Chart Forum Registration

Some readers have encountered difficulties registering for the new Chart Forum.

The emailed hyperlink is sometimes severed if it wraps over 2 lines.

HTML still has its idiosyncracies.......we are working on a solution.

Trading Diary

October 23, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow retreated in the morning but then

rallied in the afternoon to close up 0.5% at 8494 on higher

volume. A primary trend reversal will be signaled if the index

rises above 9130.

The Nasdaq Composite Index gained 2.2% to close at 1320. The primary trend will reverse if there is a break above 1426.

The S&P 500 edged up 6 points to close at 896. The primary trend is down. The index will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator has swung to a bull alert signal at 34% (October 21).

The Nasdaq Composite Index gained 2.2% to close at 1320. The primary trend will reverse if there is a break above 1426.

The S&P 500 edged up 6 points to close at 896. The primary trend is down. The index will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator has swung to a bull alert signal at 34% (October 21).

AOL Time Warner

The media giant is forced to restate earnings by $US 97 million over 2 years, because of overstatement of advertising revenue in its AOL division. (more)

Gold

New York: Spot gold was down 80 cents at $US 311.60.

The media giant is forced to restate earnings by $US 97 million over 2 years, because of overstatement of advertising revenue in its AOL division. (more)

Gold

New York: Spot gold was down 80 cents at $US 311.60.

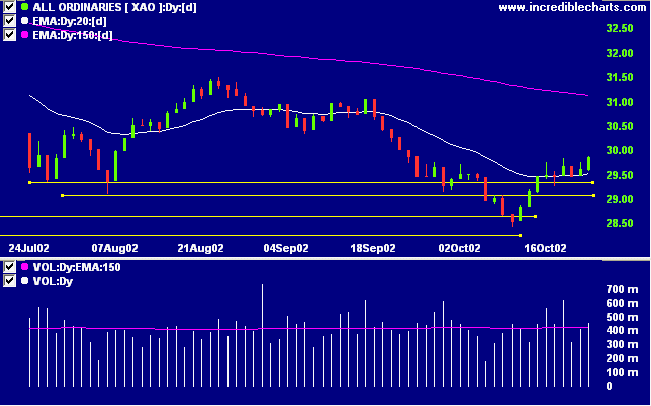

ASX Australia

The All Ordinaries put in another strong day, closing up 26

points up at 2987 on higher volume. A break above 3150 will

signal a primary trend reversal.

MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines. MACD shows a bullish divergence while Twiggs money signals accumulation.

MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines. MACD shows a bullish divergence while Twiggs money signals accumulation.

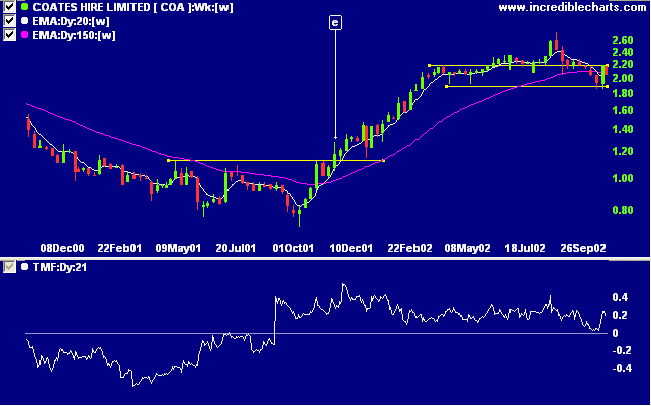

Coates Hire [COA]

After presenting a favorable entry point at [e] COA rallied strongly before leveling off into a congestion pattern: either a top or a consolidation before a further rally. Twiggs money flow displays an impressive 12 months of accumulation, never once crossing below zero.

After presenting a favorable entry point at [e] COA rallied strongly before leveling off into a congestion pattern: either a top or a consolidation before a further rally. Twiggs money flow displays an impressive 12 months of accumulation, never once crossing below zero.

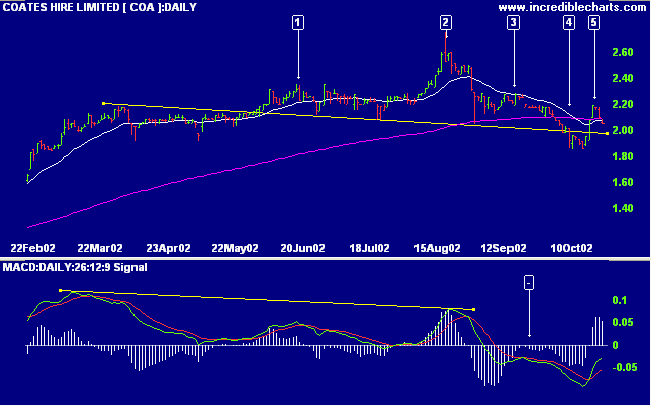

The daily chart shows a head and shoulders reversal pattern, with

the head at [2] and shoulders at [1] and [3]. MACD displays

weakness [-] after a bearish divergence. Price

broke below the neckline at [4] before rallying back above at

[5]. Is this a bear trap?

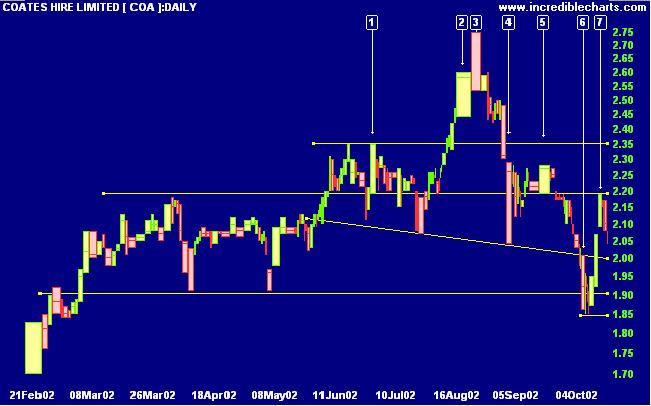

The equivolume chart shows healthy volume at the first shoulder

[1] as expected. Instead of declining, volume at [2] is stronger,

but followed by a closing price reversal at [3]. Price drops

sharply at [4], on comparatively thin volume, before a brief

rally at [5], again on stronger volume. Finally, volume at the

breakout [6] is weak, confirming that the pattern is not to be

trusted: In a healthy head and shoulders pattern, volume should

decline on each successive rally and increase on each successive

correction, ending with a sharp rise at the breakout.

The rally back to [7] was unable to overcome resistance at 2.20

and we can expect the stock to range further before giving a

clear signal.

Short-term: Long. The Slow Stochastic and

MACD are above their respective signal lines.

Medium-term: Long. Use stop losses to

protect yourself against a sudden reversal.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

Thought for the

Day:

Stan's 9th Commandment:

Don't guess a bottom. What looks like a bargain can turn out to be a very expensive stage 4 disaster.

Instead, buy on breakouts above resistance.

- Stan Weinstein, Secrets for Profiting in Bull and Bear Markets.

Stan's 9th Commandment:

Don't guess a bottom. What looks like a bargain can turn out to be a very expensive stage 4 disaster.

Instead, buy on breakouts above resistance.

- Stan Weinstein, Secrets for Profiting in Bull and Bear Markets.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.