Incredible Charts Plans

|

Your feedback and suggestions will be appreciated; at the

Chart Forum.

Trading Diary

January 19, 2004

These extracts from my daily trading diary are

for educational purposes and should not be interpreted as

investment advice. Full terms and conditions can be found at

Terms

of Use .

ASX Australia

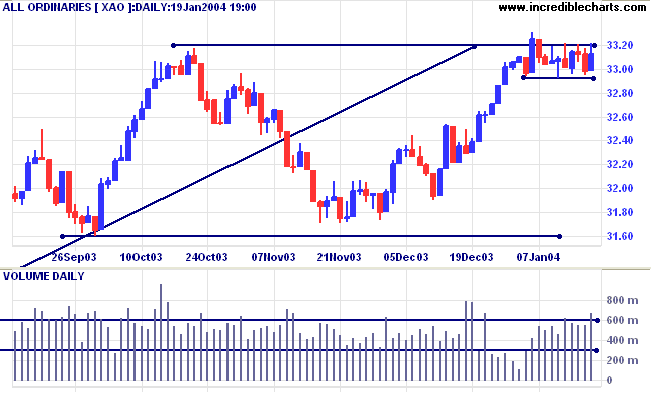

The All Ordinaries rallied to test resistance at 3320, but

selling pressure forced a close back at 3312 on strong volume.

The index is consolidating in a narrow range between 3293 and

3320; a bullish sign in an up-trend. a break below support at

3293 would be bearish, signaling a likely re-test of support at

3160.

Short-term: Bullish above 3320. Bearish below 3293.

Short-term: Bullish above 3320. Bearish below 3293.

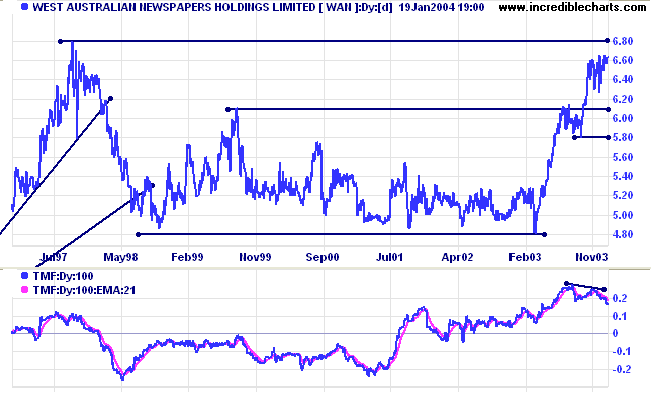

On the 3-year chart, the All Ords is consolidating between 3320

and 3160. A break above 3320 will signal a likely re-test of the

previous highs at 3425 and 3440. The primary trend is up but will

reverse if there is a fall below 3160 (the October 1

low).

Twiggs Money Flow (100) has leveled out but is still bearish after a large divergence.

Intermediate term: Bullish above 3320. Bearish below 3160.

Long-term: Bearish below 3160.

Twiggs Money Flow (100) has leveled out but is still bearish after a large divergence.

Intermediate term: Bullish above 3320. Bearish below 3160.

Long-term: Bearish below 3160.

West Australian Newspapers [WAN]

Last covered October 20, 2003.

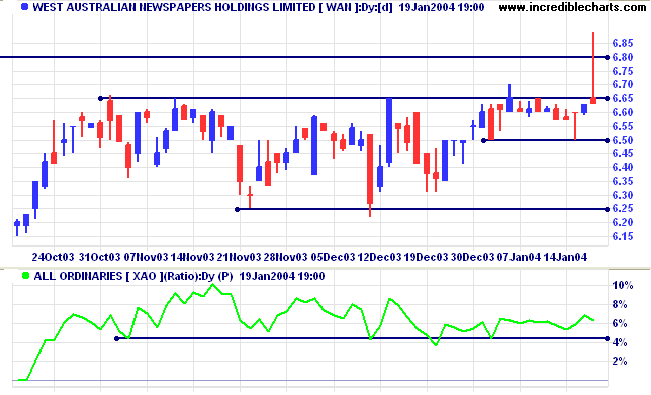

WAN is in a fast up-trend, consolidating twice without correcting back to test support at the previous peaks. The stock is now approaching the target of 6.80; the 10-year high. Twiggs Money flow (100) displays a bearish divergence, signaling potential weakness.

Last covered October 20, 2003.

WAN is in a fast up-trend, consolidating twice without correcting back to test support at the previous peaks. The stock is now approaching the target of 6.80; the 10-year high. Twiggs Money flow (100) displays a bearish divergence, signaling potential weakness.

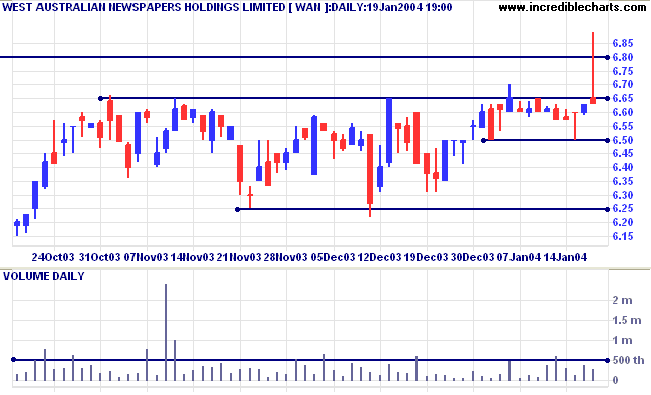

Today's bar shows a false break above 6.80. The rally was pushed

back to close below the 6.65 resistance level, on surprisingly

low volume. We should expect a fair amount of profit-taking near

the 6.80 level.

Relative Strength (price ratio: xao) is still above its support level.

Relative Strength (price ratio: xao) is still above its support level.

Short-term support is at 6.50; intermediate at 6.25; and

long-term at 5.80.

Resistance is at 6.65 and 6.80. At present, 6.80 appears to be the stronger barrier.

Resistance is at 6.65 and 6.80. At present, 6.80 appears to be the stronger barrier.

About

the Trading Diary has been expanded to offer further

assistance to readers, including directions on how to search the

archives.

Colin Twiggs

Tyson's whole thing has always

been,

"Well, everybody got a plan until they get hit."

~ Evander Holyfield

(talking about trading on margin ... of course).

"Well, everybody got a plan until they get hit."

~ Evander Holyfield

(talking about trading on margin ... of course).

Incredible Posts: Suggestions

We would like to add more 5-star posts to

the

Incredible Posts thread.

If you have any suggestions, please post the

links at

the

Suggestion box.

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.