Gold , Oil & The Dollar

By Colin Twiggs

October 31, 2006 2:30 p.m. AET (10:30 p.m. ET)

October 31, 2006 2:30 p.m. AET (10:30 p.m. ET)

These extracts from my daily trading diary are for educational

purposes and should not be interpreted as investment advice.

Full terms and conditions can be found at

Terms of Use. The next newsletter (an update on Stocks

& Indexes) will be on Saturday.

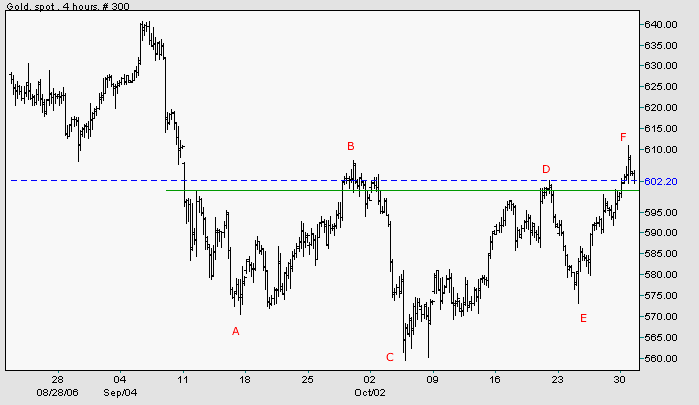

Gold

Spot gold formed a higher low at [E] before breaking through

resistance at $600/$607. Retracement that respects support at

$600 would confirm the change to an intermediate up-swing.

Source: Netdania

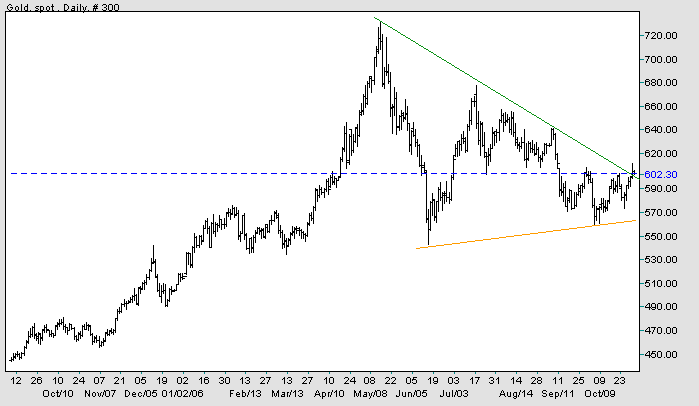

Medium Term: The recent rally also penetrated the upper

border of a large symmetrical triangle, another bullish sign.

However, crude oil prices are weakening

and may drag gold back, so we need to wait for confirmation of

the breakout. The target for an upside breakout is calculated

as $790 : (600 + {730 - 540}).

Long Term: Gold remains in a primary up-trend with support at $540.

Long Term: Gold remains in a primary up-trend with support at $540.

Source: Netdania

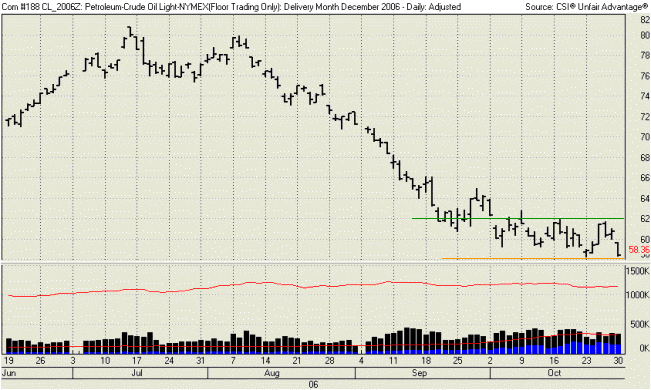

Crude Oil

December Light Crude again respected resistance at $62 before

reversing to close at $58.36: a bearish sign. A fall below last

week's low would signal another intermediate down-swing,

confirmed if the retracement respects resistance at $58.

Medium Term: Expect further support at $55.

Medium Term: Expect further support at $55.

Long Term: Retracement from $80 to $55 may merely

establish the base for continuation of the larger up-trend, but

this could take some time to emerge.

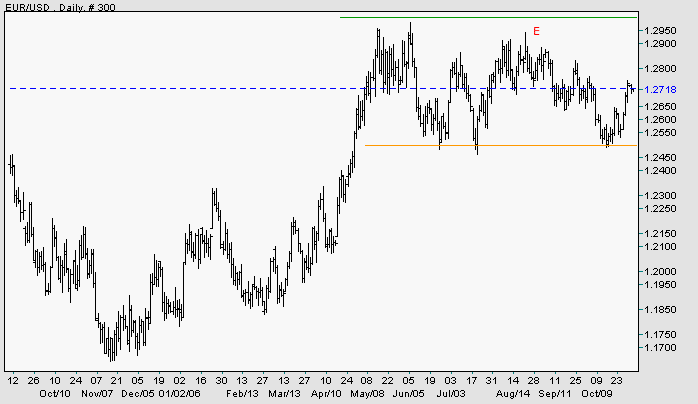

Currencies

The euro respected support at $1.250, followed by a

higher low and a new high above $1.265. The currency now

appears headed for a test of the upper border of the 6 month

consolidation.

