Daily Trading Diary

Daily Trading Diary updates will not be issued over the Christmas holiday period,

from December 16th to January 2nd.

We wish all our readers peace and goodwill over the Christmas season

and prosperity in the year ahead.

Daily Trading Diary updates will not be issued over the Christmas holiday period,

from December 16th to January 2nd.

We wish all our readers peace and goodwill over the Christmas season

and prosperity in the year ahead.

Trading Diary

November 28, 2003

These extracts from my daily trading diary

are for educational purposes

and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

Trading hours were reduced to half-day following Thanksgiving

Holiday on Thursday.

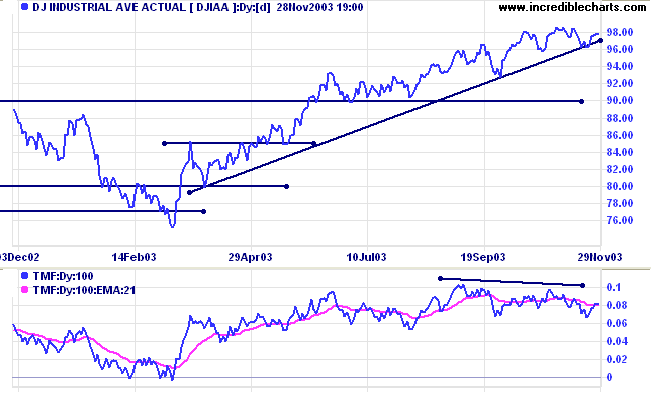

The Dow Industrial Average closed almost unchanged at 9782.

The intermediate trend is down. Expect support at 9500 and 9230.

Twiggs Money Flow shows a bearish divergence.

The primary trend is up. A fall below support at 9000 will signal reversal.

The Dow Industrial Average closed almost unchanged at 9782.

The intermediate trend is down. Expect support at 9500 and 9230.

Twiggs Money Flow shows a bearish divergence.

The primary trend is up. A fall below support at 9000 will signal reversal.

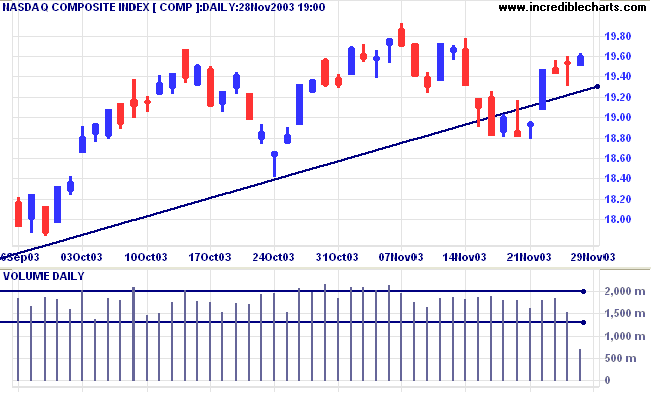

The Nasdaq Composite gained 7 points to close at 1960 on low

volume.

The intermediate trend is down. Expect support at 1880 and 1840.

The primary trend is up. A fall below support at 1640 will signal reversal.

The intermediate trend is down. Expect support at 1880 and 1840.

The primary trend is up. A fall below support at 1640 will signal reversal.

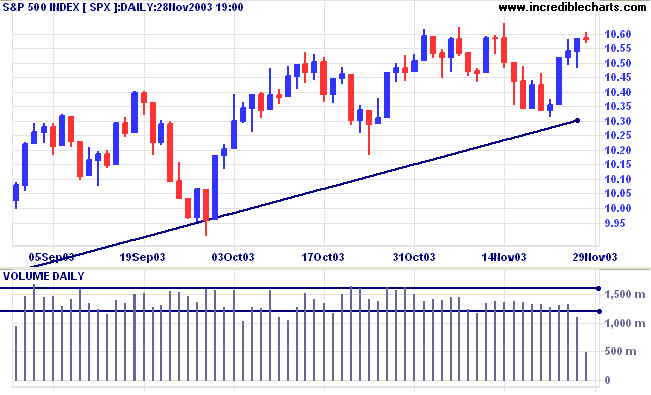

The S&P 500 closed unchanged at 1058 on low

volume.

