Trading Diary

December 4, 2004

These extracts from my daily trading diary are for educational

purposes and should not be interpreted as investment advice. Full

terms and conditions can be found at Terms

of Use.

USA

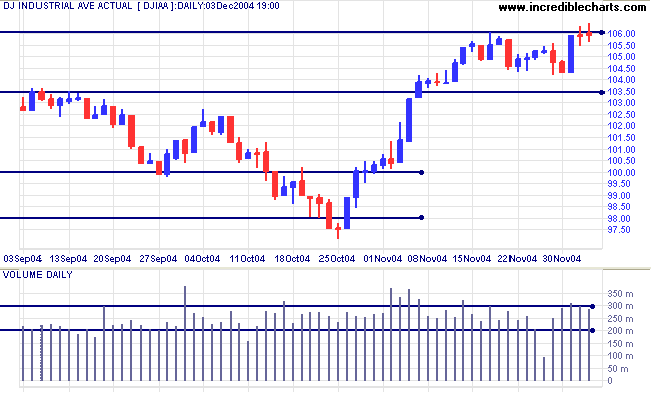

The Dow Industrial Average is consolidating in a narrow band below resistance at 10600. A breakout above 10600 would be bullish, while a fall below 10350 would signal that a test of support at 10000 is likely.

Thursday and Friday display false breaks above the resistance level and strong volume: often followed by a test of support at the opposite border of the consolidation.

The Dow Industrial Average is consolidating in a narrow band below resistance at 10600. A breakout above 10600 would be bullish, while a fall below 10350 would signal that a test of support at 10000 is likely.

Thursday and Friday display false breaks above the resistance level and strong volume: often followed by a test of support at the opposite border of the consolidation.

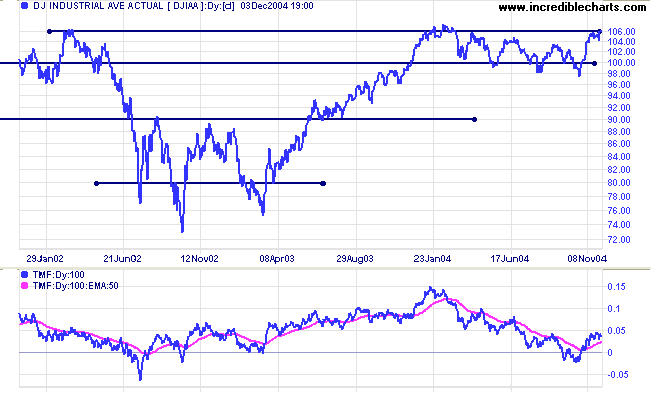

Narrow consolidation below a major resistance level is a bullish

sign. A sustained breakout (not just a false break) above 10600

would signal that a test of 11000 is likely. A fall below 10000

would be a long-term bear signal.

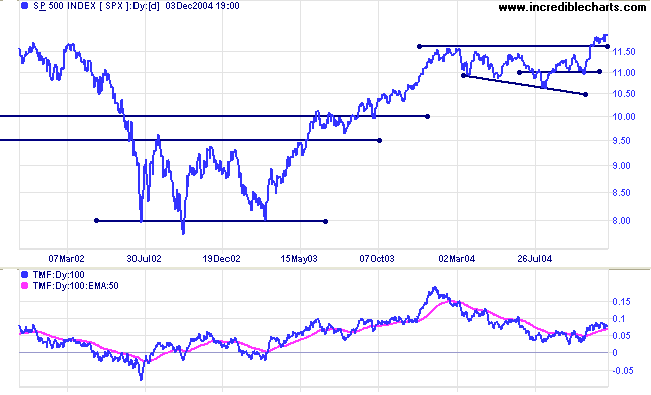

Twiggs Money Flow signals strong accumulation.

Twiggs Money Flow signals strong accumulation.

