The Trading Diary resumes today.

Coverage of stocks will resume next week.

January 06, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow is up 2.0% at 8773 on average

volume.

The index is headed for a re-test of resistance at the upper limit of the 7500 to 9130 base.

The primary trend is down and will only reverse up if the average rises above 9076 (the high from December 02).

The Nasdaq Composite rallied 2.5% to close at 1421.

The primary trend is up.

The S&P 500 is up 20 points at 929.

The index is ranging between 965 and 768, establishing a base.

All three indices have failed to re-test support at their 6-month lows, a bullish sign.

The Chartcraft NYSE Bullish % Indicator appears stuck at 50% (January 03).

The index is headed for a re-test of resistance at the upper limit of the 7500 to 9130 base.

The primary trend is down and will only reverse up if the average rises above 9076 (the high from December 02).

The Nasdaq Composite rallied 2.5% to close at 1421.

The primary trend is up.

The S&P 500 is up 20 points at 929.

The index is ranging between 965 and 768, establishing a base.

All three indices have failed to re-test support at their 6-month lows, a bullish sign.

The Chartcraft NYSE Bullish % Indicator appears stuck at 50% (January 03).

Bush to eliminate dividend taxes

Economists are divided about whether the proposed stimulus package will work. (more)

Gold

New York: After an intra-day high of $US 356.00 spot gold is back at $US 350.70.

Economists are divided about whether the proposed stimulus package will work. (more)

Gold

New York: After an intra-day high of $US 356.00 spot gold is back at $US 350.70.

ASX Australia

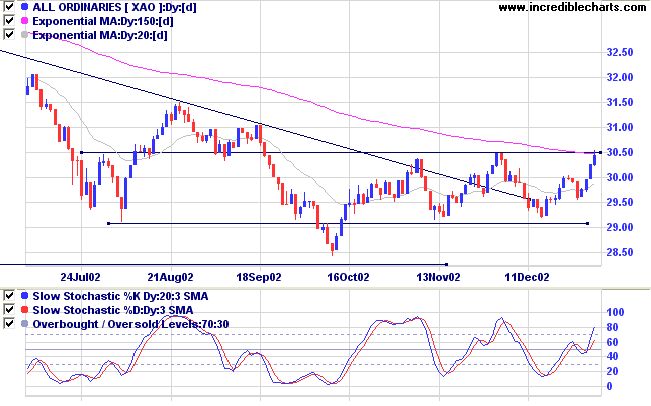

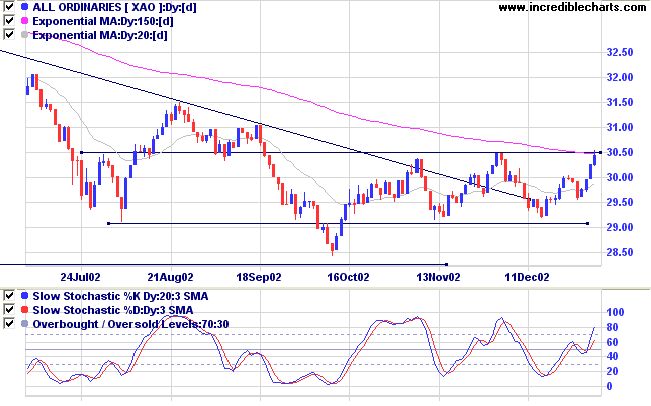

The All Ordinaries gained 19 points to close at 3045 on

increasing volume, testing resistance at the upper limit of the

2915 to 3050 range.

A break above this level will signal a primary trend change to an up-trend; the last correction taking the form of a line. Look for volume confirmation.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is above; Twiggs money flow is rising, signaling accumulation.

A break above this level will signal a primary trend change to an up-trend; the last correction taking the form of a line. Look for volume confirmation.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is above; Twiggs money flow is rising, signaling accumulation.

Market strategy

For further guidance see Understanding the Trading Diary.

For further guidance see Understanding the Trading Diary.

Short-term: Long. The Slow Stochastic

and MACD are above their respective signal lines.

Medium-term: Avoid new entries.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

Think no vice so small that you may commit it, and no virtue so

small that you may over look it.

- The Analects of Confucius

- The Analects of Confucius

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.