A Quick Survey

|

Thank you for the excellent response so

far. If you have not yet completed the survey, please assist us by replying to this email and answering the questions below. Highlight answers in red or with an asterisk*.

Your feedback will be invaluable.

Thanks |

Trading Diary

February 11, 2004

These extracts from my daily trading diary are for educational

purposes and should not be interpreted as investment advice. Full

terms and conditions can be found at Terms

of Use .

USA

The market responded well to Alan Greenspan's

positive view of the US economy and his statement that the Fed

would be "patient" about raising interest

rates.(more)

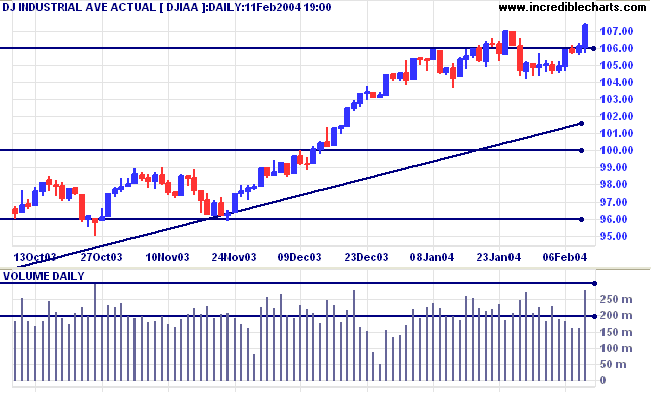

The Dow Industrial Average rallied through resistance at 10600,

making a new 2-year high on higher volume. A pull-back that

respects the new 10600 support level would be a bullish

sign.

The intermediate trend is up. Overhead resistance is at 11300 to 11350.

The primary trend is up. A fall below support at 9600 would signal reversal.

The intermediate trend is up. Overhead resistance is at 11300 to 11350.

The primary trend is up. A fall below support at 9600 would signal reversal.

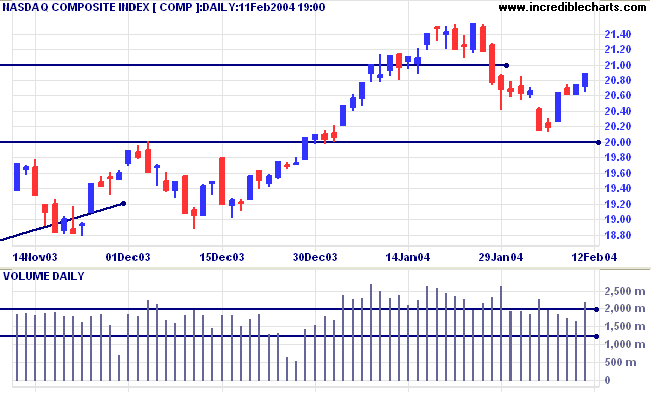

The Nasdaq Composite rallied to 2089 on strong

volume.

The intermediate trend is uncertain after the upward break. Resistance is at 2153; support at 2000.

The primary trend is up. A fall below support at 1640 will signal reversal.

The intermediate trend is uncertain after the upward break. Resistance is at 2153; support at 2000.

The primary trend is up. A fall below support at 1640 will signal reversal.

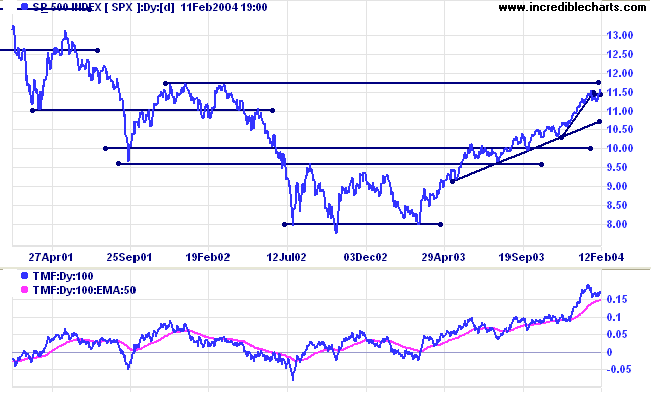

The S&P 500 also closed at a new high of 1157, on strong

volume.

The intermediate trend is up, but overhead resistance is close by at 1175.

Short-term: Bullish if the S&P500 is above 1150. Bearish below the recent low of 1122.

The intermediate trend is up, but overhead resistance is close by at 1175.

Short-term: Bullish if the S&P500 is above 1150. Bearish below the recent low of 1122.

The primary trend is up. A fall below 960 would signal

reversal.

Intermediate: Bullish above 1122.

Long-term: Bullish above 1000.

Intermediate: Bullish above 1122.

Long-term: Bullish above 1000.

The Chartcraft NYSE Bullish % Indicator is up at

84.97%.

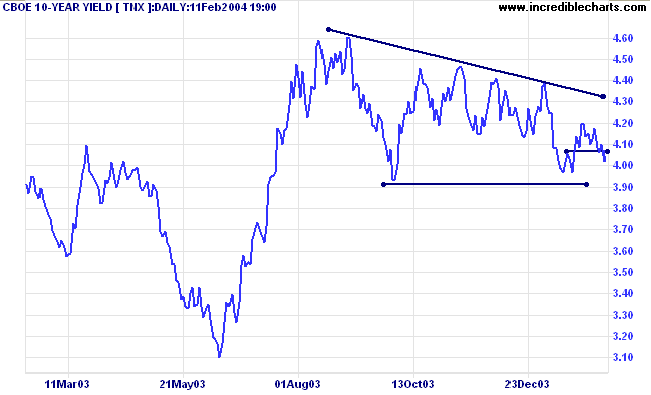

Treasury yields

Following the Fed Chairman's comments, the yield on 10-year treasury notes fell to 4.02%, continuing the intermediate down-trend.