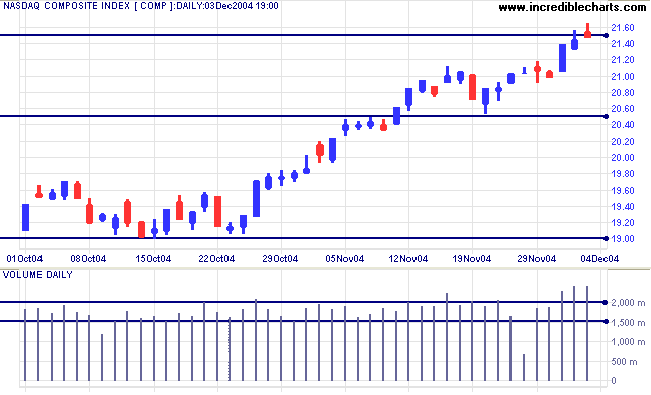

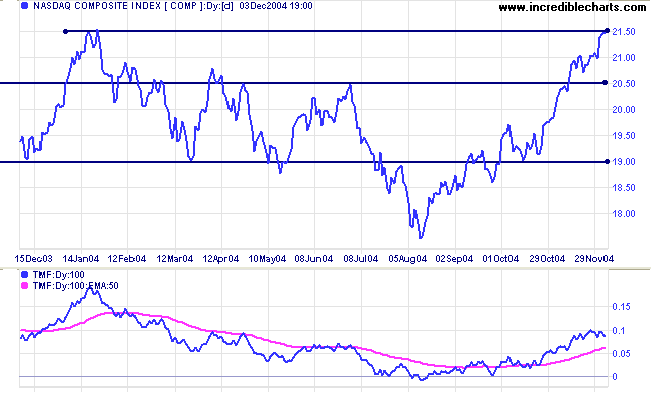

The Nasdaq Composite has rallied to test resistance at

2150. Judging by the large volume and weak closes on

Thursday/Friday, we are likely to see some consolidation below

2150, or a correction back to test support at 2050.

The primary trend is up and

Twiggs Money Flow signals strong accumulation, rising well

above its' signal line.

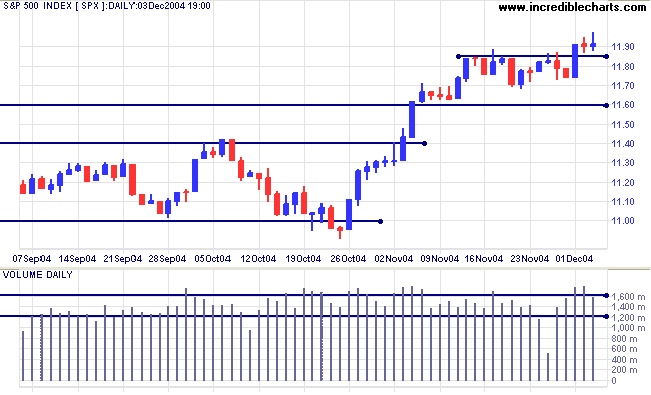

The S&P 500 has successfully tested the new support

level at 1150/1160, signaling a strong up-trend. The index

encountered resistance on Thursday/Friday with two dojis

on strong volume. The dojis are positioned near the high of

Wednesday's strong blue candle: a fall below the top half of this

candle would be a short-term bear signal; otherwise buyers are

still in control.

Twiggs Money Flow continues to signal strong

accumulation.

The primary trend is up. With no major resistance levels overhead we can expect good gains. The projected target for the recently completed broadening wedge pattern is 1240: 1140 + ( 1160 - 1060).

The primary trend is up. With no major resistance levels overhead we can expect good gains. The projected target for the recently completed broadening wedge pattern is 1240: 1140 + ( 1160 - 1060).

|

|

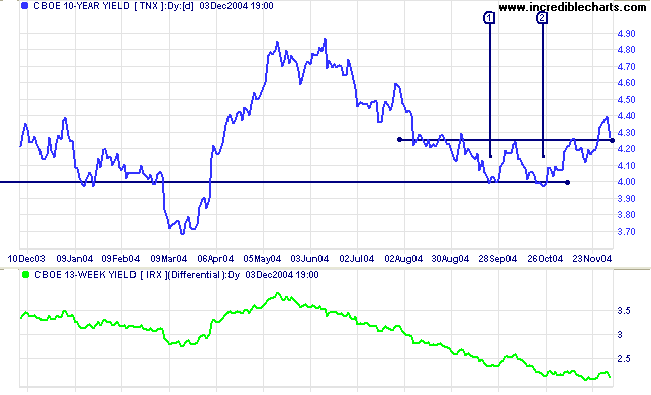

Treasury yields

The yield on 10-year treasury notes displays a breakout above 4.25%, completing the double bottom pattern at [1] and [2]. A successful test of the new support level, at 4.25%, would be a bullish sign. The target for the completed pattern is 4.50%: 4.25 + (4.25 - 4.00).

