Become a Premium member for

only $180 (AUD).

Subscribe by 31 May 2003.

The Daily Trading Diary will be mailed exclusively to Premium members from May 1st.

Subscribe by 31 May 2003.

The Daily Trading Diary will be mailed exclusively to Premium members from May 1st.

Trading Diary

April 24, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow retreated 0.9% after testing resistance

above 8500, closing at 8440 on lower volume. The bullish

ascending triangle continues.

The intermediate trend is down. A rise above 8587 will signal reversal to an up-trend; a fall below 8109 will signal continuation.

March 17th's follow through remains valid (as long as the index holds above 7763).

The primary trend is down; a rise above 9076 will signal a reversal.

The Nasdaq Composite formed an inside day, signaling uncertainty, down 9 points at 1457.

The intermediate trend is up.

The primary trend is up.

The S&P 500 lost 8 points to close at 911.

The intermediate trend is up.

The primary trend is down; a rise above 954 will signal a reversal.

The Chartcraft NYSE Bullish % Indicator is at 50% (April 23), after completing a Bull Correction buy signal.

The intermediate trend is down. A rise above 8587 will signal reversal to an up-trend; a fall below 8109 will signal continuation.

March 17th's follow through remains valid (as long as the index holds above 7763).

The primary trend is down; a rise above 9076 will signal a reversal.

The Nasdaq Composite formed an inside day, signaling uncertainty, down 9 points at 1457.

The intermediate trend is up.

The primary trend is up.

The S&P 500 lost 8 points to close at 911.

The intermediate trend is up.

The primary trend is down; a rise above 954 will signal a reversal.

The Chartcraft NYSE Bullish % Indicator is at 50% (April 23), after completing a Bull Correction buy signal.

Market Strategy

Short-term: Long if the S&P 500 rises above

917; short if the intermediate trend (Dow or S&P) reverses

down.

Intermediate: Long if the Dow/S&P primary

trend reverses upwards; short if the intermediate trend (Dow or

S&P) reverses down.

Long-term: There are already two bull signals: the March 17 follow through day and the NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

Long-term: There are already two bull signals: the March 17 follow through day and the NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

Jobless claims rise

New unemployment claims jumped to 455,000 for the week ended April 19, signaling contraction. (more)

But durable goods orders increase

A 2% jump in March durable goods orders (1.3% excluding defense items) is welcome news for the manufacturing sector. (more)

New unemployment claims jumped to 455,000 for the week ended April 19, signaling contraction. (more)

But durable goods orders increase

A 2% jump in March durable goods orders (1.3% excluding defense items) is welcome news for the manufacturing sector. (more)

Gold

New York (19.00): Spot gold is back up to $US 333.60.

New York (19.00): Spot gold is back up to $US 333.60.

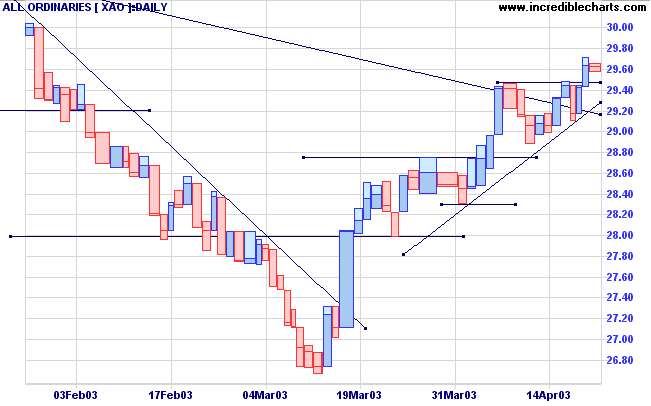

ASX Australia

The ASX formed an inside day and closed down 2 points at 2962 on

strong volume; signaling increased selling pressure.

The intermediate trend is up.

The primary trend is down; a rise above 3062 will signal a reversal.

MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines; Twiggs Money Flow (21) signals accumulation.

The intermediate trend is up.

The primary trend is down; a rise above 3062 will signal a reversal.

MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines; Twiggs Money Flow (21) signals accumulation.

Market Strategy

Short-term: Long if the index rises above 2966; short if the

intermediate trend reverses.

Intermediate: Long if the primary trend reverses up (XAO above

3062); short if the intermediate trend reverses.

Long-term: There is already a bull signal: the March 18 follow through day. Wait for confirmation from a primary trend reversal.

Long-term: There is already a bull signal: the March 18 follow through day. Wait for confirmation from a primary trend reversal.

