Trading Diary

May 14, 2005

These extracts from my daily trading diary are

for educational purposes and should not be interpreted as

investment advice. Full terms and conditions can be found at

Terms

of Use.

USA

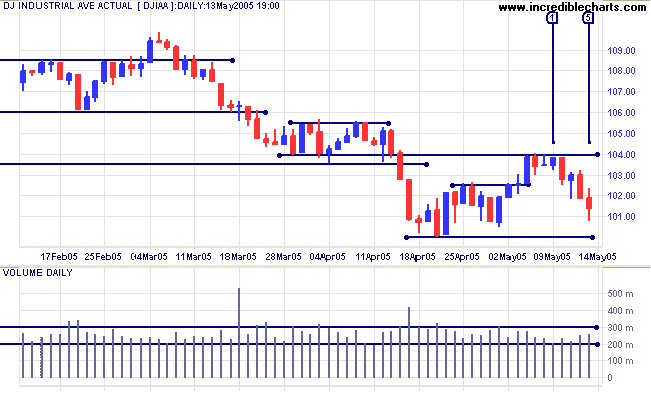

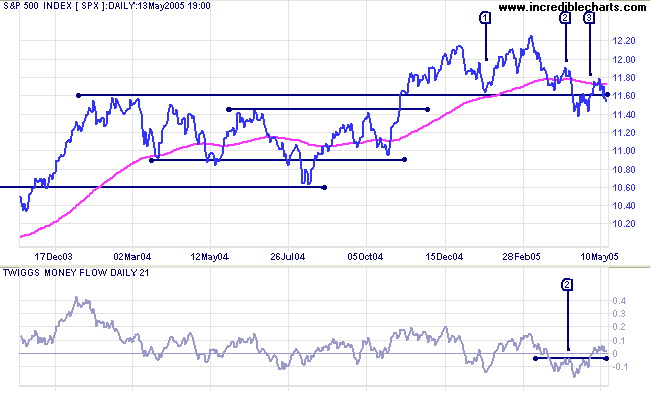

The Dow Industrial Average failed to penetrate resistance at 10400, adding further confirmation of the down-trend. The long tail and higher volume at [5] indicates buying support above 10000. If support holds we can expect consolidation between 10000 and 10400.

The Dow Industrial Average failed to penetrate resistance at 10400, adding further confirmation of the down-trend. The long tail and higher volume at [5] indicates buying support above 10000. If support holds we can expect consolidation between 10000 and 10400.

Expect buying support between 10000 and 9750, the October low. If

that fails we could face a re-test of the March 2003 low at

7500.

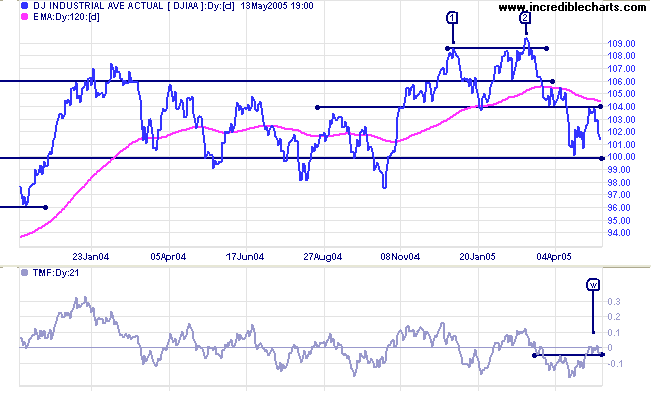

Twiggs Money Flow (21-day) signals distribution. The indicator rose above the previous peak but reversed below the zero line at [w].

Twiggs Money Flow (21-day) signals distribution. The indicator rose above the previous peak but reversed below the zero line at [w].

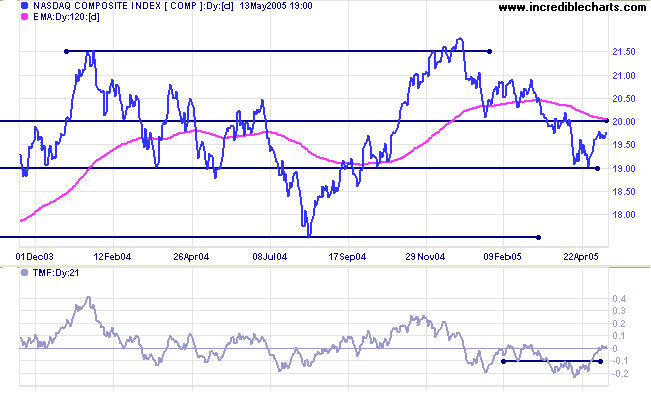

The Nasdaq Composite consolidated in a narrow band over

the last week. Expect strong resistance at 2000; committed

support at 1900. A close outside this range would be significant:

below 1900 would signal that a test of 1750 is likely; above 2000

would mean another test of resistance at 2150.

Twiggs Money Flow (21-day) has rallied above recent highs but is still bearish, remaining at zero.

Twiggs Money Flow (21-day) has rallied above recent highs but is still bearish, remaining at zero.