The intermediate down- trend is weak.

Short-term: Bullish if the S&P500 is above the high of 1064. Bearish below 1048 (Wednesday's low).

The intermediate down- trend is weak.

Short-term: Bullish if the S&P500 is above the high of 1064. Bearish below 1048 (Wednesday's low).

The primary trend is up. A fall below 960 will signal

reversal.

Intermediate: Bullish above 1064.

Long-term: Bullish above 960.

Intermediate: Bullish above 1064.

Long-term: Bullish above 960.

The Chartcraft NYSE Bullish % Indicator closed up

at 80.88% (November 28).

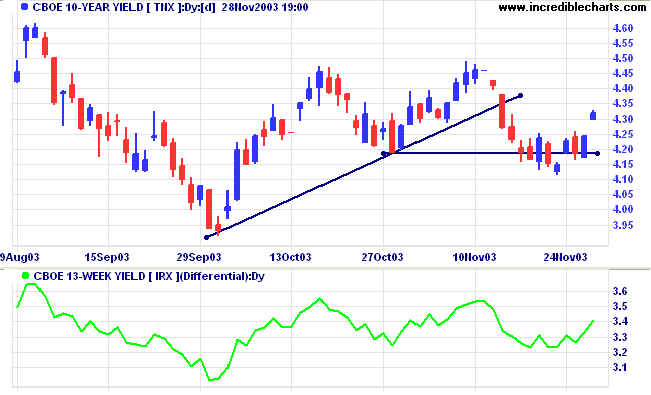

Treasury yields

The yield on 10-year treasury notes gapped up to 4.32%, after a marginal break below support at 4.19%.

The intermediate down-trend is weak..

The primary trend is up.

The yield on 10-year treasury notes gapped up to 4.32%, after a marginal break below support at 4.19%.

The intermediate down-trend is weak..

The primary trend is up.

The

yield differential is healthy at 3.4% (10-year T-notes

compared to 13-week T-bills).

Gold

New York (13.30): Spot gold closed the week up at $398.10.

The intermediate trend is up. Consolidation in a narrow band below resistance at 400 is a bullish sign.

The primary trend is up. Expect resistance at 400 to 415.

New York (13.30): Spot gold closed the week up at $398.10.

The intermediate trend is up. Consolidation in a narrow band below resistance at 400 is a bullish sign.

The primary trend is up. Expect resistance at 400 to 415.

ASX Australia

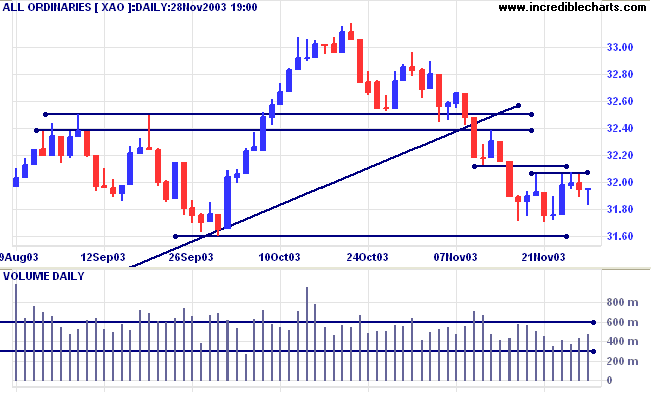

The All Ordinaries closed 2 points up at 3196. The weak close and

higher volume signal increased buying support.

The intermediate down-trend is leveling out above support at

3160.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is above.

Short-term: Bullish if the All Ords crosses above 3212, the November 12 low. Bearish below 3182 (Friday's low).

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is above.

Short-term: Bullish if the All Ords crosses above 3212, the November 12 low. Bearish below 3182 (Friday's low).

