Incredible Charts version 4.0.0.5

To be released this weekend, the new version offers:

-

A Price Ratio (relative strength) indicator

that can apply to all securities in a project.

When installing on the Indicator Panel, select "Apply to Project".

-

New Stock Screens

- Directional Movement (+DI, -DI and ADX)

- MACD above or below zero

- Volume Filter

- Equivolume with closing prices

Trading Diary

October 03, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow rallied at the opening but just as quickly fell back to

close 0.5% down at 7717 on strong volume.

The primary trend is down.

The Nasdaq Composite Index declined 1.8% to close at 1165.

The primary trend is down.

The S&P 500 lost 9 points to close at 818.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 32% (October 2).

The primary trend is down.

The Nasdaq Composite Index declined 1.8% to close at 1165.

The primary trend is down.

The S&P 500 lost 9 points to close at 818.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 32% (October 2).

Financial stocks down

Concerns over bad loan increases triggered a decline in bank stocks. (more)

Back Issues

Concerns over bad loan increases triggered a decline in bank stocks. (more)

Gold

New York: The latest spot gold price was down 210 cents at $US 321.00.

New York: The latest spot gold price was down 210 cents at $US 321.00.

ASX Australia

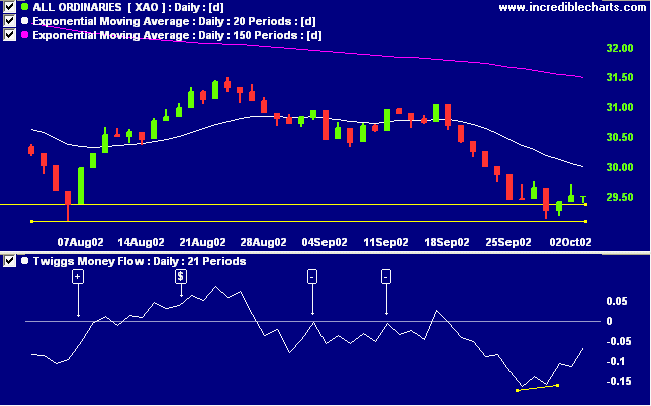

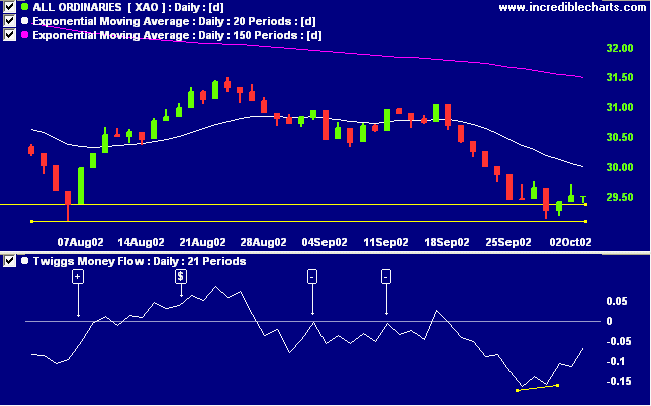

After an early fall, the All Ordinaries index made several

attempts to break above the previous close, ending unchanged at

2952 on average volume.

Slow Stochastic (20,3,3) is above its signal line, while MACD (26,12,9) is below. Twiggs money shows a small bullish divergence.

The primary trend is down.

Slow Stochastic (20,3,3) is above its signal line, while MACD (26,12,9) is below. Twiggs money shows a small bullish divergence.

The primary trend is down.

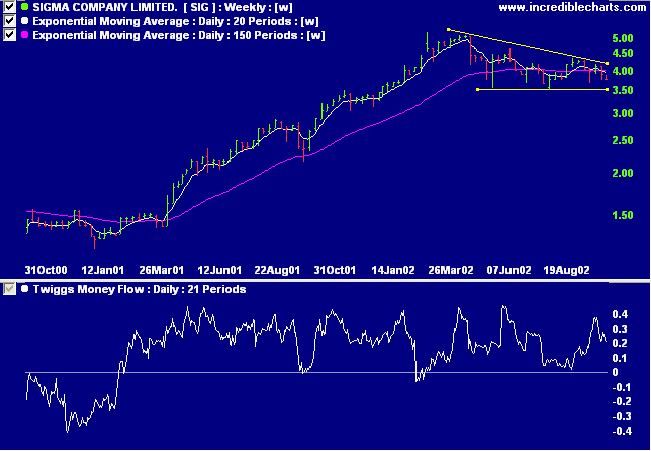

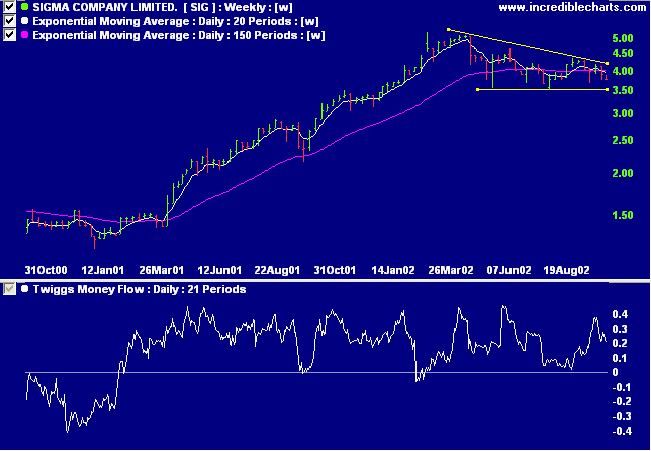

Sigma [SIG]

The pharmacy group has entered a stage 3 top, after a strong up-trend. The top has taken the form of a declining triangle, normally a bearish pattern. Twiggs money flow, however, reveals strong accumulation over the past 18 months.

