Monday USA Update

By Colin Twiggs

August 28, 2006 10:25 p.m. ET (12:25 a.m. AET)

August 28, 2006 10:25 p.m. ET (12:25 a.m. AET)

These extracts from my daily trading diary are for educational

purposes and should not be interpreted as investment advice.

Full terms and conditions can be found at

Terms of Use. Your feedback

is greatly appreciated.

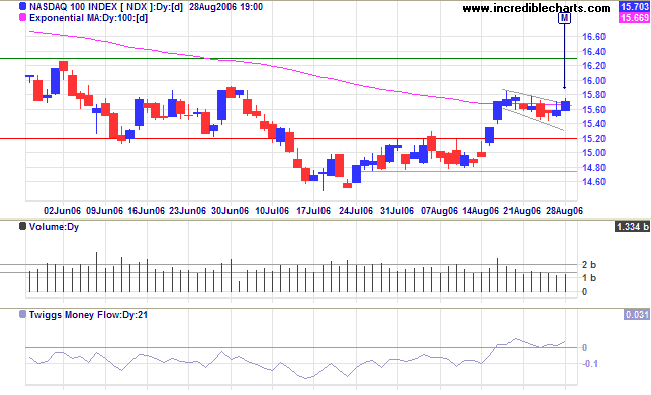

The Nasdaq 100 completed a small

flag at [M], a continuation signal that would normally mean

a test of resistance at 1630. However, the low volume is cause

for concern -- we should see an upsurge in volume at the

breakout. If volumes remain low over the next few days, the

signal is not to be trusted.

Twiggs Money Flow (21-day), however, is holding above the

zero line, an encouraging sign.

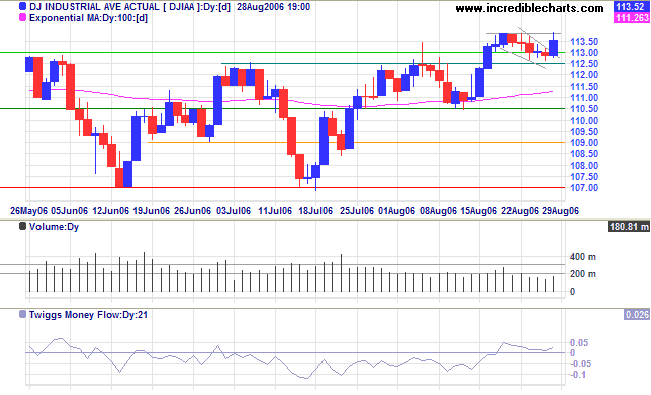

The Dow Jones Industrial Average also completed a small

flag, but the weak close and low volume indicate that

further consolidation between 11250 and 11400 is likely.

Consolidation above a new support level (11250), however, is a

bullish sign in an up-trend.

Twiggs Money Flow (21-day)is holding above the zero line,

another positive sign.

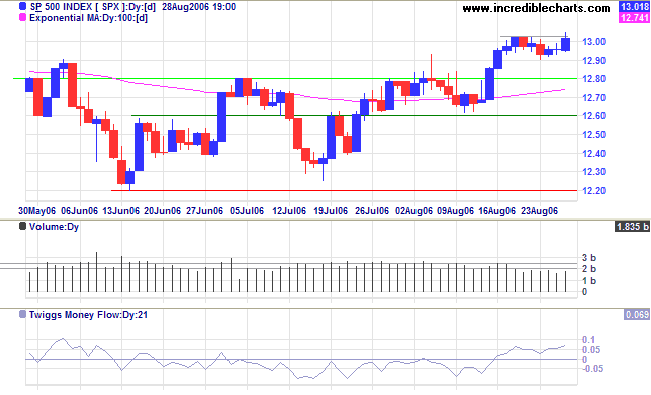

The S&P 500 completed a similar pattern, with a weak

close accompanied by low volume. Watch for a breakout above

short-term resistance (1303) to signal a test of the 6-month

high of 1325. The breakout should be accompanied by stronger

volume, showing buyers commitment.

Twiggs Money Flow (21-day) is rising -- a positive sign.

For more background information, read About

the Trading Diary.