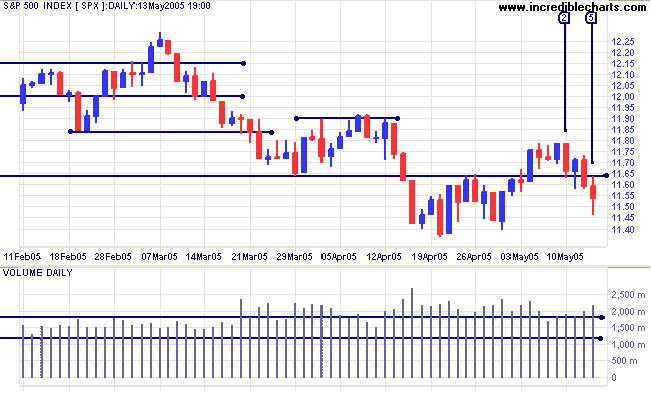

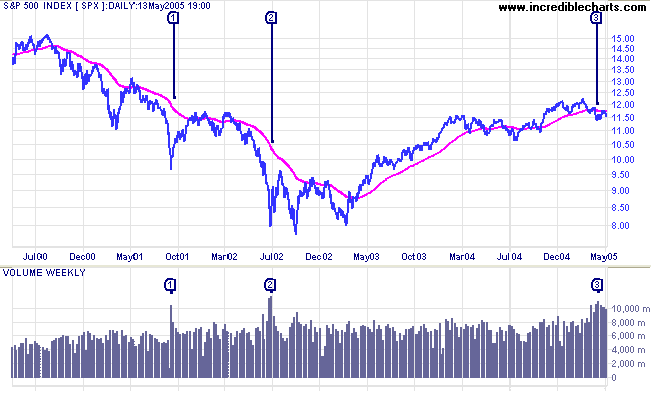

Take a look at volume on the S&P 500 over the last 2

months: a large number of bars signal unusual trading activity.

If that was driven by sellers alone, the index would already have

fallen through the floor. Why hasn't this happened? Friday's long

tail [5] and exceptional volume provide a clue.

We have had a valid

Dow trend reversal: a fall below the previous secondary low

of [1]. Admittedly, the down-swing did not carry too far before

consolidating and then doubling back, but this still qualifies as

a down-trend.

Twiggs Money Flow (21-day) has climbed above the zero line,

outstripping the previous high at [2]. Could this be a

failure swing coming?

Looking at the chart below, this is only the third time in recent

history where weekly volume exceeds 10,000m. Previously, at [1]

and [2], the market had been sold down too far, offering

exceptional value, and the big money stepped in to buy. If that

is the case now, why do indicators such as Twiggs Money Flow not

signal Accumulation? Because the buying

is against the trend.

Is this definite? No. There may be other factors causing the unusual activity.

Is it suspicious? Yes.

How can we confirm? Look for divergences or failure swings on Twiggs Money Flow (or other Accumulation indicators) and a close above 1180. A close below 1140 would signal that all bets are off -- and the down-trend continues.

Is this definite? No. There may be other factors causing the unusual activity.

Is it suspicious? Yes.

How can we confirm? Look for divergences or failure swings on Twiggs Money Flow (or other Accumulation indicators) and a close above 1180. A close below 1140 would signal that all bets are off -- and the down-trend continues.

Treasury yields

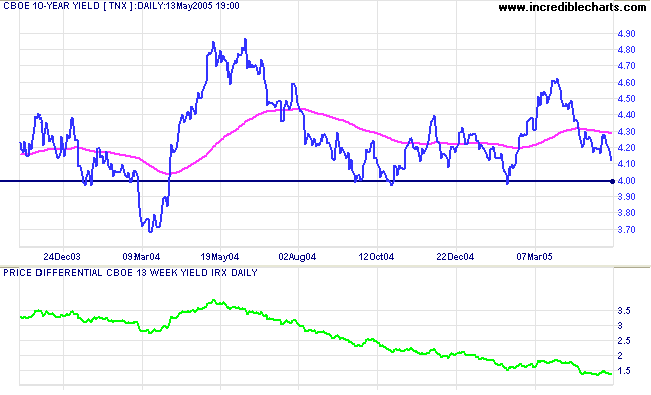

The yield on 10-year treasury notes is headed for another test of support at 4.0%.

The yield differential (10-year T-notes minus 13-week T-bills) is declining (currently 1.4%). Below 1.0% would be a long-term bear signal for equities.

The yield on 10-year treasury notes is headed for another test of support at 4.0%.

The yield differential (10-year T-notes minus 13-week T-bills) is declining (currently 1.4%). Below 1.0% would be a long-term bear signal for equities.

Gold

New York: Spot gold closed at $419.70, having fallen through support at $420.