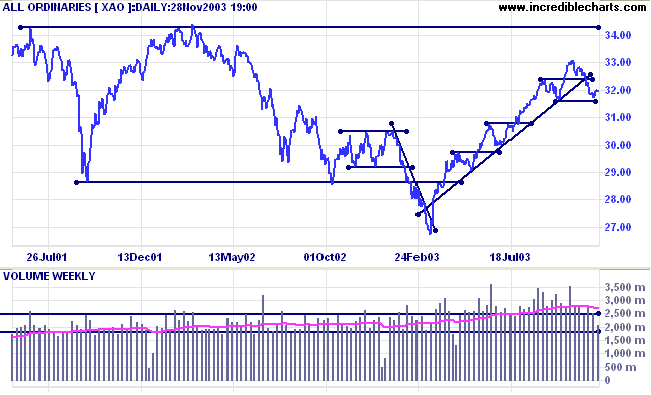

XAO is below the long-term trendline, signaling weakness. The

primary trend is up but will reverse if there is a fall below

3160 (the October 1 low). Declining weekly volume increases the

likelihood that support at 3160 will hold. Twiggs Money Flow

(100) continues to signal distribution after a bearish triple

divergence.

Intermediate term: Bullish above 3212. Bearish below 3160.

Long-term: Bearish below 3160.

Intermediate term: Bullish above 3212. Bearish below 3160.

Long-term: Bearish below 3160.

Sector Analysis

The 11 sectors (10 + Property) are in various market stages. Relative Strength (xjo) measures the performance of each sector relative to the overall index.

The 11 sectors (10 + Property) are in various market stages. Relative Strength (xjo) measures the performance of each sector relative to the overall index.

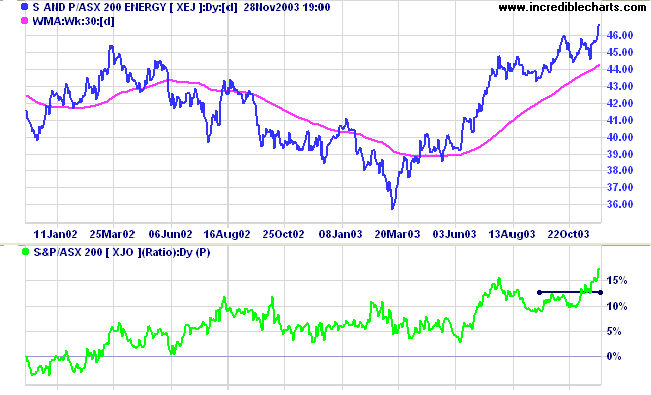

- Energy [XEJ] - stage 2 (RS is rising)

- Materials [XMJ] - stage 2 (RS is falling)

- Industrials [XNJ] - stage 2 (RS is rising)

- Consumer Discretionary [XDJ] - stage 2 (RS is falling)

- Consumer Staples [XSJ] - stage 1 (RS is rising)

- Health Care [XHJ] - stage 2 (RS is level)

- Property Trusts [XPJ] - stage 3 (RS is rising).

- Financial excl. Property [XXJ] - stage 3 (RS is falling)

- Information Technology [XIJ] - stage 2 (RS is rising)

- Telecom Services [XTJ] - stage 2 (RS is level)

- Utilities [XUJ] - stage 3 (RS is falling)

Energy [XEJ] is in a strong stage 2 up-trend, accompanied by

rising Relative Strength (xjo).

Sectors: Relative Strength

A stock screen of the ASX 200 using % Price Move (1 month: +5%) increased to 19 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003). Gold is the only prominent sector.

A stock screen of the ASX 200 using % Price Move (1 month: +5%) increased to 19 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003). Gold is the only prominent sector.

Daily Trading Diary

Stocks analyzed during the week were:

Stocks analyzed during the week were:

- Wattyl - WYL

- BHP Billiton - BHP

- Jubilee Mines - JBM

- Adsteam - ADZ

- Amcor - AMC

- Cochlear - COH

Understanding

the Trading Diary has been expanded to offer further

assistance to readers, including

directions on how to search the archives.

Colin Twiggs

We attempt to make order out of the market and

find reasons for everything.

This attempt to find order tends to block one's ability to go with the flow of the markets,

because we see what we expect to see rather than what is really happening.

~ Van K Tharp: Trade your way to Financial Freedom.

This attempt to find order tends to block one's ability to go with the flow of the markets,

because we see what we expect to see rather than what is really happening.

~ Van K Tharp: Trade your way to Financial Freedom.

Incredible Charts Premium version with adjusted data and hourly updates

and the Daily Trading Diary.

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.