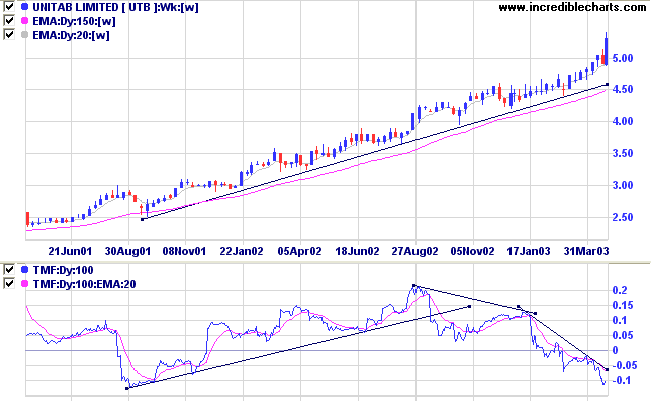

Unitab [UTB]

Last covered on September 2, 2002.

Here is an interesting divergence between two key indicators.

UTB has been in a stage 2 up-trend for the past 3 years, not crossing below its' long-term moving average in the last 18 months.

But notice how Twiggs Money Flow (100-day) has dipped below the zero line, showing a strong bearish divergence just when the general market appears to be strengthening.

Last covered on September 2, 2002.

Here is an interesting divergence between two key indicators.

UTB has been in a stage 2 up-trend for the past 3 years, not crossing below its' long-term moving average in the last 18 months.

But notice how Twiggs Money Flow (100-day) has dipped below the zero line, showing a strong bearish divergence just when the general market appears to be strengthening.

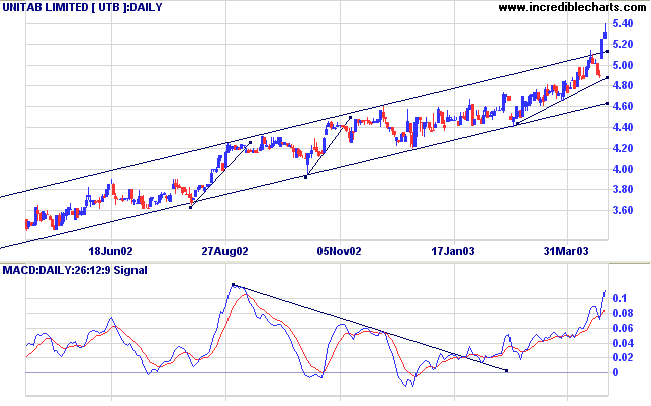

On the daily chart UTB has broken above the upward trend

channel.

Relative Strength (price ratio: xao) is rising and MACD shows a strong bull signal. Twiggs Money Flow (21) displays the same bearish divergence as the 100-day indicator.

Relative Strength (price ratio: xao) is rising and MACD shows a strong bull signal. Twiggs Money Flow (21) displays the same bearish divergence as the 100-day indicator.

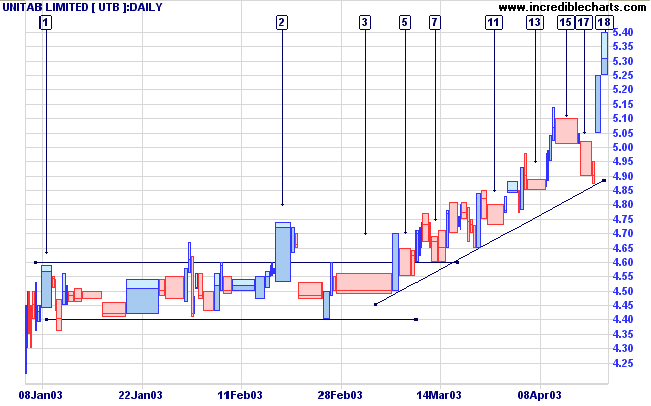

The equivolume chart shows strong accumulation

between [1] and [3], with buying support entering at the bottom

of corrections as at [3]. From [5] to [18] there is very light

volume on rallies and large volume on the corrections - the

reason for the bearish divergence on Twiggs Money Flow - but what

does this signal?

There are a few points worth attention:

There are a few points worth attention:

- long shadows at [5] and [7] signal accumulation;

- all corrections are of short duration - not more than 4 days;

- down-volume is largest on square bars [11], [13] and [15] - signaling the presence of strong buying support;

- even though down-volume appears dominant, it has not broken the upward trend.

Short-term traders may find opportunities when UTB corrects back

to the intermediate trendline [5] to [17].

Long-term traders should wait for opportunities at the long-term trendline.

When price is above the upper trend channel traders should lock in profits with tighter stops (or a trailing % stop).

A break below 4.87 (the intermediate trendline) would be bearish.

Long-term traders should wait for opportunities at the long-term trendline.

When price is above the upper trend channel traders should lock in profits with tighter stops (or a trailing % stop).

A break below 4.87 (the intermediate trendline) would be bearish.

Colin Twiggs

If you examine their trades,

many failed traders will show a series of small or moderate

gains

and then a few large, devastating losses.

Successful traders may, at times, incur a series of small

losses

but these are then offset by several large gains.

~

Protect the downside and the upside will take care of

itself.

- Donald Trump: The Art of the Deal

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.