Become a Premium member for

only $180 (AUD).

Subscribe by 31 May 2003.

The Daily Trading Diary will only be available to Premium members.

We have extended the cut-off until mid-May - to fit in with the introduction of US charts.

Subscribe by 31 May 2003.

The Daily Trading Diary will only be available to Premium members.

We have extended the cut-off until mid-May - to fit in with the introduction of US charts.

Trading Diary

May 13, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow formed an inside day, retreating 0.5% to

close at 8679 on lower volume.

The intermediate trend is up.

The primary trend is down; a rise above 9076 will signal a reversal.

The S&P 500 closed 3 points down at 942.

The intermediate up-trend continues.

The primary trend is down; a rise above 954 will signal a reversal.

The Nasdaq Composite gapped down at the opening but rallied to close almost unchanged at 1539.

The intermediate trend is up.

The break above 1521 provides clear confirmation that the index is in a primary up-trend.

The Chartcraft NYSE Bullish % Indicator rose to 58.94% on May 12, following a Bull Correction buy signal on April 3.

The intermediate trend is up.

The primary trend is down; a rise above 9076 will signal a reversal.

The S&P 500 closed 3 points down at 942.

The intermediate up-trend continues.

The primary trend is down; a rise above 954 will signal a reversal.

The Nasdaq Composite gapped down at the opening but rallied to close almost unchanged at 1539.

The intermediate trend is up.

The break above 1521 provides clear confirmation that the index is in a primary up-trend.

The Chartcraft NYSE Bullish % Indicator rose to 58.94% on May 12, following a Bull Correction buy signal on April 3.

Market Strategy

Short-term: Long if the S&P 500 is above

935; short if the S&P intermediate trend reverses down (or

falls below 897).

Intermediate: Long if the Dow/S&P primary

trend turns upwards; short if the intermediate trend (S&P)

reverses down.

Long-term: There are already two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

Long-term: There are already two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

Can the tech rally last?

The up-tick in Tech company sales may be due more to postponed replacements than to real growth. (more)

The up-tick in Tech company sales may be due more to postponed replacements than to real growth. (more)

Gold

New York (17.56): Spot gold retreated to $US 349.50.

On the five-year chart gold has respected the long-term upward trendline.

New York (17.56): Spot gold retreated to $US 349.50.

On the five-year chart gold has respected the long-term upward trendline.

ASX Australia

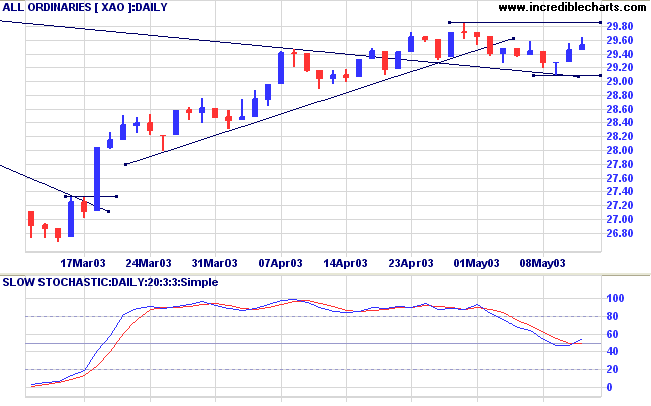

The All Ordinaries gained a further 6 points to close at 2952 on

higher volume. Weak closes on the last two days indicate some

profit-taking.

The intermediate up-trend is weak; a close below 2909 will signal a reversal.

The primary trend is down. A rise above 3062 will signal an up-trend.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to above; Twiggs Money Flow (21) is below its trendline but still signals accumulation.

The intermediate up-trend is weak; a close below 2909 will signal a reversal.

The primary trend is down. A rise above 3062 will signal an up-trend.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to above; Twiggs Money Flow (21) is below its trendline but still signals accumulation.

Market Strategy

Short-term: Long if the XAO is above 2946; short if the XAO falls

below 2909.