The primary trend is up. A close below 3.93% would signal reversal.

Following the Fed Chairman's comments, the yield on 10-year treasury notes fell to 4.02%, continuing the intermediate down-trend.

The primary trend is up. A close below 3.93% would signal reversal.

Gold

New York (21.11): Spot gold is up at $411.70.

The intermediate trend is still down. Support is at 400.

The primary trend is up.

New York (21.11): Spot gold is up at $411.70.

The intermediate trend is still down. Support is at 400.

The primary trend is up.

ASX Australia

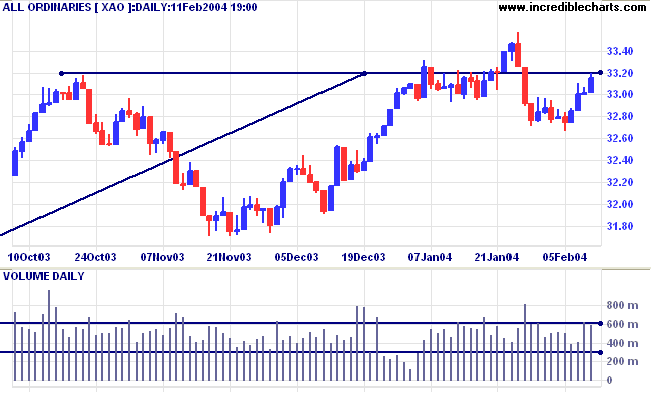

The All Ordinaries rallied to test resistance at 3320 before

retreating slightly to close at 3315. High volume indicates

selling pressure. The intermediate trend is uncertain. A

follow-through above 3320 will be bullish. A fall below 3266

would signal the start of a down-trend.

Twiggs Money Flow (100) is at its 3-month support level, but

still appears weak.

The primary trend is up. A fall below 3160 (the October 1 low) would signal reversal.

Intermediate term: Bullish above 3350. Bearish below 3160.

Long-term: Bearish below 3160.

The primary trend is up. A fall below 3160 (the October 1 low) would signal reversal.

Intermediate term: Bullish above 3350. Bearish below 3160.

Long-term: Bearish below 3160.

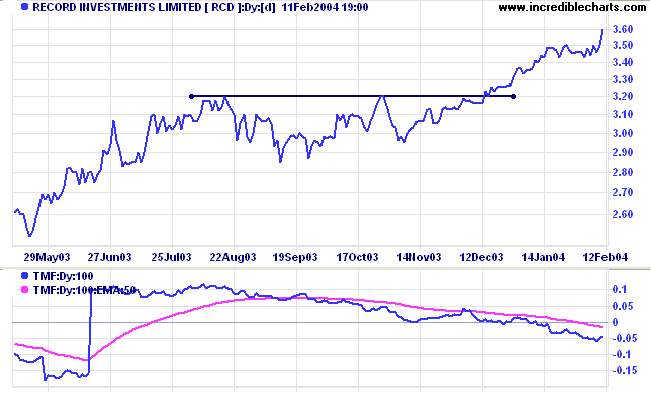

Record Investments [RCD]

One of our readers pointed this out: RCD has rallied above a mid-point consolidation but Twiggs Money Flow continues to fall, displaying a strong bearish divergence.

One of our readers pointed this out: RCD has rallied above a mid-point consolidation but Twiggs Money Flow continues to fall, displaying a strong bearish divergence.

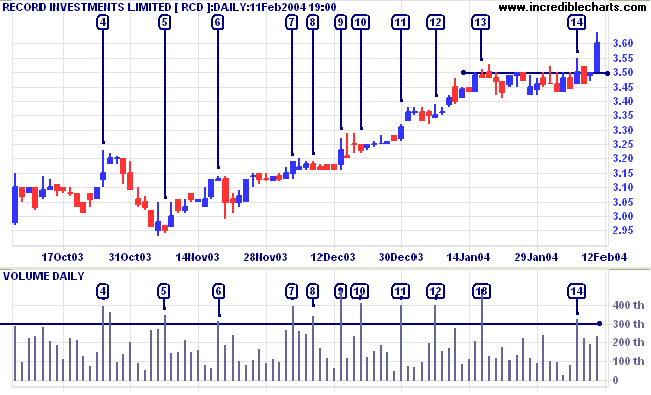

I have highlighted large volume days over the last 4 months,

selecting an arbitrary level of 300,000. All but two of the days,

[7] and [11], show signs of distribution. Weak closes can be

explained by a seller with a large parcel of stock selling into

rallies: at [4], [9], [12] and [14]. This would disguise their

presence. Narrow ranges after a strong upward day tell a similar

tale: the inside day after [4], and at [6], [8] and [13].

Selling has been very controlled throughout, with only two days,

at [5] and [10], where selling continued after the rally ended.

The latest bar seems stronger and a pull-back that respects

support at 3.50 will be a bullish sign. A fall below the low of

3.41 would be bearish. I would not touch this unless there is a

radical improvement in TMF - it would be foolhardy to ignore a

key indicator.

About

the Trading Diary has been expanded to offer further

assistance to readers, including directions on how to search the

archives.

Colin Twiggs

Anyone who stops learning is old, whether at twenty or

eighty.

Anyone who keeps learning stays young.

The greatest thing in life is to keep your mind young.

~ Henry Ford.

Anyone who keeps learning stays young.

The greatest thing in life is to keep your mind young.

~ Henry Ford.

Please remember to complete the Quick

Survey.

We will appreciate your honesty in highlighting areas that require attention.

Thanks

We will appreciate your honesty in highlighting areas that require attention.

Thanks

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.