Stock Screens: Directional Movement

We are planning to add Directional Movement/ADX to the list of Stock Screen filters

and welcome any comments or suggestions as to how the filter should be implemented.

Please post your comments at ADX on the Chart Forum.

Trading Diary

September 9, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow rose 1% to close at 8519 on lower volume. The recent

sequence of troughs and peaks on the secondary cycle has been

7500 - 8800 - 8000 - 9100 - 8200. The second rally was not as

strong as the first, while the corrections are lengthening. In

conventional terms, the last rally experienced an 80%

retracement, signaling trend weakness.

The primary cycle trends down.

The Nasdaq Composite Index formed an outside day to close 0.7% higher at 1304. The primary trend is down.

The S&P 500 gained 9 points to close at 902. The primary cycle is in a down-trend.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 46% (September 6).

The primary cycle trends down.

The Nasdaq Composite Index formed an outside day to close 0.7% higher at 1304. The primary trend is down.

The S&P 500 gained 9 points to close at 902. The primary cycle is in a down-trend.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 46% (September 6).

AOL Time Warner

AOL is expected to post annual revenue of $US 1.7 billion compared to $US 2.7 billion last year, because of a slump in advertising sales and slowing subscriber growth. (more)

AOL is expected to post annual revenue of $US 1.7 billion compared to $US 2.7 billion last year, because of a slump in advertising sales and slowing subscriber growth. (more)

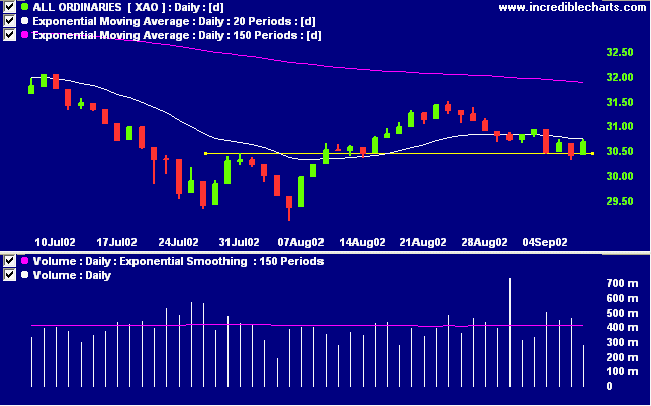

ASX Australia

The All Ordinaries rallied 27 points to close at 3069. The weak

volume signals a lack of commitment from buyers.

The primary trend is down.

The primary trend is down.

The MACD (26,12,9) and Slow Stochastic (20,3,3) are below their

respective signal lines. Twiggs money flow signals distribution.

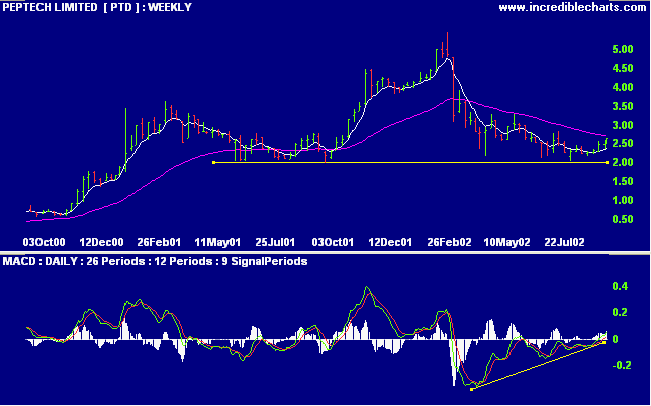

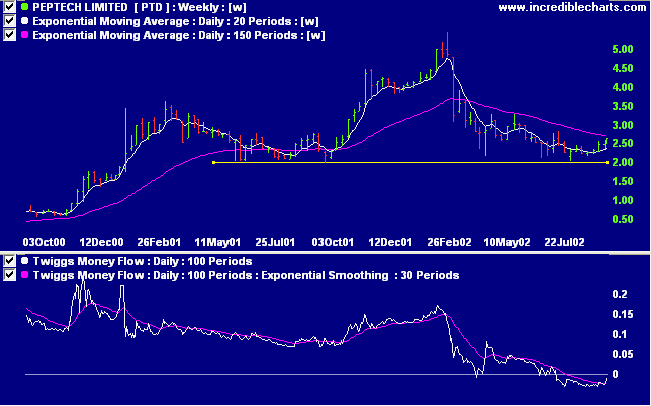

Peptech [PTD]

PTD may appeal to bottom-fishers after a 6-month bear-trend with price at roughly 50% of its previous high The biotechnology stock has held above support at 2.00, while MACD signaled a bearish divergence.

PTD may appeal to bottom-fishers after a 6-month bear-trend with price at roughly 50% of its previous high The biotechnology stock has held above support at 2.00, while MACD signaled a bearish divergence.

But Twiggs money flow has steadily weakened - best illustrated by

the 100-day TMF - and a break below 2.00 would complete a

long-term head and shoulders pattern.

Conclusion

Short-term: Avoid new entries, the All Ords shows uncertainty.

The Slow Stochastic and MACD are below their respective signal

lines.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

The conduct of successful business merely consists in doing things in a very simple way, doing them regularly and never neglecting to do them.

The conduct of successful business merely consists in doing things in a very simple way, doing them regularly and never neglecting to do them.

- William Hesketh Lever (founder of Lever Brothers)

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.