|

ETOs and

Warrants We are making progress. ETOs and warrants will be available shortly. US stocks to follow. |

Trading Diary

October 1, 2003

These extracts from my daily trading diary

are for educational purposes

and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

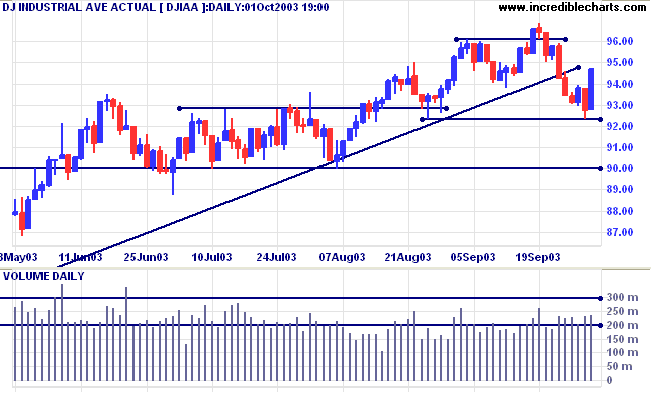

The Dow Industrial Average rallied 2.1% to close at 9469 on

higher volume.

The intermediate down-trend is weak.

The index is below the upward trendline, signaling primary trend weakness. A fall below 9000 will signal reversal.

The intermediate down-trend is weak.

The index is below the upward trendline, signaling primary trend weakness. A fall below 9000 will signal reversal.

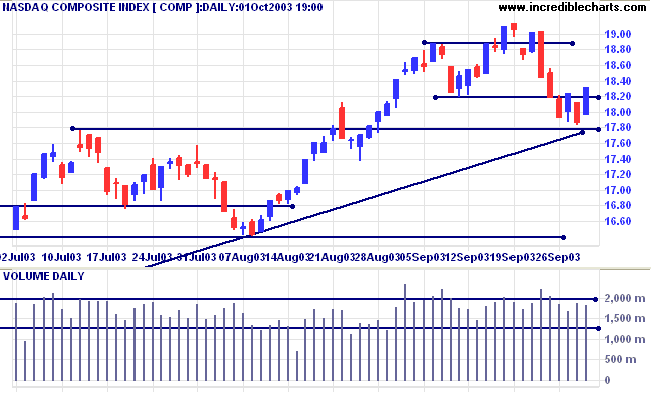

The Nasdaq Composite started an up-swing with a 45 point gain,

closing at 1832 on average volume.

The intermediate trend is down.

The primary trend is up. Price appears headed for a re-test of the supporting trendline. A fall below 1640 will signal reversal.

The intermediate trend is down.

The primary trend is up. Price appears headed for a re-test of the supporting trendline. A fall below 1640 will signal reversal.

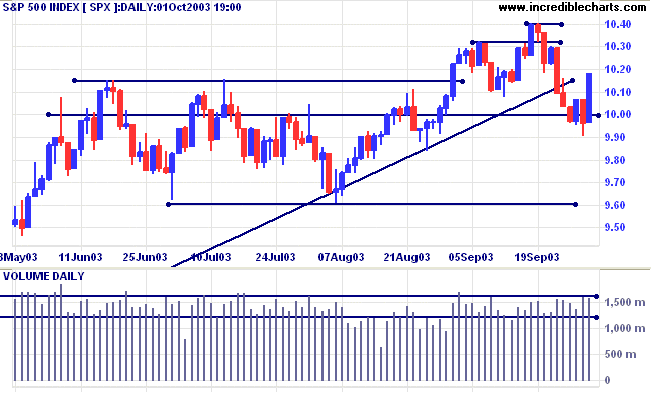

The S&P 500 rallied 22 points to close at 1018 on lower

volume.

The intermediate down-trend is weak.

The primary trend is up. The trendline has been broken, signaling weakness. A fall below 960 will signal reversal.

The intermediate down-trend is weak.

The primary trend is up. The trendline has been broken, signaling weakness. A fall below 960 will signal reversal.

The Chartcraft NYSE Bullish % Indicator rallied

to 78.60% (October 1).

Market Strategy

Short-term: Bearish below 996. Bullish above 1040.

Intermediate: Bullish above 1040. Bearish below 960.

Long-term: Bullish above 1040.

Short-term: Bearish below 996. Bullish above 1040.

