December holidays

The newsletter over the holiday season will cover fewer stocks

as we take a break from the pressures of the market.

Trading Diary

December 09, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow fell 2% to close at 8473 on lower

volume. If the next rally fails to take out the high from

December 2, we may face a re-test of the 7500 and 7200 support

levels; equal highs (August 22 and December 2) in a down-trend

are a bearish signal.

The primary trend is still down. It will reverse up if the average rises above 9130.

The Nasdaq Composite lost 3.9% to close at 1367.

The primary trend is up.

The S&P 500 fell 20 points to close at 892.

The primary trend will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 50% (December 06).

Back Issues

The primary trend is still down. It will reverse up if the average rises above 9130.

The Nasdaq Composite lost 3.9% to close at 1367.

The primary trend is up.

The S&P 500 fell 20 points to close at 892.

The primary trend will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 50% (December 06).

Snow gets tough job

President Bush appoints railroad CEO John Snow to replace Treasury Secretary Paul O'Neill. (more)

Gold

New York: Spot gold gained 10 cents to $US 326.00.

President Bush appoints railroad CEO John Snow to replace Treasury Secretary Paul O'Neill. (more)

Gold

New York: Spot gold gained 10 cents to $US 326.00.

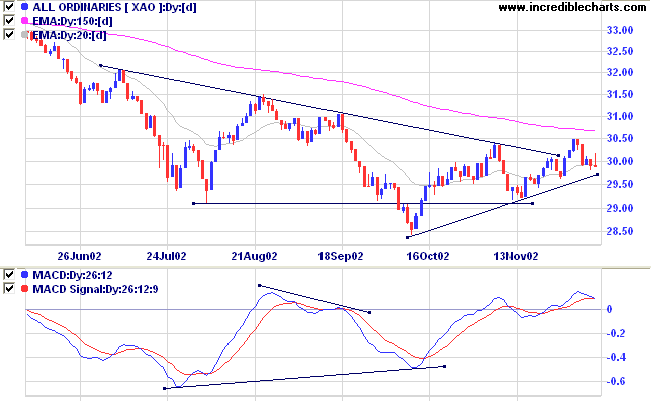

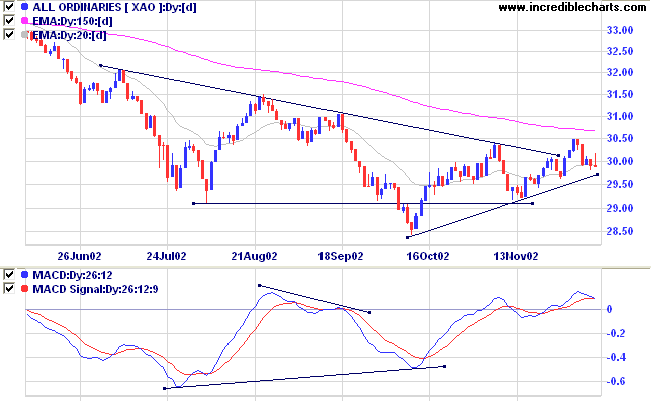

ASX Australia

The All Ordinaries rallied in the morning, only to experience a

late sell-off to close 3 points down at 2988 on low volume. The

creeping up-trend continues.

The primary trend will reverse (up) if the index rises above 3150.

MACD (26,12,9) has crossed to below its signal line; Slow Stochastic (20,3,3) is below; and Twiggs money flow is falling.

The primary trend will reverse (up) if the index rises above 3150.

MACD (26,12,9) has crossed to below its signal line; Slow Stochastic (20,3,3) is below; and Twiggs money flow is falling.

Market strategy

For further guidance see Understanding the Trading Diary.

For further guidance see Understanding the Trading Diary.

Short-term: Short if the XAO falls below 2981. The Slow

Stochastic and MACD are below their respective signal lines.

Medium-term: Avoid new entries.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

Sooner or later, those who win are those who think they

can.

- Richard Bach

- Richard Bach

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.