Chart Forum Troubleshooting

Those readers who have had difficulty registering for the Chart Forum,

or uploading chart images to their posts:

Please refer to Forum Troubleshooting for assistance.

Trading Diary

February 17, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The market was closed Monday in observance of

Washingtons's birthday.

The Chartcraft NYSE Bullish % Indicator is at 42% (February 14).

The Chartcraft NYSE Bullish % Indicator is at 42% (February 14).

Global market reaction to Iraq

Global markets rallied as the likelihood of an immediate war with Iraq fades, while gold and oil declined. (more)

Back Issues

Global markets rallied as the likelihood of an immediate war with Iraq fades, while gold and oil declined. (more)

Gold

New York (16.45): Spot gold is 460 cents down at $US 346.70.

New York (16.45): Spot gold is 460 cents down at $US 346.70.

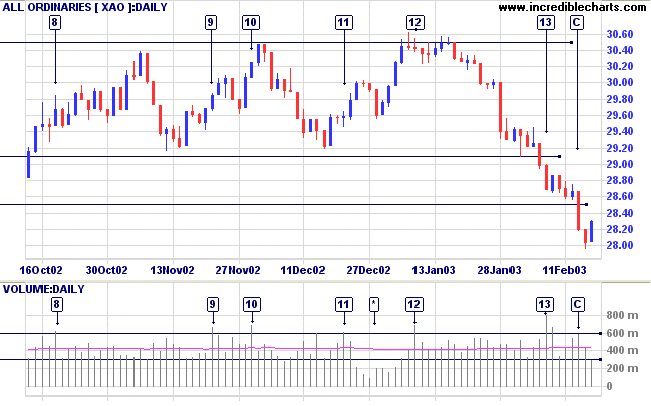

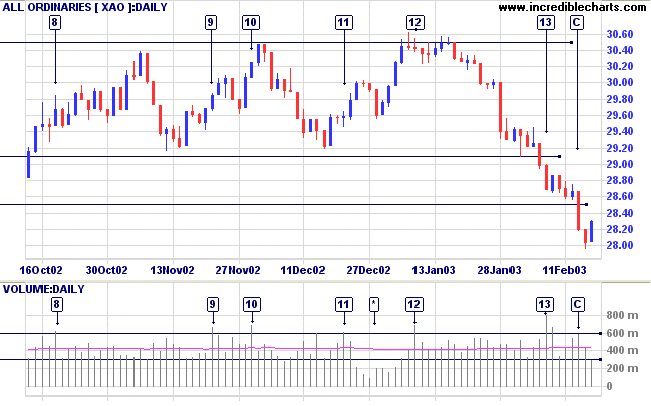

ASX Australia

The All Ordinaries rallied to 2830 on very low volume.

Duration and volume activity on the pull-back will indicate

the strength of the down-trend and whether the lower end of

the 2850 to 2779 support band is likely to hold.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is below; Twiggs Money Flow signals distribution.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is below; Twiggs Money Flow signals distribution.

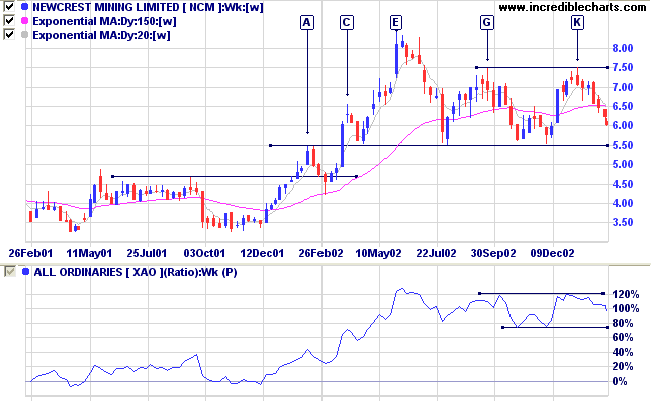

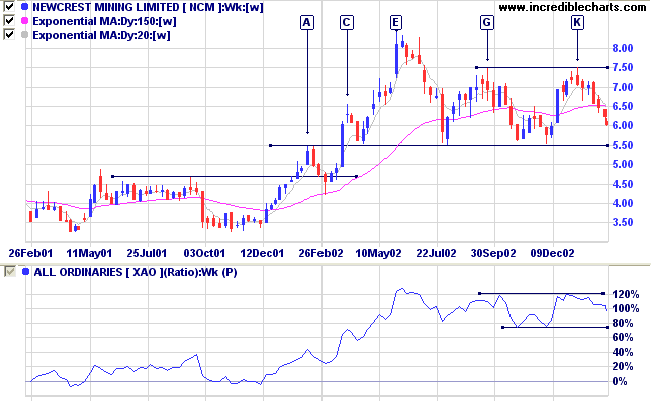

Newcrest Mining [NCM]

Last covered on November 13, 2002.

After a fast up-trend NCM formed a high at [E] before retreating back to the 5.50 support level. The stock is now ranging between 7.50 and 5.50. The lower equal highs at [G] and [K] (some would call this a double top - even though the neckline is not yet broken) are a strong bear signal and NCM appears headed for a re-test of the 5.50 support level. There has been no significant fading of volume towards the peaks, nor surge in volume on the declines, so we will have to observe the behavior of the stock when it reaches the support level.

Relative Strength (price ratio:xao) is moving sideways; MACD is bearish; and Twiggs Money Flow signals distribution.

Last covered on November 13, 2002.

After a fast up-trend NCM formed a high at [E] before retreating back to the 5.50 support level. The stock is now ranging between 7.50 and 5.50. The lower equal highs at [G] and [K] (some would call this a double top - even though the neckline is not yet broken) are a strong bear signal and NCM appears headed for a re-test of the 5.50 support level. There has been no significant fading of volume towards the peaks, nor surge in volume on the declines, so we will have to observe the behavior of the stock when it reaches the support level.

Relative Strength (price ratio:xao) is moving sideways; MACD is bearish; and Twiggs Money Flow signals distribution.

Market strategy

For further guidance see Understanding the Trading Diary.

For further guidance see Understanding the Trading Diary.

Short-term: Avoid new entries. Slow Stochastic and MACD are

on opposite sides of their respective signal lines.

Medium-term: Avoid new entries.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

Every man is proud of what he does

well;

and no man is proud of what he does not do well.

With the former, his heart is in his work;

and he will do twice as much of it with less

fatigue.

The latter performs a little imperfectly, looks at it in

disgust,

turns from it, and imagines himself exceedingly

tired.

The little he has done, comes to nothing, for want of

finishing.

- Abraham Lincoln (1859)

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.