The yield differential (10-year T-notes minus 13-week T-bills) has declined to 2.1%.

Differentials below 1.0% are bearish.

The yield on 10-year treasury notes displays a breakout above 4.25%, completing the double bottom pattern at [1] and [2]. A successful test of the new support level, at 4.25%, would be a bullish sign. The target for the completed pattern is 4.50%: 4.25 + (4.25 - 4.00).

The yield differential (10-year T-notes minus 13-week T-bills) has declined to 2.1%.

Differentials below 1.0% are bearish.

Gold

New York: Spot gold rallied late Friday to close at $455.20. The metal has successfully tested short-term support at $450 and we can expect further gains. The next resistance level is likely to form at 500.

New York: Spot gold rallied late Friday to close at $455.20. The metal has successfully tested short-term support at $450 and we can expect further gains. The next resistance level is likely to form at 500.

|

ASX Australia

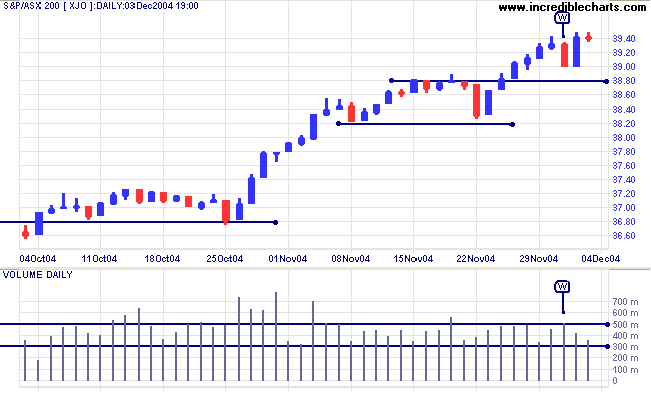

The ASX 200 correction on Wednesday [W] was short-lived, but higher volumes on Tuesday and Wednesday signal increased resistance. Expect resistance to further increase as the ASX 200 and All Ordinaries approach 4000.

The ASX 200 correction on Wednesday [W] was short-lived, but higher volumes on Tuesday and Wednesday signal increased resistance. Expect resistance to further increase as the ASX 200 and All Ordinaries approach 4000.

Twiggs Money Flow is rising steeply, signaling strong

accumulation.

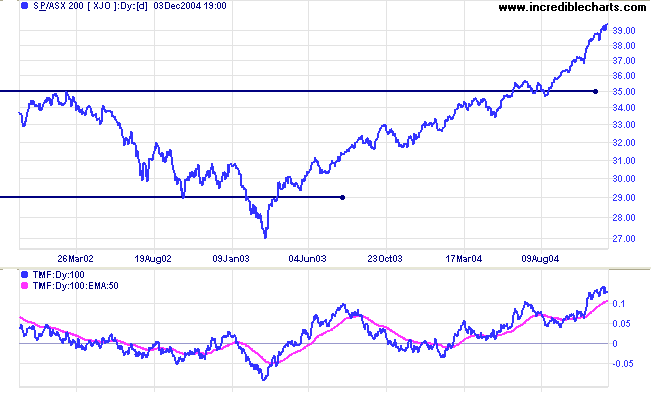

The primary up-trend is strong. The latest rally is unusually steep and at some stage (perhaps 4000) increased profit-taking will force a correction. The first major support level is at 3500 (xao: 3450): the highs of 2002.

The primary up-trend is strong. The latest rally is unusually steep and at some stage (perhaps 4000) increased profit-taking will force a correction. The first major support level is at 3500 (xao: 3450): the highs of 2002.

For further assistance, read About

the Trading Diary.

Colin Twiggs

Foreknowledge (to approach a situation with

one's mind already made up)

is the beginning of stupidity.

~ Lao Tse.

is the beginning of stupidity.

~ Lao Tse.

Back Issues

Access the Trading Diary Archives.