Intermediate: Bullish above 1040. Bearish below 960.

Long-term: Bullish above 1040.

Manufacturing slows

The Institute for Supply Management manufacturing index fell to 53.7, from 54.7 in August. (more)

The Institute for Supply Management manufacturing index fell to 53.7, from 54.7 in August. (more)

Treasury yields

The yield on 10-year treasury notes eased lower to 3.93%, below support at 4.00%.

The intermediate trend is down.

The primary trend is up. The fall below 4.00% signals weakness.

The yield on 10-year treasury notes eased lower to 3.93%, below support at 4.00%.

The intermediate trend is down.

The primary trend is up. The fall below 4.00% signals weakness.

Gold

New York (20:02): Spot gold is level at $384.30.

The primary trend is up. Expect heavy resistance between 400 and 415 (the 10-year high).

New York (20:02): Spot gold is level at $384.30.

The primary trend is up. Expect heavy resistance between 400 and 415 (the 10-year high).

ASX Australia

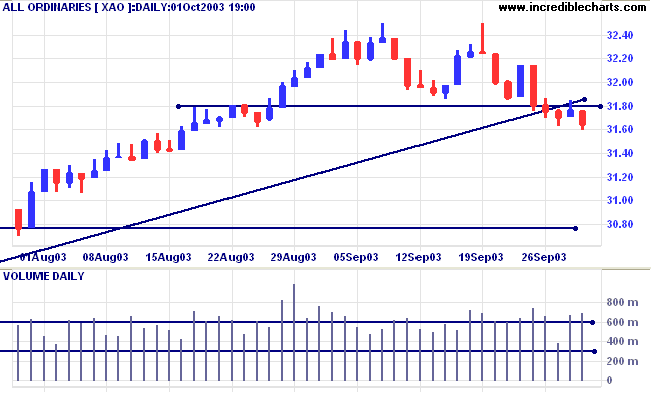

The All Ordinaries closed down 11 points at 3165 on strong

volume. Expect an up-swing after the sharp reversal in US

markets.

The intermediate down-trend (secondary reaction) continues.

The primary trend is up. A fall below 3000 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to above;

Twiggs Money Flow (21) signals distribution.

The primary trend is up. A fall below 3000 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to above;

Twiggs Money Flow (21) signals distribution.

Market Strategy

Short-term: Bullish if the All Ords is above 3250. Bearish below 3162.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3000.

Short-term: Bullish if the All Ords is above 3250. Bearish below 3162.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3000.

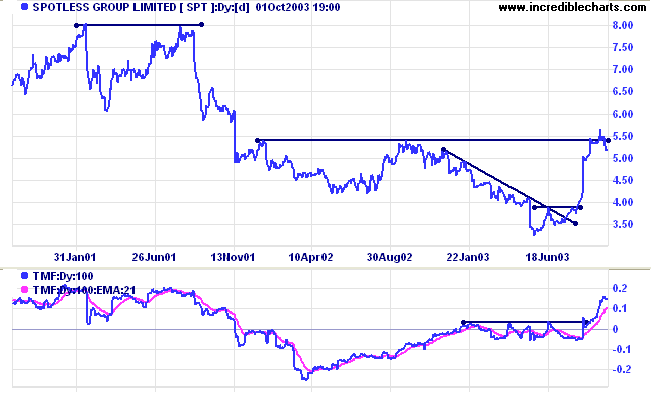

Spotless [SPT]

Last covered on August 26, 2003.

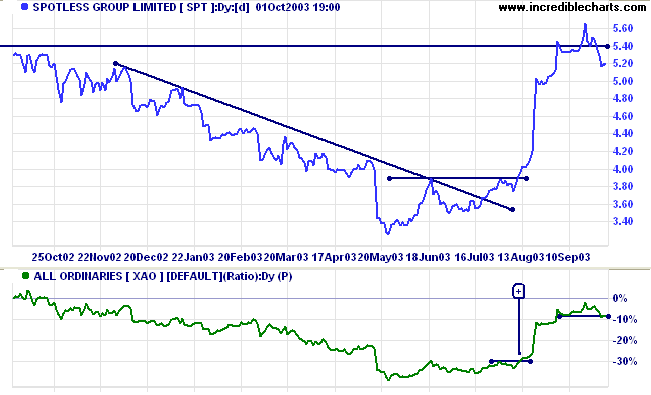

SPT rallied strongly off a narrow mid-year bottom. Price broke through resistance at 5.40 but this proved to be a marginal break, with a retreat back below the resistance line. Twiggs Money Flow (100) signals accumulation. MACD is bullish.