Intermediate: Long if the primary trend reverses up (XAO above 3062); short if the XAO falls below 2909.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

Intermediate: Long if the primary trend reverses up (XAO above 3062); short if the XAO falls below 2909.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

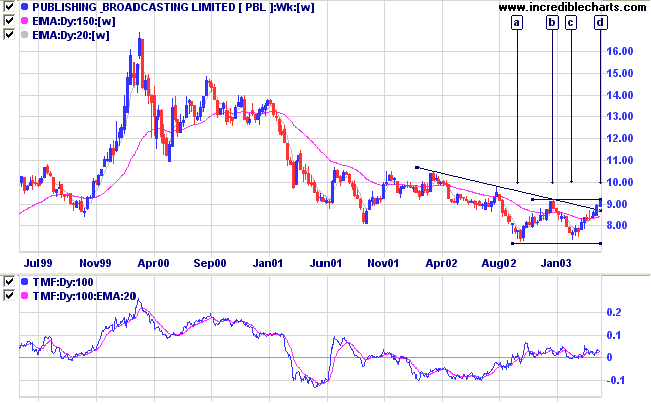

Publishing & Broadcasting Ltd [PBL]

Last covered on July 25, 2002.

PBL threatens to complete a double bottom reversal, [a] to [d], after a lengthy stage 4 down-trend.

Twiggs Money Flow (100-day) signals strong accumulation.

Last covered on July 25, 2002.

PBL threatens to complete a double bottom reversal, [a] to [d], after a lengthy stage 4 down-trend.

Twiggs Money Flow (100-day) signals strong accumulation.

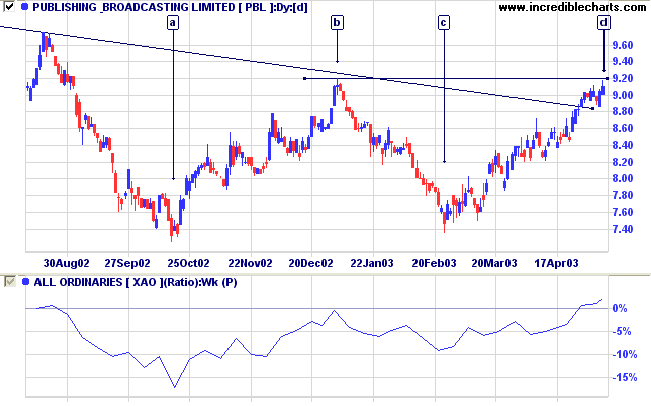

Relative Strength (price ratio: xao) is rising; MACD and Twiggs

Money Flow (21-day) are bullish.

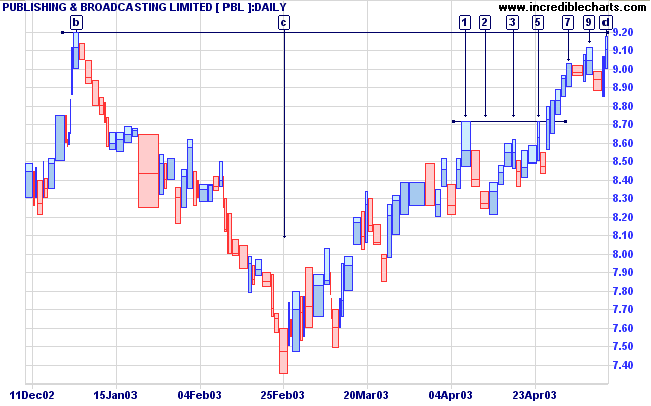

On the equivolume chart we can see that PBL overcame resistance

at 8.60 to 8.70 before rallying to [7].

Subsequent corrections have been very short but on fairly heavy

volume.

The latest rally to [d] is on thin volume and we can expect further consolidation below 9.20 before the double bottom pattern is completed.

The latest rally to [d] is on thin volume and we can expect further consolidation below 9.20 before the double bottom pattern is completed.

The target for the double bottom breakout is 11.00 (9.20 + [9.20

- 7.40]) but there is heavy resistance overhead at 10.50.

New! Understanding

the Trading Diary has been expanded to offer further

assistance to readers.

Colin Twiggs

Making no mistakes is what makes victory

certain:

Avoid what is strong and strike at what is weak

......like water, taking the line of least resistance.

- Sun Tzu: The Art of War.

Back Issues

Click here to access the Trading Diary Archives.

Click here to access the Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.