We are busy adjusting the menus.

If your Securities menu fails to load, please close the charting application and re-start.

Trading Diary

March 26, 2003

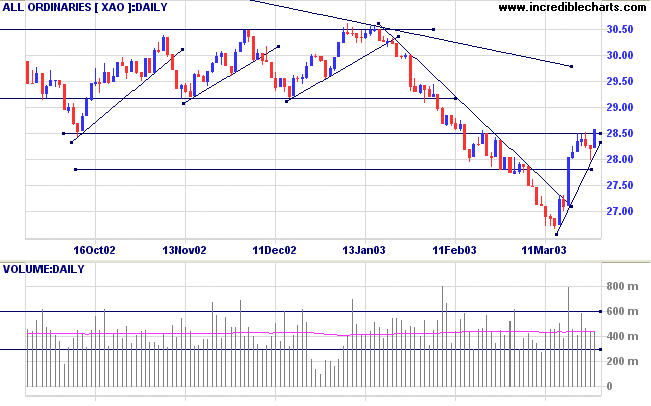

The intermediate cycle is down, although the trendline has been broken.

The primary trend is down.

The Nasdaq Composite also formed an inside day, down 4 points at 1387.

The intermediate trend is down, despite the large correction.

The primary trend is up.

The S&P 500 mimicked the Dow, down 0.5% at 869 on an inside day.

The intermediate trend is down, but the trendline has been broken.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator remains at 36% (March 25).

A protracted conflict could lead to a further contraction of the US economy: the much-feared "double dip". (more)

New York (16.45): Spot gold is up 190 cents at $US 330.10.

The primary trend is down.

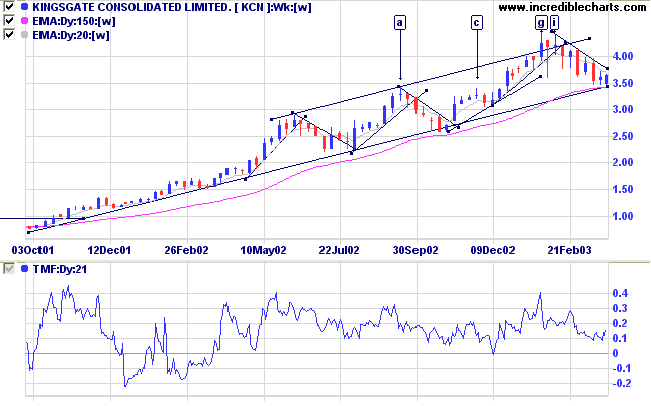

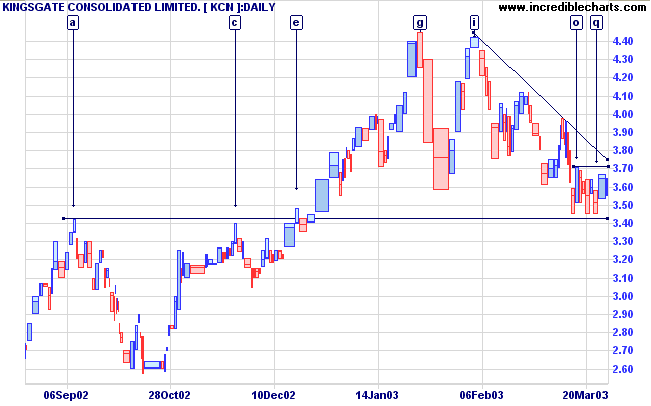

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has whipsawed back above its signal line; Twiggs Money Flow (21) is rising.

Last covered on January 23, 2003.

The Thai gold miner has pulled back from the double top at [g] and [i] and is now testing the primary supporting trendline.

Relative Strength (price ratio: xao) trends upwards; MACD is negative; Twiggs Money Flow continues to signal strong accumulation.

Spot gold is still above its long-term supporting trendline (5-year chart).

A break below 3.40 would be bearish.

For further guidance see Understanding the Trading Diary.

The generals have a saying:

"Rather than make the first move

it is better to wait and see.

Rather than advance an inch

it is better to retreat a yard."

This is called

going forward without advancing,

pushing back without using weapons.

There is no greater misfortune

than underestimating your enemy.

Underestimating your enemy

means thinking that he is evil.

Thus you destroy your three treasures

and become an enemy yourself.

When two great forces oppose each other,

the victory will go

to the one that knows how to yield.

- Lao Tse.

Back Issues