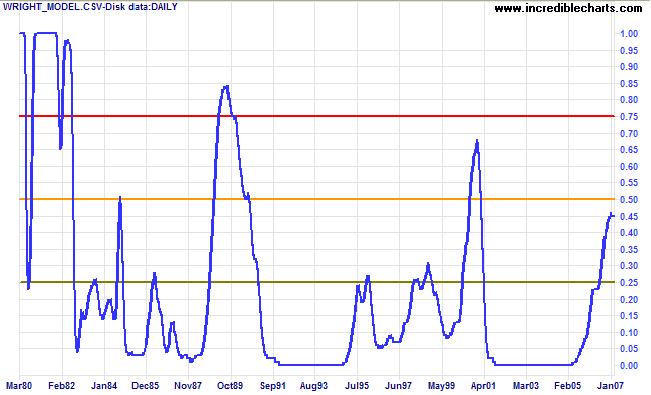

Wright Model

Probability of recession in the next four quarters has leveled off at 45 per cent according to the Wright Model.

There is some evidence that the Wright model may understate the probability of recession in a low interest rate environment (as at present).

Inflation occurs when the quantity of money rises appreciably

more rapidly than output, and the more rapid the rise in the

quantity of money per unit of output, the greater the rate of

inflation.

~ Milton Friedman: Free To Choose

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.