Last covered on August 26, 2003.

SPT rallied strongly off a narrow mid-year bottom. Price broke through resistance at 5.40 but this proved to be a marginal break, with a retreat back below the resistance line. Twiggs Money Flow (100) signals accumulation. MACD is bullish.

Relative Strength (price ratio: xao) completed a trend change at

[+] but now appears to be weakening.

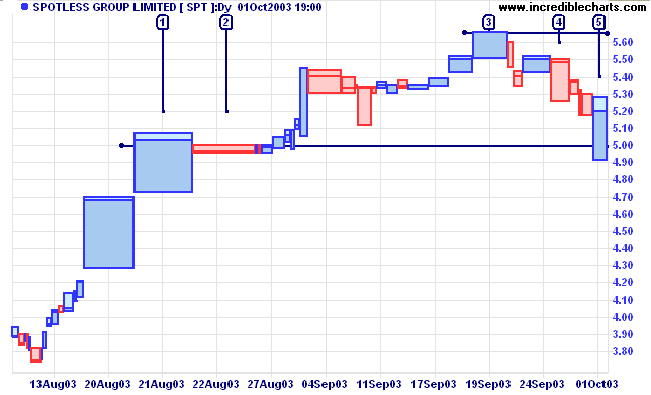

The equivolume chart highlights strong support/resistance at

5.00, with heavy volumes at [1] and [2]. Selling pressure is

evident at [3], with a large square bar. But weak closes at [4]

and [5] signal buying support.

Price may consolidate between 5.00 and 5.66, which would favor an upside breakout.

A close below 5.00 will be bearish.

Price may consolidate between 5.00 and 5.66, which would favor an upside breakout.

A close below 5.00 will be bearish.

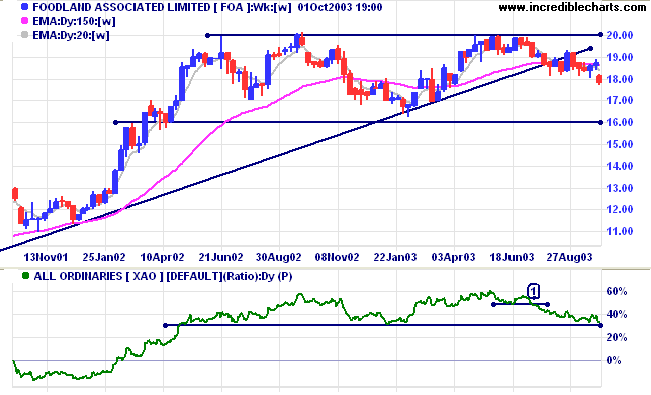

Foodland [FOA]

Last covered June 23, 2003.

FOA has formed a broad stage 3 top below resistance at 20.00. Relative Strength (price ratio: xao) started to trend down at [1], an intermediate signal. A fall below the support line from January will warn of a reversal in the primary trend.

Last covered June 23, 2003.

FOA has formed a broad stage 3 top below resistance at 20.00. Relative Strength (price ratio: xao) started to trend down at [1], an intermediate signal. A fall below the support line from January will warn of a reversal in the primary trend.

On the price chart, a fall below 16.00 will complete a large

double top pattern, with a target of 12.00.

Understanding

the Trading Diary has been expanded to offer further

assistance to readers, including

directions on how to search the archives.

Colin Twiggs

To know when you have enough is to be

rich.

To go forward with strength is to have ambition.

To not lose your place is to last long.

To die but not be forgotten - that's true long life.

~ Lao Tse.

To go forward with strength is to have ambition.

To not lose your place is to last long.

To die but not be forgotten - that's true long life.

~ Lao Tse.

Format Charts: Bar sizes

|

To change to broader price/indicator

bars, as in the above charts: (1) select Format Charts >> Indicator Width; (2) check the box next to [2]. To alter the width of the price bars separately: (1) select Format Charts >> Indicator Width >> Set Candle/OHLC/Parabolic SAR Width; (2) enter a value between 1 and 5 in the pop-up box; (3) click OK. |

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.