The most difficult task in trend analysis is distinguishing what is or is not a secondary reaction or a valid line, where price fluctuates in a narrow range over several weeks. Charles Dow used time as the main determinant: a secondary reaction must last for a minimum number of weeks. However his writings were not always consistent and the required number of weeks varies between two and four, as the theory was evolved by Dow, Nelson, Hamilton and later Rhea. Robert Rhea points out, in his book The Dow Theory, that trend analysis is as much an art as a science and that rigid adherence to a strict set of rules will not always deliver the best results. The analyst must, to some extent, use his own discretion in evaluating what is significant and what isn't.

Which brings me back to the gold chart. We have had several sharp falls of +/- 5% lasting no more than a week, interspersed with weak rallies and two lines that formed between $420 and $430 (the first in January, the second in March/April), each lasting about 3 weeks. Subsequent price action tells me that the latest line has no great significance and that the fall below $420 is merely a continuation of the secondary correction started on March 16, and not a primary trend change. The primary trend will reverse downward if price falls below the February low of $410.

New York: Spot gold closed at $419.70, having fallen through support at $420.

The most difficult task in trend analysis is distinguishing what is or is not a secondary reaction or a valid line, where price fluctuates in a narrow range over several weeks. Charles Dow used time as the main determinant: a secondary reaction must last for a minimum number of weeks. However his writings were not always consistent and the required number of weeks varies between two and four, as the theory was evolved by Dow, Nelson, Hamilton and later Rhea. Robert Rhea points out, in his book The Dow Theory, that trend analysis is as much an art as a science and that rigid adherence to a strict set of rules will not always deliver the best results. The analyst must, to some extent, use his own discretion in evaluating what is significant and what isn't.

Which brings me back to the gold chart. We have had several sharp falls of +/- 5% lasting no more than a week, interspersed with weak rallies and two lines that formed between $420 and $430 (the first in January, the second in March/April), each lasting about 3 weeks. Subsequent price action tells me that the latest line has no great significance and that the fall below $420 is merely a continuation of the secondary correction started on March 16, and not a primary trend change. The primary trend will reverse downward if price falls below the February low of $410.

ASX Australia

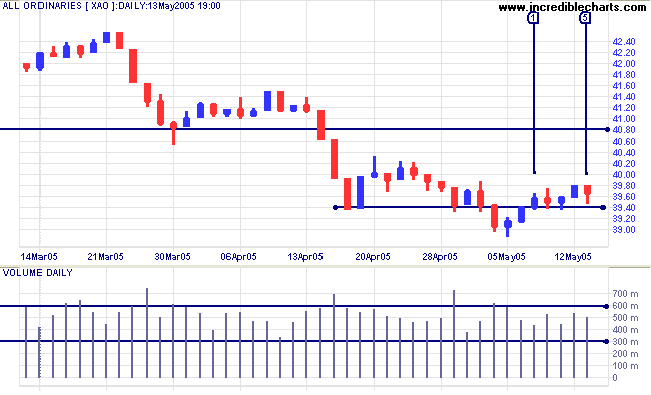

The All Ordinaries is no longer in a hard down-trend, having crossed back above resistance at 3940. The market is indecisive at present, with the index trading in a narrow range between 3940 and 3980. Long tails at [2] [3] and [5] signal buying support but the market is vulnerable to bad news and could easily be panicked into another sharp fall. If the index breaks above 3980, expect a test of resistance at 4080.

The All Ordinaries is no longer in a hard down-trend, having crossed back above resistance at 3940. The market is indecisive at present, with the index trading in a narrow range between 3940 and 3980. Long tails at [2] [3] and [5] signal buying support but the market is vulnerable to bad news and could easily be panicked into another sharp fall. If the index breaks above 3980, expect a test of resistance at 4080.

Twiggs Money Flow (21-day) returned above the zero line but

still appears weak.

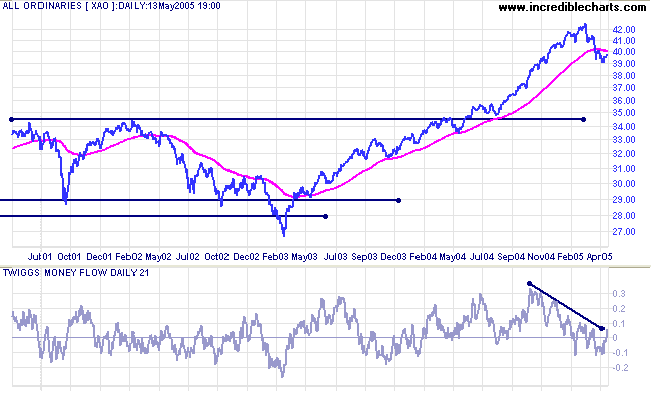

The primary trend is downwards. Failure of support at 3900 will

signal that a test of support at 3450 is likely, amounting to

roughly a 50% retracement of the previous up-trend. If you review

the

All Ords over the past 25 years, the index has regularly cut

back to test support at previous highs.

For further assistance, read About

the Trading Diary.

Colin Twiggs

There are risks and costs to a program of action.

But they are far less than the long-range risks

and costs of comfortable inaction.

~ John F Kennedy

But they are far less than the long-range risks

and costs of comfortable inaction.

~ John F Kennedy

Back Issues

Access the Trading Diary Archives.