Medium Term: A peak below the high of [E] would make a bearish descending triangle, with support at $1.250/$1.245.

Long Term: A rise above $1.30 would test the previous high at $1.37, while a fall below $1.245 would test primary support at $1.165, threatening to complete a large head and shoulders reversal.

Medium Term: A peak below the high of [E] would make a bearish descending triangle, with support at $1.250/$1.245.

Long Term: A rise above $1.30 would test the previous high at $1.37, while a fall below $1.245 would test primary support at $1.165, threatening to complete a large head and shoulders reversal.

Source: Netdania

Treasury yields

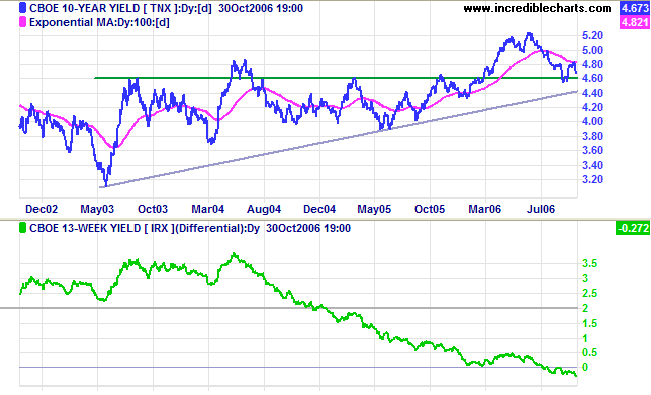

The 10-year yield respected its 100-day moving

average and is headed for another test of support at 4.60%

-- a bearish sign that would be confiirmed if there is a break

below the recent lows.

Medium Term: Respect of support at 4.60% would confirm that we are still in a primary up-trend. Failure of support, however, and a break of the long-term trendline is now a distinct possibility.

The yield differential (10-year T-notes minus 13-week T-bills) is declining further below zero, increasing risk of an economic slow-down.

Medium Term: Respect of support at 4.60% would confirm that we are still in a primary up-trend. Failure of support, however, and a break of the long-term trendline is now a distinct possibility.

The yield differential (10-year T-notes minus 13-week T-bills) is declining further below zero, increasing risk of an economic slow-down.

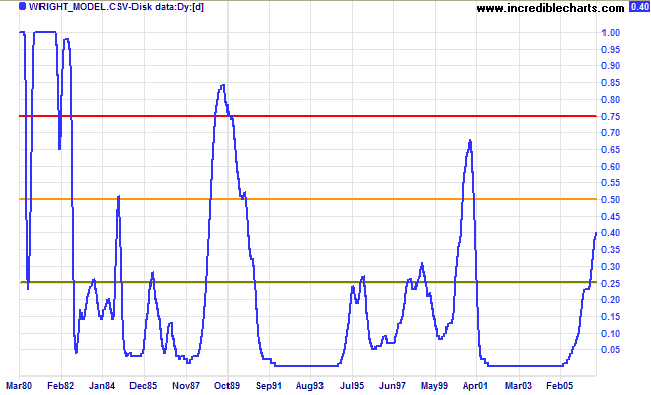

Long Term: Probability of recession in the next

four quarters rose to 40 per cent according to the

Wright

Model. A rise above 50 per cent would be cause for

concern.

The past is to learn from and not to live

in.

~ Richard L. Evans

~ Richard L. Evans

Technical Analysis and PredictionsI believe that Technical Analysis should not be used to make predictions because we never know the outcome of a particular pattern or series of events with 100 per cent certainty. The best that we can hope to achieve is a probability of around 80 per cent for any particular outcome: something unexpected will occur at least one in five times.My approach is to assign probabilities to each possible outcome. Assigning actual percentages would imply a degree of precision which, most of the time, is unachievable. Terms used are more general: "this is a strong signal"; "this is likely"; "expect this to follow"; "this is less likely to occur"; "this is unlikely"; and so on. Bear in mind that there are times, especially when the market is in equilibrium, when we may face several scenarios with fairly even probabilities. Analysis is also separated into three time frames: short, medium and long-term. While one time frame may be clear, another could be uncertain. Obviously, we have the greatest chance of success when all three time frames are clear. The market is a dynamic system. I often compare trading to a military operation, not because of its' oppositional nature, but because of the complexity, the continual uncertainty created by conflicting intelligence and the element of chance that can disrupt even the best made plans. Prepare thoroughly, but allow for the unexpected. The formula is simple: trade when probabilities are in your favor; apply proper risk (money) management; and you will succeed. For further background, please read About The Trading Diary. |