The pharmacy group has entered a stage 3 top, after a strong up-trend. The top has taken the form of a declining triangle, normally a bearish pattern. Twiggs money flow, however, reveals strong accumulation over the past 18 months.

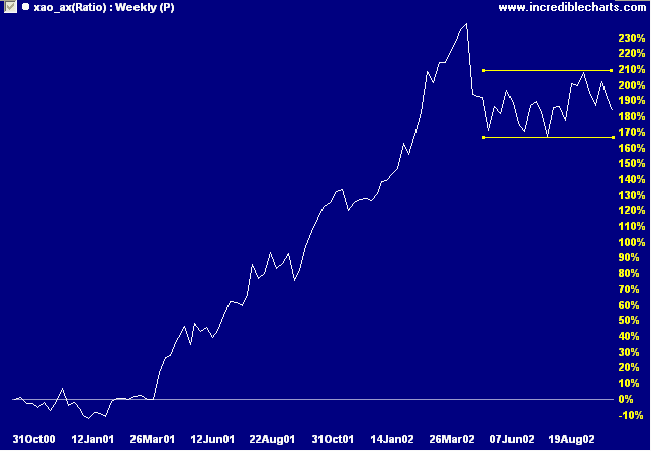

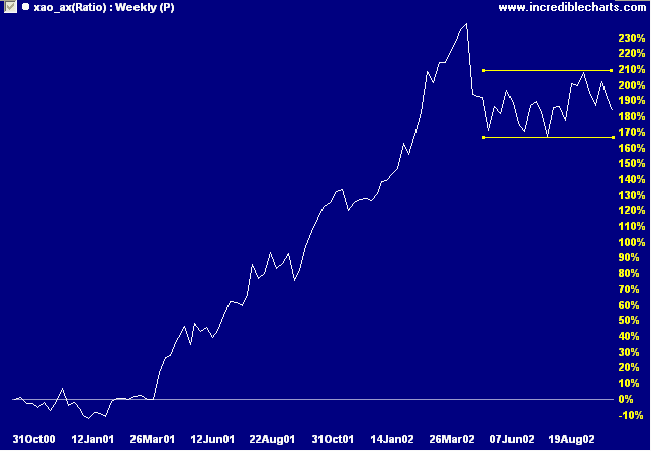

Relative strength (price ratio: xao) is ranging within a narrow

band, after falling from its April peak.

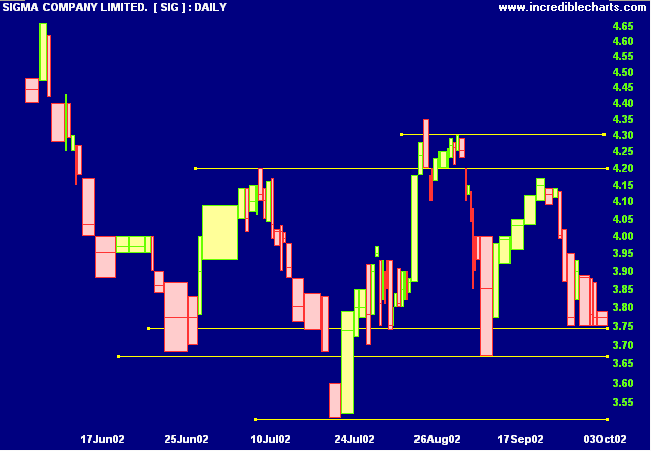

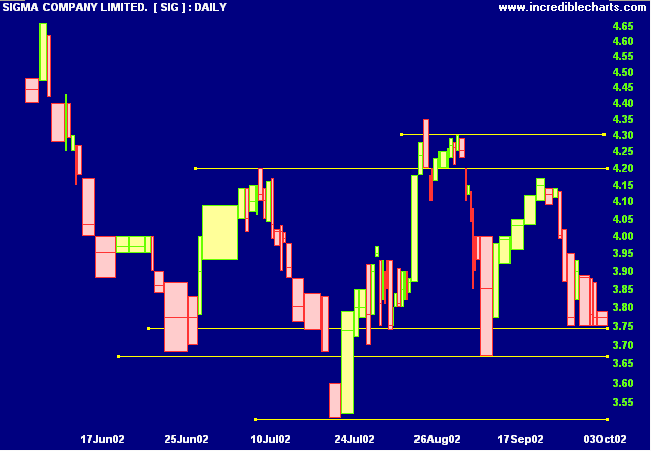

At present SIG is holding above support at 3.75. Support and

resistance levels can be seen on the daily equivolume chart.

The shaded areas depict closing prices, with the lighter shade

above the close in an up-trend, and below the close in a

down-trend.

Worth watching: a fall below 3.50 will be a strong bear signal, but a rally above 4.30 will signal the return of the bulls.

Worth watching: a fall below 3.50 will be a strong bear signal, but a rally above 4.30 will signal the return of the bulls.

Short-term: Avoid new entries. The Slow Stochastic and MACD are

on opposite sides of their respective signal lines.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

There is a time for all things, but I didn't know it. And that is precisely what beats so many men in Wall Street who are very far from being in the main sucker class. There is the plain fool, who does the wrong thing at all times everywhere,

but there is the Wall Street fool, who thinks he must trade all the time.

- Edwin Lefevre

There is a time for all things, but I didn't know it. And that is precisely what beats so many men in Wall Street who are very far from being in the main sucker class. There is the plain fool, who does the wrong thing at all times everywhere,

but there is the Wall Street fool, who thinks he must trade all the time.

- Edwin Lefevre

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.